In 2021, we published “How We’ll All Be Doing Things Differently“, a paper looking at how the Covid-19 pandemic impacted society and how this was influencing investment decisions. Three years later, what does normal look like? Are people predominantly working from home? Have consumers changed their travelling and shopping behaviours? Most importantly, how are we investing around these long-term structural growth trends?

How are people working now?

The Covid-19 pandemic severely impacted the global workforce, with office-based employees shifting to virtual working overnight. With many enjoying more time at home with family, flexible hours, and savings from not having to commute, it is no surprise that people wanted to retain some of these benefits as economies and offices reopened. Businesses also recognised potential productivity gains from hybrid working.

Microsoft’s research indicates that 70% of its employees would like to continue flexible working, while 66% of business decision-makers are considering alternative spaces for hybrid work.1 The Office for National Statistics (ONS) reports that 24% of UK workers are now hybrid workers, with 14% working from home full-time.2 The pandemic effectively broke through cultural and technological barriers that once prevented remote work, triggering a structural shift in where work takes place. Employers have noticed and are facilitating this desire for remote work, as evidenced by Spotify’s “work from anywhere” policy.

We believe the balance is somewhere between full flexibility and full-time office working. For this reason, it is essential to have exposure to businesses that either facilitate or improve hybrid working practices. This may include investing in various enablers or facilitators of this structural trend, such as home working productivity tools, home office providers, data processing companies, and cloud storage companies. As a result, we have holdings in Apple, Samsung, SAP, Microsoft, and Automatic Data Processing, which are providing companies and employees with the tools to be productive and efficient using the hybrid working model.

How are people shopping?

The pandemic also had a profound impact on the way that we shop. Many bricks-and-motor businesses – highly dependent on foot traffic – were forced to close, and many could not reopen when lockdowns were lifted. At the same time, the shift towards e-commerce and omnichannel models, which blend physical and online channels to engage with customers, accelerated during this time. According to Adobe, Americans spent $1.7 trillion during the two years of the pandemic, representing a 55% increase in online spending compared to the two years before Covid.3

Though online spending has decreased post-pandemic for obvious reasons, the trend shows a continued increase in sales activity, indicating that digital dependency is here to stay. That is not to say physical stores will be a thing of the past. Instead, their purpose and role within the customer experience/journey will change to complement the convenience of online shopping options that consumers have grown to expect over the last three years.

Our investment approach in the retail space has always been nuanced. Rather than focusing on traditional brick-and-motor retailers, we focus on e-commerce enablers, specifically cashless payment providers such as American Express and Visa. This approach aligns with the ongoing shift towards digital payments, with research from PwC forecasting global cashless payment volumes to increase by more than 80% between 2020 to 2025 and to almost triple by 2030. Therefore, investing in companies that are leading this shift will likely be beneficial for our investors.

How we are travelling

The COVID-19 pandemic and resulting lockdowns had a devastating impact on industries reliant on freedom of movement, including hotels, car hire firms, airlines, travel agents, and tourist attractions. According to the UN World Tourism Organization, the travel industry experienced a 10 times greater shortfall in spending compared to the 2008 financial crisis. The aviation industry alone suffered an estimated $370 billion loss in global revenues. Long-haul flights were hit the hardest, while low-cost and legacy carriers, supported by government funding, were relatively safe.

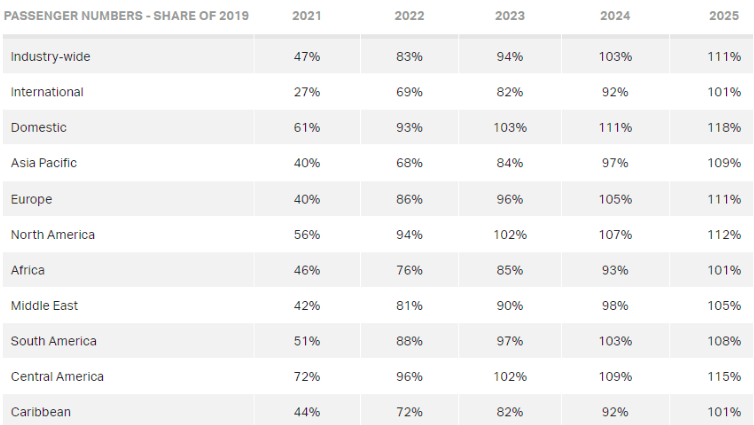

Source: IATA/Tourism Economics Air Passenger Forecast, March 2022

There is no guarantee that past trends will continue, or forecasts will be realised.

Despite the challenges faced in 2020, the airline industry is starting to see improvements in travel frequency. In 2021, passenger numbers only reached 47% of 2019 levels, primarily driven by domestic travel. International passenger numbers only reached 27% of pre-COVID levels. However, in 2022, the number of international travellers picked up to 69%, and overall passenger numbers reached 83% of 2019 levels.4 Meanwhile, an interesting trend has been gaining traction in the automotive industry. In 2020, electric vehicle (EV) registrations grew by 92% – the biggest annual increase. EV sales continue to expand rapidly as governments and society push aggressively to wean themselves from fossil fuels.

In our portfolio, we hold aircraft manufacturer Airbus and global aerospace supplier Safran as we believe the reopening of the global economy, the search for more sustainable planes, and extra defence spending will benefit both companies. We also have exposure to EV car manufacturer Nissan, lithium battery maker, Contemporary Amperex Technology, and leading solar power inverter maker, Sungrow Power as we expect EV demand to continue to rise and as the global economy transitions towards cleaner energy.

At BNKRs, we remain agile in adapting our portfolio in line with macro and micro-economic trends. For example, we previously held Meta which we sold during euphoria of the Metaverse which subsequently faded. Additionally, higher inflation and interest rates have put pressure on the market. With the flexibility to invest in any sector or geographic region, and no limit on our exposures, we can exploit opportunities quickly to generate capital growth and income for our shareholders. However, as long-term investors, we will continue to look for and invest in companies that are tapping into long-term structural growth trends that will shape decades to come.

Sources

1Source: https://www.microsoft.com/en-us/worklab/work-trend-index/hybrid-work

4Source: https://www.iata.org/en/pressroom/2022-releases/2022-03-01-01/

Glossary

Net zero – A target of completely negating the amount of greenhouse gases produced by human activity, to be achieved by reducing emissions and implementing methods of absorbing carbon dioxide from the atmosphere.

Important information

Please read the following important information regarding funds related to this article.

- Global portfolios may include some exposure to Emerging Markets, which tend to be less stable than more established markets. These markets can be affected by local political and economic conditions as well as variances in the reliability of trading systems, buying and selling practices and financial reporting standards.

- Where the Company invests in assets that are denominated in currencies other than the base currency, the currency exchange rate movements may cause the value of investments to fall as well as rise.

- This Company is suitable to be used as one component of several within a diversified investment portfolio. Investors should consider carefully the proportion of their portfolio invested in this Company.

- Active management techniques that have worked well in normal market conditions could prove ineffective or negative for performance at other times.

- The Company could lose money if a counterparty with which it trades becomes unwilling or unable to meet its obligations to the Company.

- Shares can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- The return on your investment is directly related to the prevailing market price of the Company's shares, which will trade at a varying discount (or premium) relative to the value of the underlying assets of the Company. As a result, losses (or gains) may be higher or lower than those of the Company's assets.

- The Company may use gearing (borrowing to invest) as part of its investment strategy. If the Company utilises its ability to gear, the profits and losses incurred by the Company can be greater than those of a Company that does not use gearing.

- Using derivatives exposes the Company to risks different from - and potentially greater than - the risks associated with investing directly in securities. It may therefore result in additional loss, which could be significantly greater than the cost of the derivative.

- All or part of the Company's management fee is taken from its capital. While this allows more income to be paid, it may also restrict capital growth or even result in capital erosion over time.