Bond markets: The reversal of cheap money was always going to be bumpy

Jay Sivapalan, Head of Australian Fixed Interest, discusses the recent financial crises across SVB and Credit Suisse, how the market has responded and how the team are positioning portfolios to weather the volatility and capitalise on opportunities that present themselves.

9 minute read

Key takeaways:

- Silicon Valley Bank and others are idiosyncratic issues and where contagion risks exist, authorities are acting swiftly, shoring up confidence.

- While bond markets in certain pockets are dislocated, pricing in outcomes resembling more system-wide problems, credit pricing is not reflecting stress.

- Opportunities for active managers are becoming apparent, but must be nimble to take advantage of the unfolding situation.

By now you would have read more about a regional bank on the US west coast than anyone would have cared about a week ago. Yet today markets are concerned about a contagion that risks rocking the whole global financial system.

What’s driving this and why? And where to from here?

Whilst too early to make a call on the short-term market moves, taking a step back, this market malaise is an example of the dislocation that will result from the reversal of years of ultra-low rates and elevated liquidity as businesses that were reliant on the growth that this post-GFC period enabled are now proving to be less than resilient.

This reversal process should be mostly an orderly process, however, there will be pockets of ugliness – and this is what we are witnessing currently.

Central banks, regulators and opportunistic capital providers are there to assist in the adjustment process and in our assessment are satisfactorily dealing with systemic tail risk.

Our experience tells us that markets will revert to focusing on economic fundamentals, as they always do after a period of noise and distraction.

Silicon Valley Bank (SVB), Credit Suisse

Much has already been written on SVB, but in our view, the key challenges faced by the bank were:

- A concentrated exposure to an industry and geography that had grown very quickly (potentially too fast) – the tech, venture capital sector in Silicon Valley.

- A gross interest rate risk (duration) mismatch of their liabilities (short-term deposits) and assets.

- An amplified mark-to-market loss of assets, as a direct bi-product of sharp central bank policy tightening.

The regulator promptly shored up depositors through a comprehensive package, taking system-wide risks of a further ‘run on banks’ off the table. While these developments are quite idiosyncratic, they had the potential to become broad based if not dealt with promptly and effectively.

Credit Suisse (CS) was the next cab off the rank – below are our observations:

- CS had no practical relationship with SVB, no material US customer deposit issues but had independently faced heightened liquidity challenges in Q4, 2022.

- CS has become a financial institution of focus for the market, leading to a crisis of confidence.

- Past risk management missteps are still fresh in investors’ minds, including more recent financial reporting irregularities.

- CS is a Global Systemically Important Bank (G-SIB), meaning it has higher regulatory oversight, therefore its capital and liquidity remain strong and its asset quality is robust.

- The Swiss regulator and central bank have affirmed the bank’s capital strength as well as liquidity back-stops, however, in the interest of stabilising the situation and CS’ future, it orchestrated a merger with UBS which essentially resolves the near-term crisis of confidence in CS.

- Under the terms of arrangement, senior debt holders are ‘money-good’, but holders of additional Tier 1 note holders are at risk of permanent loss of capital.

With both examples, whilst they had the ability to negatively affect risk appetite, market liquidity and confidence, we believe they are unlikely to result in a GFC-style crisis or a Lehman Brothers moment.

The banking system, particularly at the bigger end of town, has been made safer after the GFC. Instead, we see the risks lying in the less regulated private markets with concentrated exposures. However, that’s not to say there won’t be other spot fires and contagion to be addressed over time, with the latest example being HSBC. Indeed, markets will remain vulnerable to both risk-off episodes and more importantly a lack of liquidity at critical moments, which in turn have the potential to cause further vulnerabilities.

Markets: Swift re-pricing

In less than five trading days, bond markets have swiftly re-priced large swathes of liquid assets and derivatives across interest rates, semi-governments, supranational and credit. For investors, it is worth taking note of both the magnitude and implications of these moves as they represent both risks and opportunities for all asset classes.

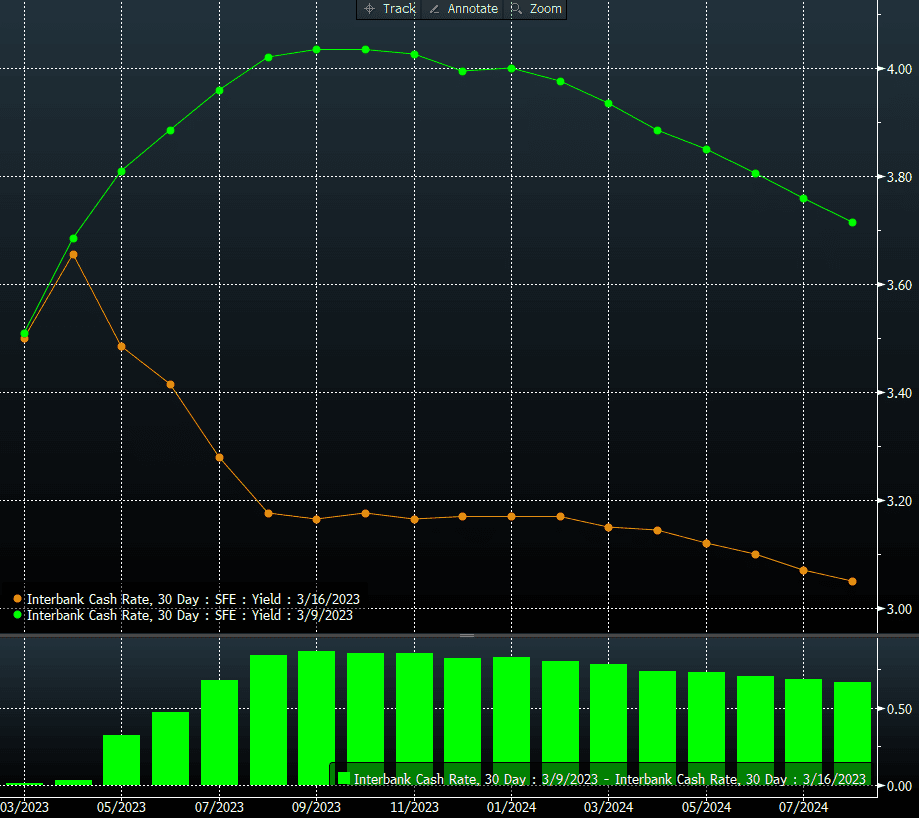

Perhaps the most eyebrow raising move has been cash rate expectations given the inflation fight by central banks. In the case of the US, markets have taken out the equivalent of some five cash rate policy changes from implying a peak US Federal Funds rate around 5.5% (a further 75bps of tightening) a week ago, to now implying an imminent easing cycle. A similar dynamic has been priced in for the Reserve Bank of Australia’s (RBA) own monetary policy as shown below:

Chart 1: 30-day interbank cash rate

Source: Bloomberg. Green line – Cash rate expectations as at 09/03/23, Orange line – Cash rate expectations as at 16 March 2023.

In our assessment, the significant rally in bonds resulting from ‘flight to quality’ flows and the associated fall in yields doesn’t necessarily imply a near-term easing cycle unless central banks need to address a much more significant crisis. Whilst inflation may have peaked, the fight against inflation is not yet over and there’s a near-term opportunity for active duration positioning for investors.

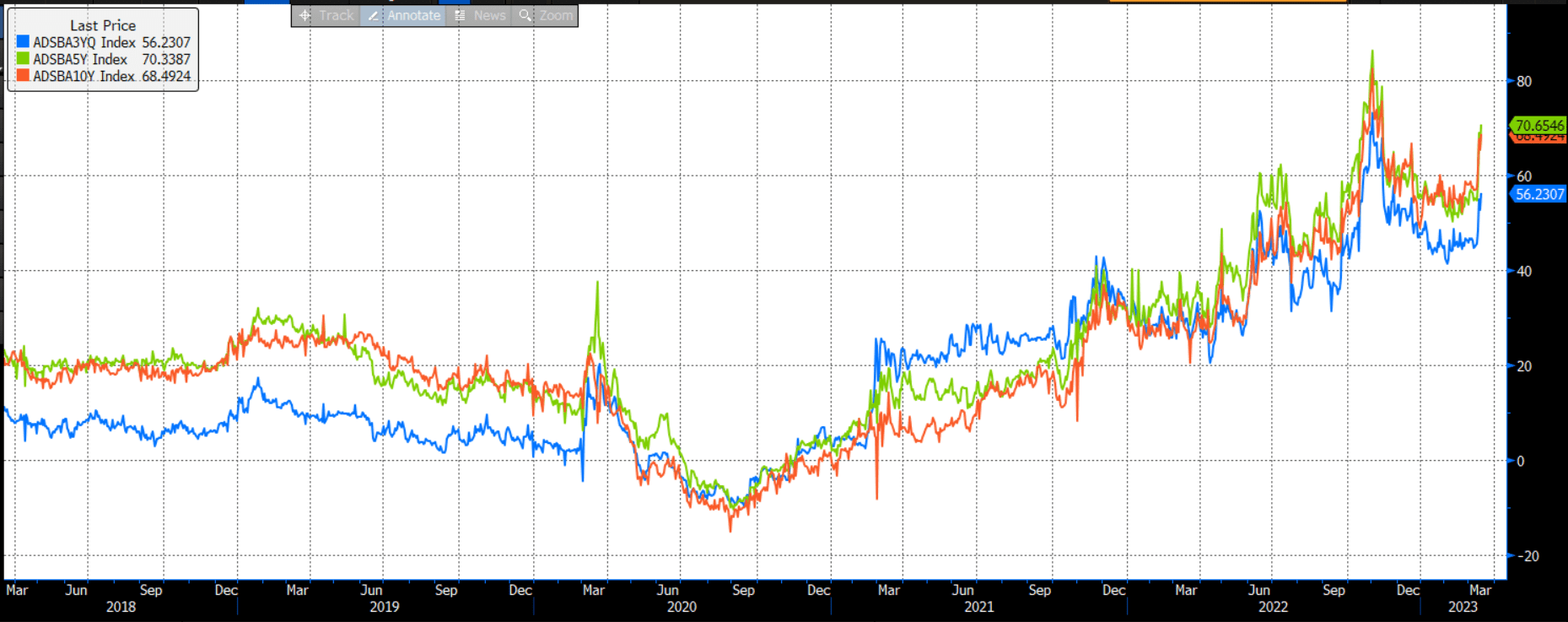

The sudden move in market pricing accompanied with a loss in liquidity has also resulted in some meaningful moves in the default-risk free rate or very low risk physical assets as well as derivatives.

The bond/swap exposure is one example which is the spread investors receive/pay when they choose to receive/pay in the swap market and hedge the interest rate risk by selling/buying physical government bonds or government bond futures. Chart 2 shows the uptick in spreads since this recent market event has unfolded.

Chart 2: Bond/swap spreads

Source: Bloomberg. Blue line – 3yr bond-swap spread, Green line – 5yr bond-swap spread, Orange line – 10yr bond-swap spread. Y-axis units in basis points, as at 16 March 2023.

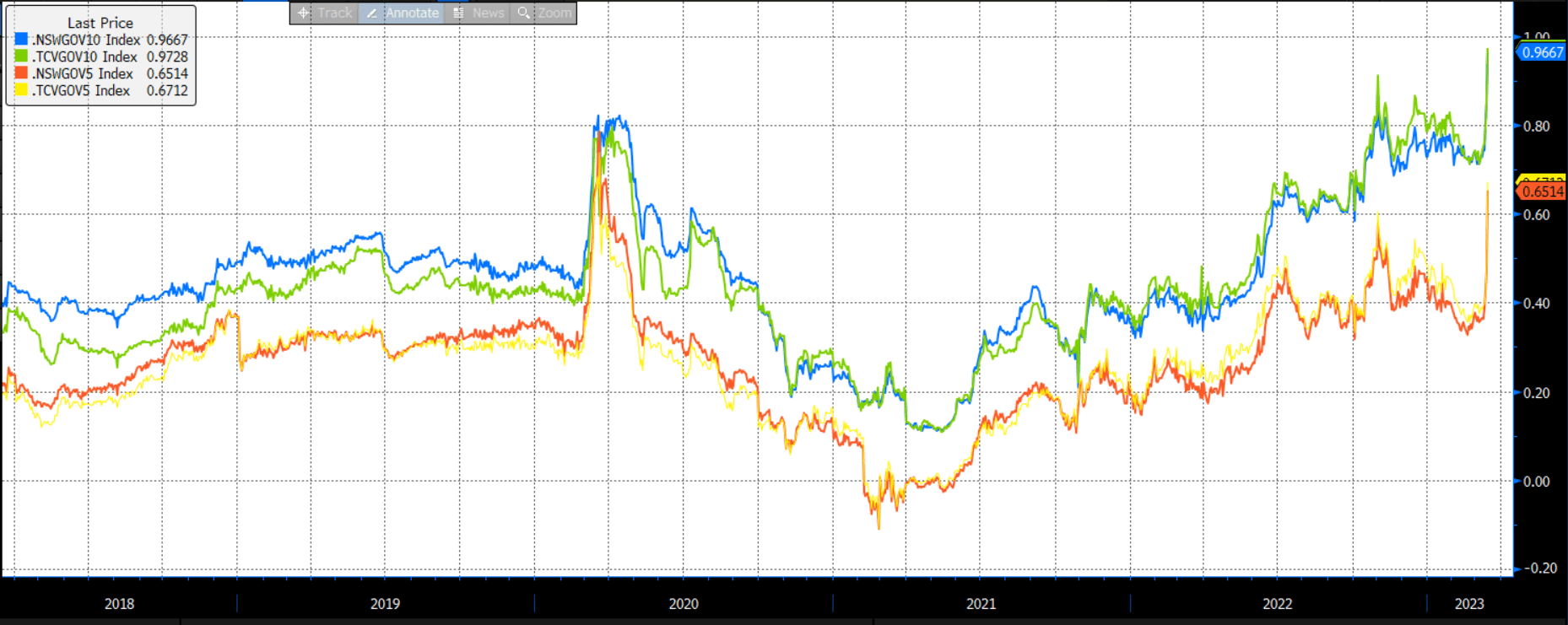

Bond/semi spreads

Again, the spread between government bond yields and state government bond yields have also spiked to above Pandemic levels and one would have to go back to the European sovereign debt crisis to witness more elevated levels.

In reality, no amount of market volatility is going to change the creditworthiness or default risk of the New South Wales or Victorian governments, for example, in such a short period of time. To our way of thinking, these are exactly the moments when technical factors drive pricing away from fundamentals.

Chart 3: Semi-government bond spreads

Source: Bloomberg. Blue line – New South Wales vs Commonwealth government spread (10yr), Green line – Victoria vs Commonwealth government spread (10yr), Orange line – New South Wales vs Commonwealth government spread (5yr), Victoria vs Commonwealth government spread (5yr). Y-axis units in basis points, as at 16 March 2023.

The above are examples of market overshoots and are exploitable by nimble, active management strategies.

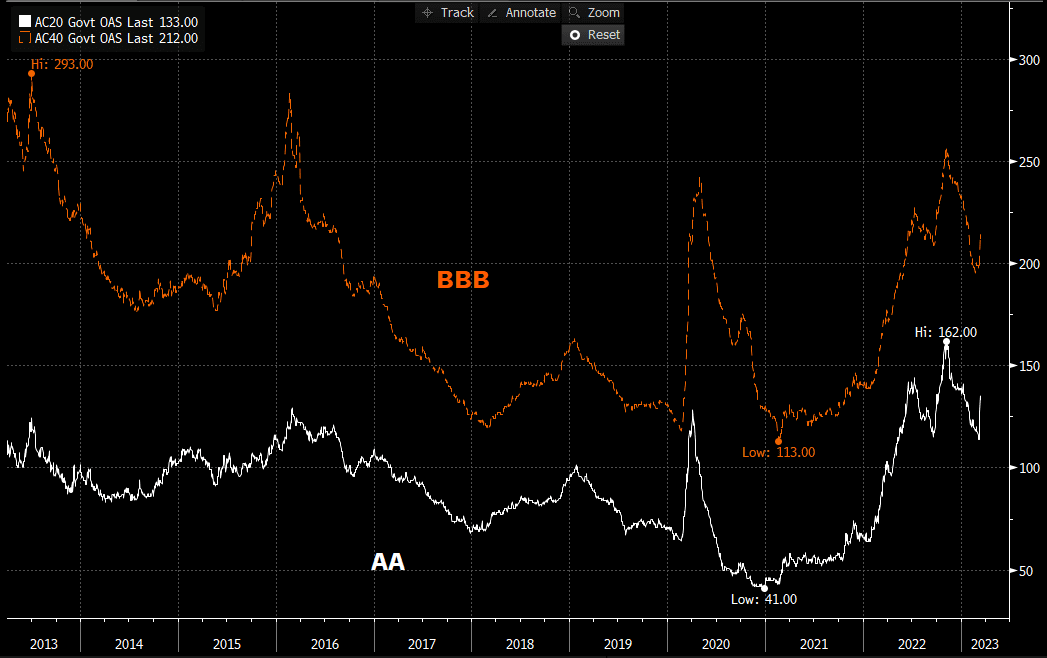

The dislocations continue into other segments of spread sectors including credit markets. But in our assessment, the re-pricing to date is not sufficient enough to materially change positioning (other than small, highly selective pockets of credit, such as top tier US financials).

Chart 4: Australian Credit Spreads (AA and BBB)

Source: Bloomberg. ICE/BAML Indices, credit spread to government. Y-axis units in basis points, as at 16 March 2023.

Investment strategy implications

In volatile times like these, it is often helpful to take a big step back and look much further ahead and then work backwards to today. With this in mind, we offer the following thoughts to 2024 and beyond:

- From a macroeconomic perspective, we are at best in the second half of the economic and business cycle and at worst very late cycle.

- Going forward, we believe the allocation of capital will be different to the past 5+ years, favouring public assets that are re-pricing more quickly than private assets.

- Risks have built up in certain segments and industries, and while some risks may never be realised, others will be. In this environment, we think that erring on the side of caution will serve investors best.

- We place heavy emphasis on very low permanent loss of capital in pockets of the bond market, but believe near-term mark-to-market volatility should not be feared as they often bring the best risk-adjusted return opportunities.

With these ‘North Stars’ in mind, in our assessment, systematically evaluating each pocket of bond market dislocation and favouring taking bigger active positions in the safest opportunities, rather than smaller exposures to lower quality or tail risks is important. In our view, the time to have simply chased yields or lower quality credit has passed.

Investment strategy implications

Across our Australian fixed interest strategies, we maintain (at all times) prudent levels of highly liquid assets including government, semi-government, supranational and money market assets.

Currently, we have a conservative view and positioning of credit in terms of ratings exposure, with a skew towards AAA, AA rather than BBB, and very limited exposure (if any) to sub-investment grade depending on the strategy. In addition, we employ credit protection via credit default swaps (CDS).

We have a heavy focus on ‘quality before price’, with emphasis on highly diversified financials, companies that are often the top tier operators in their industries. We also skew towards issuers backed by hard assets such as infrastructure (toll roads, universities, airports, seaports, lowly geared REITs) or non-discretionary companies, such as Woolworths and Coles, along with members of the ‘unquestionably strong’ Big Four banks.

We have minimal asset backed exposure, including Residential Mortgage Backed Securities and virtually no private debt.

Whilst we enter this latest crisis in a relatively healthy state, investment portfolios aren’t immune to the mark-to-market impacts from risk-off market movements. We expect some volatility, but on the flipside, some of the ‘safer’ dislocations (opportunities) shared above have already been capitalised on, with expectations of strong contribution to returns over the year ahead.

Markets today are not to be feared, but judiciously exploited for the benefit of investors. Once implemented, patience may be required, but if history is a guide, our experience tells us that dislocations such as these often result in strong investment outcomes.

This information is issued by Janus Henderson Investors (Australia) Institutional Funds Management Limited (AFSL 444266, ABN 16 165 119 531). The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson Investors (Australia) Institutional Funds Management Limited believe that the information is correct at the date of this document, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson Investors (Australia) Institutional Funds Management Limited to any end users for any action taken on the basis of this information. All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson Investors (Australia) Institutional Funds Management Limited is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect.