Downturn implications and a reconvergence of rates

The global manufacturing downturn has recently entered its fourteenth consecutive month of decline as measured by the Global Manufacturing PMI. The downturn, which emanated in Asia, has had a severe knock-on effects on economies like Germany, which have created an economic model heavily interconnected with an emergent China in recent decades.

6 minute read

Key takeaways:

- The global manufacturing downturn has recently entered its fourteenth consecutive month; but examining the downturn through the prism of the US may leave investors with too sanguine a view.

- While policy options are mostly hamstrung in Japan, Europe has ample room to buy more corporate bonds. Meanwhile, the US and Australia have the means for further conventional easing.

- In our view, the next big move in developed bond markets will ultimately see interest rates reconverge, with the US moving down towards the rest.

In other countries, such as Australia, it has coincided with a housing and consumer downturn, whose rhythm has been out of step with the slow consumer deleveraging in the rest of the developed world.

The result of such a prolonged period of weak global trade and export growth is that many central banks have moved on from the ‘denial’ phase and are actively discussing, and in some cases pursuing, monetary easing (Australia and New Zealand).

An unusual cycle with the Fed out of the driving seat

Looking at this global growth downturn through the prism of the US economy is fraught with danger, as investors are likely to come away with too sanguine a view. We have said in the past that the US was not the source of this slowdown (unlike in 2000 and 2007) and it remains a relatively insular economy — US exports form approximately 15% of its GDP versus 50% in Germany and 30% in the UK.

This is an unusual cycle where other central banks and the bond markets in the developed world are now conducting the mood music, which the US Federal Reserve (Fed) is increasingly reactive to. This note explores the policy options in various countries to enact meaningful policy easing.

As we sit near or at the lower bound for interest rates, the ability to act is a new question for investors who previously focused on the willingness to act.

Central banks that have not done QE yet…

…a relatively sparse list of central banks in the developed world, but one that includes both Australia and Canada. Notably, Australia has only cut rates since 2011. With interest rates currently sitting at a historic low of 1.25% and expected to fall to at least 1%, this bank only begun discussing quantitative easing (QE) as a policy tool in December 2018. In a speech given by Guy Debelle, Deputy Governor, he stated that “QE is a policy option in Australia, should it be required. There are less government bonds here, which may make QE more effective. But most of the traction in terms of borrowing rates in Australia is at the short end of the curve rather than the longer end of the curve, which might reduce the effectiveness of QE.”

In our view, it was no coincidence that the foreign currency pairing of AUDJPY (Australian dollar versus the Japanese yen) experienced a 7% flash crash in a few hours in early January 2019, following an eight percent depreciation in the month prior to this move. This currency pairing perfectly encapsulates the central bank with the most (Australia), and the one with the least (Japan), scope for monetary policy easing.

Evolving reaction function at the Fed

The Fed signalled in early 2019 that rates had peaked but appears to be in an intellectual transition regarding the policy framework and the ability of the US economy to remain immune from the global industrial downturn.

In this context, there is renewed focus on the structural undershooting of inflation since 2009. Notably, this is a very different spin from the comparisons to 1967 (inflation breakout risk) provided by Fed Chair Powell in the summer of 2018. Here, under the guidance of Vice Chair, Clarida, there is renewed focus on the international experience of low inflation and interest rates.

The recent signalling of a readiness to cut interest rates appears logical. The final 50 basis points of hikes in October and December 2018 into pronounced weakness in rates-sensitive sectors such as housing and autos, was clearly a mistake. Any deterioration in the employment market from here will likely engender an even stronger reaction. It is worth remembering that ‘surprising’ in a rate cutting cycle is admirable (unlike in a rate hiking cycle).

ECB’s Draghi (and board) retiring soon plus hamstrung policy options in Japan

This is where it gets really interesting. First, because the starting point is not one that you would choose as a policymaker (negative interest rates plus government bond purchases close to their legal and technical limit), and second, because in Europe President Draghi and significant members of the board are due to retire in 2019.

Starting with the European Central Bank (ECB), Mario Draghi has been clear that he believes the bank has room in all of its policy levers — including rate cuts into even more negative territory. It is worth noting that at -0.4% deposit rate the only relevant comparable is Switzerland with a -0.75% sight deposits rate, even Japan sits at -0.1% (key interest rate).

In our view the most likely meaningful policy loosening is through investment grade corporate bond purchases, which was first announced in March 2016. The ECB owns €178bn (approximately 20%) of the eligible universe of corporate bonds. Its mandate allows purchases of up to 70% (ECB, 31 May 2019). An increase to 40% seems wholly credible and would imply another €200bn of purchases of eligible investment grade corporate bonds.

In the case of Japan, policy options really do look close to exhausted. With close to 50% of the JGB market owned by the central bank, explicit yield curve control (target for 10-year yields), negative interest rates and purchases of equity ETFs for years, it is difficult to find a policy option which could surprise to the upside.

The key constraining factor for the Bank of Japan was the market reaction in January 2016 when it cut interest rates into negative territory. The share price of banks plummeted and its currency moved higher as a result of a risk-off reaction. This effectively tightened financial conditions and illustrated how hamstrung policy options were and still are.

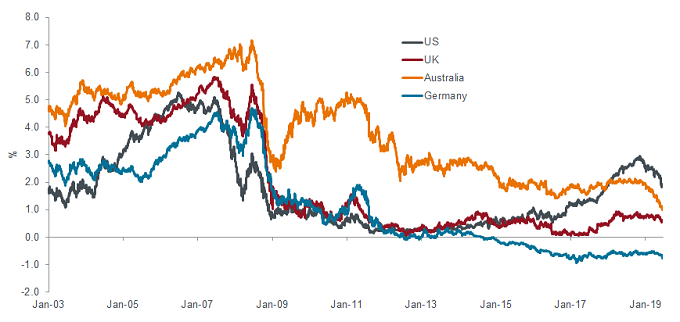

Stopping inflation expectations from sliding into the abyss

In summary, the next big move for bond markets will likely see interest rates in the developed world reconverge. For many years, consensus has argued that this was likely to occur through rates in the rest of the developed world moving up towards US interest rates. We have long disagreed and positioned for continuing divergence between the US and rest of the world viewing many economies as trapped in a lobster pot of low interest rates and quantitative easing.

Short-term rates signalling rate cuts?

Source: Bloomberg, Janus Henderson Investors, as at 18 June 2019 Note: Generic 2-year bond yields

Source: Bloomberg, Janus Henderson Investors, as at 18 June 2019 Note: Generic 2-year bond yields

The next big structural move in interest rates and government bond yields should be policy easing from those with ability to do so (ie, the US and Australia). For Europe, a move into private assets (corporate bonds) is likely as the limit of meaningful government bond QE is reached.

This may not be the ‘normalisation’ many hoped for but it is a natural reaction for inflation targeting central banks trying desperately to keep inflation expectations from sliding into a natural abyss, driven by long-term structural factors over which they have little control.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- CoCos can fall sharply in value if the financial strength of an issuer weakens and a predetermined trigger event causes the bonds to be converted into shares/units of the issuer or to be partly or wholly written off.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.