A fertile ground for European smaller companies stock pickers in 2021

European smaller companies managers Rory Stokes and Ollie Beckett discuss their outlook for the asset class in 2021.

4 minute read

Key takeaways:

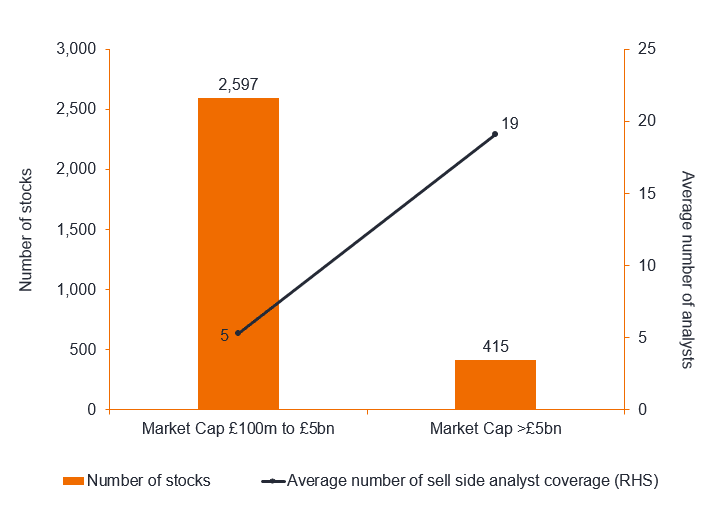

- The small cap market space offers a much larger universe of stocks that is far less well-researched than mid or large cap equivalents, providing great stock picking opportunities.

- We anticipate that a focus on the value of the cash-generative abilities of companies will matter more in 2021 as tides begin to turn on growth stocks.

- As ESG continues to gain attention, we believe there is potential for smaller companies – which often have solid, yet unsung ESG credentials – to perform well.

Small cap offers a larger, less well-researched universe

Will value prevail in 2021?

A second concentration of opportunity is in value stocks over growth. Within the smaller companies’ universe, growth stocks are as expensive as they have been during our investment careers and are now more expensive than they were during the Tech boom. We expect the focus on the value of the cash generative abilities of companies to matter more in 2021.

Our team’s view has always been to target more of the smaller market cap companies than much of our peer group as we believe this neglected area of the market is systematically mispriced. We believe the more attractive valuations and premium growth rates that these types of companies offer will attract new investments in what has been a relatively expensive market this year.

We are not value investors, but we have always applied a valuation overlay in our investment approach even though value has been desperately out of favour for some time. That said, we do not invest in a stock just because it is cheap. Disruption caused by new technologies has left the market littered with value traps (ie stocks that appear cheaply priced because they trade at low valuations, but may turn out to be a ‘trap’ if the company’s share price does not improve or falls). However, what we pay for the cash flows of a company has always mattered to us and we expect it to benefit us in 2021.

At a more macroeconomic level, we expect inflation to be a hot topic of discussion in 2021. We believe stocks that have the capacity to manage a more inflationary dynamic because of the strength of their product or service is such that they can raise prices without jeopardising sales (ie they have pricing power) ought to do well alongside the beneficiaries of higher inflation, such as banks.

The principal risks we perceive are: policy error from governments and central banks; negative developments in managing COVID-19; and geopolitical tensions (principally the US-China relationship where the market is optimistic about improvement following the election of Joe Biden as President in the US).

Casting a light on ‘hidden’ ESG

Another strategic theme that we expect to play out is the rerating of ‘hidden’ ESG (environmental, social and governance) factors. The trend to more sustainable investing is a welcome one, especially as smaller companies can be far better operationally on an ESG basis than their larger peers, but far less good at presenting the benefits to the environment and society. There is a big rerating potential for such stocks as these strengths are uncovered.

Takeaways from 2020

The experiences of 2020 have not shifted our approach to investment but have reminded us of some of the key benefits to how we allocate capital. 2020 highlighted the benefits of our investing across the corporate lifecycle with a balanced portfolio of early cycle, quality growth, mature and turnaround stocks.

At the start of the pandemic, early cycle businesses better exposed to digitalisation and online retail benefited from an acceleration in underlying growth trends in the second quarter of 2020. Meanwhile, more mature value / turnaround names – companies that have experienced poor performance but are in a period of a financial recovery – responded positively in the second half. The key takeaway for us is that the most unexpected of scenarios can play out, so pursuing diversification at a stock level is very important. In addition, 2020 has taught us that stock specific factors such as self-help or structural growth can offer valuable sources of return during times of crisis and should be considered when making investment decisions.

Growth stocks/investing: Growth investors search for companies they believe have strong growth potential. Their earnings are expected to grow at an above-average rate compared to the rest of the market, and therefore there is an expectation that their share prices will increase in value. Inflation: The rate at which the prices of goods and services are rising in an economy. The CPI and RPI are two common measures. Market capitalisation: The total market value of a company’s issued shares. It is calculated by multiplying the number of shares in issue by the current price of the shares. The figure is used to determine a company’s size, and is often abbreviated to ‘market cap’. Self-help: Opportunities taken internally to improve a company’s prospects, such as better operational efficiency, which are independent of what is happening in the wider economy. Structural growth: Growth related to a dramatic shift in the way the market or economy operates, often brought about by changing trends or product/service innovation. Value stocks/investing: Value investors search for companies that they believe are undervalued by the market, and therefore expect their share price to increase. One of the favoured techniques is to buy companies with low price to earnings (P/E) ratios.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.