Lithium and the clean energy revolution

Darko Kuzmanovic, Portfolio Manager in the Janus Henderson Global Natural Resources team, discusses the impact of the clean energy transition on the outlook for lithium.

As natural resources equity investors, we believe the clean energy transition and its impact on materials demand should not be overlooked. This is a global, multi-year trend, driven by the growing adoption of electric vehicles (EVs) and continued investment in renewable energy generation.

With many countries and corporations committing to net zero carbon emission targets by 2050, a massive transformation will be required to attain them. Commitment to these targets will result in strong demand for copper, nickel, aluminium, cobalt, lithium, graphite and various rare earths as they are key components in EVs and renewable energy generation infrastructure. Investment in new production capacity will be required to meet the predicted demand.

Lithium, which forms the core of the lithium ion batteries that power EVs and store renewable power, are a key beneficiary of the clean energy transition. During the last lithium boom (2014-2018), lithium demand expanded at approximately 20% compound annual growth rate (CAGR), while product prices more than tripled.

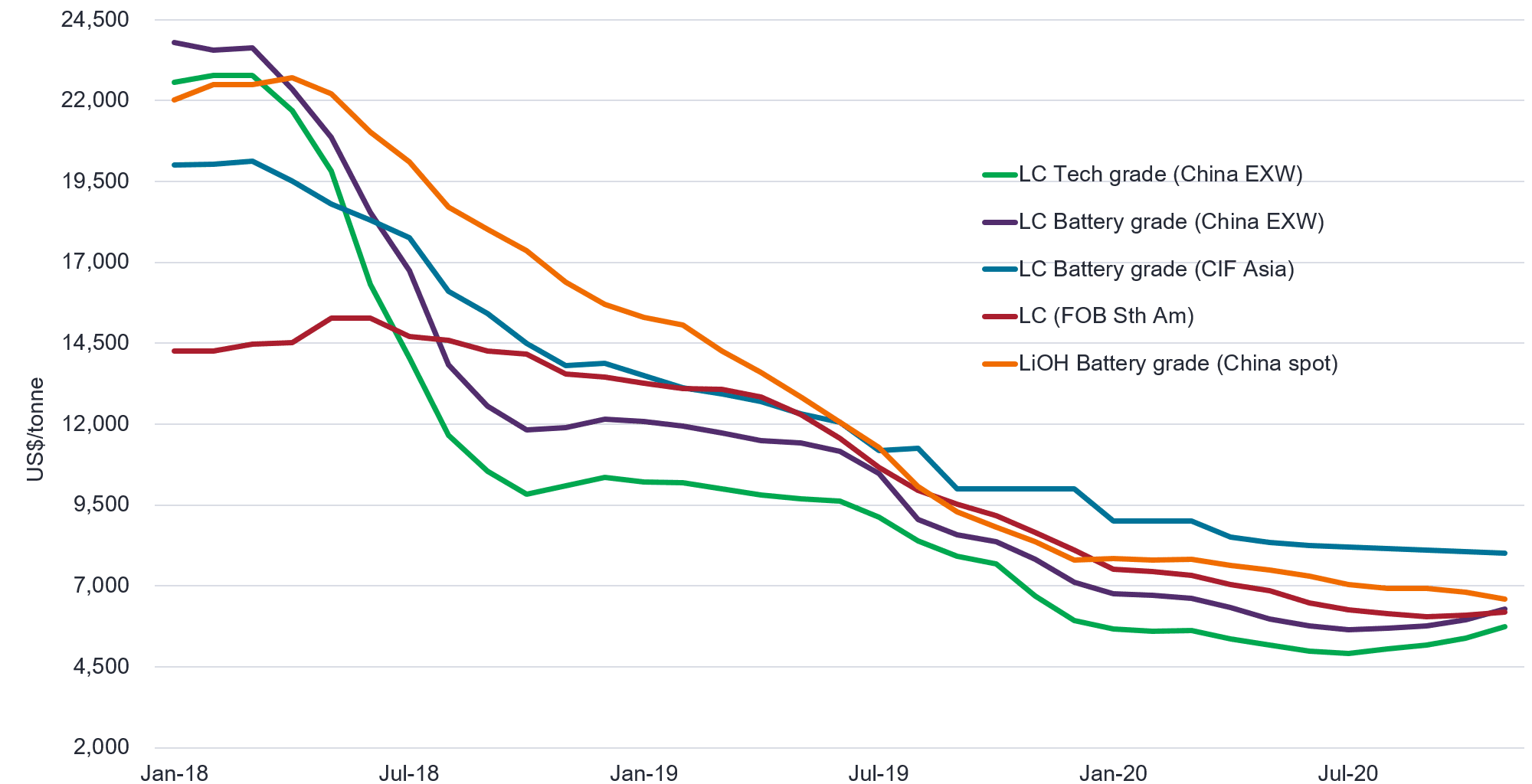

This is a relatively common dynamic for commodity markets where new demand surges and existing supplies are inadequate to respond. Higher prices encouraged exploration, leading to the discovery of numerous hard rock lithium deposits in Australia, with five new mines built in quick succession. Increased supply coupled with short-term flattening of demand led to a 50% fall in prices since the 2018 peak. This now appears to be over, with demand increasing and a reduction in the raw material and product investment leading to prices increasing.

After the boom – lithium prices (US$/tonne)

Source: Bloomberg, as at 26 November 2020.

It is anticipated that 2021-2022 will be the inflection point for EV demand1., as the mainstream auto industry begins to roll out new cost-competitive models. EV penetration is expected to increase from 3% to +30% of vehicle sold by 20302., as battery costs decline to US$100/kWh making EVs very cost-competitive with internal combustion engine vehicles. Demand for lithium ion batteries should therefore grow materially, in parallel with growth in EV production with CAGR’s of +30% p.a.

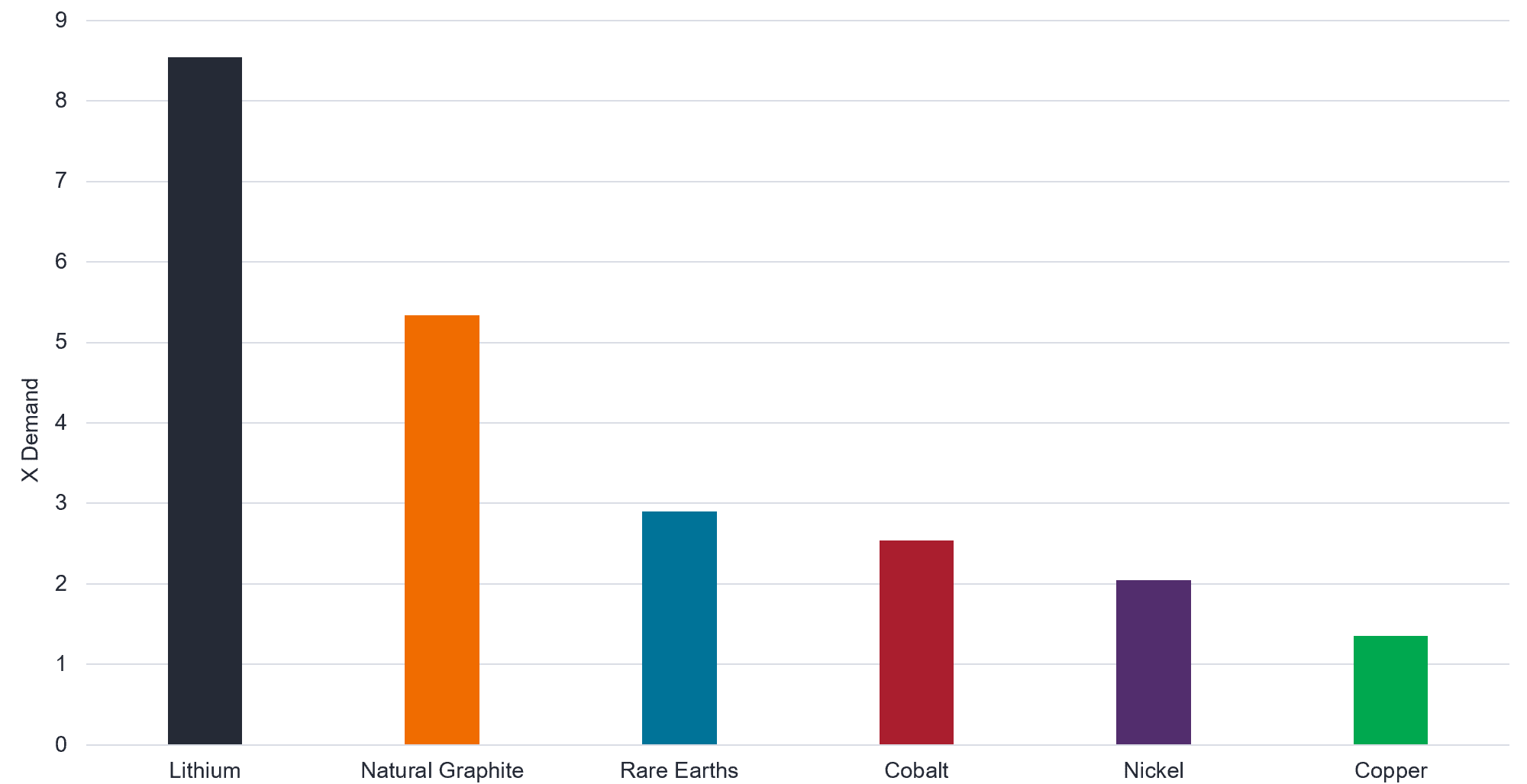

Tesla at its recent investor day3. suggested that battery capacity could increase to 3 terawatt-hours (3 million megawatt-hours) by 2030, which is equivalent to demand of 2.4-2.8 million tonnes per annum of lithium carbonate equivalent (LCE). This is significant given that demand for lithium in 2020 was estimated at 0.35 million tonnes of LCE, with capacity of around 0.55 million tonnes. According to UBS, lithium demand and production may need to increase 8-fold over the next 10 years. Meeting this rapid demand growth will be a major undertaking given lithium companies have reduced/delayed capital investment in the recent price pullback. Lithium supply could become acute over the medium-term once current production capacity is fully utilised, leading to supply tightness. Many of the major auto and battery makers have not secured lithium supply volumes that they need.

Estimated growth in market size (demand) to 2030

Source: UBSe, 2020. Estimated growth to 2030.

Although EV batteries have been the main talking point regarding raw materials demand, we cannot overlook the potential growth from the stationary storage market (residential, utility and industrial applications). This could increase demand for battery raw materials significantly; 5X for graphite, 3X for rare earths and cobalt and doubling in nickel. Whilst these numbers look very large, the investment intentions of the global auto and battery industry imply these are growth levels driven by government regulatory actions and the improving competitiveness of EVs themselves.

Copper is expected to be a beneficiary of EV growth as it is an essential material for EV components and renewable energy infrastructure. According to the Copper Development Association Inc., battery EVs contain 83kg of copper, while electric buses contain up to 370kg.

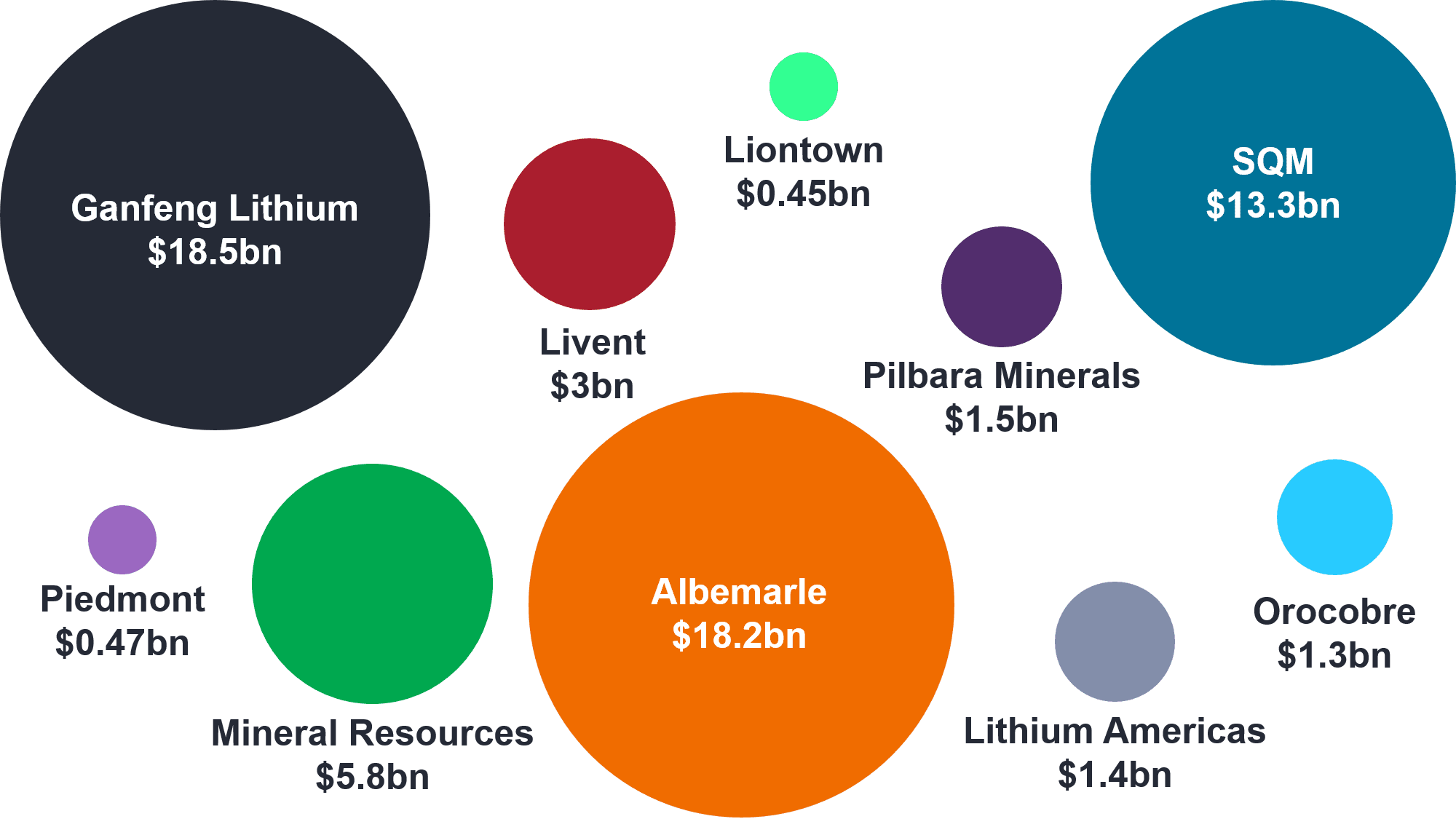

The equity market has already started to move ahead of the commodity price moves in anticipation of the return to boom times. Producers such as Albemarle, Ganfeng Lithium, SQM, Livent, Pilbara Minerals, Mineral Resources and Orocobre have performed strongly in 2020 with the Global X Lithium and Battery ETF (NYSE ARCA:LIT) price up 94% YTD. As in the last lithium cycle, we anticipate the emergence of new producers, such as Lithium Americas, Piedmont and Liontown as well as new development opportunities. The chart below shows the current relative market capitalisation of these producers, but we believe this chart could look quite different in 12-24 months’ time.

Relative size of lithium producers by market capitalisation (AUD)

Source: Janus Henderson Investors, Bloomberg. As at 26 November 2020. For illustrative purposes only. References made to individual securities should not constitute or form part of any offer or solicitation to issue, sell, subscribe or purchase the security.

This article first appeared on Livewire Markets as part of their One Thing Investors Can’t Ignore in 2021 series

1. 29 May 2020, https://www.cnbc.com/2020/05/29/led-by-tesla-electric-vehicle-sales-are-predicted-to-surge-in-2021.html2. 28 July 2020, https://www2.deloitte.com/uk/en/insights/focus/future-of-mobility/electric-vehicle-trends-2030.html

3. Tesla Battery Day, 22 September 2020.

latest insights from

Janus Henderson

on LinkedIn. Follow

This information is issued by Janus Henderson Investors (Australia) Institutional Funds Management Limited (AFSL 444266, ABN 16 165 119 531). The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson Investors (Australia) Institutional Funds Management Limited believe that the information is correct at the date of this document, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson Investors (Australia) Institutional Funds Management Limited to any end users for any action taken on the basis of this information. All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson Investors (Australia) Institutional Funds Management Limited is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect.