On the journey to decarbonize

The European Union (EU) is on a journey to achieve net zero by 2050. Decarbonising the economy is a truly massive job that will take many years. It is most certainly a process rather than an event and the green transition is going to provide a framework through which we need to interpret capital markets for many decades to come. Fortunately for the planet, the European smaller companies market is awash with companies that will help bring about a carbon neutral world. At the European Smaller Companies Trust, we do not invest thematically. Our mantra has always been to invest in undervalued companies that can create value. However, the green transition will drive growth for many of the companies that are facilitating it. Amazingly you do not need to pay high prices for these companies either.

Net zero is a continent-wide commitment driven by the growing demands of citizens, consumers, and investors to preserve our environment. There is a lot that can be done with existing technologies and resources, and we are confident new technological development will further improve things. Our job as managers of the European Smaller Companies Trust is to sieve out the winners among the companies involved and buy the undervalued ones.

Push towards electrification

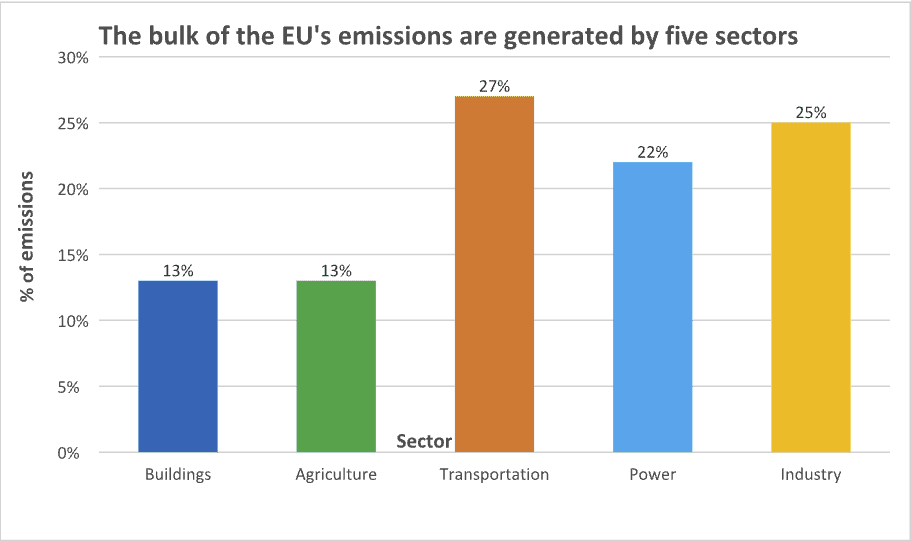

The political agenda in the EU is focused around five sectors that produce the most emissions: transportation; industry; power; buildings; and agriculture – see chart below. Within these sectors, 80% of the emissions come from fossil fuel combustion with passenger cars being the main culprit, along with heavy-duty trucks and busses.i In order to hit its net-zero targets, the EU needs to cut these emissions by 90% by 2050. ii One way of achieving this is by incentivizing the shift to Electric Vehicles (EVs). Good progress has already been achieved, with EV sales in Europe rising by 65% in 2021.iii

Source: IEA; UNFCCC; McKinsey Analysis as at 20 December 2022

The portfolio has a range of exposures to the EV supply chain. For instance, French company Merson makes the silicon carbide that allows for faster charging, range extension and lowers the total-cost-of-ownership of an EV. They do this using the furnaces made by German company, PVA-Tepla which is also one of our portfolio holdings. We also hold Italian scooter manufacturer Piaggio, who are now producing an electric version of their iconic Vespa moped. Meanwhile, Dutch listed TKH makes the machinery for making the tyres for EVs as well as the cables that help connect offshore wind energy to the grid to charge the cars.

Building the infrastructure

The infrastructure for charging all these EVs is clearly not in place. While the EU has over 330k charging points, 69% of them are located in Germany, France, and the Netherlands. 10 European countries do not have a single charger per 100km of road. iv Therefore, it is no surprise that range, the scarcity of charging stations and snail-paced charging are top concerns for EV drivers. The provision of this infrastructure is an exciting area, and we own French listed company, NHOA that is developing the largest and fastest ultra-charging network in Southern Europe, powered by renewables and grid-integrated technology. It has over 50k e-mobility charging stations and offers a range of charging devices for homes, businesses, industries, and public use.

Upgrading the power grid

The power grid will also need to be invested in to cope with the increased demand for electricity, as well as to manage the higher variability in supply that comes from wind energy and solar. One solution for variability of supply is to store energy as green hydrogen, which can be done by Elogen – an electrolyser business owned by our portfolio holding GTT. The power itself will need to come from renewable source – Swiss listed Meyer Burger makes the photovoltaic panels that capture the suns energy and convert it into usable electricity. We also hold Swiss company Klingelnberg, which makes the machinery for making the gear boxes of wind turbines. Meanwhile, French listed Nexans makes the high voltage cables that are used to connect the grid and help move power from where it is generated to where it is needed all across Europe.

The European Smaller Company arena is laden with companies that are doing the real work to deliver the energy transition. However, despite the advent of ESG (Environment, Social and Governance) as a market theme, so many of them are not making a lot of noise about their green credentials and weconsider many of these players to be “hidden ESG” stocks that can rerate from the low valuation multiples that they currently trade on.

To find out more about The European Smaller Companies Trust and how other companies within our portfolio are helping to transform the global energy picture, please click here.

Footnotes

iii Source: https://www.iea.org/reports/global-ev-outlook-2022/trends-in-electric-light-duty-vehicles

Important information

Please read the following important information regarding funds related to this article.

- If a Company's portfolio is concentrated towards a particular country or geographical region, the investment carries greater risk than a portfolio that is diversified across more countries.

- Where the Company invests in assets that are denominated in currencies other than the base currency, the currency exchange rate movements may cause the value of investments to fall as well as rise.

- Most of the investments in this portfolio are in smaller companies shares. They may be more difficult to buy and sell, and their share prices may fluctuate more than those of larger companies.

- This Company is suitable to be used as one component of several within a diversified investment portfolio. Investors should consider carefully the proportion of their portfolio invested in this Company.

- Active management techniques that have worked well in normal market conditions could prove ineffective or negative for performance at other times.

- The Company could lose money if a counterparty with which it trades becomes unwilling or unable to meet its obligations to the Company.

- Shares can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- The return on your investment is directly related to the prevailing market price of the Company's shares, which will trade at a varying discount (or premium) relative to the value of the underlying assets of the Company. As a result, losses (or gains) may be higher or lower than those of the Company's assets.

- The Company may use gearing (borrowing to invest) as part of its investment strategy. If the Company utilises its ability to gear, the profits and losses incurred by the Company can be greater than those of a Company that does not use gearing.

- Using derivatives exposes the Company to risks different from - and potentially greater than - the risks associated with investing directly in securities. It may therefore result in additional loss, which could be significantly greater than the cost of the derivative.

- If the Company seeks to minimise risks (such as exchange rate movements), the measures designed to do so may be ineffective, unavailable or negative for performance.