European stocks come from behind

Head of Equities – America's George Maris and Portfolio Manager Julian McManus argue structural shifts in the global economy could favor an unlikely area of the market: European equities.

6 minute read

Key takeaways:

- European equities outperformed U.S. stocks over the past one- and two-year trailing periods, as high interest rates weighed on the value of long-duration markets.

- We think structural changes in the global economy could work to keep inflation and therefore rates elevated for longer.

- Going forward, investors may need to take a more global approach with equity portfolios.

European stocks – the underdogs of the low-rate, high-growth post-Global Financial Crisis (GFC) period – did something surprising lately: They outperformed.

In 2022, when the S&P 500® Index declined by 18.1%, the STOXX® Europe 600 Index, a pan-European equities benchmark, fell by less than 10%. Thanks to this shallower correction and a strong start in 2023, trailing returns for more recent periods for the European market look even better. For the 12 months through April 2023, the STOXX 600 returned 7.3%; the S&P 500 delivered less than a third as much. For the two years through April, European stocks gained a cumulative 13.8%; the S&P only 2.8%.1

To be sure, over longer periods U.S. equities are still the clear winners. (Looking at the past 10 years, the S&P 500 returned a cumulative 215%; the STOXX only 115%.2) But as we also explored in a recent episode of our Global Perspectives podcast, we think Europe’s outperformance – which coincided with a rise in inflation and interest rates – could be a signal to investors that now may be the time to take a more global approach with equity portfolios.

A new formula for stock picking amid rising rates…

One reason for optimism about European stocks has to do with rates. When interest rates are low (or turn negative, as they did in Europe starting in 2014), longer-dated cash flows tend to be awarded higher present values. But as interest rates rise, the reverse generally happens, with current or visible earnings being accorded greater value than those in the distant future.

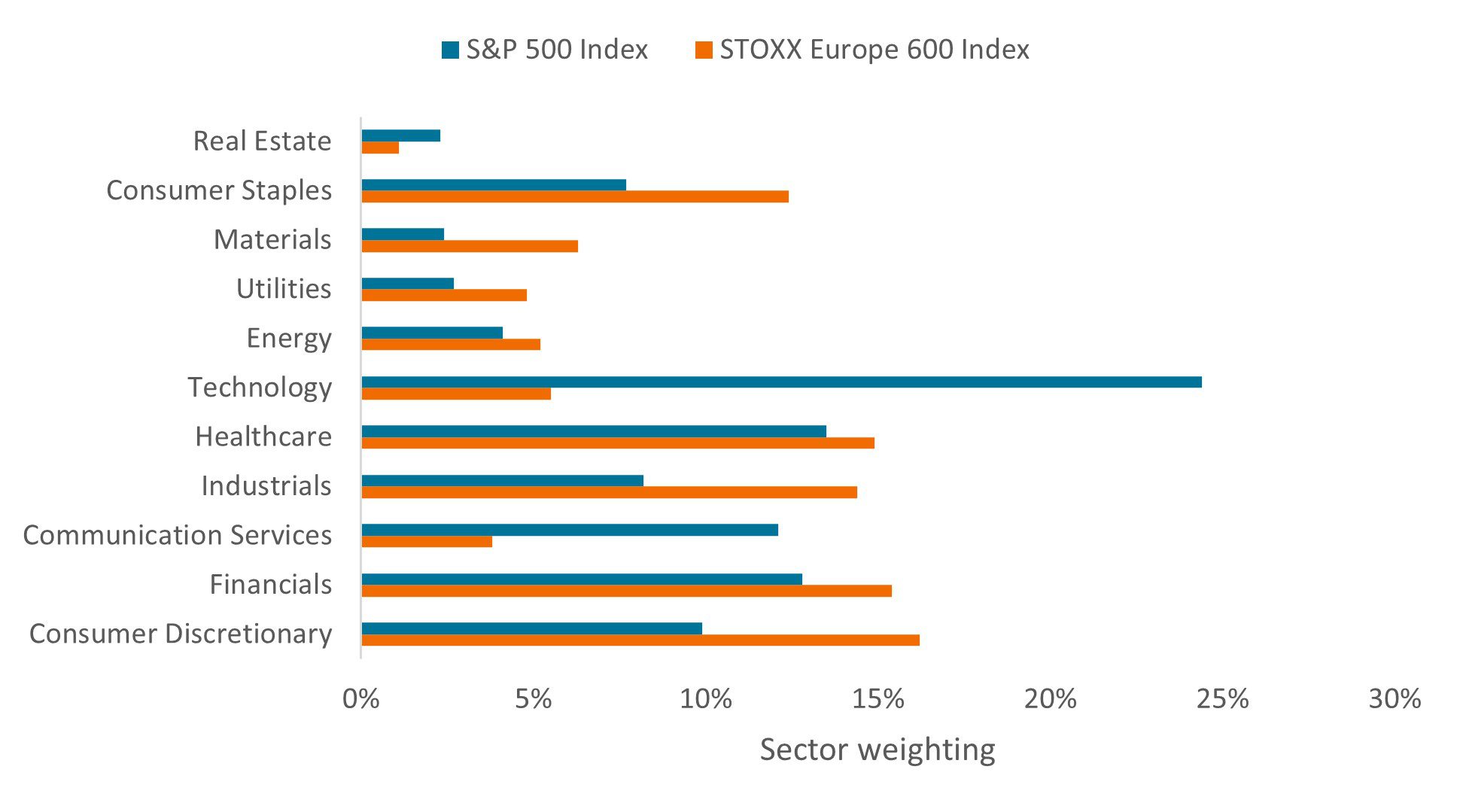

As shown in Exhibit 1, Europe has a significant portion of firms with earnings characteristics that fall into the latter group, including industrials (such as defense and manufacturing), healthcare, and financials. In the U.S., technology and other fast-growing sectors make up a bigger share of the market, and while the largest of these businesses have ample near-term cash flows, for most the growth is more longer-term weighted.

Exhibit 1: Europe’s underweight to tech

The region’s economic composition could be an advantage amid higher interest rates.

Source: Bloomberg, as of 10 May 2023.

Source: Bloomberg, as of 10 May 2023.

Today, market participants are trying to determine what’s next for interest rates. Most major central banks are roughly one year into an inflation-fighting tightening cycle and data show higher rates are having some effect. In the U.S., topline inflation fell from a high of 9.1% in 2022 to 4.9% in April of this year, while in Europe inflation dropped from its peak of 10.6% last year to 7.0%.3 Consequently, futures markets are pricing in a Federal Reserve (Fed) rate cut by as soon as July.

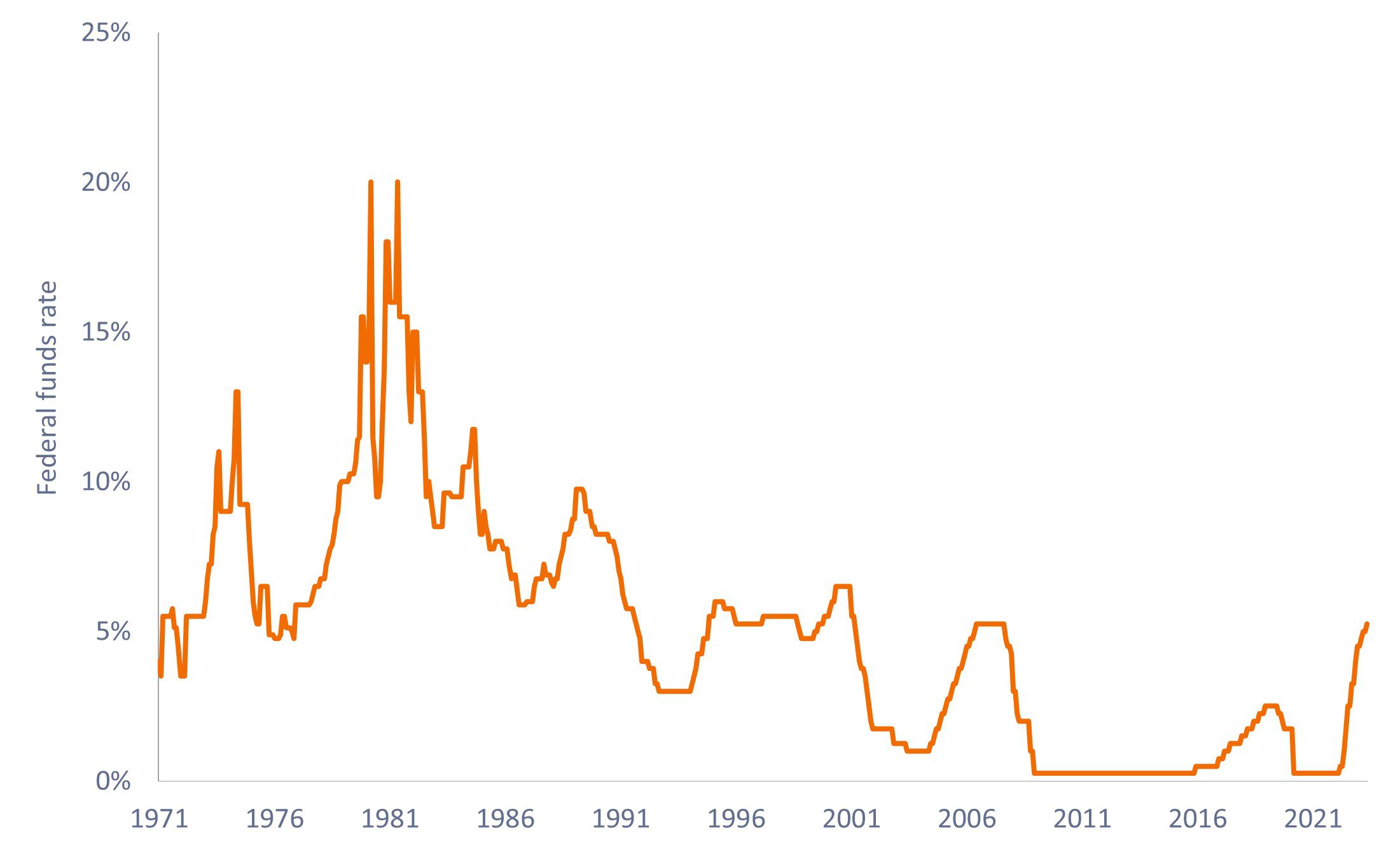

Exhibit 2: Path of federal funds rate

The Fed historically pivoted relatively quickly once having reached its cycle terminal rate, but we doubt that will be the case this time.

Source: Bloomberg, from 29 January 1971 to 30 May 2023.

Source: Bloomberg, from 29 January 1971 to 30 May 2023.

Historically, the Fed pivoted relatively quickly after reaching its so-called terminal rate during a tightening cycle, and at its May meeting, regulators implied they could be ready to pause hiking (Exhibit 2). But we are skeptical. For one, much of the recent cooldown in inflation can be attributed to short-term factors, such as the ending of China’s zero-COVID policy, which temporarily choked the global flow of goods.

Secondly, we expect major changes now percolating through the global economy could keep prices higher for longer. These include tight labor markets, reshoring and fragmentation of global supply chains, a sharp rise in defense spending, and a higher regulatory burden across industries – all of which add to costs, not reduce them.

…and slowing growth

Meanwhile, rate hikes – along with recent banking turmoil – are having another impact: They are causing growth to slow.

During the first quarter of 2023, the U.S. economy expanded only 1.1%, less than half the rate of the previous three months. The European Union experienced negative growth during the fourth quarter of 2022 and narrowly missed falling into a recession after posting modest growth of 0.3% from January to March of this year (a recession is defined as two consecutive quarters of negative gross domestic product growth).4

While the U.S. labor market remains strong (the unemployment rate sits at multidecade lows), technology companies in particular have announced large rounds of layoffs, suggesting the tech sector – a major engine of the U.S. economy – may be entering a more mature phase of its lifecycle.

The valuation advantage

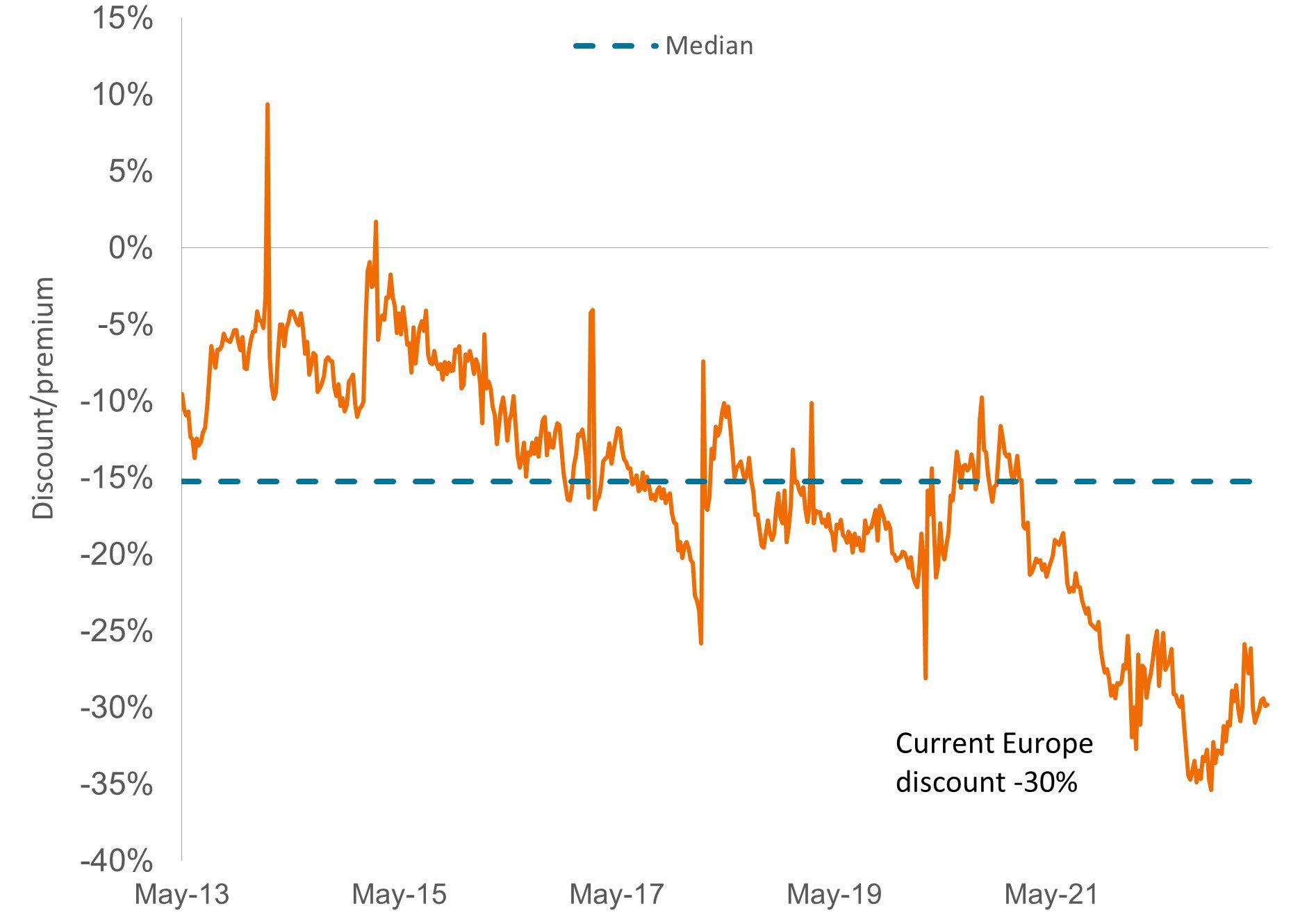

With economic growth slowing, the price you pay for a stock becomes especially important. Here again, European equities have lately possessed a big advantage. The STOXX Europe 600 trades at roughly a 10% discount to its median price-to-earnings (P/E) ratio for the past decade and roughly twice its typical discount relative to the S&P 500 over the same period (Exhibit 3).

Exhibit 3: Forward P/E of STOXX Europe 600 vs. S&P 500

European stocks trade at a significant discount to U.S. equities

Source: Bloomberg, from 10 May 2013 to 5 May 2023. Chart shows relative forward P/Es of of the S&P 500 Index to the STOXX Europe 600 Index. Median = 15%. Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio. Past performance is no guarantee of future results.

These levels are among the most attractive seen and help limit downside risk during a challenging macro backdrop. Furthermore, many European firms are used to operating amid sluggish growth after the GFC and other crises led to prolonged stagnation on the continent. (During his eight years as president of the European Central Bank from 2011 to 2019, Mario Draghi never once raised interest rates.) As such, many European firms are now efficient operators relative to peers.

Overall, we think European stocks could continue to upset the market playbook of the past. But as ever, low valuations do not guarantee success: Companies still need to innovate, and Europe still faces endemic challenges, such as aging demographics and a heavy regulatory burden. As such, we encourage investors to focus on firms with attributes we think are key for the current environment. These include high operating leverage (i.e., a high portion of costs that are fixed, making incremental revenues more profitable – something especially beneficial during inflationary periods) and competitive positioning in goods that are staples or in areas with critical supply/demand imbalances.

The European Union, for example, is a global leader in industrial automation, for which demand could rise exponentially as the reshoring of supply chains squeezes already tight labor markets. Europe also has sizable commodities and defense industries, which could benefit as the green-energy transition places enormous pressure on the supply of raw materials and as geopolitical tensions rise. (Global military spending hit a record $2.24 trillion in 2022, with Europe seeing its steepest one-year increase in defense outlays in the last 30 years.5)

Firms in these areas focused on controlling costs, while investing in innovation, are more likely to be able to command pricing power and provide visibility around free cash flows – all factors that could lead to a win for investors.

IMPORTANT INFORMATION

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

1 Bloomberg, as of 28 April 2023.

2 Bloomberg, as of 28 April 2023.

3 U.S. Bureau of Labor Statistics Eurostat, as of 10 May 2023. Data based on U.S. Consumer Price Index for All Urban Consumers. Eurostat, as of 10 May 2023. Data are for the Euro area.

4 Bureau of Economic Analysis, as of 27 April 2023, eurostat as of 28 April 2023.

5 Stockholm International Peace Research Institute, “World military expenditure reaches new record high as European spending surges,” 24 April 2023.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

STOXX® Europe 600 Index represents large, mid and small caplitalization companies across 17 countries in the European region.

Quantitative Tightening (QT) is a government monetary policy occasionally used to decrease the money supply by either selling government securities or letting them mature and removing them from its cash balances.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.