With most developed market economies having returned to relative normality over the past two years, there’s arguably been daylight between the nadir of the lockdowns and the present day to shuffle the pandemic into the ‘bad dream’ category of our collective consciousness.

Did that really happen?

Such is our collective recency bias that while shopping in the reanimated Oxford Street or jockeying for seats on the 5pm Piccadilly line, the pandemic gradually becomes an ever more distant memory. However, one only has to scratch the surface of our economy to feel the continued reverberations of those fateful years.

The global pandemic disrupted the movement of people, goods, and capital, and highlighted the vulnerabilities of globalization. The rise of nationalism and protectionism in some parts of the world has led to trade tensions and disputes, further disrupting global supply chains and investment flows. Put simply, we are investing in a new climate, one with a revised set of rules and priorities. One where knowledge of local markets and dynamics is now more important than ever.

While existing in a globalisation-oriented world for much of its lifespan, The Bankers Investment Trust, managed by Portfolio Manager, Alex Crooke has always recognised the value of investing globally through a local lens. Since 1888, the Company has sought to provide investors with income and capital growth from a globally diversified portfolio.

A local but global approach to investing

The Trust invests across six regions – North America, Europe, Japan, China, the Asia Pacific Region, and the UK. However, far from simply employing top-down analysis from afar, each region is managed by a regional specialist with comprehensive knowledge of their local market. This is particularly important during periods of uncertainty because it helps the managers to accurately assess how changes in local consumer preferences, regulations and infrastructure impact the investment landscape.

Having a global but local approach to investing also allows us to take advantage of the different regional dynamics at play. With Western economies stuck in the quagmire of stickier inflation and slowing economic growth, we’ve been looking to the East for opportunities. Generally, Asian economies are not suffering from the malaise of higher inflation, and as a result, interest rates have not risen as high. This combination means that consumers are not under the same cost pressures compared to those in the West. In addition, China’s reopening and growth has also been a strong tailwind to the region’s growth prospects.

As such, we have been investing in companies within areas such as travel and leisure, food and beverages and consumer goods, as they should benefit from increased domestic spending. Having local knowledge is crucial to this process because it enables us to sift through the noise to find high quality businesses that are providing their customers with high quality services or goods. This is just one example of how we blend our global outlook with local, bottom-up analysis. It is an approach vindicated by the Trust’s performance.

Walking the walk

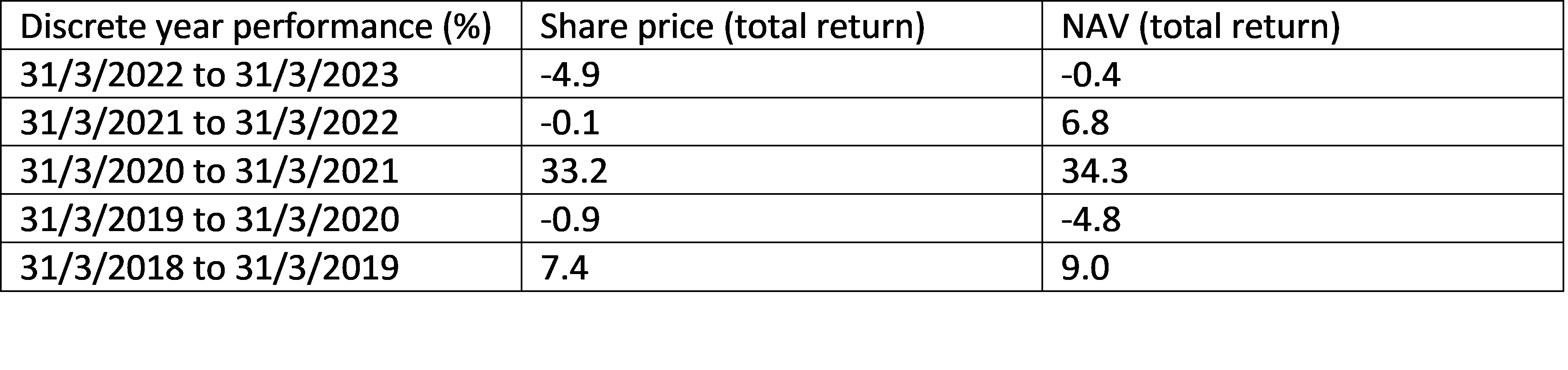

Our consistency in approach has yielded some impressive results; the Trust has increased its dividend every year over the last 56-years. This record is the longest of any investment trust and is the reason why BNKR sits atop the Association of Investment Company’s (AIC) Divided Heroes list. Capital growth has also been solid, with the Trust outperforming its benchmark over the longer term. In addition, the Trust’s ongoing charge is amongst the lowest in its sector.

BNKR offers investors a globally sustainable, diversified, and actively managed investment solution with a local focus. This makes it an attractive opportunity for investors that are keen on the prospects of the global economy but desire a more holistic approach to regional investing.

The post-pandemic world is indeed a ‘new normal’ and to fully appreciate the investment opportunities it presents, there is ample rationale to think globally but invest locally.

Glossary

Diversification – A way of spreading risk by mixing different types of assets/asset classes in a portfolio. It is based on the assumption that the prices of the different assets will behave differently in a given scenario. Assets with low correlation should provide the most diversification.

Disclaimers:

Not for onward distribution. Before investing in an investment trust referred to in this document, you should satisfy yourself as to its suitability and the risks involved, you may wish to consult a financial adviser. This is a marketing communication. Please refer to the AIFMD Disclosure document and Annual Report of the AIF before making any final investment decisions. Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Tax assumptions and reliefs depend upon an investor’s particular circumstances and may change if those circumstances or the law change. Nothing in this document is intended to or should be construed as advice. This document is not a recommendation to sell or purchase any investment. It does not form part of any contract for the sale or purchase of any investment. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes.

Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier).

Janus Henderson, Knowledge Shared and Knowledge Labs are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc

Important information

Please read the following important information regarding funds related to this article.

- Global portfolios may include some exposure to Emerging Markets, which tend to be less stable than more established markets. These markets can be affected by local political and economic conditions as well as variances in the reliability of trading systems, buying and selling practices and financial reporting standards.

- Where the Company invests in assets that are denominated in currencies other than the base currency, the currency exchange rate movements may cause the value of investments to fall as well as rise.

- This Company is suitable to be used as one component of several within a diversified investment portfolio. Investors should consider carefully the proportion of their portfolio invested in this Company.

- Active management techniques that have worked well in normal market conditions could prove ineffective or negative for performance at other times.

- The Company could lose money if a counterparty with which it trades becomes unwilling or unable to meet its obligations to the Company.

- Shares can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- The return on your investment is directly related to the prevailing market price of the Company's shares, which will trade at a varying discount (or premium) relative to the value of the underlying assets of the Company. As a result, losses (or gains) may be higher or lower than those of the Company's assets.

- The Company may use gearing (borrowing to invest) as part of its investment strategy. If the Company utilises its ability to gear, the profits and losses incurred by the Company can be greater than those of a Company that does not use gearing.

- Using derivatives exposes the Company to risks different from - and potentially greater than - the risks associated with investing directly in securities. It may therefore result in additional loss, which could be significantly greater than the cost of the derivative.

- All or part of the Company's management fee is taken from its capital. While this allows more income to be paid, it may also restrict capital growth or even result in capital erosion over time.