View from the desk: Australia’s bond yield eruption

5 minute read

Amid the wild swings in the bond market and the RBA’s new stance, Jay Sivapalan, Head of Australian Fixed Interest at Janus Henderson, provides his perspective on the threats and opportunities.

The race that stops a nation didn’t stop our fixed interest team’s active bond trading and portfolio management right across Melbourne Cup day and long into the night as the Australian bond market continued its wild swings.

What’s the situation?

Inflation fears resulting from COVID-related supply issues have led markets to ignore the Reserve Bank of Australia’s (RBA) forward guidance, bringing forward monetary policy tightening expectations to mid-2022 and factoring in both rising inflation and a strong economic rebound in 2022.

Yields have risen sharply across the government yield curve, with the largest moves at the shorter end of the curve, suggesting cash rates rising in the near-term.

While the RBA stayed the course by keeping cash rates at 0.10%, it has responded by changing its stance on yield curve control. Through its pandemic response, monetary policy support from the RBA included a commitment to cash rates remaining at 0.10% until 2024, but this is now no longer the case.

The Reserve Bank of New Zealand is already fending off 4.9% inflation, while other major economies are also recording rising inflation, this is clearly worrying investors about what might be ahead for Australia, contributing to the market’s response to the latest CPI figures released on 27 October.

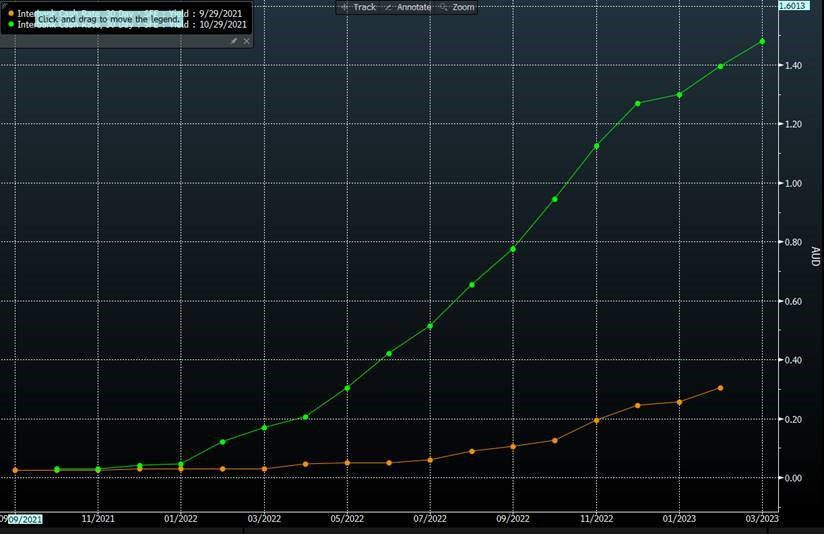

Chart 1: Cash rate expectations (%):140bps of rate rises by Q1 2023?

Source: Bloomberg. ASX 30-Day Interbank Cash Rate Future Contract (orange curve: 29 September 2021, green curve: 29 October 2021). As at 2 November 2021. Chart 2: Swap rates (%)

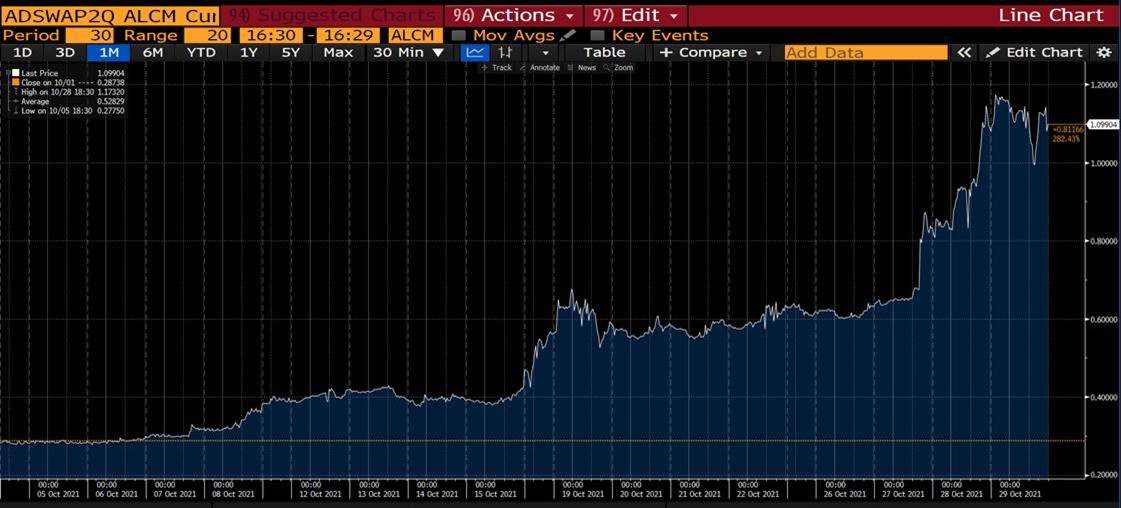

The surge in swap rates shows the market’s reaction to the CPI release and expected average cash rates over the next two years.

Source: Bloomberg. As at 2 November 2021.

The Australian bond market (as defined by the Bloomberg AusBond Composite 0+ Yr Index), fell by 3.55% over October, mirroring February’s falls, resulting in the second biggest bond market sell-off in nearly four decades. Over the past year to the end of October, the bond market is down 5.30%.

What’s your take?

Markets have baked in an aggressive monetary policy tightening profile over the next two to three years and noting that the cash rate before the pandemic was 1%-1.5%, we assessed this as an overshoot representing good value, essentially enabling investors to ‘lock in’ higher yields.

It is hard to predict exactly when markets will re-assess and even more difficult predicting turning points in markets. What is clear, however, is that attempting to pursue active strategies after the market has turned is too late and ineffective.

How are you responding?

In both periods of market turmoil and in periods of market stability, our approach to investing places a strong emphasis on preserving our investors’ capital. As such, while October left bond investors with few places to hide, the impact to the returns of the Janus Henderson Tactical Income Fund in these conditions was materially less than that of the Australian bond market1 and the fund’s benchmark2. This was principally due to active interest rate management.

Through the pandemic period, we have been guided by our investing ‘North stars’, which provide us with perspective in periods of market volatility. These are:

- Expectations of a gradual ‘normalising’ in cash rates around the globe lifting risk-free yields

- Active navigation of bond markets, adding duration when yields overshoot to the upside and taking profit when yields retreat

- Holding inflation protection when it’s cheap

- Recognising that income producing assets will remain in high demand during a period of low risk-free rates (spread sectors, including credit)

- Investing with a cautious mindset – managing ESG/stranded asset risk and deploying capital to positive impact opportunities

- Aiming to fully participate in the cyclical growth uplift

Specifically, through the recent bond market turbulence:

- We have built active duration positions so we have our largest position when the turning point occurs in order to be well-placed to capitalise on opportunities that present themselves.

- We still see a role for some modest inflation protection given cyclical pressures from challenged global supply chains and the wider opening up of the economy from late 2021. This is despite breakeven inflation rates moving into the bottom end of the RBA’s 2-3% target band.

- We have found sources of incremental returns through semi-government bonds, such as NSW and Victorian state government bonds, and credit sub-sectors including those set to benefit from increased people movement, including the re-opening of international borders.

- We have also invested opportunistically in higher yielding sector securities, but have avoided investing in global high yield and emerging market corporate debt which can be more sensitive to interest rate moves.

1. Bloomberg AusBond Composite 0+ Yr Index.

2. Bloomberg AusBond Composite 0+ Yr Index and Bloomberg AusBond Bank Bill Index (equally weighted).

latest insights from

Janus Henderson

on LinkedIn. Follow

Any funds mentioned in the article is issued by Janus Henderson Investors (Australia) Funds Management Limited ABN 43 164 177 244, AFSL 444268 and is for general information only. This information is intended solely for the use of wholesale clients, as defined in section 761G of the Corporations Act 2001 (Cth).

This information is issued by Janus Henderson Investors (Australia) Institutional Funds Management Limited (AFSL 444266, ABN 16 165 119 531). The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson Investors (Australia) Institutional Funds Management Limited believe that the information is correct at the date of this document, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson Investors (Australia) Institutional Funds Management Limited to any end users for any action taken on the basis of this information. All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson Investors (Australia) Institutional Funds Management Limited is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect.