A different stage for the next era of growth

Macro trends will be decidedly inflationary in coming years. Portfolio Managers Doug Rao, Nick Schommer, and Brian Recht discuss identifying the U.S. growth opportunities ahead.

4 minute read

Key takeaways:

- We are seeing substantial economic shifts − many inflationary − that will change how companies grow in the coming years.

- Amongst other trends, the ultra-efficient, deflationary world of globalization is retrenching toward one that is defined more by deglobalization, or regionalization.

- In this shifting environment, investors must deeply understand how U.S. companies are positioned to grow.

Over roughly the last two decades, globalization – driven by increased global trade cooperation and the opening of large, previously closed markets such as China – has led to inexpensive, plentiful labor, integration of global supply chains for efficiency, and outsourced production. Those days now appear to be ending.

Falling rates, rising asset prices, and growing wealth inequality

Globalization’s effects were highly deflationary, which led to consistently declining interest rates as central banks pursued easy monetary policy to stimulate growth. Lower rates, in turn, fueled rising asset prices − from equities to real estate and other assets.

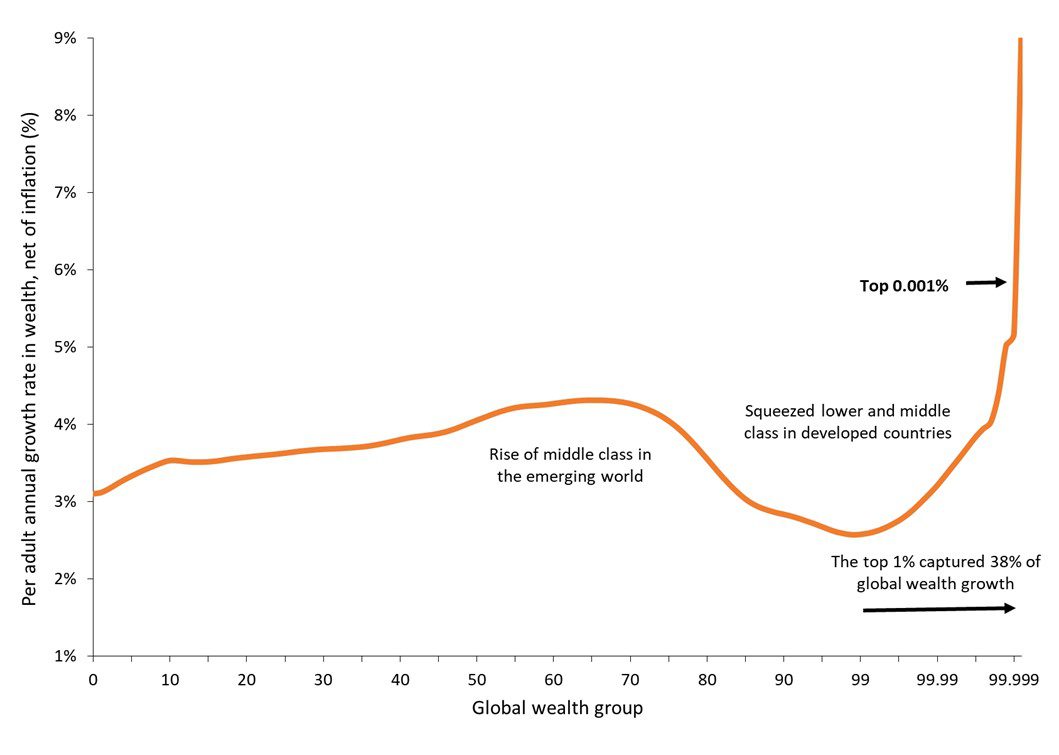

As asset prices climbed, however, the wealth created was distributed unequally. For instance, while the lower and middle classes saw wealth growth of about 3% per year since 1995, the top 0.001% and wealthier averaged between 5% and 9% annually, with the top 1% capturing 38% of total wealth growth. Populism gained steam as some blamed the effects of globalization for this growing inequality, driving labor force changes that have placed upward pressure on wages.

Figure 1: Average annual wealth growth rate, 1995-2021

Source: World Inequality Report, 2022.

Source: World Inequality Report, 2022.

COVID forced the reorganization of supply chains

While simmering populism provided one jolt toward deglobalization, COVID accelerated it as complex, integrated global supply chains were exposed and failed. From generic drugs manufactured in India to personal protective equipment from China to apparel and footwear from Vietnam, as well as a host of input materials, many goods became difficult to acquire during the pandemic. Some companies have since diversified suppliers and overstocked inventory to compensate, and the reinforcement of supply chains has also driven a movement to re-shore operations domestically.

A manufacturing resurgence in the U.S.?

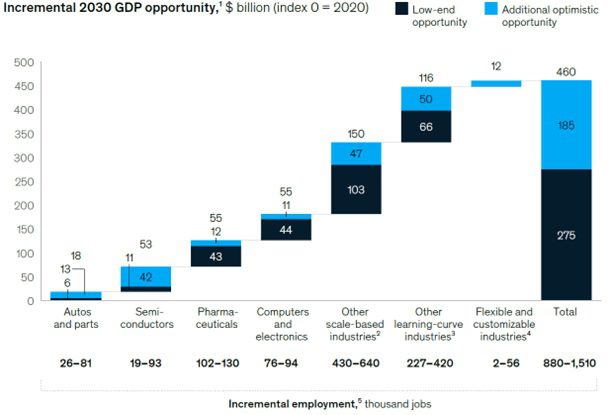

The manufacturing sector has been in secular decline in the U.S., with jobs in the sector falling by 6.5 million from 1979 through 2019. However, in the last two years we have seen the largest annual increases in manufacturing jobs in over 25 years.1 Recent McKinsey Global Institute analysis estimates that the U.S. could add between $275 and $460 billion to its gross domestic product (GDP) and up to 1.5 million jobs by 2030 due to continued transformation in the domestic manufacturing sector.

Figure 2: 2030 GDP estimate

¹Above 2030 IHS forecast. ² Basic metals, electrical equipment, fabricated metals, general machinery, petrochemicals, specialty chemicals. ³ Communications equipment, medical devices, precision tools, special-purpose machinery. 4 Aerospace and defense equipment, railroad and maritime equipment. 5 Includes direct jobs within each industry and indirect jobs in other sectors. Source: IHS Markit (January 2021 forecast); Organisation for Economic Co-operation and Development (OECD); McKinsey Global Institute analysis.

Focusing on the micro amid macro change

There are some upsides to deglobalization-driven inflationary factors, which could be beneficial for certain industries and portions of the labor force and help contribute to domestic economic growth. However, we also expect the overall result of deglobalization to be structurally higher inflation – and, therefore, higher interest rates. Companies that are now forced to eschew low-cost labor, hyper-efficient supply chains, and offshore production may not enjoy the same level of profitability and will need to boost growth in other ways. The same is true for all businesses seeking to grow in a setting of higher prices and a higher cost of capital.

Therefore, we think it is particularly important to remain focused on companies with strong business models in healthy, growing end markets that have the potential to thrive regardless of the economic backdrop. In any environment, we believe it’s crucial for companies to have a sustainable competitive advantage − to be the best at something.

That competitive advantage can take on different forms – unique technology, a strong brand, network effects, a beneficial cost structure, or superior distribution are all potential attributes that can improve a company’s growth prospects. For instance, businesses deploying technology effectively may be able to enhance labor productivity and supply chain efficiency through automation, software, and artificial intelligence (AI) applications, thereby offsetting wage and other cost pressures. And while deglobalization could slow the movement of physical goods and labor around the world, we expect the flow of intangible and digital information to continue to increase in coming years.

The old world of low rates and globalization provided universal tailwinds that were broadly supportive for growth; the new setting may make the path to growth more challenging. Thus, we believe that deeply understanding a business’s fundamentals and its potential for future cash flows will be essential to investment success.

1Source: Bureau of Labor Statistics, all employees, manufacturing, seasonally adjusted, as of 3/31/23.

Era of growth

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.