Can corporate cash drive further market growth?

Portfolio Manager Jeremiah Buckley discusses the growth decisions companies now face as they sit on record levels of cash.

4 minute read

Key takeaways:

- Corporate cash sits at record levels following the numerous challenges presented by the COVID pandemic over the past year.

- Management teams must now consider what is the best use of this capital to foster future growth and reward shareholders.

- While stock buybacks could provide one significant tailwind for market growth in 2021, capital spending trends and secular themes also appear to be supportive in the long term.

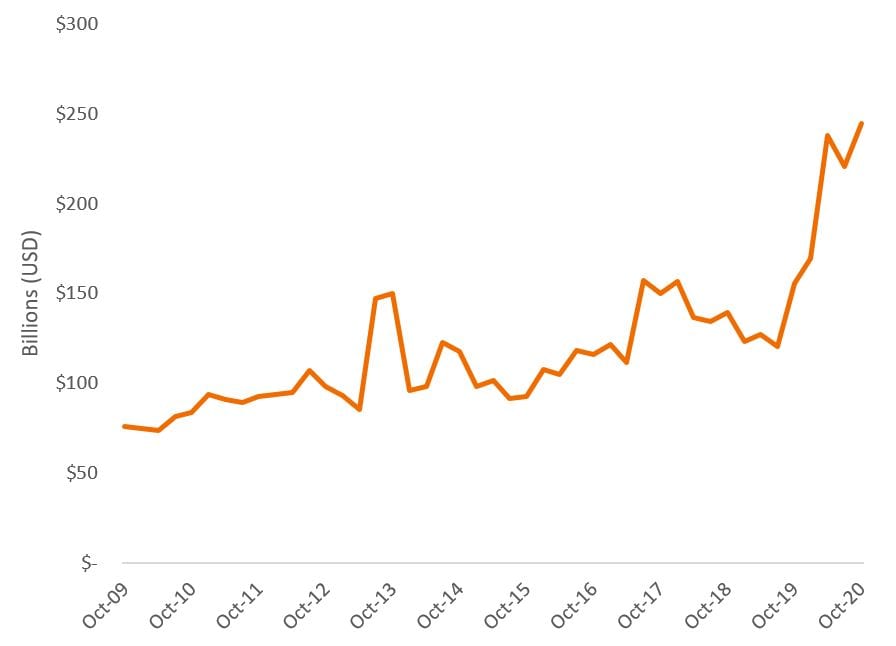

We recently wrote about how significant pent-up demand and the general strength of American consumers’ balance sheets may help drive a strong economic recovery, particularly in market segments like travel and leisure. Just as consumers are emerging from the pandemic with significant excess savings, corporations are also now sitting on record levels of cash. By the end of the fourth quarter 2020, corporate cash had risen to $244.7 billion. As investors consider potential market tailwinds, this corporate balance sheet strength may be one factor that can support valuations and further growth in 2021.

Exhibit 1: S&P 500 annual earnings change vs. price change (%)

US corporations: Total cash on hand and in US banks (4Q 2009 through 4Q 2020)

Corporate cash levels have expanded during the pandemic for several reasons. To begin with, companies stockpiled cash throughout 2020 as a hedge against the economic risks presented by COVID-19, often raising much-needed capital through debt issuance at inexpensive rates. Others postponed or were forced to halt stock buybacks, resulting in higher cash on balance sheets. Interestingly, while stock buybacks were halted in many cases and a small group of companies skipped dividends, most dividend-paying U.S. companies maintained and even increased their dividends during the pandemic.

Deploying capital efficiently

How management teams decide to deploy excess cash will significantly impact future growth – and, ultimately, returns for investors. Businesses can invest organically in internal growth projects if they believe those projects can provide attractive returns on investment. Alternatively, they can try to grow inorganically through mergers and acquisitions (M&A). Lastly, they can distribute cash to shareholders through share buybacks and/or dividends. Each company must determine which tactic or combination of tactics will be in the best long-term interest of its shareholders.

A look at buybacks in the current market

Share repurchases have become increasingly popular because of the potential tax benefits and financial flexibility they offer to companies and investors. Buybacks reduce the number of a company’s shares outstanding, thereby improving earnings per share and, consequently, pushing down the price-to-earnings ratio. Buybacks are often favored by management because their returns are more predictable than the potential returns from M&A, which tend to have more risk.

Amid the pandemic, full-year buybacks decreased in 2020 to $519.7 billion; in 2021, buybacks are expected to be nearly double that amount, approaching pre-pandemic levels seen in 2019. With markets near record highs, increased buyback activity can be a powerful factor in supporting company valuations and propelling further stock market growth in 2021.

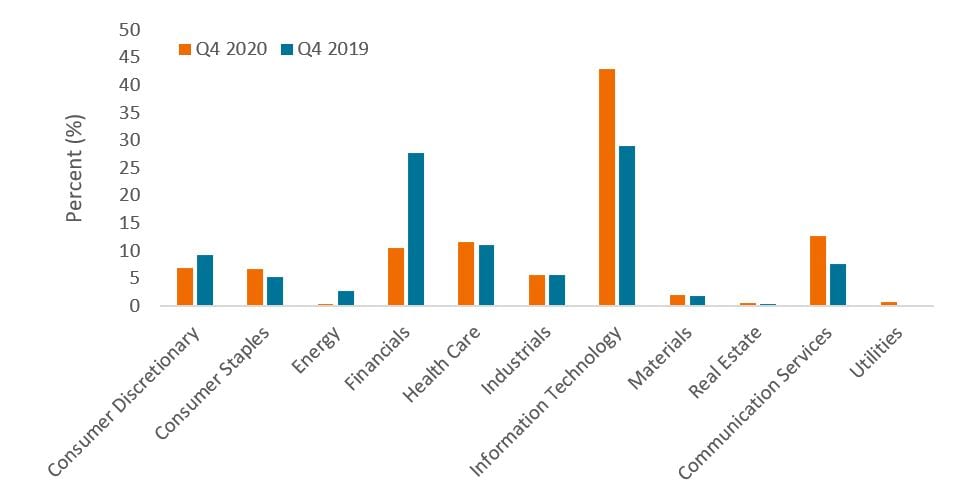

Driving a significant part of the buyback market are large banks, which were temporarily barred from buyback activity by the Federal Reserve as a precaution during the pandemic but have now been allowed to resume some repurchases. Prior to the pandemic, financials were the second-highest sector in terms of buyback activity, nearly equal to the leading tech sector. Tech company buybacks have since grown and now represent nearly 43% of the buybacks in the S&P 5001, due in part to recent buybacks to prevent dilution from stock options. The jump in tech sector buybacks can also be attributed to the general strength of large-cap tech firms through the pandemic.

Sector buyback market (%)

Capital investment and trends for long-term growth

Exhibit 1: S&P 500 annual earnings change vs. price change (%)

While corporate actions like buybacks can help increase shareholder value and provide short-term tailwinds, we think it is important to focus on characteristics that will also allow companies to grow over the long term. Corporate balance sheets in most sectors remain healthy, and we expect long-term secular trends that have been accelerated by the pandemic – including cloud services, Software as a Service and health care innovation – to further cement themselves in the global economy. While market activity now points to a significant uptick in buybacks in 2021, there continues to be evidence that companies are also ramping up capital spending, which we believe is a positive for longer-term growth.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.