In defence of defensive fixed income: The case for adding duration

The PCS team outlines three reasons why investors should consider adding intermediate-duration bonds back to their fixed income portfolios.

6 minute read

Key takeaways:

- Investors have understandably shortened the duration in their fixed income portfolios to weather the interest rate volatility that has plagued core fixed income this year.

- In our view, looking at this environment as a blank slate makes it clear that there are potential benefits in adding back intermediate-duration bonds.

- Outside of near-term income and risk-off diversification benefits, we believe the biggest opportunity in owning duration now is potential capital appreciation.

This year, the motto for fixed income investors is “pain to gain” – historical losses in traditional fixed income benchmarks (pain) have given way to an environment where investment grade, core fixed income is offering yields in the mid-single digits (gain). The challenge for fixed income investors is how to best access the silver lining that comes with this year’s volatility.

Fixed income’s precipitous decline alongside the downturn in equities has left investors with existential questions surrounding their bond portfolios. Many are wondering what, if any, benefit bonds can provide in portfolios going forward.

Throughout our consultations this year, we have found that it’s difficult for most investors to avoid dwelling on the year-to-date trauma. Some have been hiding out on the short end of the yield curve, which has been more insulated from the extreme interest rate volatility. In our view, however, today’s rapidly shifting environment means investors should shift their focus to the fresh opportunity set these historic losses have left in their wake.

While questions remain on the path forward for inflation, we would encourage investors to embrace intermediate bonds again, and to look to extend duration for the following three reasons.

1. Income

For years, central banks have kept interest rates artificially low, minimising the income one could get from a fixed income portfolio. One benefit of the repricing we’ve seen with bond valuations is that investors can now realise more attractive yields from core fixed income.

Given its dominance of financial markets, let’s consider the US economy and the yields available on US Treasuries as an example.

| US Treasury rates | 5y | 10y | 30y |

|---|---|---|---|

| 2020 | 0.36% | 0.93% | 1.65% |

| 2021 | 1.26% | 1.52% | 1.90% |

| 2022 | 3.85% | 3.68% | 3.74% |

Source: US Department of the Treasury, figures at year end (31 December) for 2020 and 2021 and 25 November 2022 for 2022. Past performance does not predict future returns.

If no further hawkishness from the US Federal Reserve (Fed) is required and rates remain consistent where they’re currently priced, longer duration fixed income can reliably provide coupons at more compelling levels than were afforded in the past.

While the yield curve inversion during 2022 means that short duration is providing similar levels of income as intermediate duration, it is the additional duration “risk” in the intermediate space that proves most attractive if we enter into a risk-off recessionary environment.

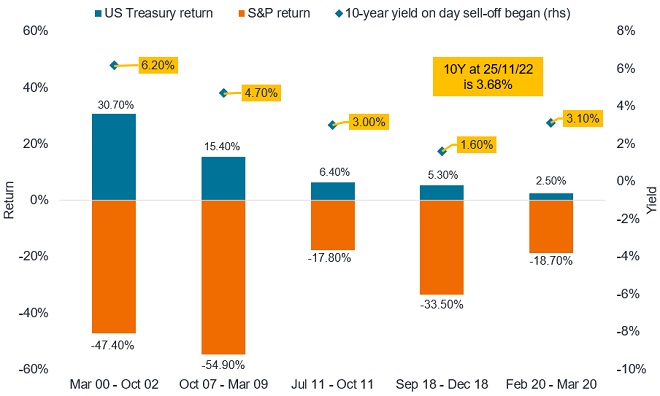

2. Risk-off diversification

The diversification benefits of fixed income were practically nonexistent this year as markets revalued both equities and fixed income amid a drastically different inflation regime. But we still believe that core fixed income can provide benefits in a true crisis. Should slowing growth continue and recession fears become a greater concern, we believe buyers will come back to the bond market in search of a stable ballast. Throughout history, even when rates were as low as they were during the COVID pandemic, Treasuries still were able to serve their purpose in a diversified portfolio. It is in these types of flight-to-quality situations that longer, intermediate-duration fixed income will typically outperform its shorter duration counterparts.

Bonds have provided needed diversification in past market corrections

Source: US Department of the Treasury and Morningstar as at 28 November 2022. Returns in US dollars. Past performance does not predict future returns.

3. Potential capital appreciation

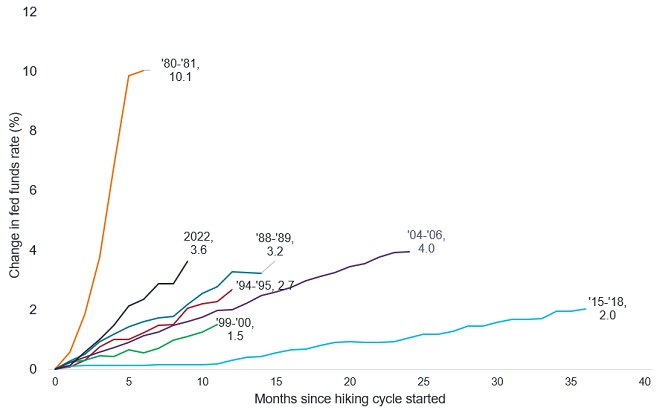

Outside of near-term income and risk-off diversification benefits, we also see the long-term case for intermediate-duration fixed income. With sell-offs like the one we’ve experienced this year, we believe the biggest opportunity in owning duration now is potential capital appreciation. In the current tightening cycle, the Fed has raised rates at one of the most rapid and dramatic paces in history. The full effects of these interest rate hikes might not be felt for months, yet many are already worried about the pace at which the economy is slowing.

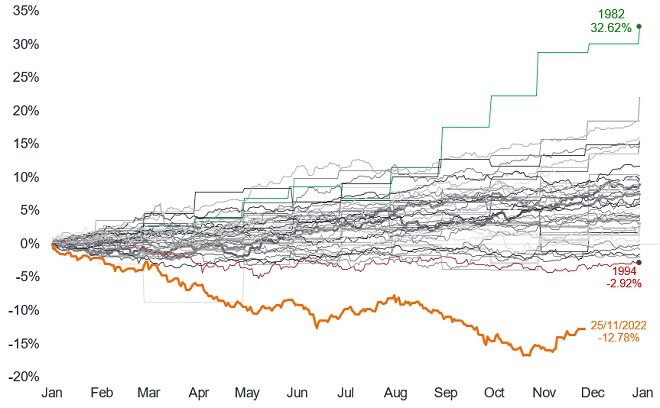

In the early 1980s, the Fed dramatically raised rates to fight inflation. Once prices moderated, the Bloomberg US Aggregate Index (Agg) subsequently had its best year on record, returning almost 33% in 1982, as shown in the second chart below. Should inflation levels start cooling and the Fed is forced to lower rates, a longer duration profile could capture significant capital appreciation.

The current rate hiking cycle has been one of the most dramatic in history pursued by the Fed

Source: Janus Henderson as at 28 November 2022.

Year-to-date total return for the Bloomberg US Aggregate Index

Negative returns resulted in a better starting point for income and diversification

Calendar year total returns in US dollars for Bloomberg US Aggregate Bond Index going back to 1975. Source: Bloomberg, Janus Henderson as at 28 November 2022. Past performance does not predict future returns.

The path ahead

While the future macro environment is impossible to predict and interest rate volatility may very well continue, the market suffered this year as it priced in potential future interest rate hikes. High-quality US dollar-denominated fixed income is now offering yields at levels investors have not seen for years, and duration once again provides income for portfolios along with the potential for downside risk management and capital appreciation.

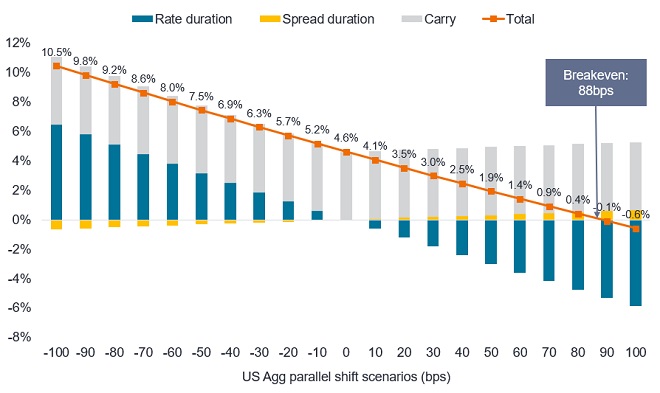

As seen in the chart below, the current yield cushion in the US Agg affords protection against an additional 88 basis points (bps) of rate increases before capital starts to erode. On the other hand, if rates decline by 100 bps, investors could earn capital appreciation on top of the current 4.6% yield, leading to double-digit total returns.

Breakeven rates have reset much higher

Source: Janus Henderson as of 25 November 2022.

Investors have understandably shortened the duration in their fixed income portfolios to weather the interest rate volatility that has plagued core fixed income this year. But in our view, looking at this environment as a blank slate makes it clear that there are potential benefits in adding back intermediate-duration bonds.

To gain confidence that your portfolio is behaving as you intend or discuss opportunities in fixed income that might align with your goals, please reach out to our Portfolio Construction and Strategy team for a customised consultation.

IMPORTANT INFORMATION

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Investing involves risk, including the possible loss of principal and fluctuation of value.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Bloomberg US Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market.

Carry is the excess income earned from holding a higher yielding security relative to another.

Credit spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Inverted yield curve occurs when short-term yields are higher than long-term yields.

Quantitative tightening (QT) is a government monetary policy occasionally used to decrease the money supply by either selling government securities or letting them mature and removing them from its cash balances.

US Treasury securities are direct debt obligations issued by the US Government. With government bonds, the investor is a creditor of the government. Treasury Bills and US Government Bonds are guaranteed by the full faith and credit of the United States government, are generally considered to be free of credit risk and typically carry lower yields than other securities.

Yield cushion, defined as a security’s yield divided by duration, is a common approach that looks at bond yields as a cushion protecting bond investors from the potential negative effects of duration risk. The yield cushion potentially helps mitigate losses from falling bond prices if yields were to rise.

Yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.