Positive impact investing: Can you do well by doing good?

6 minute read

Jay Sivapalan, Head of Australian Fixed Interest, and Artee Khiatani, Credit Analyst – ESG, explain how positive impact credit securities can achieve incremental returns relative to their non-impact equivalents.

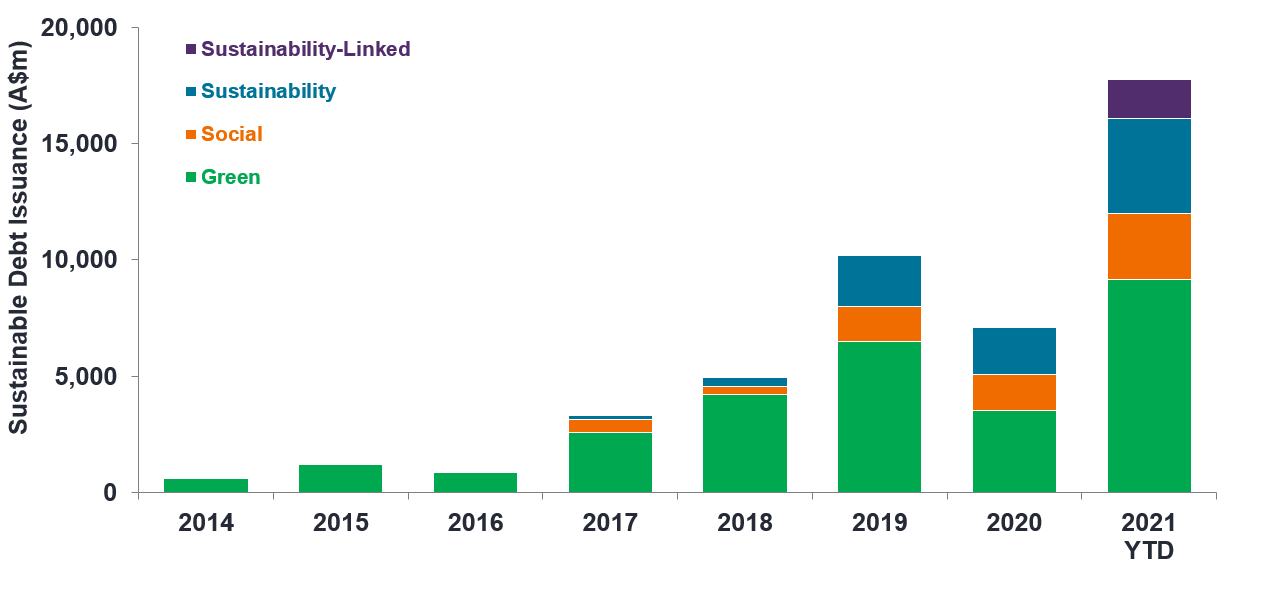

Positive impact bonds have soared in popularity in recent years as investors become more focused on the potential social and environmental benefits of their invested capital.

In the Janus Henderson Australian Fixed Interest team, identifying environmental, social and governance (ESG) risks and opportunities are embedded into our investment approach. As part of our credit analysis process, we form a view on issuers’ material ESG risks, and in our engagements with company management, we seek to understand how they approach material ESG risks. Engaging with management not only provides us with a deeper understanding of a company, it also ensures issuers are aware that ESG risk considerations are a significant factor in our bottom-up assessment process and can determine our appetite to invest.

We periodically meet with issuers in the Australian market, engaging with those we actively allocate capital to, as well as those we do not offer financing to. This approach enables us to not only engage with issuers on their material ESG risks, but also play a role in facilitating the overall transition of the economy into a more sustainable one for the benefit of people and the planet we live on.

Can positive impact investing have a positive impact on returns?

There is still a notion that positive impact investors must choose between impact outcomes and financial returns. In this piece, we explore whether we can deliver better positive impact outcomes for society as well as our investors. Do positive impact bonds outperform their non-impact counterparts?

Assessing performance between a positive impact bond and its non-impact counterpart can be difficult. Reasons for outperformance can be nuanced and driven by factors such as income, duration, yield curve, and spread duration, rather than issuer-specific or security factors alone. To answer this, we make certain assumptions and dive in to explore whether being a good corporate citizen can also deliver positive returns.

To do this exercise adequately, we commenced by looking at the pool of our investments which we classify as positive impact.

Our pool includes a range of different sustainable finance options including those that fall in the Use of Proceeds (UoP) format – which include green bonds, social bonds, and sustainable bonds (where the proceeds of the bond are allocated toward a sustainability goal) – as well as those classified as sustainability-linked bonds (where the proceeds of the bond are allocated toward a company’s sustainability goal, with key performance indicators measuring the outcome) – for more detail, read Shan Kwee’s article here. These bonds have explicit positive impact targets that address social housing, climate change, diversity, and other UN Sustainable Development Goals (SDGs) aligned initiatives.

One such security that we own* is the National Housing Finance and Investment Corporation (NHFIC) bond. These bonds support NHFIC’s mandate of funding affordable housing and improving housing for Australians, particularly low-income and vulnerable Australians. Through the proceeds of these bonds, NHFIC was able to fund community housing providers (CHP) to help finance over 4,500 dwellings across the country.

Once we had identified our pool of positive impact investments, we then selected a similar “non-impact” peer for each security in that pool. The comparable non-impact security is in a similar sector, with a similar maturity profile as well as a similar credit rating. The idea was to more accurately compare the returns of positive impact bonds to its non-impact peer, from the issuance date of the former.

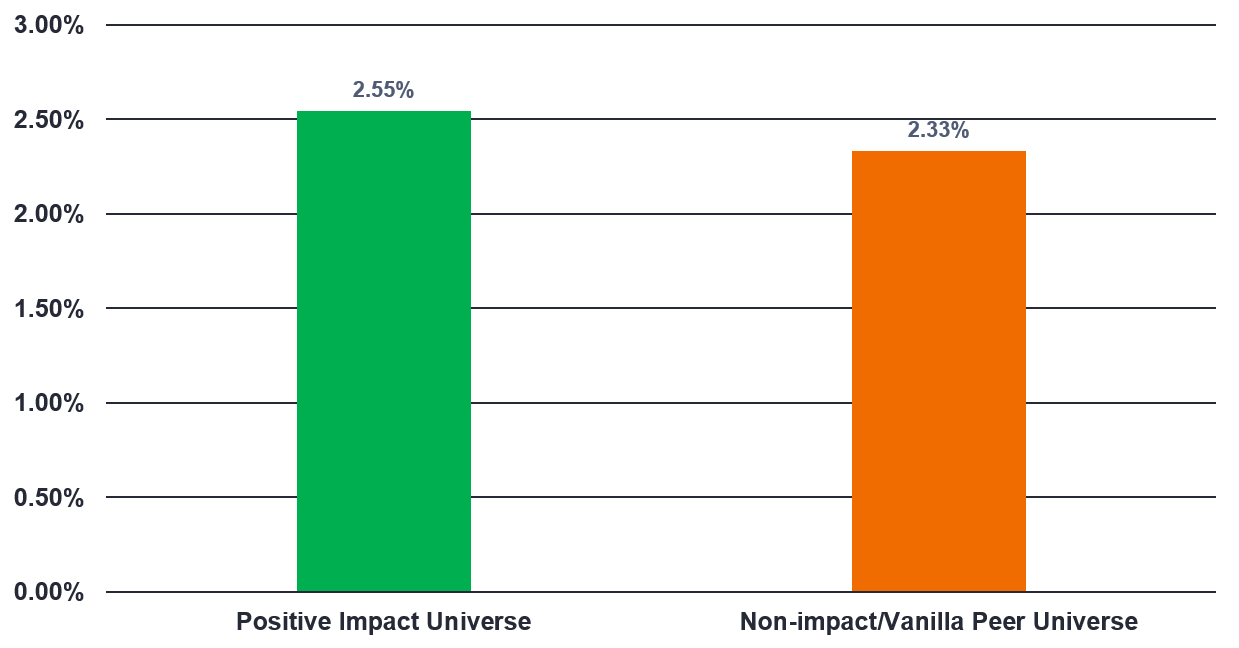

The chart below shows the average performance return of the pool of positive impact investments we hold versus the average of their “non-impact” peers (annualised), since issuance. The excess return of the former over the latter, on average, is 15 basis points (bps).

Chart 1: Performance since inception (p.a.)

15bps incremental return for sustainable portfolio

Source: Janus Henderson, Bloomberg. As at 30 September 2021. Positive Impact Universe = positive impact credit held within Janus Henderson Australian Fixed Interest Funds. Non-impact/Vanilla Peer Universe = a pool of securities selected as a “non-impact” peer for each “positive impact” security in the Janus Henderson Positive Impact Universe. Past performance is not a guide to future performance.

Noteworthy here is that this wasn’t driven by a few securities alone, but rather 75% of this universe has outperformed their “non-impact” bond peers.

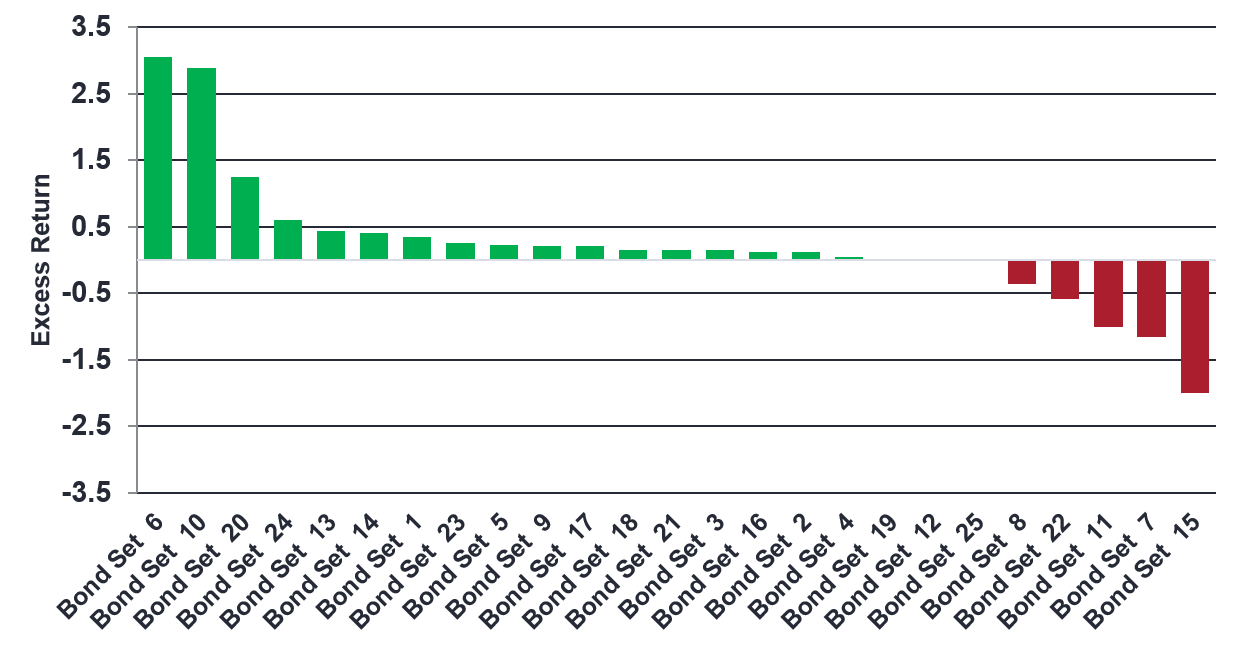

Chart 2: Excess return of positive impact bonds over their non-impact peer

(cumulative returns since issuance %)

Source: Janus Henderson, Bloomberg. As at 30 September 2021. Positive Impact Universe = positive impact credit held within Janus Henderson Australian Fixed Interest Funds. Non-impact/Vanilla Peer Universe = a pool of securities selected as a “non-impact” peer for each “positive impact” security in the Janus Henderson Positive Impact Universe. Past performance is not a guide to future performance.

This brings us to the “greenium” aspect – the premium in price that the investor pays for a green/positive impact bond. While positive impact bonds have gained popularity and investor portfolio inclusion for most managers, we are still at the infancy stage of this market, particularly in comparison to our global peers. Hence a strong distinct “greenium” hasn’t been observed in the Australian market yet. Viewing European markets as a potential glimpse into our future, and taking into account investors’ growing appetite and preference for green and social impact bonds, we would expect the supply and demand dynamics to change over time. The Australia market may well see a more pronounced “greenium” going forward and early adopters and investors with access should therefore outperform.

Source: Janus Henderson Investors, Bloomberg, RBC, KangaNews as at 30 September 2021.

Early days but return opportunities exist for early adopters

The positive impact bond market in Australia is still in its infancy, but so far we are seeing supporting evidence in terms of outperformance by impact bonds, meaning investors are being rewarded for their early adoption.

Active management is vital

The importance of active security selection is key when considering positive impact investing. Assessing first and foremost the creditworthiness of issuers, evaluating their sustainable impact objectives and target to ensure they are tangible, avoiding greenwashing, and determining suitable security structures are crucial elements to the decision-making process. Done correctly, investors can achieve both a positive impact for people and the planet we live on, as well as achieve superior investment outcomes.

*As at 31 December 2021. Portfolio exposures are subject to change without notice.

![]() Don’t miss the

Don’t miss the

latest insights from

Janus Henderson

on LinkedIn. Follow

This information is issued by Janus Henderson Investors (Australia) Institutional Funds Management Limited (AFSL 444266, ABN 16 165 119 531). The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Whilst Janus Henderson Investors (Australia) Institutional Funds Management Limited believe that the information is correct at the date of this document, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson Investors (Australia) Institutional Funds Management Limited to any end users for any action taken on the basis of this information. All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson Investors (Australia) Institutional Funds Management Limited is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect.