Strategic Fixed Income — where are bond markets heading in 2020?

Key takeaways:

- Bonds can be good diversifiers for portfolios and equity risk as they react to changes in economic growth and inflation.

- The Strategic Fixed Income Team entered 2019 with a non-consensual view that bond yields and interest rates would stay low for a very long period of time – there was no sustained breakout of growth or inflation as the US Federal Reserve overtightened policy on the false belief that inflation was back! Bond yields fell materially over the period, which was beneficial for their portfolios.

- The consensus has now come around to our view of the world – one of much lower bond yields. The key question for 2020 is whether the decline in economic growth and inflation is now coming to an end and if so for how long?

Fate of bonds in 2020

An often underappreciated fact about bonds is that they are a relatively simple asset class – government bond yields follow the rate of change in growth and inflation in the economy. For the last 12 months, bonds have done a great job diversifying portfolios and equity risk and, as growth peaked and inflation peaked, bond yields peaked around the world and bond prices rallied significantly thereafter as bond yields fell.

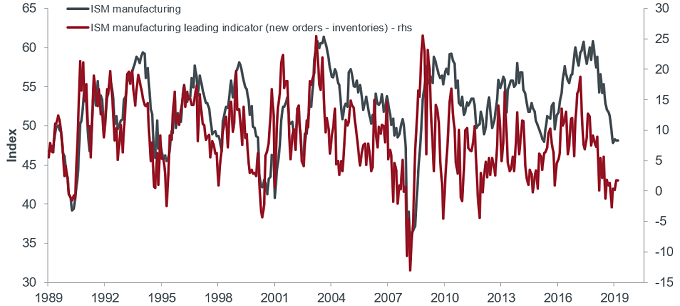

Going forward, into 2020, the question is whether the decline in economic growth and inflation is coming to an end. That is the debate that has been going around in financial circles since September. Equity markets have their view, which is, as usual, more optimistic than that of the bond market. However, there are signs that the manufacturing cycle may be bottoming (see chart) and that the rate of change in growth and inflation may begin to pick up once more. In which case, sovereign bonds will have a tougher time as one would expect. Corporate bonds would perform better in this reflationary environment.

ISM manufacturing lead indicator bottoming?

Source: Bloomberg, Janus Henderson Investors, as at 31 December 2019

Note: Institute for Supply Management (ISM) manufacturing index versus a lead indicator (new orders minus inventories). The index, a widely viewed indicator of recent US economic activity, is based on a survey of purchasing managers and monitors monthly changes in production levels.

Bond funds should behave like bond funds

Bond funds should behave like bond funds — that is a central pillar of our strategy. There should not be any surprises for clients and hopefully they know our philosophy and our strategy.

We believe quite passionately in active asset allocation. In practice that means changing the allocation to different asset classes as frequently as we deem necessary to suit the economic climate and prevailing markets. Thus, we are not a slave to gilts or sovereign bonds, investment grade or high yield corporate bonds, or loans.

We can, and do, vary the interest rate sensitivity (duration) and the credit sensitivity of our portfolios — independently of each other — is seeking to achieve good, long-term, reliable returns for clients. Importantly, we focus very heavily on the downside risk to avoid having big capital losses at any time. The latter focus chimes with our stock selection, which we describe as ‘sensible income’. We tend to invest in large, non-cyclical, reliable and quality businesses, which over time, we have found should not let us down.

No change in our approach or outlook

For a number of years now, we have held a non-consensual view on bond yields and interest rates, believing that they would stay low for a very long period of time. We never agreed with the consensus view that bond yields and bond markets were a bubble — 2019 has confirmed that. If anything, consensus has now come around to our view.

In recent months ‘Japanification’ has been talked about ad infinitum in financial circles and, central banks around the globe have also begun to shift their stance; now saying that the biggest challenge is that inflation is too low and has been too low since 2009. In particular, the US Federal Reserve has changed its view, which is very different to 18 months ago, when it thought inflation taking off would be the biggest challenge. Thus, while we have not changed our philosophy or approach, it is interesting that consensus has come around to our view of the world.

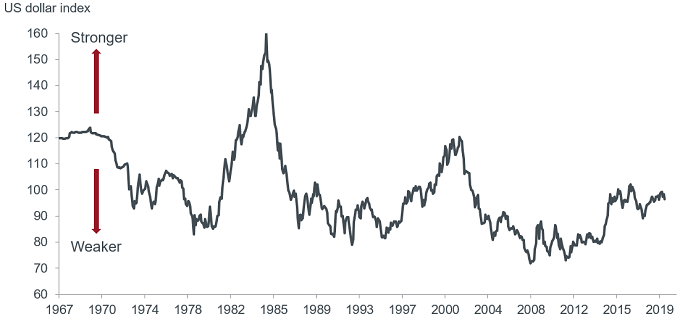

A chart to watch in 2020?

The irony is that we spend our lives looking at endless charts. We carry out significant amounts of research to see if there is confirmation between different charts or between different asset classes and, whether they corroborate or contradict existing views and evidence. However, one key chart could be the performance of the US dollar.

US dollar’s performance over the years

Source: Bloomberg, US dollar index DXY, Janus Henderson Investors, as at 31 December 2019.

Note: the US dollar index, DXY

There is obviously significant debate as to whether we are in a soft landing and it is mid-cycle, or a hard landing and it is late-cycle in economies. The first case is more an equity view of the world and the second case reflects more of a bond view of the world. However, in our mind, a significant soft landing and a reflation, is unlikely without a soft (structurally lower) US dollar.

Against that we look at endless charts, of which many are important. The price of oil (general proxy for demand), the shape of the yield curve (of course we do, we are bond people!), financial conditions and money supply are probably the most topical ones. There are a hundred more to be honest but really the dollar is the ‘tell’ and that’s the one which in my opinion, is really significant.

What next?

We are currently in a reflationary period. It is hard to determine its strength or longevity. Consquently, we have pared back duration to around four years, awaiting developments. We may well extend duration again in the spring or summer.

Glossary

Duration: how far a fixed income security or portfolio is sensitive to a change in interest rates, expressed in years. The larger the figure, the more sensitivity to a movement in interest rates.

Economic cycle: the fluctuation of the economy between expansion (growth) and contraction (recession). It is influenced by many factors including household, government and business spending, trade, technology and central bank policy.

(Economic) soft/hard landing: soft landing refers to a cyclical downturn in an economy that avoids recession; a hard landing by contrast is a marked economic slowdown, which could slip the economy into a recession.

Japanification: a term describing Japan’s battle over three decades with low growth and low/negative inflation, characterised by extraordinary monetary stimulus propelling bond yields lower.

Reflation: in simple terms, this refers to a return of inflation.

Yield curve: a graph that plots the yields of similar quality bonds against their maturities. A yield curve can signal market expectations about a country’s economic direction.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- CoCos can fall sharply in value if the financial strength of an issuer weakens and a predetermined trigger event causes the bonds to be converted into shares/units of the issuer or to be partly or wholly written off.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- CoCos can fall sharply in value if the financial strength of an issuer weakens and a predetermined trigger event causes the bonds to be converted into shares/units of the issuer or to be partly or wholly written off.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.