ISG Insight: beyond an inflation peak

In the Fixed Income Investment Strategy Group (ISG)* asset allocation meeting, we debated what happens beyond peak inflation and whether central banks can achieve a soft landing. Discussion around the pricing of risk assets and recession risk were held in tandem with our London-based Multi-Asset Team.

2 minute read

Key takeaways:

- Surpassing an inflation peak could encourage central banks to take their foot off the accelerator in tightening.

- However, orchestrating a soft landing for economies has been achieved in different circumstances to today.

- Investors need to establish a peak too. Until rates peak, it’s hard to give the all-clear for risk assets.

What goes up must come down

Markets have been searching for an inflation peak as a signal on the appropriate quantum of concern about central banks tipping economies into recession. A relentless pursuit towards tightening has ignited demand destruction, narrowing supply/demand imbalances and fuelling falling inflation expectations. Freight rates (with new ships and capacity all expected to step up next year) are falling, while commodity prices are showing significant declines in line with demand.

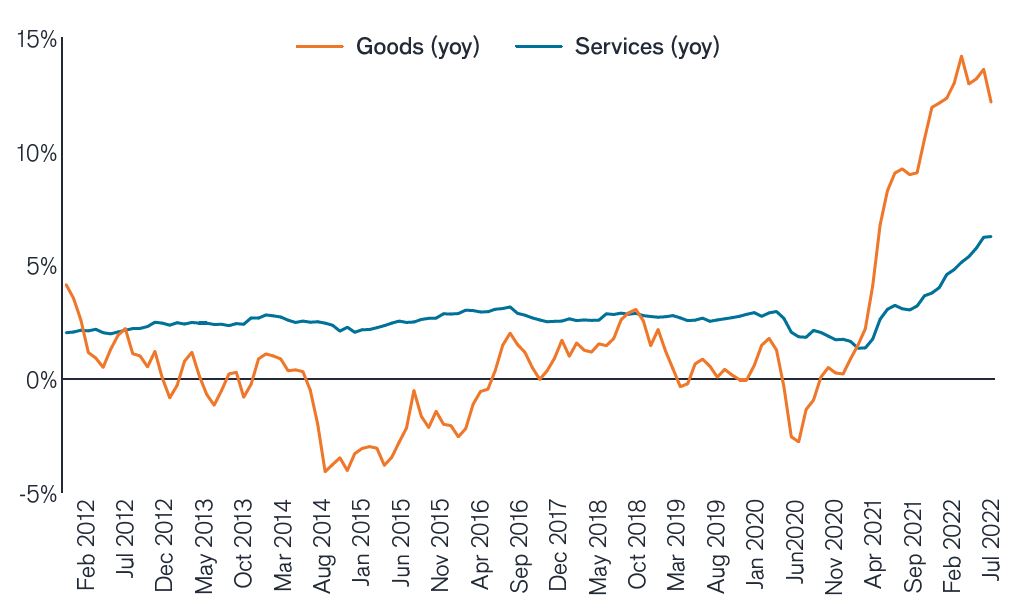

Figure 1: Goods inflation appears to be rolling over

Source: Bloomberg, 11 August 2022.

One measure of inflation, goods inflation in the US appears to be rolling over, which could be followed by services (a stickier key CPI component and therefore key to watch) as squeezed disposable incomes become better reflected in consumer behaviour by further scaling back of spend in this area. One ISG member noted however, that goods inflation can be persistent and is still extremely high while supply disruption continues.

The increasing glut of retail inventories suggests a moderating impulse to goods inflation later this year, while base effects are washing out, such as weak consumer demand, disrupted vehicle production (used car price strength) and other supply bottlenecks. Some remain however, like food inflation which tends to have a delayed effect in coming through.

While monetary policy operates with a lag – the full force of a rate hike won’t typically be felt until 12-18 months later – central banks are making decisions based on the latest inflation data, which means a risk of overtightening.

The Janus Henderson Fixed Income Investment Strategy Group (ISG) brings together investment professionals from across the global fixed income platform and other Janus Henderson teams, providing a forum for research and debate on the key areas of fixed income asset allocation and the macroeconomic outlook, including rates and currency. It is designed to bring together our best ideas globally, aiding portfolio manager decision making around both portfolio positioning and risk allocation. The ISG Insight seeks to provide a summary of recent debate within the group.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.