Choice growth: potential opportunities from high yield expansion

Tom Ross and Seth Meyer, corporate credit portfolio managers, explain why the rise in the size of the high yield bond market is to be welcomed.

6 minute read

Key takeaways:

- Between 2014 and 2020 the global high yield bond market was approximately the same overall size despite fluidity in its constituents.

- The COVID-19 pandemic led to a rise in supply as companies issued bonds to raise funds to survive the economic downturn and investment grade bonds were downgraded; there was also additional choice from first-time issuers.

- Investor appetite for yielding assets, together with an improving picture for credit fundamentals, has meant demand has kept up with the increased supply.

Exhibit 1: S&P 500 annual earnings change vs. price change (%)

A common refrain of recent years was that the growth in the size of the BBB rated corporate bond market (the lowest rated area of investment grade) would lead to a tidal wave of fallen angels (investment grade bonds downgraded into high yield). This would likely overwhelm and destabilise the high yield market. All it would take would be an economic crisis.

Cue COVID-19.

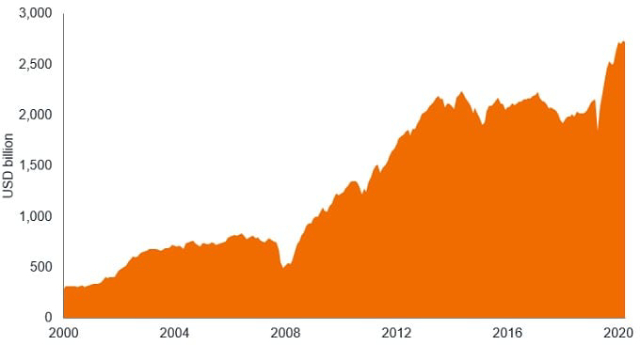

Why such a muted response? The chart below is instructive. For the better part of six years from 2014, the high yield bond market had been broadly static in size. Far from being a market where there was an excess supply of bonds, this was one that could happily afford an influx.

Figure 1: Market size of global high yield bond sector

Source: Bloomberg, Full market value in USD billion of ICE BofA Global High Yield Index, 31 December 2000 to 31 March 2021.

Source: Bloomberg, Full market value in USD billion of ICE BofA Global High Yield Index, 31 December 2000 to 31 March 2021.

Constant change

The high yield market is in a constant state of flux. At one end, there are bonds journeying back and forth between investment grade and high yield. At the other end, bonds that are on the brink of default. All the while, there are hundreds of different issuers jostling for position along the credit spectrum.

There are several reasons why the market remained broadly the same size in recent years. Moderate economic growth meant some companies had been able to finance growth from cash flows without recourse to capital markets. Improving cash flows and credit fundamentals had also allowed bonds to make the journey from high yield to investment grade. Some bonds had simply matured and not been rolled over. On a less positive note, some bonds had defaulted, thus exiting the market in a less favourable way.

Alternative forms of capital financing were also a factor. Some companies had opted to go down the leveraged loan route of financing since this could offer more flexible terms for the issuer (such as earlier redemption with fewer penalties). The growth of collateralised loan obligations (structured vehicles that purchase several loans, repackage them and sell them on to investors) had also created a ready buyer for loans, again increasing the attractiveness of this form of debt capital for the borrowing company.

Pandemic response

The pandemic broke the stalemate. The need for fresh funds to tide companies through economic lockdowns meant there was a broad variety of existing high yield companies seeking to tap the bond market. This was met by eager investors, whose appetite for bonds had swelled in the face of interest rate cuts and evidence of central bank and government support for the corporate sector. In Europe, purchasing programmes for investment grade bonds had a cascade effect, with investors moving down the credit spectrum to capture higher yields. In the US, the Federal Reserve even went so far as to announce it would directly buy high yield bonds. This generated a high degree of confidence among investors that the central bank would help support markets. In the end, such was the level of demand that US corporate bond purchases by the Federal Reserve were fairly limited, with robust market demand easily absorbing bond issues.

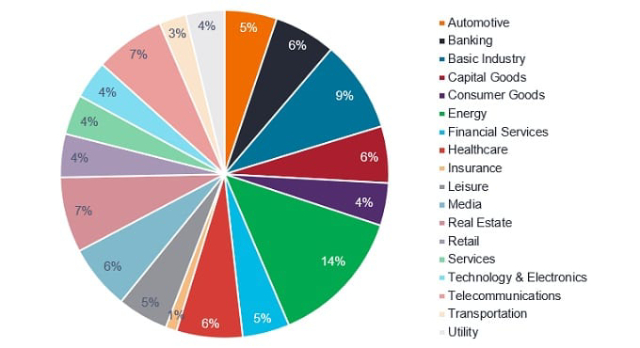

There were also plenty of debut issuers, i.e. borrowers raising finance through the high yield market for the first time. In the US, 111 tranches were by debut high yield borrowers in 2020, the highest count since 2013 and the second highest count for any calendar year.3 There has also been a pick-up in more sustainable bond issuance. For example, high yield green bond issuance in the US in the first quarter of 2021 alone was US$4 billion, double the level of the whole of 2020.4 Together, this has brought fresh issuance across many sectors, allowing for a high yield bond universe that is well diversified (Figure 2). This includes more defensive sectors such as healthcare, utilities and telecoms, alongside sectors that are more economically-sensitive such as banking, basic industry, capital goods and energy.

Figure 2: Sector breakdown of global high yield bonds

Source: Bloomberg, ICE BofA Global High Yield Bond Index, sector breakdown at 31 March 2021.

Source: Bloomberg, ICE BofA Global High Yield Bond Index, sector breakdown at 31 March 2021.

Bigger and better

We believe this is an important consideration. In our view. the improvement in credit quality means there is some justification to argue that credit spreads could move below their historical lows of the last 10 years, reflecting the changed composition of the index to companies rated with better credit quality.

Improving credit fundamentals

All this comes at a time when the picture for credit fundamentals looks set to improve as economies reopen and revenues recover. Leverage ratios (net debt/EBITDA) should begin to look more favourable, i.e. move lower, as a pick-up in surplus cash generation allows companies to pay down some of the debt they have accumulated (shrinking the numerator in this ratio) while the rise in earnings swells the denominator. We are of course mindful that economic re-openings are at the mercy of successful vaccine programmes and unpredictable variants of COVID.

Similarly, there is also the concern that economic strength causes corporate management to engage in behaviour that is less friendly to bondholders such as debt-fuelled merger and acquisition activity, or that it ignites more permanent inflation. High yield bonds have historically been able to tolerate periods of higher inflation, given it can assist revenues while the higher yields and low maturities prevalent among high yield bonds offer some cushioning against higher interest rates.

Nevertheless, we would not want a disorderly rise in yields. We believe that central banks will try to forestall excess market volatility and maintain support for economic recovery by keeping interest rates low and engaging in asset purchases as appropriate. This ought to provide a reasonably favourable environment for both the supply and demand for high yield bonds, creating opportunities for good credit selection.

1Source: Deutsche Bank, Bloomberg Finance, ICE Indices, 11 March 2021.

2Source: Bloomberg, ICE BofA Global High Yield Index, Govt option adjusted spread was 410 basis points (4.10%) at 31 December 2020, up from 371 (3.71%) basis points on 1 January 2020. A Basis point is 1/100th of 1%.

3Source: LCD, S&P Global Market Intelligence, 11 January 2021.

4Source: Morgan Stanley, Bloomberg, 8 April 2021.

5Source: Bloomberg, ICE BofA Global High Yield Index weights at 31 March 2021, 31 December 2019 and 31 March 2011.

Collateralised Loan Obligations (CLOs): Debt securities issued in different tranches, with varying degrees of risk, and backed by an underlying portfolio consisting primarily of leveraged loans.

Credit ratings: A score assigned to a borrower, based on their creditworthiness. It may apply to a government or company, or to one of their individual debts or financial obligations. An entity issuing investment-grade bonds would typically have a higher credit rating than one issuing high-yield bonds. The rating is usually given by credit rating agencies, such as Standard & Poor’s or Fitch, which use standardised scores such as ‘AAA’ (a high credit rating) or ‘B-‘ (a low credit rating). Moody’s, another well-known credit rating agency, uses a slightly different format with Aaa (a high credit rating) and B3 (a low credit rating).

Default: The failure of a debtor (such as a bond issuer) to pay interest or to return an original amount loaned when due.

EBITDA: Earnings before interest, tax, depreciation and amortisation.

Green bonds: These are bonds that are issued to fund projects that have environmental benefits.

High yield: A bond that has a lower credit rating than an investment grade bond. Sometimes known as a sub-investment grade bond. These bonds carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher coupon to compensate for the additional risk.

Inflation: The rate at which the prices of goods and services are rising in an economy. The CPI and RPI are two common measures. The opposite of deflation.

Investment grade: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings when compared with bonds thought to have a higher risk of default, such as high-yield bonds.

Leveraged loans: Loans arranged by a syndicate of banks to companies that typically have high borrowings.

Spread: The difference in the yield of a corporate bond over that of a government bond of equivalent maturity. In general, widening spreads indicate deteriorating creditworthiness of corporate borrowers, tightening spreads are a sign of improving creditworthiness

Volatility: The move up or down in asset prices.

Yield: The level of income on a security, typically expressed as a percentage rate. For equities, a common measure is the dividend yield, which divides recent dividend payments for each share by the share price. For a bond, this is calculated as the coupon payment divided by the current bond price.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.