Shock therapy: Portfolio solutions for this year’s market turmoil

EMEA Head of Portfolio Construction and Strategy Matthew Bullock introduces the PCS Team’s latest Trends and Opportunities report, which seeks to provide therapy for recent market shocks by offering long-term perspective and potential solutions.

3 minute read

Key takeaways:

- Investors are grappling with severe market shocks from slowing growth, inflation and interest rate volatility.

- While history tells us there is likely more pain to come, it also tells us that patient investors have historically experienced more upside than downside over the long term.

- In our view, investors should view the current landscape as a blank slate and seek to take advantage of new opportunities.

This article is part of the latest Trends and Opportunities report, which seeks to provide therapy for recent market shocks by offering long-term perspective and potential solutions.

Portfolio solutions for this year’s market turmoil

Throughout the year, the Portfolio Construction and Strategy Team has written extensively on the need to stay the course during volatile market times and to maintain a diversified portfolio even when it is tempting to succumb to fear. No matter where you are in the world, investors have grappled with severe market shocks driven by slowing growth, inflation and interest rate volatility.

Europe is also grappling with an energy shortage just when governments have pledged to reduce carbon emissions. The push for greater sustainable energy production while at the same time trying to keep the lights on leaves policy makers and investors with a significant moral dilemma.

In this edition of Trends and Opportunities, we aim to offer some therapy for those shocks by providing a long-term perspective on the markets and economy and focusing on strategies that we believe will be long-term winners. We examine strategies – including quality equities, alternatives and balanced funds – which we believe may help investors ride out the market volatility and be well positioned for a market recovery. We also look at sustainable options that aim to generate positive investment returns while considering the future of the planet.

Putting volatility in historical context

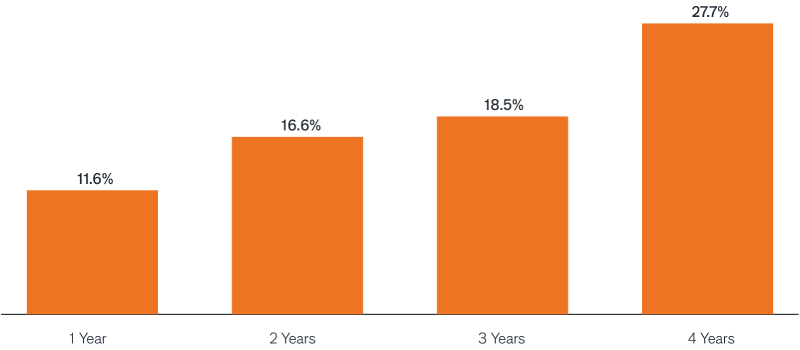

After living through this year’s volatility, “shock” is probably an understatement. On the bright side, while the history of global equities tells us there is likely to be more pain to come, it also tells us that patient investors have historically experienced more upside than downside over the long-term. Since 1972, every time the MSCI World Index has lost more than 20% of its value, it has made a full recovery within 4 years with 6% annualised gains – exhibit 1. For context, the average time to recovery is 3.5 years. Given this year’s sequence of market events, investors should take the current landscape as a blank slate and take advantage of new opportunities.

No one can call the bottom, but anyone can call a dip: for medium- and long-term investors, the question shouldn’t be if they should take advantage, but how.

Average cumulative MSCI World performance after 20% drawdown

Source: Janus Henderson Portfolio Construction and Strategy, Bloomberg, as at 31 August 2022.

The slowing growth, inflation, and interest rate volatility we are currently experiencing are generating market shocks of unusual prominence and magnitude. These shocks will likely drive ongoing volatility to which investors, unfortunately, will need to grow accustomed.

To help investors overcome that trifecta of market shocks, the Portfolio Construction and Strategy Team is focused on providing “shock therapy” in the form of portfolio solutions tailored to today’s new investing paradigm, while addressing the ubiquitous asset allocation gaps and concentrations we see in investor portfolios every day though our consultations with financial professionals.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.