In today’s uncertain economic environment, it is more difficult than ever to find a fund that can combine reliable, consistent, and competitive income with attractive capital growth. With interest rates likely to remain high for some time, investors will need to diversify their portfolios to find funds that can provide growth and income above stubbornly high rates of inflation. But while it is tempting to look closer to home, the answer may lie further afield where economic growth rates are higher and different sectors and industries can be accessed that can offer that elusive blend of reliable income and capital growth.

Backing equities to deliver income

While the improved yields on bonds have caught the spotlight – following recent interest rate hikes – investors could still lose out over the long term if inflation remains stubbornly high. We believe that equities are still best equipped to fight this battle, even though the economic headwinds that characterised 2022 remain in place. When growth and investment return expectations are low, global equities have proved themselves time and again to be one of the best options for those seeking a steady income as well as capital growth.

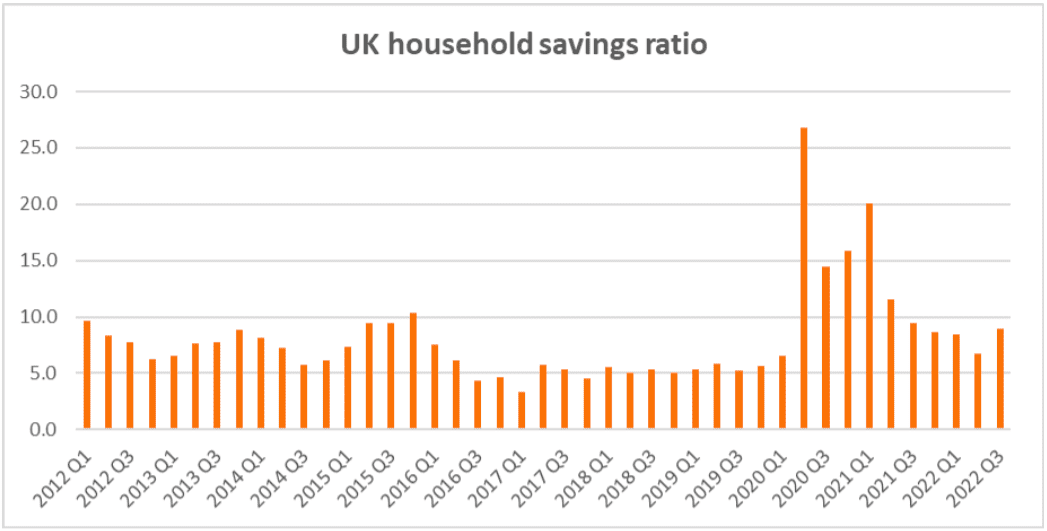

Helping us keep faith with equities for both growth and income is the fact that company finances are in a much stronger position than on the eve of previous downturns, with cash reserves still high after pandemic belt-tightening. The same goes for household finances, with consumers who remain concerned about the economic outlook still sitting on – and indeed growing – their savings. In the UK for example, though the rate at which households have been saving has slowed, data shows that on average, households have not yet had to eat into their savings to pay for the cost-of-living crisis (see chart below). It’s one of the main reasons why retail sales figures around the world have held up against expectations, despite falling real incomes.

Source: Office for National Statistics, 22 December 22 (seasonally adjusted – sa)

Plentiful cash on corporate balance sheets is also one of the main reasons that company dividends are still growing. Rising dividends are an indispensable tool for helping compensate for market volatility and inflation and, as can be gleaned from our most recent Global Dividend Index Report1, the outlook for growth in payouts appears steady. Though dividends are expected to slow from the exceptionally high levels enjoyed in 2022, they are still forecast to rise by 2.3% in 2023 and dividend cover remains high, suggesting confidence in earnings.1

Importantly, there is also attractive value still to be found in equities. Certain parts of the market remain comparative bargains, and we are yet to see the prices of many ‘value’ companies fully catch up after their marked underperformance of ‘growth’ shares in the last decade. Indeed, it could be argued that by receiving attractive dividends, investors are being ‘paid to wait’ until the true value of stocks is realised. These boosted payouts can also be a valuable underpinning for portfolio performance by helping compensate for weaker capital returns when share prices are falling.

So, all in all, equities look still look like a strong bet for generating inflation-beating total returns for some time yet.

Why Henderson International Income Trust for dividends?

A global equity income fund, HINT is a focused portfolio of some of the best income-generating stocks. It boasts an exceptional record in that regard, having grown its dividend every year since inception in 2011.

Underpinning HINT’s success is its harnessing of the power of diversification. Spreading risk broadly across different geographies and industry sectors is key for preserving capital in an uncertain economic environment. As well as helping to smooth out the market’s peaks and troughs by blending assets whose performance is not in lockstep with each other, prudent diversification can enhance long-term returns and buffer against large, damaging drawdowns. For example, those portfolios that were too concentrated in struggling US technology companies last year will have fared appreciably worse than those that which held exposure to foreign companies and value stocks.

And it is not just capital growth that benefits from diversification. It is also an important discipline for income generation as payout rates can be vulnerable if they are concentrated too much in one country or sector.

But effective diversification needs to be more than just diversification for diversification sakes, it needs to give investors access to complimentary return profiles. To this end, HINT is an ideal complement to a balanced portfolio as it only invests in markets outside the UK, thereby eliminating the risk of ‘doubling up’ exposure given UK investors’ typical bias to their home market. What is more, the UK market is fairly concentrated, with dividends dominated by sectors such as oils, miners, pharmaceuticals, and financials. That represents a risk to returns when the economy dips and companies are forced to cut payouts.

HINT also boasts a well-defined investment process that focuses on high-quality companies benefiting from strong pricing power and the ability to pass on rising costs to protect their margins. We believe this emphasis currently gives the trust a tactical advantage in terms of capital growth potential as these companies remain cheap, meaning there is more room to run.

Grounds for optimism but diversification remains key

While there are still challenges for 2023, we are optimistic that some of the elements that have weighed on markets and economies in the last year or so – notably the growth slowdown in China and the spike in energy prices – will ease somewhat. Given the prospect that uncertainty will remain high, diversification will nevertheless be key to generating a consistent and stable income. The companies in which you invest will determine how you fare through these difficult market conditions.

HINT, with its inflation-beating dividend growth and compelling diversification advantages, slots perfectly into the portfolio of those investors wishing to maximise the benefits of income-generating equities without sacrificing too much of the potential for capital growth. The time for ‘quality income’ investing is now.

1https://www.janushenderson.com/en-gb/adviser/insights/global-dividend-index/

Glossary

Balance sheet – A financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time. Each segment gives investors an idea as to what the company owns and owes, as well as the amount invested by shareholders. It is called a balance sheet because of the accounting equation: assets = liabilities + shareholders’ equity.

Volatility – The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. Higher volatility means the higher the risk of the investment.

Disclaimers:

References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Not for onward distribution. Before investing in an investment trust referred to in this document, you should satisfy yourself as to its suitability and the risks involved, you may wish to consult a financial adviser. This is a marketing communication. Please refer to the AIFMD Disclosure document and Annual Report of the AIF before making any final investment decisions. Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Tax assumptions and reliefs depend upon an investor’s particular circumstances and may change if those circumstances or the law change. Nothing in this document is intended to or should be construed as advice. This document is not a recommendation to sell or purchase any investment. It does not form part of any contract for the sale or purchase of any investment. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes.

Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier).

Janus Henderson and Knowledge Shared are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc

Important information

Please read the following important information regarding funds related to this article.

- Higher yielding bonds are issued by companies that may have greater difficulty in repaying their financial obligations. High yield bonds are not traded as frequently as government bonds and therefore may be more difficult to trade in distressed markets.

- The portfolio allows the manager to use options for efficient portfolio management. Options can be volatile and may result in a capital loss.

- Global portfolios may include some exposure to Emerging Markets, which tend to be less stable than more established markets. These markets can be affected by local political and economic conditions as well as variances in the reliability of trading systems, buying and selling practices and financial reporting standards.

- Where the Company invests in assets that are denominated in currencies other than the base currency, the currency exchange rate movements may cause the value of investments to fall as well as rise.

- This Company is suitable to be used as one component of several within a diversified investment portfolio. Investors should consider carefully the proportion of their portfolio invested in this Company.

- Active management techniques that have worked well in normal market conditions could prove ineffective or negative for performance at other times.

- The Company could lose money if a counterparty with which it trades becomes unwilling or unable to meet its obligations to the Company.

- Shares can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- The return on your investment is directly related to the prevailing market price of the Company's shares, which will trade at a varying discount (or premium) relative to the value of the underlying assets of the Company. As a result, losses (or gains) may be higher or lower than those of the Company's assets.

- The Company may use gearing (borrowing to invest) as part of its investment strategy. If the Company utilises its ability to gear, the profits and losses incurred by the Company can be greater than those of a Company that does not use gearing.

- If the Company seeks to minimise risks (such as exchange rate movements), the measures designed to do so may be ineffective, unavailable or negative for performance.

- All or part of the Company's management fee is taken from its capital. While this allows more income to be paid, it may also restrict capital growth or even result in capital erosion over time.