First Republic Bank failure: What does it mean for the U.S. economy and banking sector?

Portfolio Manager John Jordan and Credit Analyst Nick Caes discuss the implications of the collapse of First Republic Bank (FRC) for the U.S. economy and banking sector.

6 minute read

Key takeaways:

- In the wake of the third U.S bank failure of 2023, investors are asking what this means for the U.S. economy and banking sector.

- While the acute stress in the banking sector has largely abated, we believe higher interest rates may pose ongoing challenges for weaker banks.

- In returning to a historically normal world of interest rates above zero, we think an active, research-driven approach can help investors navigate the risks posed by a more challenging macro environment.

First Republic Bank (FRC) became the third U.S. bank to fail in 2023, as J.P. Morgan acquired the ailing lender over the weekend following its seizure by the Federal Deposit Insurance Corporation (FDIC). While there is much to digest from the terms of the deal, in this article we focus on what another bank failure may mean for the U.S banking sector and economy. Specifically, we attempt to answer the most pressing questions for investors: Are we in a banking crisis, which bank (if any) might be next, and how does this impact portfolio strategy?

Are we in a banking crisis?

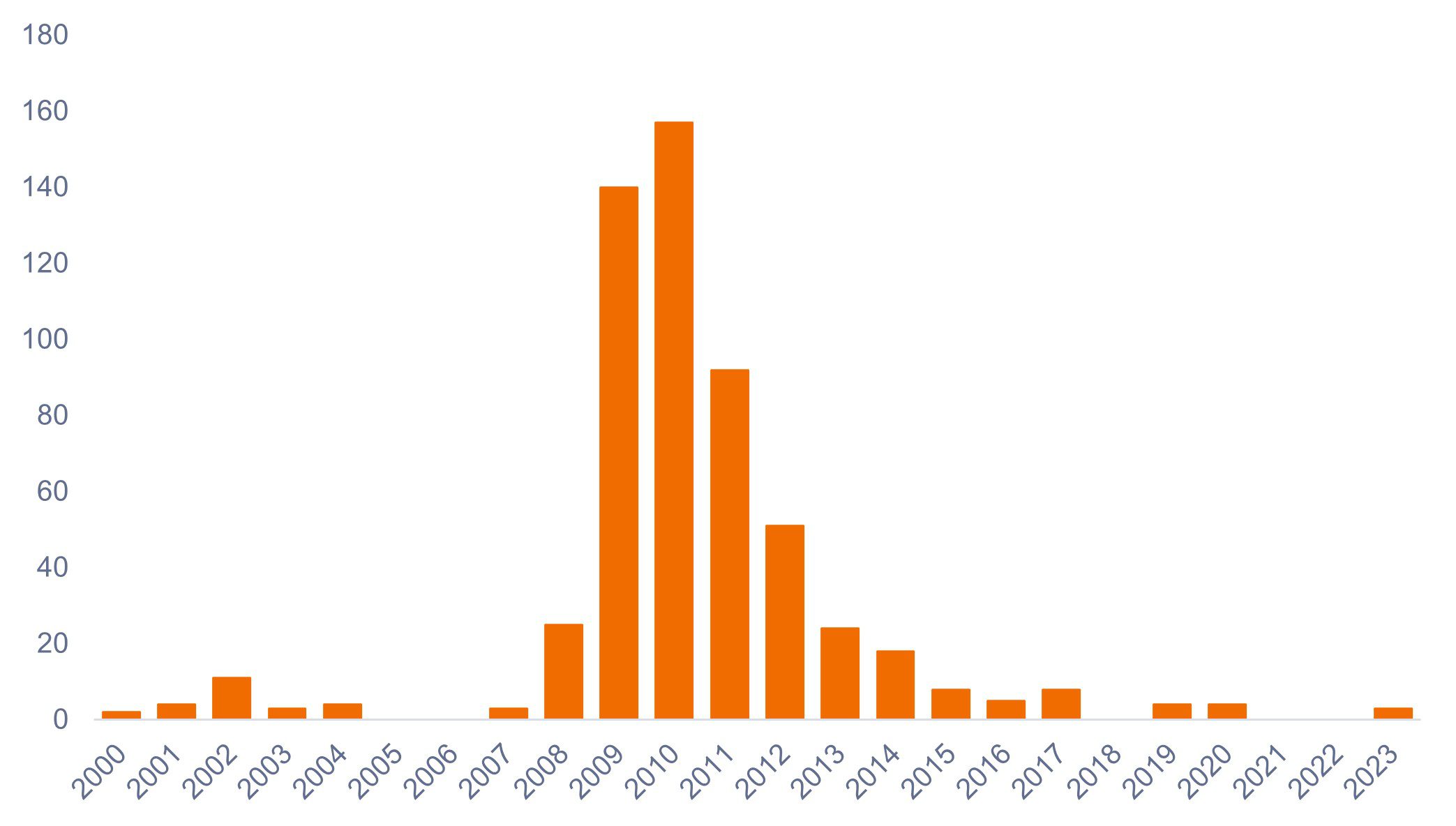

FRC’s failure has reignited investor concerns that first surfaced in March as to whether the U.S. is in a banking crisis, with some even invoking memories of the Global Financial Crisis. In our view, such comparisons are unwarranted at this stage. While the size of the failed banks has drawn much attention, in terms of the number of failures, we are still a long way from a crisis, as shown in Figure 1.

Figure 1: Three is a crowd, not a crisis

Source: FDIC, as of 1 May 2023. Past performance is not indicative of future results.

Who might be next?

Investors may naturally be worrying about who is next to fail, but before we can determine which banks are most at risk – or even if another will fail – it’s advisable to distinguish between acute stress and ongoing headwinds in the banking sector.

In our view, the three banks that have failed in 2023 – Silicon Valley Bank (SVB), Signature Bank (SBNY), and FRC – failed under acute stress. After the sharp rise in interest rates in 2022 had devalued their long-term fixed-rate loan and securities portfolios, they faced unprecedented deposit outflows in Q1 of this year, which left large funding gaps. These gaps could ostensibly be bridged by selling long-term mortgages and government-backed securities, but in doing so, some banks would have to recognize unrealized losses that would essentially render them insolvent, while for others the speed of deposit outflows was too fast to build these liquidity needs.

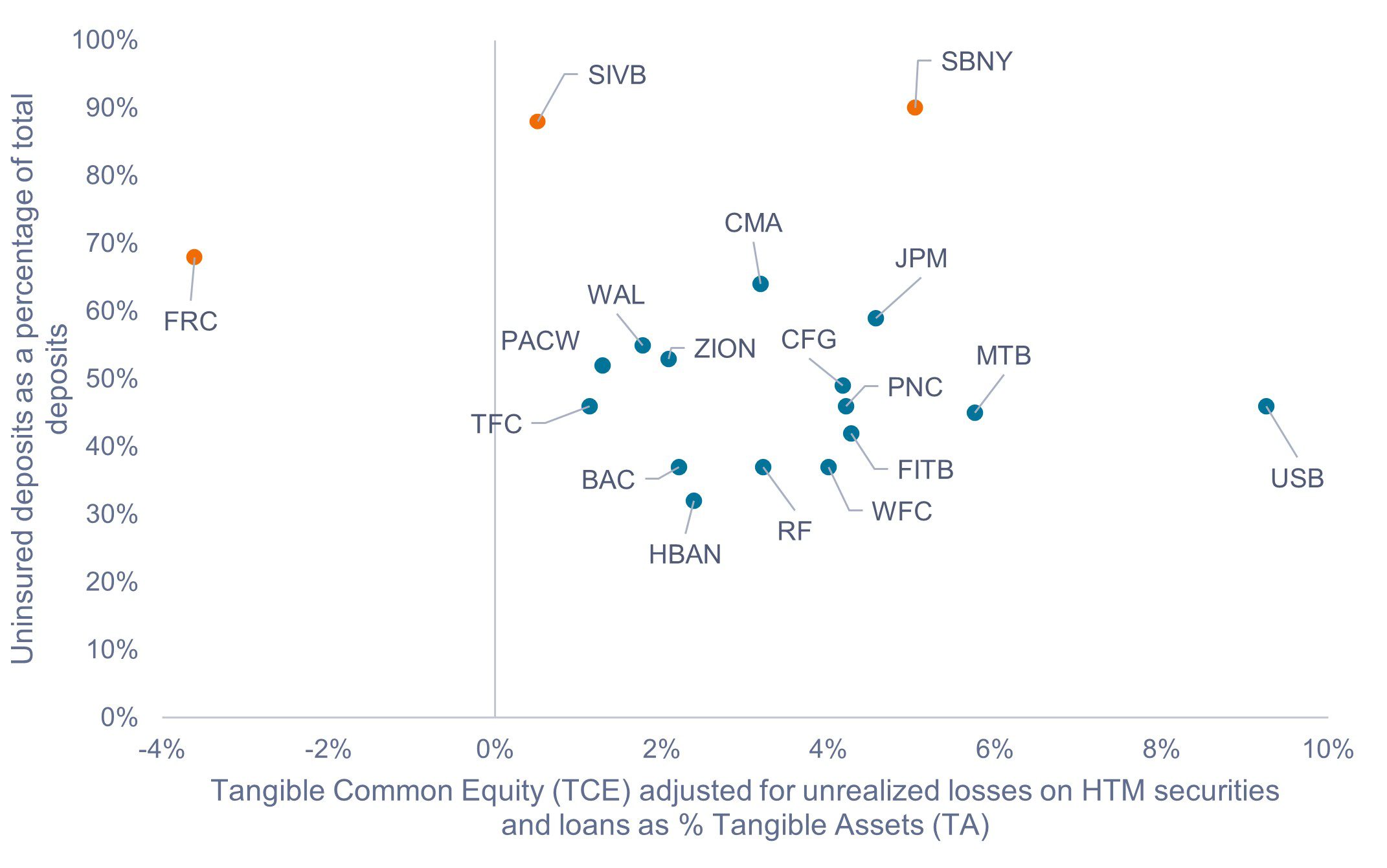

In the case of SVB, SBNY, and FRC, a mixture of high exposure to rising interest rates and high levels of uninsured deposits (i.e., deposits that exceed the FDIC’s $250,000 insured limit) proved to be their downfall. As shown in Figure 2, these three banks were outliers in the regional banking sector when evaluated on those two metrics.

Figure 2: Failed banks were more exposed to uninsured deposits and/or higher interest rates than their peers

Source: JP Morgan, Company 10-Ks, Janus Henderson Investors, as of 31 December 2022. Note: The Tangible Common Equity Ratio, or TCE ratio (TCE divided by Tangible Assets), is a measure of a bank’s capital adequacy. It can be used to estimate a bank’s sustainable losses before shareholder equity is wiped out. Held-to-maturity (HTM) securities are purchased to be owned until maturity. HTM securities have different accounting treatment compared to securities that are liquidated in the short term – notably, unrealized losses are only required to be recognized upon realization, or sale, of the affected securities. A tangible asset is an asset that has a finite monetary value and usually a physical form. Unrealized losses’ impact on TCE assumes a 21% tax rate. Past performance is not indicative of future results.

Deposit outflows at the remaining banks appear to have stabilized, and they have navigated the acute stress by being proactive in tightening lending standards, being more conservative in their balance sheet management, and tapping expanded Federal lending facilities to increase their liquidity buffers. Therefore, purely from a fundamental standpoint, we do not think the remaining banks are facing an imminent liquidity crisis.

That said, a lack of confidence could persist among some market participants, and bank stocks and debt instruments could face additional selling pressure. So, despite being in a stronger liquidity position than they were before the collapse of SVB, a crisis of confidence remains a legitimate risk for regional banks.

Investor concerns are, in part, justified by the ongoing headwinds in the banking sector, namely high interest rates, an inverted yield curve, and forthcoming stricter regulation. As long as short-term interest rates remain high, banks are likely to face competition for deposits from money market funds and government bonds. As such, we do think there will be an impact on profitability in the sector, especially for smaller banks that don’t have the diversified revenue streams and client bases of the Global Systemically Important Banks (G-SIBs).

Implications for investors

Since 2008, we have been in a highly accommodative monetary environment, with interest rates at 0% for most of that time and the Fed stepping in to help anytime it could. But a return to a historically normal world, with interest rates above zero, has changed the picture.

While inflation has started to cool, it is still well above the Fed’s 2% target, and it therefore seems unlikely the central bank will have the ability to materially cut rates anytime soon, barring a full-scale recession. We believe the full extent of ongoing headwinds on the economy will depend largely on how long the Fed keeps rates at elevated levels to curb high inflation, which itself is dependent on a cooling economy and tighter lending standards from banks.

In our view, a more challenging macroeconomic environment is likely to lead to bifurcation within the banking sector and other industries. Therefore, we think an investment strategy that carefully weighs the risk-reward relationship of individual companies is vital at this stage. In addition, the situation is dynamic and rapidly evolving, which requires investors to be continuously processing new information and to maintain a nimble approach to adjust to changing circumstances.

In summary, the bar of higher interest rates has been raised and the competition has become more demanding for financial and non-financial companies alike. We think the likelihood of clear winners and losers emerging within industries has increased and, as such, we’d advocate against owning every company in an index. Instead, we believe a research-driven, active approach can enable proven investment managers to identify and manage the risks in the market, while being constructive on those companies that are set to thrive in a tougher competitive environment.

IMPORTANT INFORMATION

Financials industries can be significantly affected by extensive government regulation, subject to relatively rapid change due to increasingly blurred distinctions between service segments, and significantly affected by availability and cost of capital funds, changes in interest rates, the rate of corporate and consumer debt defaults, and price competition.