The end of the free put

Equities have historically outperformed over the long run. However, big losses often occur at bad times so stocks, careers, house prices, and even relationships are unintentionally linked. We can't easily diversify our jobs or spouse, making it important to diversify our investment portfolio.

2 minute read

Key takeaways:

- Bonds have been the natural choice for income and diversification, with the adverse effect of falling rates made up by growing hedging benefits.

- However, bonds are mathematically less attractive now, given that the yield and diversification benefits of bonds have shrunk, while the risks of higher rates or correlations have risen.

- Instead of relying primarily on bonds, investors can now add absolute return strategies that offer performance that is uncorrelated to stocks, both in theory and in practice.

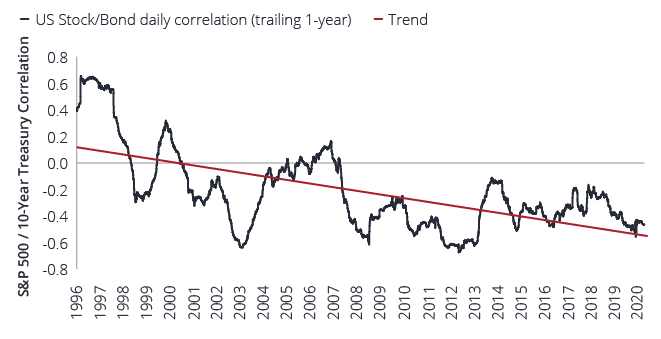

Bonds have been the natural choice providing income and diversification. The adverse effect of falling rates was made up by growing hedging benefits. Notably, the correlation between stock and bond price moves turned increasingly negative over the last 25 years.

Exhibit 1

Exhibit 1: US stock vs bond correlations

The diversification benefits of bonds rose, even as yields fell

Source: FTSE, S&P, Janus Henderson Investors, 29 March 1996 to 21 July 2020. Past performance is not a guide to future performance.

This offsetting relationship is valuable. De facto, a bond buyer receives an equity put option in addition to interest payments. We estimate the value of this embedded option using observed bond moves during stock market selloffs. We ballpark that explicitly replicating the implicit hedge provided by Treasuries to a 50% stock/50% bond portfolio via S&P 500 put options would have otherwise cost around 2.5% per year.

Bondholders not only received a decent coupon – the 10-year yield averaged 3.75% since 1995, but also “free” protection against stock market drops. Historically, during corrections, bond gains offset approximately 40% of concurrent equity losses.

However, in the drawdown between February 19 2020 and March 23 2020, 10-year Treasuries returned +7% while the S&P 500 dropped -34%. Treasuries hedged only about 20% of the equity drop, as low starting yields in February reduced upside from the bond rally.

Bonds are mathematically much less attractive now with the 10-year yield at 0.7% reducing both income and upside. Barring negative rates, we estimate the embedded put option is only worth about 1% per year, even if stock/bond correlation stays quite negative. The yield and diversification benefits of bonds have shrunk while the risks of higher rates or correlations have risen.

Instead of relying primarily on bonds, investors can add absolute return strategies that are uncorrelated to stocks both in theory and in practice. Diversifying equities can potentially reduce not just portfolio risk, but many other risks that an investor faces.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.