No recovery in global money growth in August

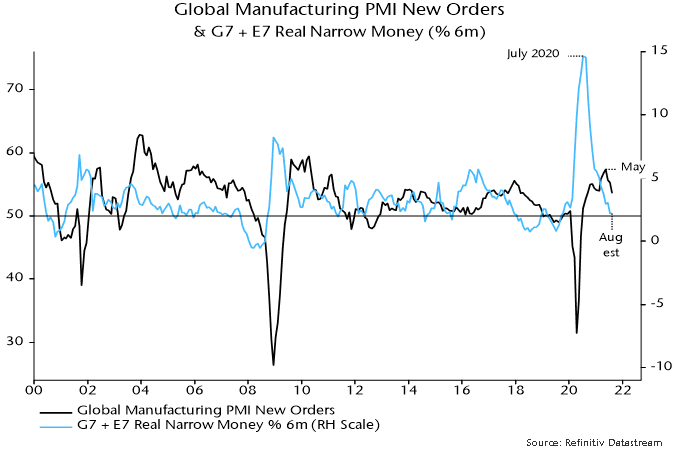

Partial data indicate that global six-month real narrow money growth was little changed in August, following July’s fall to a 22-month low. Allowing for the usual lead, the suggestion is that the global economy will continue to lose momentum into early 2022, with no reacceleration before late Q1 at the earliest.

Global PMI results for August were consistent with the slowdown forecast, with the manufacturing new orders index falling for a third month – see chart 1.

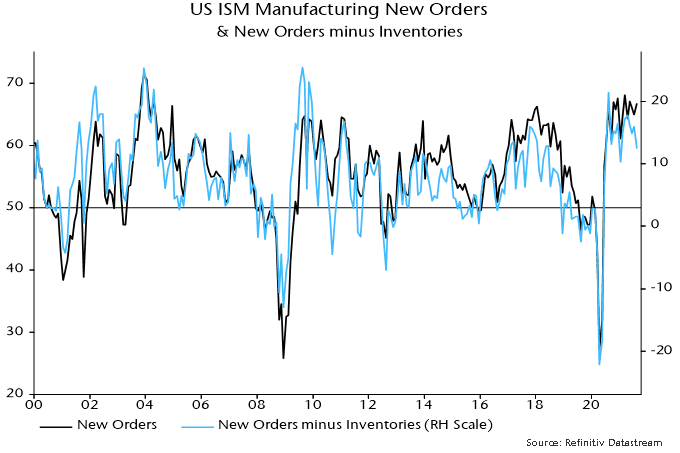

The US ISM manufacturing new orders index unexpectedly rose in August but this appears to have been driven by a rise in inventories: the new orders / inventories differential, which often leads, fell to its lowest since January – chart 2.

The US ISM manufacturing new orders index unexpectedly rose in August but this appears to have been driven by a rise in inventories: the new orders / inventories differential, which often leads, fell to its lowest since January – chart 2.

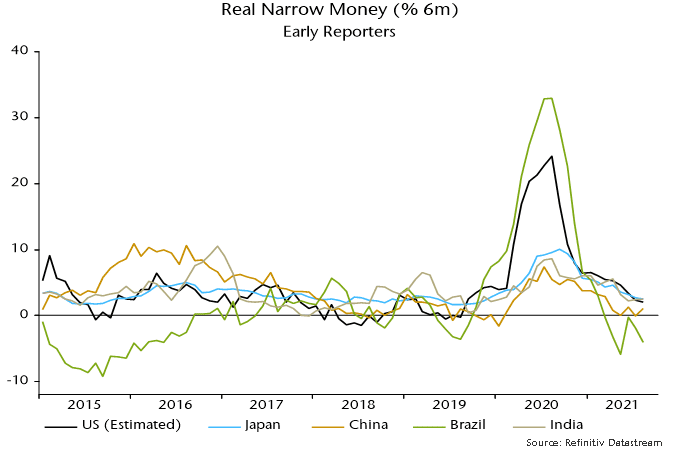

The US, China, Japan, Brazil and India have released monetary information for August, together accounting for 70% of the G7 plus E7 aggregate calculated here*. CPI data are available for all countries bar the UK and Canada.

The US, China, Japan, Brazil and India have released monetary information for August, together accounting for 70% of the G7 plus E7 aggregate calculated here*. CPI data are available for all countries bar the UK and Canada.

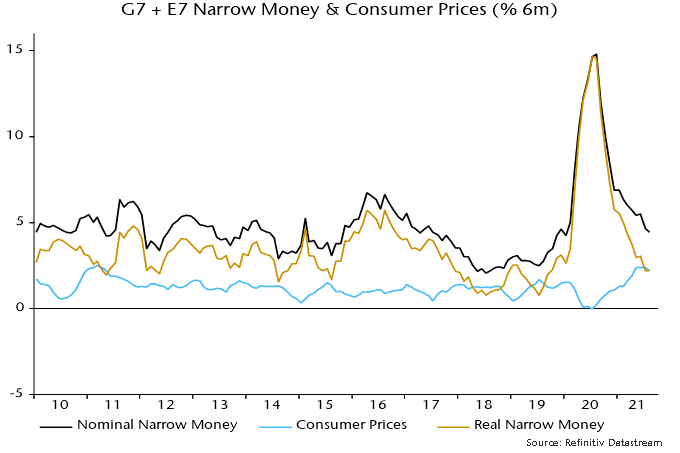

The stability of six-month real narrow money growth in August conceals a further slowdown in nominal money expansion offset by a small decline in CPI momentum – chart 3.

Previous posts discussed the possibility that real money growth would rebound during H2 2021, warranting optimism about economic prospects for 2022 and supporting another leg of the “reflation trade”. The monetary data have yet to validate this scenario.

Previous posts discussed the possibility that real money growth would rebound during H2 2021, warranting optimism about economic prospects for 2022 and supporting another leg of the “reflation trade”. The monetary data have yet to validate this scenario.

The real money growth rebound scenario depended importantly on a pick-up in China in response to recent and prospective policy easing. Chinese six-month real narrow money growth does appear to have risen slightly in August** but there were offsetting declines in the US, Japan and Brazil – chart 4.

*The US number is estimated from weekly data on currency in circulation and commercial bank deposits.

**The household demand deposit component is estimated pending release of full data.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.