Reflation for now, but how long will it last?

There is a strong consensus in financial markets these days. Post the election of Donald Trump headlines such as ‘regime change’ and ‘the Trump reflation¹ trade’ have dominated the financial media as investors happily embraced the ‘reflation’ trend and started to put their money to work based on the view that growth and inflation are going to rise. This has favoured equities over bonds.

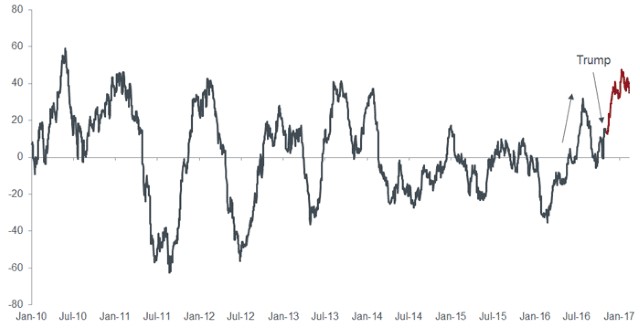

However, the catalyst for the rise in bond yields predates the US elections; since mid-2016 there have been signs that growth was picking up in the major economies. Economic surprise indices such as the G10 Citigroup Economic Surprise Index, show that economies were experiencing a cyclical uplift prior to Trump’s election, and Purchasing Managers’ Indices (PMIs) were indicating a concerted uptick in global activity.

This uptick occurred in response to a number of factors, including a loosening of monetary policy in China about a year earlier, sparking a rally in commodities. Thus, the rotation seen in equities from defensives to cyclicals and banks, the consensus move on being long the US dollar and rising bond yields were already in progress. Trump’s election simply amplified it — a ‘Trump bump’ if you like (see chart 1).

Chart 1: Major economies were experiencing a cyclical uplift pre-Trump

[caption id=”attachment_250099″ align=”alignnone” width=”640″] Source: Bloomberg, G10 Citi Economic Surprise Index, as at 14 February 2017[/caption]

Source: Bloomberg, G10 Citi Economic Surprise Index, as at 14 February 2017[/caption]

Reflation for now, but how long will it last?

Headline inflation is on the rise around the globe on the back of rising commodity prices, while core inflation (which excludes volatile items such as food and energy) remains more muted (see chart 2). In the US the tick up in activity and expectations of expansionary policies have helped the trend, while in the UK the commodity uptick has been exacerbated by a weakening sterling following the Brexit vote. Headline inflation trends are similarly on the way up in Europe and Japan.

Chart 2: Differentiating core from headline inflation

[caption id=”attachment_250088″ align=”alignnone” width=”640″] Source: Bloomberg, monthly data as at 31 January 2017[/caption]

Source: Bloomberg, monthly data as at 31 January 2017[/caption]

Given the current inflation expectations, consensus among market participants now appears to be for a rise in 10 year US Treasury bond yields to 3%, which would represent a further significant sell-off (lower prices) in bonds. Additionally, data shows that short positions in US government bond futures have reached extreme levels compared to history.

A cyclical uptick and not a structural trend

We believe the current uptick to be cyclical in nature, which should not be confused with the long term structural issues that we have talked about for so long — weak productivity, demographics and digitalisation to name but a few — that ultimately lead to lower growth and subdued inflation.

Furthermore, there is evidence that money supply growth has been declining in China and the US in recent months. Given that monetary changes usually lead activity swings by between six and 12 months, this indicates a mild slowdown around spring time this year. We therefore believe that consensus positioning has gone too far and this is, perhaps, a sign that the reflation trade may soon have run its course.

All in all, this is not an unusual picture and does not in our opinion represent a regime change; it simply reflects the normal ebb and flow of economic cycles.

Being pragmatic

As bond investors our focus is on income, while we try to also preserve capital for our investors. Although we believe that the current run of inflation will likely tail off by the second half of the year, we tend to manage our portfolios pragmatically.

In 2016 we kept an open mind on duration (interest rate sensitivity) with a view to potentially extend or lower it within our portfolios subject to how the world economies behaved. Thus we profited by positioning for the different policy responses that were expected post Brexit and the election of Trump. This was achieved by increasing duration following Brexit, which brought about a monetary policy response, and aggressively cutting it post Trump’s election, which led to a rise in expectations for fiscal policies aimed at growth.

Going forward, given low default rates in Europe, while those in the US have also peaked, should the consensus prove correct, we would view any sell off in bonds as an opportunity to find quality investment grade US corporate bonds. To us, the current yield levels present more of an opportunity than a threat. The biggest threat to our portfolios to our mind is a systemic risk in Europe as a result of politics.

We continue to favour sensible income from large, non-cyclical businesses, which are most likely to continue paying their coupons in the years to come. In 2017, coupons should look after investors reasonably well.

¹Reflation: government policies intended to stimulate an economy and promote inflation.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- CoCos can fall sharply in value if the financial strength of an issuer weakens and a predetermined trigger event causes the bonds to be converted into shares/units of the issuer or to be partly or wholly written off.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- CoCos can fall sharply in value if the financial strength of an issuer weakens and a predetermined trigger event causes the bonds to be converted into shares/units of the issuer or to be partly or wholly written off.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.