Surging inflation, high interest rates and a slowdown in global growth meant that overall, performance in 2022 was disappointing for investors across the board. In every region, financial markets posted steep losses, with many registering the worst performance since the 2008 downturn. Little could be done to mitigate the influences of international events, including the fallout from the pandemic, and food and energy supply imbalances caused by war in Ukraine. Short of investing exclusively in energy companies, there were no fool-proof strategies available to insulate investors from poor market performance.

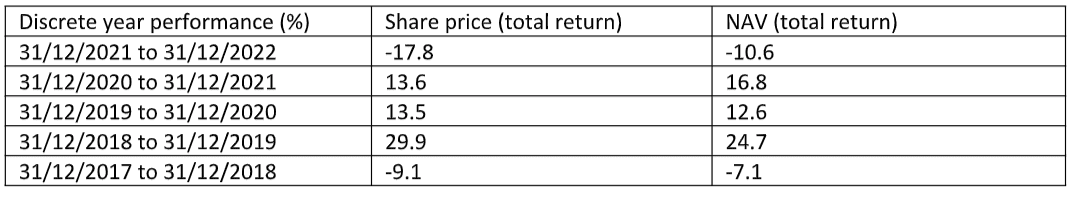

The Bankers Investment Trust (BNKR) was no exception and performance reflected these uncertain markets. The NAV total return was down 11.3%, underperforming the FTSE World Index on a relative basis. A key part of this underperformance can be attributed to weakness in Asian markets, as Covid continued to affect trade and travel. However, with Asian economies looking buoyant following China’s faster-than-expected reopening, is BNKRs now positioned to capture the upside?

To answer this question, the first place to look is China, the second biggest economy in the world. It has been the biggest contributor to global GDP growth since the financial crisis and between 2010 and 2020, the country’s economy grew by $11.6trn.i According to the International Monetary Fund (IMF), the Chinese economy is forecast to grow by roughly 5.2% in 2023, versus 3.0% last year.ii Much of this growth is going to be driven by the release of pent-up consumer demand among a Chinese middle class sitting on record-high domestic savings, accrued during extended periods of lockdown.

As activity picks up, sectors likely to benefit are those reliant on consumption and mobility. In fact, consumption has already rebounded strongly, with retail sales rising by 3.5% year-on-year in the first two months of 2023.iii There has also been an uptick in domestic travel and hotel revenues have also increased by around 20% compared to 2022. The latest spending patterns suggest that Chinese consumers are generally engaging in travel closer to home and are more focused on domestic consumption.

These trends bode well for our positions in China, including leading food producers ChaCha Food and Inner Mongolia and beverage companies Kweichow Moutai and Wuliangye Yibin. The uptick in domestic travel should also serve as a tailwind to China Tourism Group, which provides tourism, hotel, scenic passenger transport and other travel-related services domestically and across the Asia Pacific region. Our holdings in Sungrow Power, a solar power inverter maker and EV battery producers Contemporary Amperex Technology and Yunnan Energy New Material, reflect our longer-term belief these companies will have a role to play in China’s transition towards a cleaner, more sustainable economy.

China’s reopening and growth will also be good news for the Asia Pacific region, as its consumer wealth and exports will flow outwards into the wider Asian market. Currently the most dynamic of the world’s economic regions, in February the IMF described Asia as a “bright spot in a slowing global economy”, with growth set to hit 4.7% this year.iv

Generally, Asian economies are not suffering from the malaise of high inflation to the same extent as the West. As a result, interest rates have not risen as high to counter inflation. This combination of lower inflation and lower rates means that consumers are not under the same cost pressures to tighten their belts. Add to this a drop in oil and food prices, and there are better prospects for spending.

South Asia fared better than the region’s more northerly countries during 2022, and we expect to see further growth throughout 2023 in commodity-heavy economies such as Malaysia, where the outlook is based on resilient domestic demand and contained inflation. In Indonesia, foreign investment and favourable commodity prices are helping to support the economy. Meanwhile, Thailand has seen its most profitable sector – tourism – bounce back, with an estimated 25 million visitors forecast for 2023, more than double its 2022 haul.v

Global diversification is valuable during periods of uncertainty, acting as an insurance policy against poor market performance in any one region. It allows us to take advantage of the different regional dynamics at play. While our positioning in Asia detracted last year, due to short-term market drivers (the Covid-19 pandemic and supply chain disruptions), the longer-term thesis still holds. The rise of the middle class in Asia will continue to increase, Asian economies are shifting from production to consumption, and the region will be instrumental in the shift towards a cleaner global economy.

With a particular focus on cash generation and dividend growth over the medium term, our regional investment specialists take an agile approach to stock picking, based on their local market expertise. This allows us to find businesses that will not only perform well in normal market conditions but will also be resilient during difficult periods and come out of the other side. As the short-term noise/disruptions subside, we believe the regional trends and dynamics that are tied into the medium-and-long term structural growth drivers will come back into the fore. As such, BNKRs is well placed to capitalise on these trends. Following 56 years of dividend increases, we are confident that we will continue to deliver strong long-term performance.

Sources

i Source: The implications of China’s mid-income trap | Financial Times (ft.com)

ii Source : https://www.imf.org/en/News/Articles/2023/02/02/cf-chinas-economy-is-rebounding-but-reforms-are-still-needed

iii Source: https://www.ft.com/content/a67c7717-c117-4778-b2f3-324d1c9fdd11

iv Source: https://www.imf.org/en/Blogs/Articles/2023/02/20/asias-easing-economic-headwinds-make-way-for-stronger-recovery

v Source: https://www.bbc.co.uk/news/business-64369279

Glossary

Diversification – A way of spreading risk by mixing different types of assets/asset classes in a portfolio. It is based on the assumption that the prices of the different assets will behave differently in a given scenario. Assets with low correlation should provide the most diversification.

Net asset value (NAV) – The total value of a fund’s assets less its liabilities.