Eurozone monetary update: false hope from broad money

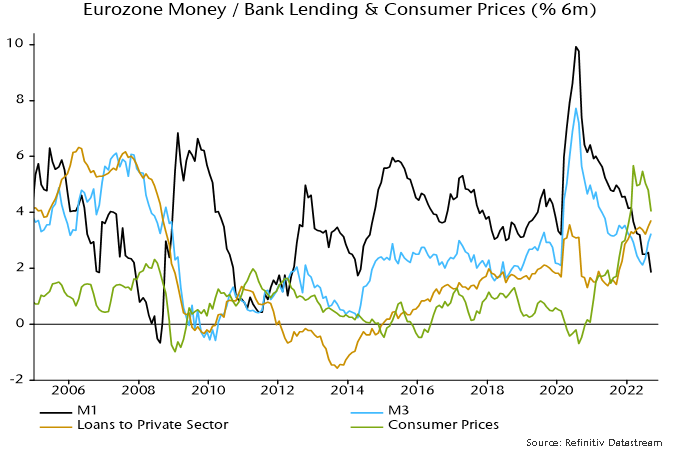

Eurozone money measures are giving mixed signals. Headline broad money M3 rose by a strong 0.7% in September, pushing six-month growth up to 3.3% (6.6% annualised), the highest since December. Narrow money M1, by contrast, contracted on the month, with six-month growth falling further to 1.8% (3.7% annualised) – see chart 1.

Chart 1

Broad money reacceleration, on the face of it, suggests an economic recovery towards mid-2023 after a sharp winter recession. The judgement here, however, is that broad money numbers have been boosted by technical / temporary factors and intensifying narrow money weakness is a better representation of current monetary conditions and economic prospects.

The six-month rate of change of real M3, it should be emphasised, remains negative, with consumer prices (ECB seasonally adjusted series) rising by an annualised 8.2% between March and September.

The sectoral breakdown of the headline M3 / M1 numbers, moreover, shows a significant recent contribution from rising money holdings of financial institutions. This probably reflects cash-raising related to weak markets and is not an expansionary / inflationary signal for the economy.

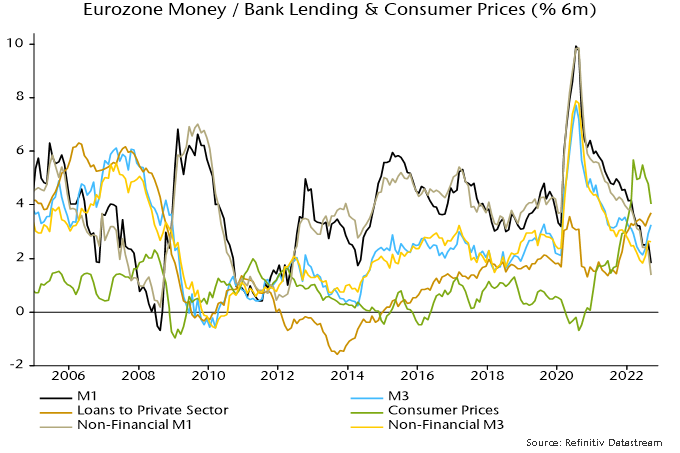

The forecasting approach here focuses on non-financial money measures where available, i.e. encompassing holdings of households and non-financial firms only. Six-month growth of non-financial M3 was 2.6% in September versus 3.3% for M3 and has shown a smaller recent recovery – chart 2.

Chart 2

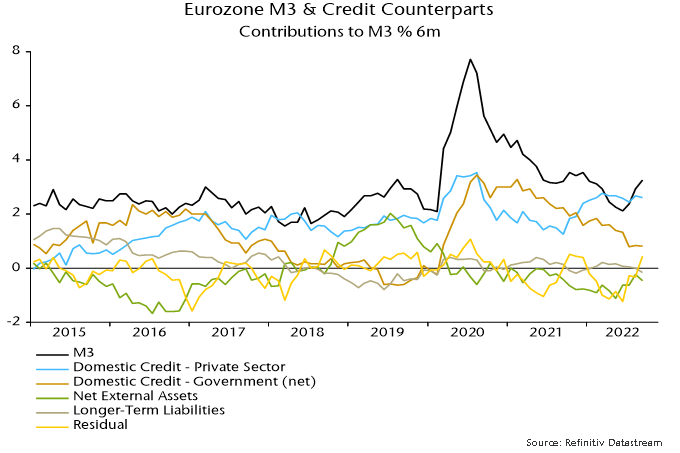

A further reason for playing down the broad money pick-up is that it is not explained by any of the conventional “credit counterparts” – credit to the private sector and government, net external assets and longer-term liabilities. The counterparts analysis shows a positive contribution from unspecified residual items, which behave erratically, suggesting a future reversal – chart 3.

Chart 3

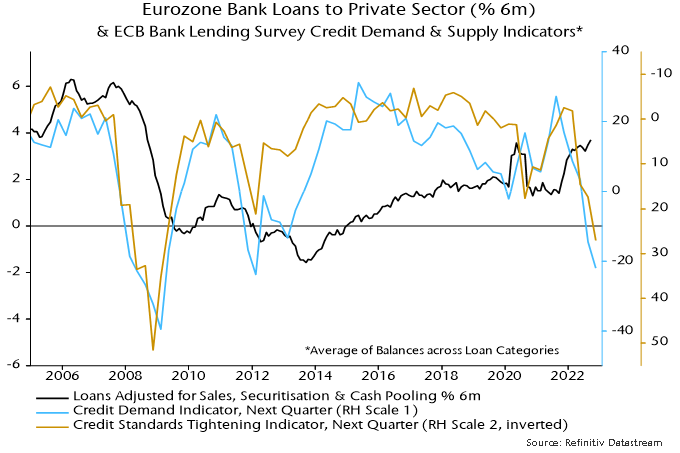

Solid growth of lending to the private sector has been the key driver of recent M3 expansion. The October bank lending survey, however, showed a further plunge in credit demand and supply balances, signalling a future lending slowdown or even contraction – chart 4.

Chart 4

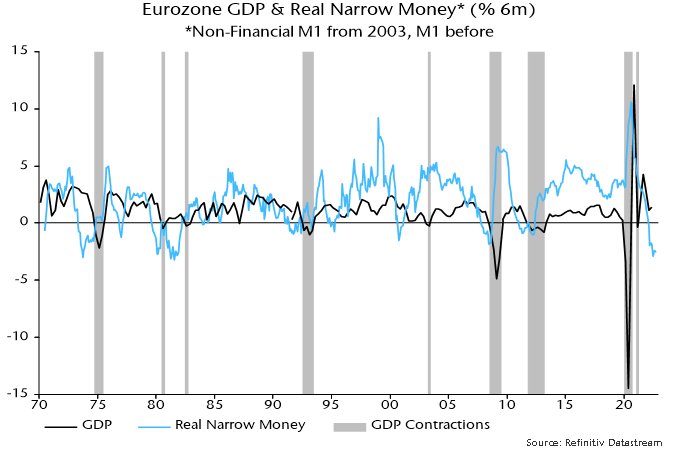

Statistical studies show that real non-financial M1 has the strongest leading indicator properties of the various money and lending measures. Its six-month rate of change remains at the bottom of the historical range, suggesting no economic recovery before H2 2023 – chart 5.

Chart 5

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.