Global Structured Debt Insight – March 2022

The third edition of the Global Structured Debt Insight is now available. This regular publication aims to explore topical themes in structured debt markets and share the team's thinking on key issues of interest.

1 minute read

Key takeaways:

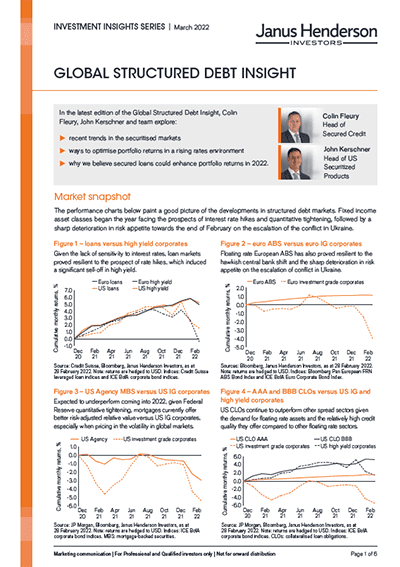

- recent trends in the securitised markets

- ways to optimise portfolio returns in a rising rates environment

- why we believe secured loans could enhance portfolio returns in 2022

The third edition of the Global Structured Debt Insight is now available. This regular publication aims to explore topical themes in structured debt markets and share the team’s thinking on key issues of interest.

In this edition, Colin Fleury, John Kerschner and team explore:

Key Takeaways

- recent trends in the securitised markets

- ways to optimise portfolio returns in a rising rates environment

- why we believe secured loans could enhance portfolio returns in 2022

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.