JH Explorer in Japan: ‘Tokyo Drift’ – the struggling office market

A trip to Tokyo reconfirms Portfolio Managers Tim Gibson and Xin Yan Low’s negative view of offices and that a selective approach is justified given the bifurcation within the sector.

5 minute read

Key takeaways:

- The global office sector continues to be weak as it undergoes structural change, but Tokyo looks to be faring slightly better than other key cities, particularly in the US.

- Ample brand-new office supply is coming in, boasting high quality features and functionality with sustainability attributes, pulling tenants away from existing buildings and putting pressure on rents.

- Our negative view on the global office sector remains unchanged. A focus on quality is now more important than ever to sift out the winners from the losers.

| The JH Explorer series follows our investment teams across the globe and shares their on-the-ground research at a country and company level. |

Tokyo was a different city compared to our last visit in September 2022. The city centre was bustling again, with traffic levels back to their pre-pandemic norms. After three years, the official mask-wearing mandate was only dropped in March, in contrast to a year earlier in countries like the US and UK. We met with various real estate companies and industry experts during our trip but found little to excite us. With the exception of hotels, which quickly bounced back post the reopening of Japan’s borders, most other sectors are struggling to see much growth.

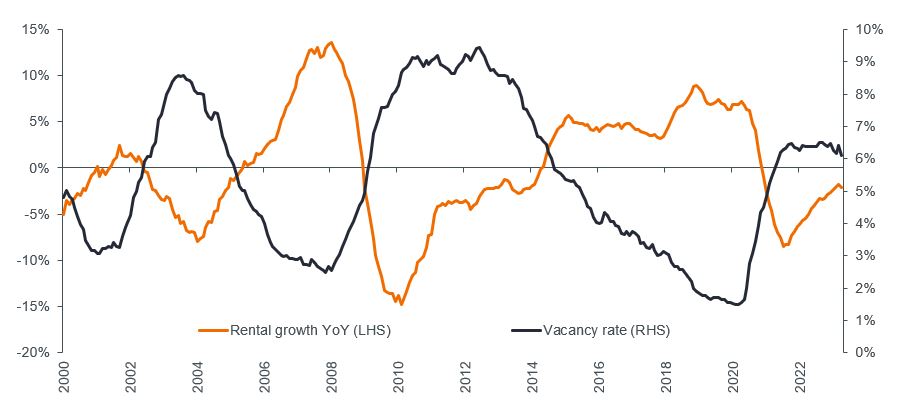

Elevated supply continues to weigh on vacancies and rents

Office – the largest sector, making up almost half of listed property exposure in Japan, continues to suffer from rising vacancies. Landlords are also having to accept lower rents, with many leases being renewed at lower levels. A key driver of office malaise has been oversupply. 2020 saw record high new supply of office space, which unfortunately hit the market at the start of the pandemic. Since then, the Tokyo office market has been in steady decline and it is difficult for us to see how fundamentals can improve in the near term as supply issues emerge once more.

Tokyo central 5 wards office rental growth & vacancy

Source: Miki Shoji Office Market Report, Janus Henderson Investors as at April 2023.

Stepping out from the east exit of Tokyo Station, we were greeted by a brand-new shiny building. Tokyo Midtown Yaesu is a mixed-use project with a total floor area of around 290,000 m2 comprising not just the usual office, retail and hotel (the first Bulgari Hotel in Japan) components, but it also houses one of Japan’s largest bus terminals and an elementary school. Developer Mitsui Fudosan pre-leased 100% of the office space ahead of its opening, with tenants predominantly being the headquarters of large corporations looking for better location and specifications. The building has completely contactless office spaces (a first in Tokyo), uses robots for cleaning and delivery, and has amenities to support varied workstyles as well as a focus on wellness and sustainability.

Tokyo Midtown Yaesu – the latest major addition to the Tokyo office market.

Redevelopment underway to appeal to changing tenant needs

In contrast, the Yaesu/Nihonbashi district (east side of Tokyo Station) has lagged the Marunouchi/Otemachi district (west side of Tokyo station) in terms of redevelopment, being still dominated by old, smaller multi-tenanted buildings. Office rents are on average 20% below that of Marunouchi/Otemachi.1 However, multiple redevelopment plans over the next two decades are underway. There are at least 10 major redevelopment projects in the area, including Torch Tower, which at 390 meters will be the tallest building in Japan (predominantly office space) when it completes in 2028.

Smaller, old multi-tenanted buildings dominate the landscape on the east side of Tokyo Station.

While Japan has had a relatively less challenging experience in getting workers back to the office than other places, just like their global counterparts many large corporations have adopted a hybrid work model and are rethinking their office needs in terms of both space and functionality. Ample brand-new office supply is coming in, boasting high quality features and functionality with sustainability attributes, typically part of mixed-use projects with a variety of other supporting amenities. Tenants are taking advantage of this to relocate, given that modern offices with the right design and amenities, in locations with good connectivity, are imperative to retain and attract talent.

Also, the average size of office buildings is increasing in Tokyo; supply of new buildings larger than 100,000 m2 is expected to rise significantly in the next few years.2 This will allow companies that have grown larger to consolidate their office footprint across different assets – a key driver of relocation demand. While rents are unlikely to rise given plentiful supply, new buildings can at least take comfort that they are more likely to be able to attract sufficient interest to fill the space and maintain their targeted returns.

On the other hand, older existing Grade A buildings are struggling with large tenant departures, having to cut rents sharply and/or increase incentives (eg. rent-free periods offered to new tenants has increased with some as much as 10 months). We expect this gap to continue to widen as new supply looks to remain elevated in the medium term.

Maintaining our negative view on the office sector

Movie review site Rotten Tomatoes gave “The Fast and the Furious: Tokyo Drift” a not very complementary score of 38% – very much a ‘thumbs down’. This reflects our view about the Tokyo office market now. That said, while the office sector is struggling globally as it undergoes a period of structural change, Tokyo probably stacks up better than many other key cities. Our negative view on the global office sector remains unchanged. A selective approach when it comes to investing in office landlords is key as quality is now more important than ever to sift out the winners from the losers in a bifurcating office landscape.

1 Savills Tokyo Office Leasing Q1/2023 Report.

2 Mori Building Co. 2022 Survey of Large-scale Office Building Market in Tokyo’s Core 23 Cities, 26 May 2022.

IMPORTANT INFORMATION

REITs or Real Estate Investment Trusts invest in real estate, through direct ownership of property assets, property shares or mortgages. As they are listed on a stock exchange, REITs are usually highly liquid and trade like shares.

Real estate securities, including Real Estate Investment Trusts (REITs) may be subject to additional risks, including interest rate, management, tax, economic, environmental and concentration risks.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.