The UK’s dovish turn: The £ gets pounded

The Bank of England's May meeting has stoked recession and stagflation risks, and a more measured approach to tightening.

4 minute read

Key takeaways:

- The Bank of England (BoE) hiked benchmark interest rates for the fourth consecutive time, but the committee was divided on the magnitude of the hike and only 0.25% was delivered.

- It also signalled a delay in the peak in inflation and that economic growth may collapse in Q4 2022 and be flat next year.

- Yield curves steepened as short-term gilt yields moved lower on reduced rate hike expectations. This indicates a more normalised environment emerging for fixed income investors, but there are recession risks to watch for.

Recession risks loom large

Consumer price index (CPI) inflation was previously expected to peak in the spring, but the BoE signalled it is now expected to hit double digits in October, exacerbated by the Russia-Ukraine conflict. CPI is expected to rise further to a peak of slightly above 10%, on average, in Q4 2022. In a similar vein to the February projections, it forecasts inflation to fall sharply to 2.1% in two years’ time and to well below target at 1.3% in three years.

A positive note sounded on getting inflation under control was dampened by gross domestic product (GDP) growth expectations. Bank staff forecasters have updated their projections and GDP is forecast to fall by nearly 1% in the final quarter of this year as energy price hikes bite, and to be broadly flat for 2023, raising prospects of a recession. Hiking rates into an impending growth slowdown is not a comfortable position for any central bank. In the press conference, Governor Bailey appeared to avoid the word ‘stagflation’, but it sure looks like that is the word for it.

To put this in context, such a downturn will represent the second biggest hit to living standards since 1964. Total real household disposable income is projected to fall by 1.75% in 2022, despite the support from the fiscal measures contained in the Spring Statement. This is a greater fall than in the February projection, and apart from in 2011, would be the largest contraction since records began. Meanwhile, it was reported that Boris Johnson was considering calling a snap election this year, after being warned the economy will not improve before his term runs out.

A hawk-dove divide

While rates were raised by 0.25% to 1% in the BoE’s fourth consecutive hike, this was not unanimous as three members voted for a larger 0.5% increase. The meeting minutes noted significant disagreement among committee members. On the more hawkish side, three members favoured a 0.5% hike, believing that capacity pressures would be greater than suggested by the projections. But on the more dovish side, two members thought that risks around activity and inflation were “evenly balanced”, and ergo preferred to remove the forward guidance that further rate hikes would be appropriate.

The BoE is treading very carefully but as it has highlighted, inflation could continue to surprise to the upside and, in which case, it may be forced to continue rate hikes even during a recession.

Gilts prices up, sterling down

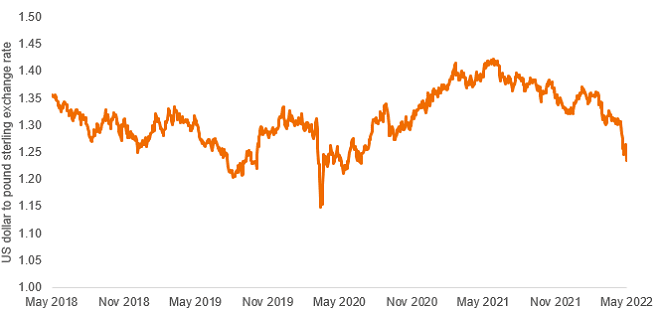

Given the downbeat growth forecasts, the market trimmed expectations for future rate hikes, with more measured expectations around hikes of 0.25% at future meetings rather than the chance of 0.50% increments. Sterling fell sharply (Figure 1) to levels seen in July 2020, reflecting the downbeat growth outlook.

We have highlighted previously that the market’s continued extrapolation of future rate hikes was hard to deliver, and that the BoE may well be forced to pause and ultimately undershoot expectations. The fact that Bank projections have inflation falling well below target suggests that the current market pricing (which is used to construct the forecasts and assumes that the bank rate rises to 2.5% by mid-2023)1, is too aggressive. Even now, the BoE has already delivered the fastest rate of policy tightening since 1999.

A dovish turn?

The BoE has kicked the can down the road on active gilt sales, with more details not expected until the end of the summer. The smaller programme of corporate bond sales will begin in September. Even so, over the next four years, the balance sheet of gilts accumulated through quantitative easing will already begin to shrink on its own as assets mature, reducing the balance sheet by one-third. While estimates vary widely on the impact of such quantitative tightening (QT), this could further temper the path of rate hikes.

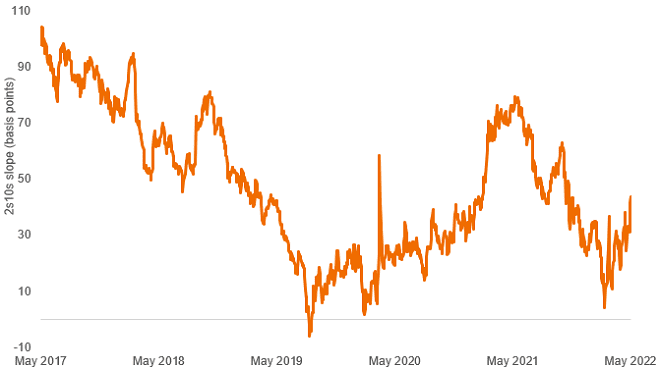

A more measured hiking cycle indicates a potential normalisation of yield curves in the UK, where the flatness of the yield curve at this point in the cycle has at times been at extreme levels, as discussed in a previous article. Indeed, post the BoE announcement, the 2s10s slope – the difference in basis points between the 2-year and 10-year gilt yields – steepened (Figure 2). We would caution against a re-steepening of the yield curve being viewed as a positive signal for the economy. Recession risk remains tangible for the UK, and the BoE’s path to tighten financial conditions through policy and QT is one to watch, especially as a dovish turn can easily change direction.

Figure 2: UK yield curve (2-year / 10-year) slope steepens

Source: Bloomberg, as at 6 May 2022. Note: one basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Footnotes

Consumer price index (CPI): A measure that examines the price change of a basket of consumer goods and services over time. It is used to estimate ‘inflation’.

Inflation: The rate at which the prices of goods and services are rising in an economy. The CPI and RPI are two common measures. The opposite of deflation.

Gross domestic product (GDP): The value of all finished goods and services produced by a country, within a specific time period (usually quarterly or annually). It is usually expressed as a percentage comparison to a previous time period, and is a broad measure of a country’s overall economic activity.

Hawkish: indication that central bankers are looking to restrict money supply to achieve their policy objective. The opposite of dovish.

Quantitative tightening (QT): A contractionary monetary policy used by a central bank to reduce the amount of liquidity within the economy.

Quantitative easing (QE): An unconventional monetary policy used by central banks to stimulate the economy by boosting the amount of overall money in the banking system.

Yield curve: A graph that plots the yields of similar quality bonds against their maturities. In a normal/upward sloping yield curve, longer maturity bond yields are higher than short-term bond yields. A yield curve can signal market expectations about a country’s economic direction.

Stagflation: A relatively rare situation where rising inflation coincides with anaemic economic growth.

Gilts: British government bonds sold by the Bank of England, done to finance the British national debt.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.