Yield revival entices investors back to bonds

Recent market events have proved unsettling but volatility offers opportunities. This is particularly the case in fixed income where yields are at levels not seen for more than a decade. Here, we explore why investors are likely to increasingly allocate to fixed income given the opportunities available.

5 minute read

Key takeaways:

- We believe that the compelling characteristics of bonds – providing attractive income and acting as a counterweight to equities – remain intact.

- Irrespective of an eventual downturn in markets, fixed income investors are in a far more favourable position today than in recent years, as higher yields offer more of a buffer against a broad bond market downturn.

- Looking forward, we expect investors to increasingly allocate to fixed income in light of the asset class’s improved outlook.

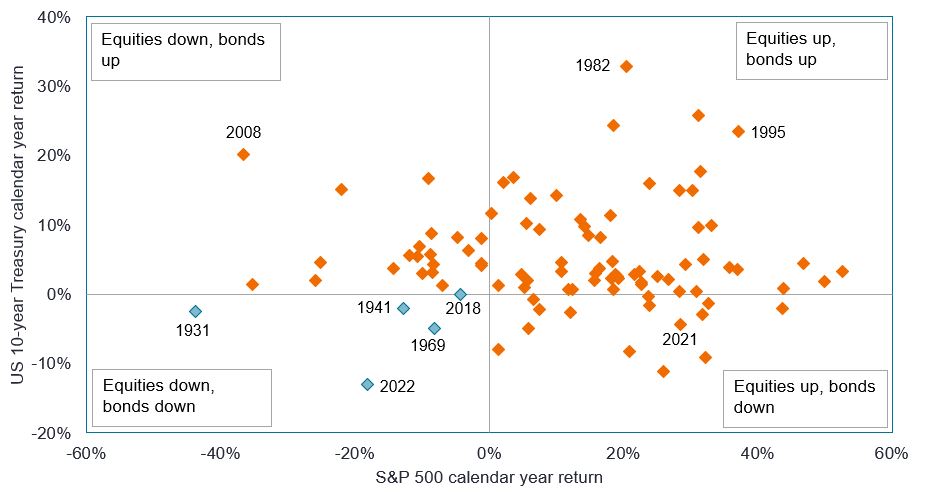

Investors endured a dismal 2022, as the impact of rising rates sent shockwaves through both fixed income and equity markets. As global bond markets slumped to the worst year on record, investors were left with nowhere to hide, with equities also ending the year in negative territory. In fact, this was just the fifth time in almost a century that investors suffered a simultaneous sell-off in bonds and stocks.

Figure 1: It is rare for equities and bonds to sell off together

Source: Bloomberg, Morningstar, NYU Stern, as of December 31, 2022. S&P 500 Index total returns and 10-year U.S. Treasury Bond total returns, calendar years in US dollars, 1928-2022. Blue represents years in which both stocks and bonds were down, orange represents years in which stocks were up and bonds were down, or bonds were up and stocks were down, or both stocks and bonds were up. Past performance does not predict future returns.

While last year’s bond market rout was painful, investors have renewed optimism in 2023, with the asset class offering yields not seen in more than a decade. However, after the synchronised slump for bonds and equities, there are mounting fears fixed income’s traditional role of providing downside protection in risk-off periods has been permanently upended.

On the contrary, we retain our faith in fixed income, and believe the compelling characteristics of bonds – as an all-important counterweight to equities, as well as able to offer attractive income – remain intact. Looking forward, we expect investors to increasingly allocate to fixed income in light of the asset class’s improved outlook. 2023 has already got off to a stronger start for the asset class.

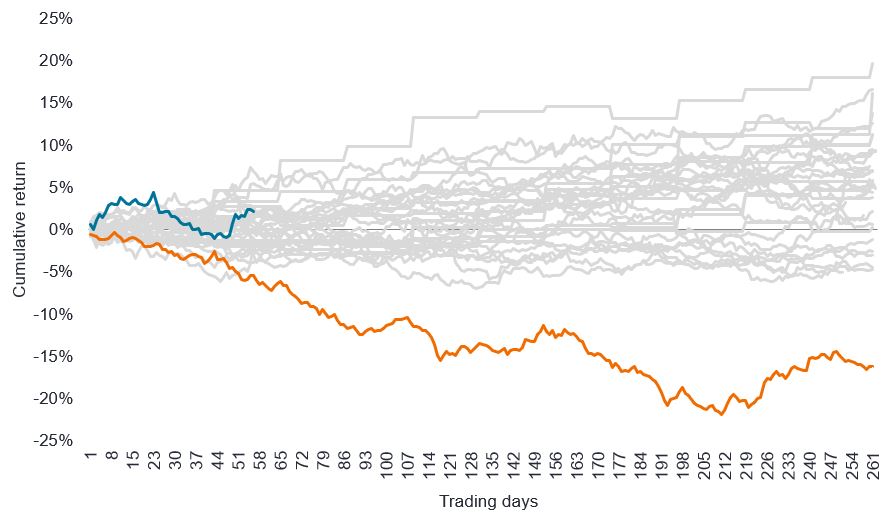

Figure 2: Progression of cumulative return (%) of global bonds by trading days in years 1990-2023

Bloomberg Global-Aggregate Total Return Index Value Unhedged USD

Source: Bloomberg, Janus Henderson Investors, 31 December 1989 to 21 March 2023. Orange line represents 2022, blue line represents 2023 year to date, grey lines are all the other years. Past performance does not predict future returns.

The return of income

We are already witnessing signs of a sustained fixed income sentiment shift, with the enticing yield opportunity – both on an absolute level and relative to equities – powering substantial investor inflows so far this year.

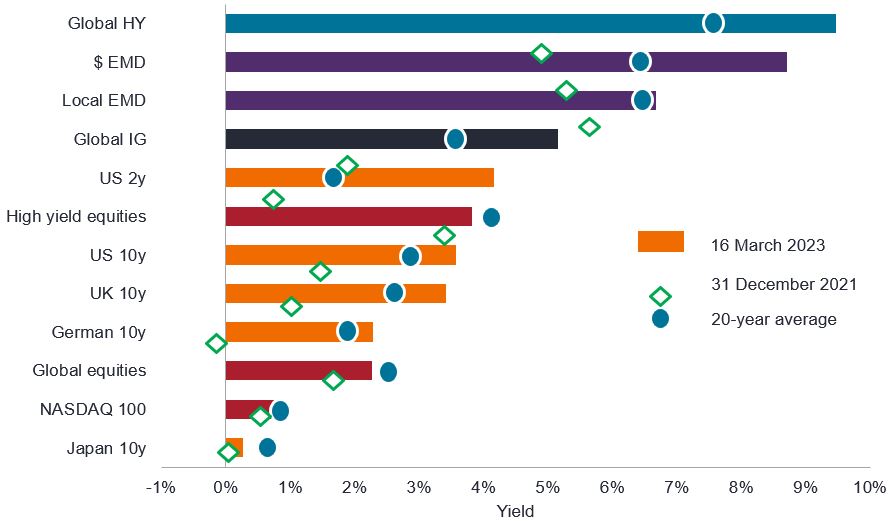

Figure 3: The revival in yields leaves most markets yielding above their 20-year averages

Source: Bloomberg, Refinitiv Datastream, Macrobond, Janus Henderson Investors Analysis, as at 16 March 2023 and 31 December 2021. 20-year average uses month end data points between 28 February 2003 and 28 February 2023. Indices used: Global HY = Bloomberg Global High Yield Index, $ Emerging Market Debt (EMD) = J.P. Morgan EMBI Global Diversified Index, Local EMD = J.P. Morgan GBI-EM Index, Global Investment Grade (IG) = Bloomberg Global Aggregate Corporate Index, High yield equities = MSCI World High Dividend Yield Index, US 2year, US 10y, UK 10y, Germany 10y, Japan 10y = Bloomberg Generic Government Bond yields, Global equities = MSCI All Countries World Index, Nasdaq 100 = Nasdaq 100. Yield to maturity for government indices, yield to worst for corporate bond indices, dividend yield for equity indices. Yields may vary over time and are not guaranteed.

With the extreme inversion of government bond yield curves, even two-year sovereign bonds from the US government are offering yields around 4%. In the credit space, global investment grade yields have risen sharply from an average 2% to 5% since the beginning of 2022, while global high yield has jumped from around 5% to 9%. Within securitised credit, an area of the market that felt the full force of last year’s sell-off, yields of 4-10% are compelling given the securities are largely investment grade quality with floating rates.

Looking across regions, the European corporate credit market shows particular promise, benefiting from attractive valuations and a somewhat more favourable growth outlook than the US or UK. Elsewhere, emerging markets are likely to once again drive global growth – led by China’s post-Covid recovery. This is constructive for emerging market debt, where credit quality in certain areas is robust and a number of central banks are well positioned to manage a potential slowdown.

Most awaited recession ever

As we move through 2023, the impact of a potential recession is clouding the investment landscape. With central banks continuing to tighten rates in response to elevated inflationary pressures, most lead indicators are pointing to an eventual slowdown – and economists are forecasting a global downturn.

Even though a recession would likely take the pressure off rising rates, it may be challenging for central banks to engineer a slowdown in inflation to the desired 2%, without triggering a larger rise in unemployment. Should a 0.5% decrease in employment spiral to 1-2%, companies would likely retrench, banks would become more reticent to lend, and demand for credit would wane – thus fuelling a deeper crisis.

However, a recessionary environment could ultimately be positive for key parts of fixed income, notably government bonds, as it would allow bond yields to reconnect to the lack of growth, creating an opportunity for potential capital gain as bond prices rise. While yields will be reset lower, the relatively steady income provided by bonds should be in demand from investors looking to de-risk.

A comfortable cushion

Irrespective of the eventual depth of the downturn, fixed income investors are in a far more favourable position today than in recent years, as higher yields offer more of a buffer against a broad bond market downturn.

In addition, the upcoming slowdown may provide an opportunity to generate strong total returns within government bonds. It is not uncommon for rate cuts to come in quick succession following the end of a hiking cycle. Here, a turn in employment figures will be a key indicator to watch.

Within corporates, it may be prudent to keep some powder dry should credit spreads widen. While today’s record corporate margins could come under pressure in the medium term, credit fundamentals are broadly resilient and default rates are expected to remain low. Volatility in the market should offer opportunities for active investors.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.