Four ways institutional investors can seek incremental yields

Jay Sivapalan, Head of Australian Fixed Interest, and Shan Kwee, Portfolio Manager, discuss how far fixed interest markets have come in the past 12 months and outline four ways institutional investors can seek incremental yield opportunities.

Key Takeaways

- X

- X.

While bond market participants process a wall of worries, the seeds of the next set of compelling investment opportunities are already being sewn. Markets continue to be rocked by out-of-control inflation, and credit spreads are widening at the sobering thought of central bank support being withdrawn.

But it is not all doom and gloom, as hidden amongst the bond market carnage are opportunities for yield, which don’t require a journey too far up the risk curve.

When we reflect on where the market was 12 months ago, investors were chasing 4% yields, but had to pursue investments in private debt, loans, high yield, mezzanine residential mortgage-backed securities (RMBS) and CLOs to achieve it.

Today, investors can shift into higher quality, higher capital structure, and in most cases, more liquid investments with similar yields. Below we describe four opportunities with all-in yields of over 4%. Our view is that the following strategies are likely more suitable for the mature stage of the economic and business cycle that we find ourselves in today*:

*These are the views of the Portfolio Manager as of 3 June 2022, which are subject to change and should not be construed as advice.

1. Senior major bank (AA rated) and other highly rated financial fixed rate bonds

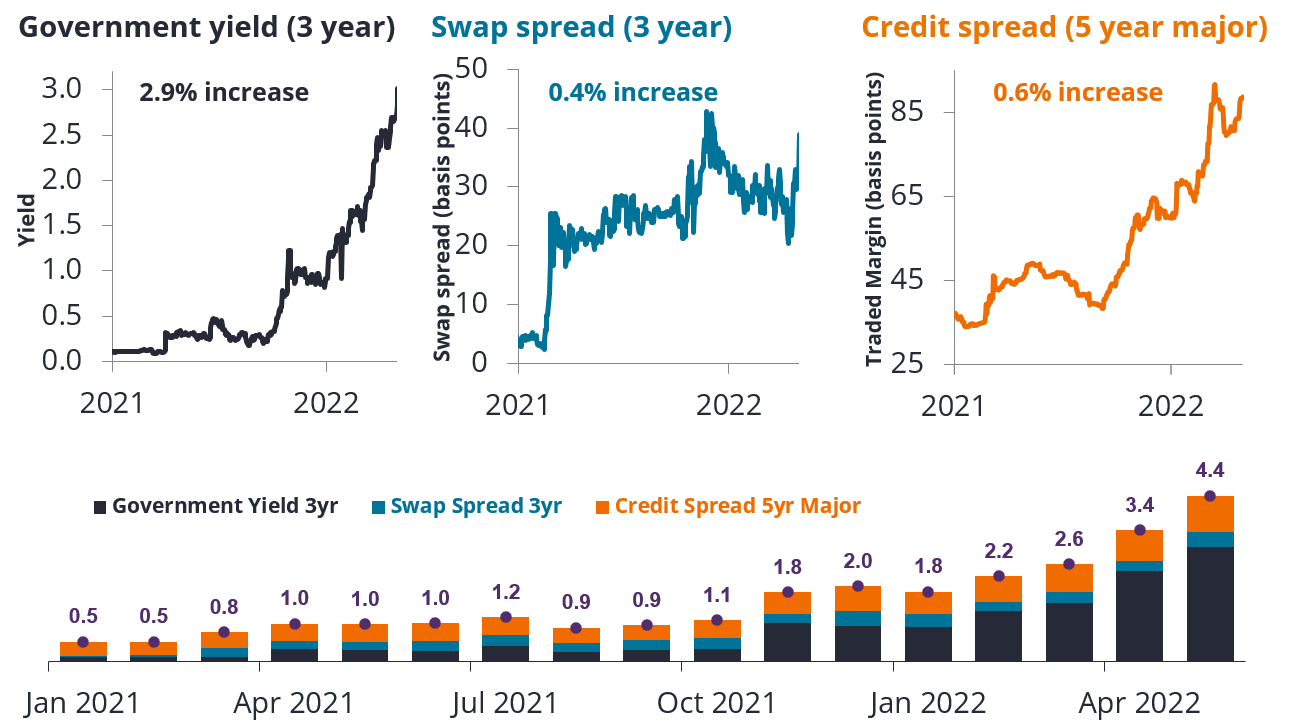

A rare combination of markets pricing in aggressive cash rate tightening (2.5% cash rate by the end of 2022 and 3.5% by this time next year) combined with normalising swap spreads and widening bank credit spreads has delivered a quadrupling of the all-in yield of senior bank bonds.

There is an opportunity for investors to lock in 4%+ p.a. yields over a three-year period, providing a good margin beyond what we see as an overly aggressive cash rate tightening profile priced in by markets.

Chart 1: Australian three-year government bond yield, Three-year swap spread and Five-year major credit spread

Source: Bloomberg, Janus Henderson Investors. Government Yield, Swap spread, and Bank credit spread measured from 1 January 2021 to 6 April 2022.

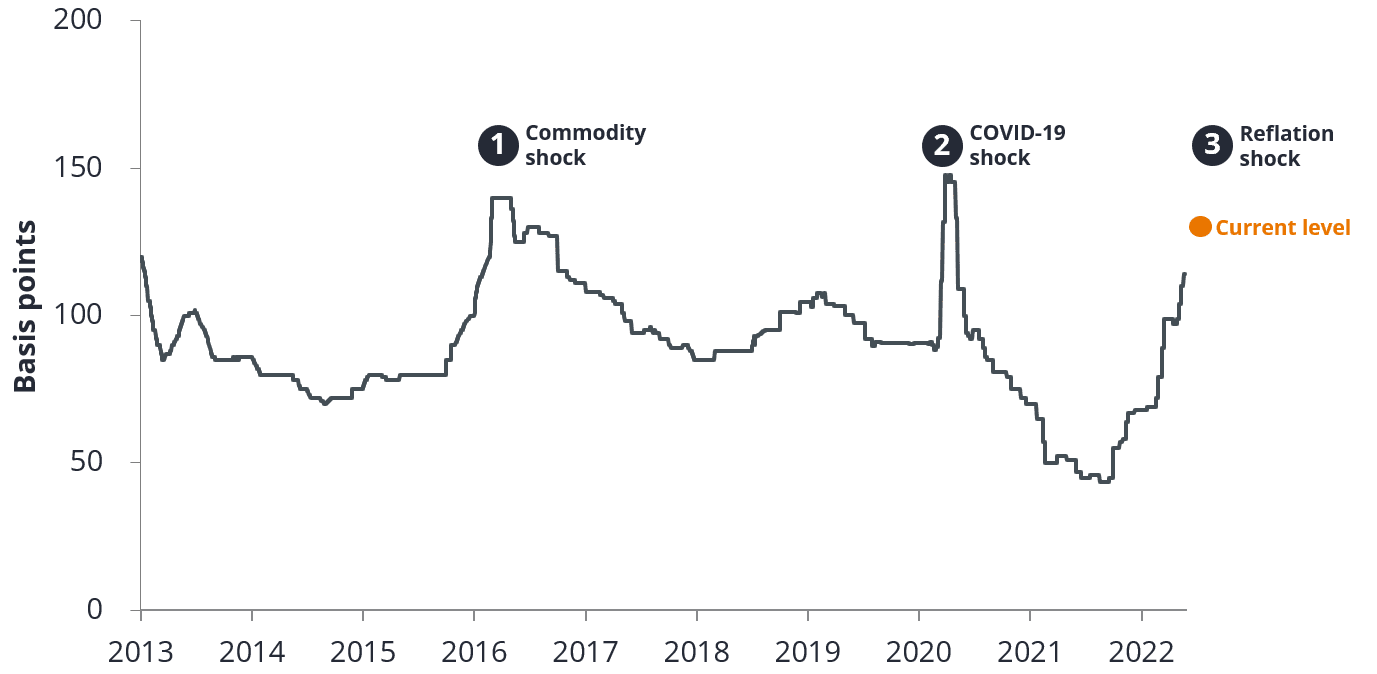

2. Prime AAA rated senior tranche RMBS coupled with 3-year swaps

One notable development over the past year has been the RBA ceasing the Committed Liquidity Facility (CLF), which was brought in after the Global Financial Crisis to provide banks with a mechanism to meet their increased High Quality Liquid Asset (HQLA) requirements. This change, coupled with recent risk-off credit market weakness, a flurry of mortgages needing to be cleared from warehouse financing and concerns regarding rising mortgage rates has created an attractive opportunity for investors to lock in three-year Weighted Average Life (WAL) AAA rated RMBS, which are currently trading at around a 120 basis point (bps) spread, coupled with three-year interest rate swaps to achieve 4.0-4.5% all-in yields.

Being late in the cycle and with rising mortgage rates, it is vital for banks to do the hard work on credit assessments and to target older, seasoned pools with low loan to value ratios (LVRs). This is particularly important for any loans written over the past two years. Exposure to fixed rate mortgages in this environment must also be managed.

Chart 2: Residential mortgage-backed securitiesAustralian banks are moving out of RMBS as the CLF winds down

Source: Janus Henderson Investors, NAB, Westpac, Bloomberg. As at 31 April 2022. Note: Spread is Prime Bank RMBS A1 tranche, rated AAA.

3. Highly defensive, resilient sectors

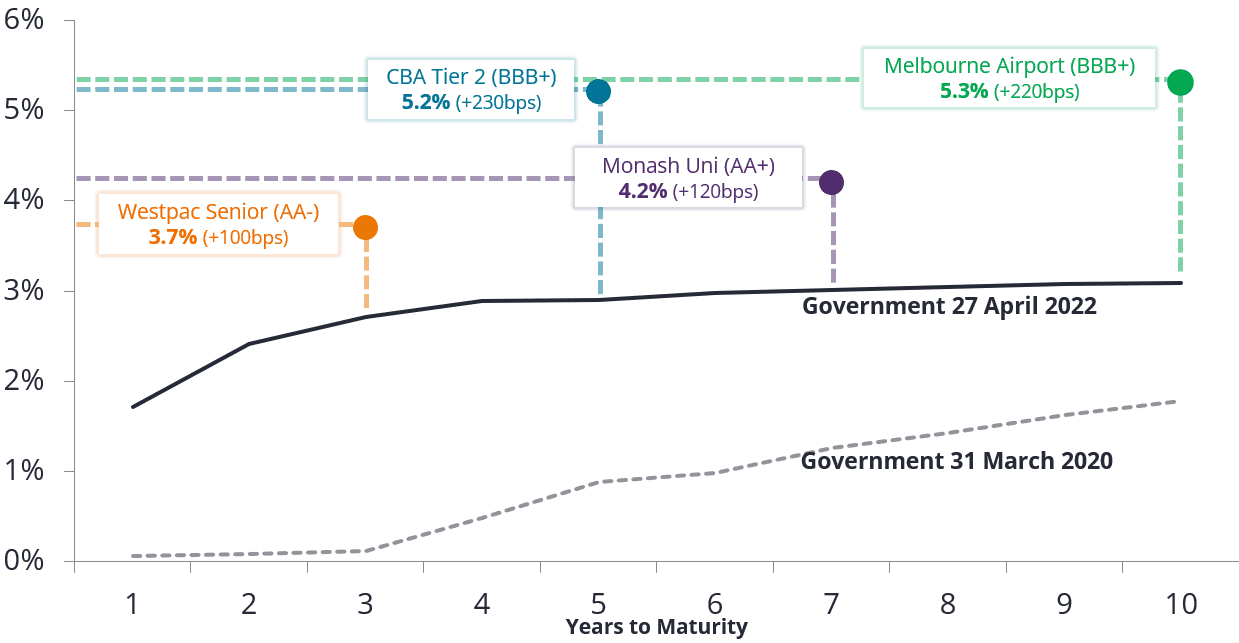

Within certain sectors, some companies have managed to navigate the pandemic effectively and are still trading at elevated spreads, delivering 4-5% all-in yields. This is despite their outlooks being greatly improved, with strong balance sheets and cashflow generation.

These resilient sectors include the airports, universities and shopping centre and office REITs. By way of example, Vicinity centres (the owner of Chadstone Shopping Centre amongst other high-quality assets) and Melbourne Airport both have 3.5 to 4.5year bonds trading within the 4-5% yield. Some other examples are shown in the chart below.

Chart 3: Yield curve and individual issuer spreads

Source: Janus Henderson Investors, Bloomberg. As at 27 April 2022. Note: Yield curve based on Australian Government Bond Yield. Dashed line represents the yield curve in 31 March 2022. References made to individual securities should not constitute or form part of any offer or solicitation to issue, sell, subscribe or purchase the security.

4. Australian household names

Further to the general widening in credit spreads, which were exacerbated by financial debt issuance, investors can now secure three- to five-year fixed rate high-quality and/or defensive Australian ‘household name’ corporate debt that provides essential services to the Australian public such as:

- Woolworths Ltd

- Coles Group Ltd

- Telstra Corporation Ltd

- NBN Co. Ltd

- Jemena (SGSP (Australia) Assets Pty Ltd)

- Transurban Group

At the time of writing, each of these deliver investors an all-in yield above 4%, while just 12 months ago investors would have had to invest in riskier assets to achieve similar yields. What a difference a year makes.

latest insights from

Janus Henderson

on LinkedIn. Follow

This information is issued by Janus Henderson Investors (Australia) Institutional Funds Management Limited (AFSL 444266, ABN 16 165 119 531). The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson Investors (Australia) Institutional Funds Management Limited believe that the information is correct at the date of this document, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson Investors (Australia) Institutional Funds Management Limited to any end users for any action taken on the basis of this information. All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson Investors (Australia) Institutional Funds Management Limited is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect.