Using the 1890s as a guide to bond investing (not the 1980s)

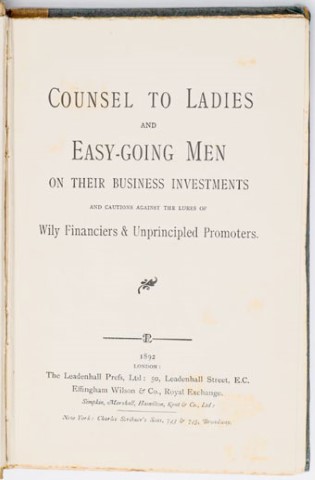

Last month, I received a birthday present of a singular little book dating from 1892, which was found by chance in a second-hand book dealer. Counsel to Ladies and Easy-Going Men on their Business Investments and Cautions Against the Lures of Wily Financiers & Unprincipled Promoters’ turned out to be a personal guide to bond investing written by an anonymous woman based on her own investment experience in the late 1800s. Understandably, this might not appeal to everyone, but from my perspective it turned out to be a rare birthday present gem.

Its contents are not only instructive but bring illumination to the predicament facing bond investors more than a century later. It is worth noting that the book was written in the UK in 1892 in the midst of what was known as ‘The Long Depression’. This period has many parallels to our own but hit the UK particularly hard as it became a pursued economy with its industrial hegemony eroded by the emergence of the US as a competitor. Globally, the 1870s, 1880s, and 1890s were a period of falling price levels and rates of economic growth significantly below the periods preceding and following. Triggered by financial crises (railroad bonds in the US, a silver crisis in Europe) and stagnant real wages there are many parallels to the current global malaise.

The book contains timeless investment precepts that have a healthy overlap with our own style of bond management, which we have termed “Sensible Income”. This style reflects the needs of our clients, with the average investor in one income fund we run being named Margaret, who is 78 years old and lives in Bournemouth on the south coast of England. We imagine Margaret when selecting bonds for all of the funds we manage and understand that she wants solid, dependable income prospects, not equity-type risk from her bond fund. We are bond managers and clients, in our view, do not want to be unsettled or stressed by the bond allocation in their portfolios. We leave that to other asset classes with the prospect of greater return in exchange for greater risk. Ideally, the bond allocation should provide diversification against risk assets and hence a focus on more reliable income generation can be very useful in turbulent times. This approach is neatly summarised in the book:

In what follows I’ve chosen a few choice quotes from the book to reflect on:

“France, Austria, Hungary and Italy, are honest, but they add to their debts year by year.”

The relevance of these statements is obvious given the experience of Europe in recent years but it continues to amaze us that some investors exhibit little long-term stewardship of their clients’ money or perspective during ‘hot’ markets, where demand heavily outstrips supply and can lead to investors overpaying. A classic case in point was the almost farcical Argentinian 100-year bond issued in 2018, which saw ludicrously strong demand at the time of its issue but then the reality of Argentina’s troubled economy and politics set in and the bond is currently trading at 67 cents on the dollar1.

This point is not lost on anyone who might have invested in bonds from Metro Bank, a UK challenger bank that was launched a few years ago – the bond highlighted below is trading well below its 100 issue price.

“Loans of small states and the securities of companies with small capital…are difficult of sale and the quoted margin…is usually considerable. Moderate stakes in large companies are the best.”

We have also found the bonds of smaller companies to have higher default rates on average and lower recovery rates. Lending to a company with <US$100m in EBITDA (eanings before interest, tax, depreciation and amortisation) is, in our view, best avoided.

The issue of reinvestment rates is particularly pertinent today if, as we believe, the Federal Reserve has signalled that rates in the US have peaked at around a 2.4% effective Fed Funds rate. Rates in much of the developed world will likely not rise by much, if at all, this cycle. Thinking through where rates may go in the next recession is sobering and makes longer dated investment grade bonds attractive. This is something which the industry, with its short duration bias and constant misforecasting that government bond yields are set to move substantially higher, does not seem to agree with.

“Avoid bonds or shares to concerns which hold out a promise of an unusually high rate of interest, or an excessive profit.”

In conclusion, this little book is a useful reminder of the importance of style and discipline in bond investment. It also emphasises that anchoring to the high interest rate and inflation regime of the 1980s when many started their career is neither useful nor rewarding as a mental starting point. Periods of low inflation, low interest rates and speculative manias are many and varied through history. Sensible bond investing can help investors navigate through these environments with capital intact.

NotesThe book mentioned in this article is: Anon (1892) ‘Counsel to Ladies and Easy-Going Men on their Business Investments and Cautions Against the Lures of Wily Financiers & Unprincipled Promoters’, London, The Leadenhall Press, Ltd: 50 Leadenhall Street, E.C. Effingham Wilson & Co., Royal Exchange. Simpkin, Marshall, Hamilton, Kent & Co., Ltd.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- CoCos can fall sharply in value if the financial strength of an issuer weakens and a predetermined trigger event causes the bonds to be converted into shares/units of the issuer or to be partly or wholly written off.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- CoCos can fall sharply in value if the financial strength of an issuer weakens and a predetermined trigger event causes the bonds to be converted into shares/units of the issuer or to be partly or wholly written off.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.