The attraction of European equities

8 minute read

Mario Aguilar, from the Portfolio Construction and Strategy (PCS) Team, considers the value of allocating to European equities for Latin American (LatAm) and US offshore (USO) investors.

Key takeaways:

- Latin American investors display a safety bias whereby they are likely to make most of their investments in US dollars and consequently in US equities, to which they have a high degree of familiarity.

- Over the long-term, Europe may likely be a sought-after investment destination with a large and diverse opportunity set full of world-renowned firms with entrenched competitive advantages and a sustainability boom.

- We believe European equities offers a compelling opportunity for LatAm and USO investors to diversify their portfolios.

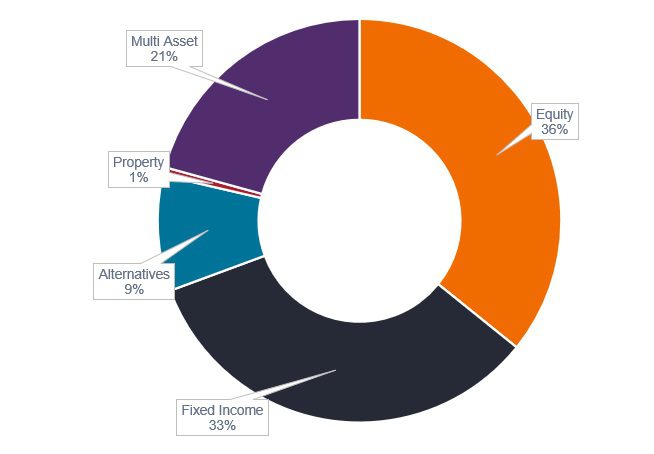

Latin Americans have a very high degree of familiarity with the US. This is perhaps driven by the large influence of the US over the rest of the continent in economic, financial, cultural, and historical aspects. The history of dollarized economies has shaped how Latin Americans think about savings, and consequentially, investments. Latin American investors tend to keep the core of their savings in US dollars, which has an impact on how they invest. With few exceptions, most of their investments are also made in US dollars, and on average the portfolios are broken down into three equally weighted buckets made up of equities, fixed income, and alternatives, including property and multi-asset funds – chart 1.

Chart 1: average asset allocation in LatAm and USO client portfolios

Source: Janus Henderson PCS Team, as at 31 January 2022

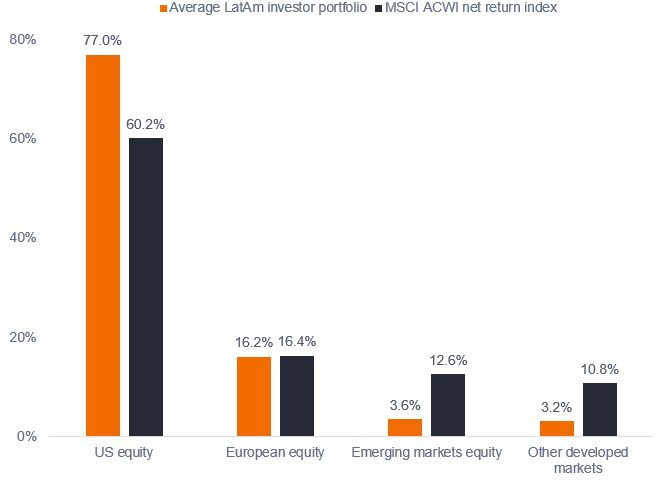

From portfolios shared with us, we find that on average, the equity bucket has over 77% allocated to the US specifically, a relative overweight compared to the MSCI All Country World Index (ACWI) – chart 2. We interpret this as a ‘safety’ bias in Latin American investment portfolios, whereby investors stick to regions or sectors that they are more familiar with and therefore consider to be more secure. Even though US equities may not technically be considered ‘local’ to a Latin American, this overweight is akin to traditional home bias because in both cases one holds assets denominated in the same currency as that of one’s savings thus avoiding currency risk. The underweight to emerging markets equities is also very common and intentional, as Latin American investors tell us they want to diversify away from their own country and currency risks to which their fixed assets (i.e. residential property, main source of income, cars, etc) are exposed to every day.

Chart 2: regional allocations in LatAm client portfolios

Source: Janus Henderson PCS Team and Morningstar as at 31 January 2022.

Should Latin American investors consider adding to European equities?

Although the allocation to European equity is neutral versus the index (see chart 2), would additional exposure to this asset class aid a portfolio? We firmly believe the answer is yes. Given the typical LatAm portfolio’s stance – i.e. a material overweight to US equities and the desire to avoid emerging markets equities – we believe European equities can be powerful portfolio diversifiers compared to other developed country equities.

We cannot, however, ignore the potential financial effects of Russia’s continued attack on Ukraine. Beyond the human tragedy, the knock-on effects on financial markets will be felt for months and possibly years to come. Over the short-term we have seen an uptick in volatility and a jump in commodity prices and market losses1 in the face of the current uncertainty. Despite this, we believe now is the time to consider a long-term strategic overweight to European equities. In our view, investors could potentially benefit from:

- a historical valuation discount

- Europe’s unique structural economic opportunities

- growth driven by the expected investments into European sustainable efforts, championed by the European Green Deal

(Valuation) opportunities ahead?

While it is important to consider the aforementioned risks, we believe it is equally important to assess the potential opportunities that are borne out of these risks. The worst days in markets tend to be followed by good days, and just missing out on the ten best days can mean foregoing most of the gains or even result in losses, as reflected in chart 3. Legendary investor Peter Lynch said, “far more money has been lost by investors preparing for corrections, than has been lost in the corrections themselves”, thus, acting on fear has negative long-term effects on our wealth.

Chart 3: The impact of missing the 10 best market days

Source: Janus Henderson PCS Team and Morningstar. Data from 2 January 2001 to 10 March 2022. Shows the growth of an investment of 1000 in base currency terms. US equity = S&P 500 Total Return in USD; Global equity = MSCI World Net Return in USD; European equity = MSCI Europe Net Return in EUR.

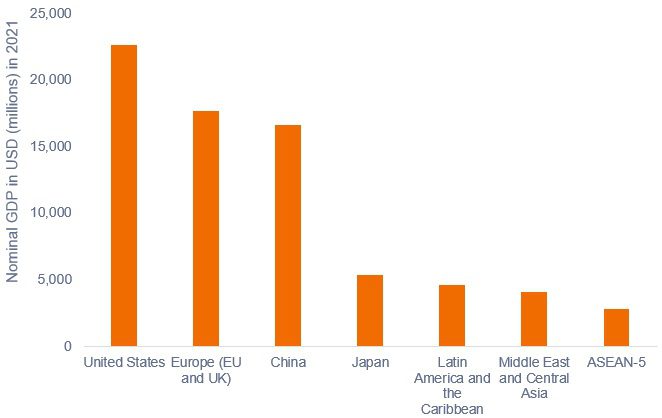

We believe the argument is not just to stay invested through current volatility, but to consider additional exposure. Over the long-term, Europe will likely be a sought-after investment destination as it is the second largest economic block in the world (just behind the US in GDP terms – see chart 4) and has a large and diverse opportunity set full of world-renowned firms with entrenched competitive advantages.

Chart 4: Europe is the second largest economic block

Source: International Monetary Fund (IMF), as at 2021

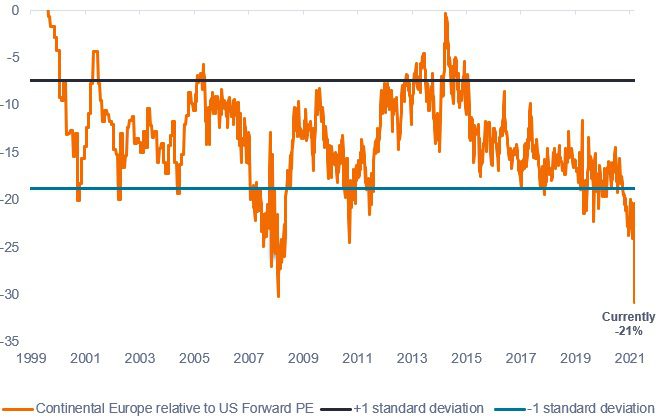

European equities provide investors with exposure to multinational, market-leading companies at lower valuations when compared with the US. Data suggests that this valuation gap could be at or close to historical highs with Europe showing a 21% discount on a forward price-to-earnings (PE) basis – chart 5.

Chart 5: European equities valuation versus US equities

Source: Refinitiv datastream, Janus Henderson Investors Analysis, as at 31 January 2022. Indexed to 0 on 31 December 1999.

What are Europe’s unique structural economic opportunities?

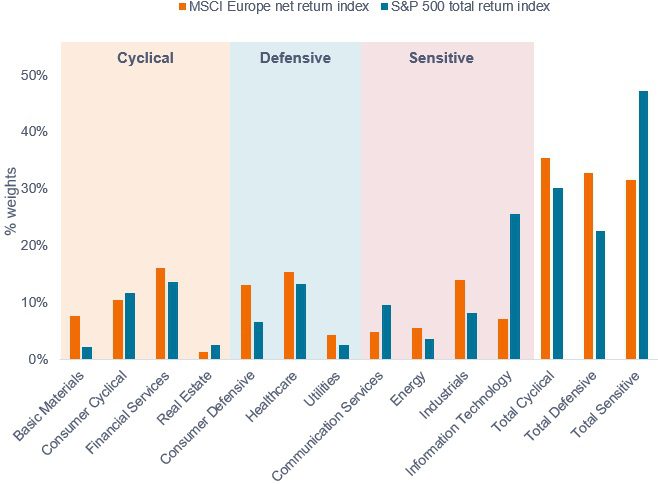

Europe’s equity market is characterized by higher weighting to cyclical and defensive sectors2 than the US. These sectors account for about 68.4% of the MSCI Europe Index versus 52.8% for the S&P 500 Index – chart 6. The lower valuation metrics, more favourable dividend yields, and higher earnings per share (EPS) growth are reflective of this.

Chart 6: Sector breakdown in Europe versus the US

Source: Morningstar as at 28 February 2022

| 12-month forward valuations | |||

| P/E | dividend yield | EPS growth | |

| US | 20.1 | 1.4 | 12.0 |

| Eurozone | 14.2 | 3.1 | 13.6 |

Source: Bloomberg, FactSet, Janus Henderson Investors as of 31 January 2022

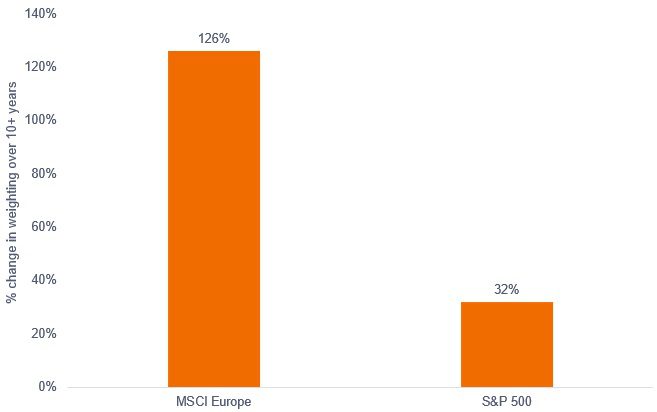

Over the past 10 years, the best opportunities across the world were found in growth stocks, and in particular US growth stocks, which have driven the US market to higher valuations. It is important to recognize that diversifying towards European equities is not necessarily a diversification away from technology and innovation, as the European technology sector has grown at a much faster rate than that of the US over the last decade. As impressive as the performance of US technology has been, the weight of this sector in the S&P 500 increased by 32% going from 19.4% to 25.6%, whereas over the same period, it more than doubled in the MSCI Europe index, going from 3.2% to 7.1%

Chart 7: Europe’s weighting to information technology has more than doubled

Source: Morningstar, FactSet. Percentage change in weighting from 30 September 2011 to 28 February 2022.

Green investments – a once in a lifetime opportunity?

Investing is a discipline focused on the long-term. Despite short-term volatility and uncertainty, we believe the best approach is to stay the course and position portfolios towards the expected drivers of future growth.

The European Green Deal Investment Plan3, has allocated a budget of €1 trillion to sustainable investments over the next decade. The plan lists four areas as priorities and offers opportunities to companies across different sectors, which make up over a third of the MSCI Europe Index, and are sectors in which the MSCI Europe index is overweight versus the S&P 500. The European Commission has identified the following areas of priority:

- Renewable energy: doubling EU renewable electricity production by 2030

- utilities, energy, offshore infrastructure

- Green mobility: near term focus on rail and electric vehicles

- railway infrastructure, electric trucks, electric autos

- Renovation wave: doubling the renovation rate from 2026

- building materials, lighting, and ventilation

- Hydrogen: ambitious growth in renewable hydrogen in 2023

- utilities, industrial gases, fuel cell infrastructure

| Sector | Benefitted by | MSCI Europe Index weight | Over/underweight versus S&P 500 |

| Industrials | All priorities | 14.01% | 5.74% |

| Consumer cyclical | Green mobility | 10.45% | -1.23% |

| Energy | Renewable energy, hydrogen | 5.51% | 11.83% |

| Utilities | Renewable energy, hydrogen | 4.30% | 1.73% |

| Total | 34.27% | 8.07% |

Source: Portfolio Construction and Strategy Team. Index weightings are from Morningstar, as at 28 February 2022.

The €1 trillion inflows will be largely directed through these local channels so there is significant cause for long term optimism for European equities and ample potential opportunity for investors to participate in this growth.

Conclusion

Diversifying away from a large ‘safety’ or ‘home’ bias and into a market with historically low valuations and unique structural opportunities are alone sufficient reasons to consider a greater allocation to European equities. However, the most compelling reason, or should we say a trillion compelling reasons, comes in the form of the European Green Deal. This plan provides an opportunity for savvy investors to position their portfolios in line with the industries and companies that would benefit from the Plan’s €1 trillion budget. Nobel Prize laureate Harry Markowitz once said “Diversification is the only free lunch”. We cannot predict the future, so let’s diversify our portfolios in line with our long-term goals, remember that diversification is our friend, and recognize that European equities could be a feast to behold.

Footnotes

1 As at 11 March 2022.

2 All definitions are according to Morningstar: https://www.morningstar.com/invglossary/

Cyclical sectors include industries significantly impacted by economic shifts. When the economy is prosperous these industries tend to expand, and when the economy is in a downturn these industries tend to shrink.

Defensive sectors include industries that are relatively immune to economic cycles. These industries provide services that consumers require in both good and bad times, such as health care and utilities.

Sensitive industries fall between the defensive and cyclical industries as they are not immune to a poor economy, but they also may not be as severely impacted by a poor economy as industries in the Cyclical Super Sector.

3 https://ec.europa.eu/commission/presscorner/detail/en/qanda_20_24

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.