Autocallables and the art of risk transfer

Autocallables and the art of risk transfer

Portfolio manager Natasha Sibley explores the realm of autocallables, looking at the investment opportunities created by banks’ need to transfer risk.

Key Takeaways

- Autocallables are a yield-enhancing structured product, with the potential for attractive coupons balanced against the risk that the underlying asset will fall below a certain value, resulting in losses for the product.

- The large demand for equity forwards from banks to manufacture autocallables has led to distortions in the price of equity forward parameters.

- The market for risk transfer continues to evolve rapidly, providing opportunities that could help to enhance diversification or performance across a portfolio or strategy.

Structured products can often seem as one of the more exotic parts of the investment world. But in reality, while the underlying products may have complex features, they tend to be a simple function of ‘need and opportunity’. Innovative and highly customisable instruments, structured products offer investors a reasonably accessible route to holding derivatives, providing flexible solutions tailored to meet specific objectives.

Autocallables are one such example; a structured product that generates yield by selling puts. The ‘autocallable’ feature means that that the product is automatically called – ie. the investor receives their capital back, along with a generous coupon – if the price of an underlying asset (an index or stock, for example) is above a pre-set level on pre-set dates. Capital is at risk in these products, and if the underlying price drops below the strike of the embedded put, investors can find themselves exposed to losses.

Need and opportunity

The past decade has seen interest rates stuck at, or close to, historic lows, leaving investors engaged in a search for yield. At their heart, autocallables are ostensibly a yield-enhancing product, with the potential for attractive coupons balanced against the risk that the underlying asset will fall below a certain value. Despite the variations in terms and structure, the high coupons that can be manufactured by selling out of the money puts has made autocallables a popular choice, particularly during what has been an extended period of low interest rates. As their popularity increased, banks that issue these products broadened the range, adding various features, and issuing autocallables on a wider range of indices, baskets and individual stocks.

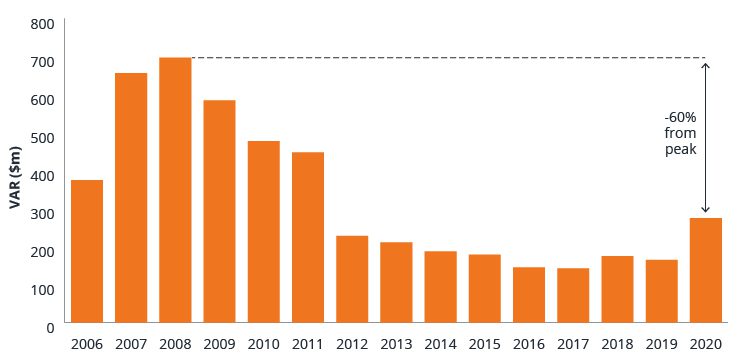

However, this growth in demand brought with it a dilemma. The introduction of stricter regulations (Exhibit 1) saw banks required to hold more capital, or hedge exposure more precisely, impacting their ability to warehouse the risk associated with structured notes (the ‘need’). As a consequence, banks tightened their hedging of issued notes, shifting more risk off their books (the ‘opportunity’), to make room for more issuance. This has created an opportunity for investors willing or able to provide liquidity to banks that are limited in how much risk they can hold on their balance sheets.

Exhibit 1: Bank ability to hold the risk associated with structured notes has been limited

Source: Janus Henderson, Bloomberg, at 31 December 2020.

Note: This is intended for illustrative purposes only. Summed Investment Bank Equity VaR on 99% daily basis.

This dynamic has made for interesting markets as pricing moves away from fundamentals and supply/demand becomes more of a factor. One of the key exposures of an autocallable is forward equity exposure. In order to offset this exposure, when banks issue autocallables they typically buy forwards on the indices and stocks that underlie them. This large demand for equity forwards from banks hedging their structured product exposure fuels distortions in the price of equity forward parameters.

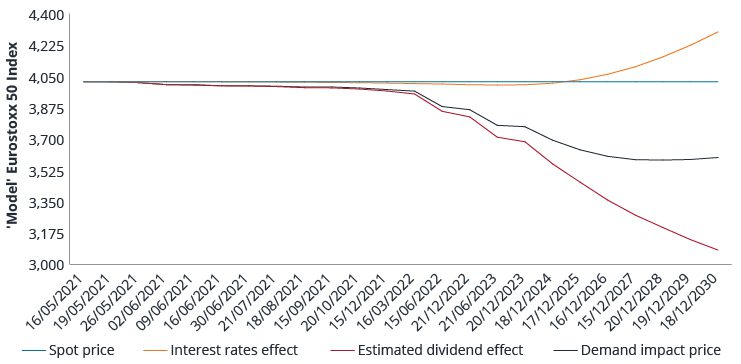

In theory, the price of an equity forward is determined by the spot price, adjusted by both interest rates and expected future dividends. This is illustrated in Exhibit 2: spot price, adjusted higher for interest rates, and then lower to account for the estimated dividend effect (pricing in the market’s expectations for dividends for those investors holding shares).

Exhibit 2: Finance 101 meets the real world

Source: Janus Henderson Investors, Eurostoxx 50 Index, 16 May 2021 to 18 December 2030.

Note: For illustrative purposes only. Used here to highlight the difference that demand can have on fundamental pricing for equity forwards. It does not reflect actual performance or pricing.

In reality, equity forwards in markets with heavy autocallable issuance typically trade higher than theory would suggest, as this hedging demand from banks moves prices away from fundamentals.

The premium of forwards to theoretical value can be split into two main components. The first is the dividend price discount – demand on forwards equates to supply on dividends, so high forward prices mean low dividend prices. There is a tradeable market for dividends which allows us to quantify the component of equity forward premium that is due to discounted dividend prices relative to expectations.

The second component is referred to as ‘equity repo’, or equity funding. It is the spread on top of interest rates that is paid to take long synthetic equity exposure. It directly parameterises how expensive an equity forward is compared to its theoretical level. Investors can ‘earn’ this repo rate by selling forward equity and buying spot.

It comes down to what risk transfer can offer investors

While much of this can seem fairly esoteric, risk transfer strategies such as this can represent an additional source of diversification for investors. It can provide different opportunities from traditional risk assets at different points in the cycle, and during major market events.

The market for risk transfer has grown significantly over the past few years, and it continues to evolve rapidly. Every market event provides more information to improve models and evolve risk-testing. Different types of structured products are being developed all the time, driven by the same function of need and opportunity, which will inevitably present new opportunities (and new pitfalls) for investors. Careful analysis to identify advantageous solutions could help to enhance diversification or performance across a portfolio or strategy.