Aptiv: driving sustainability

While new technology developed by the automotive industry has made modern vehicles safer, more efficient and more environmentally sustainable than ever before, efforts to improve road safety and to reduce the number of road traffic deaths and injuries are still needed.

3 minute read

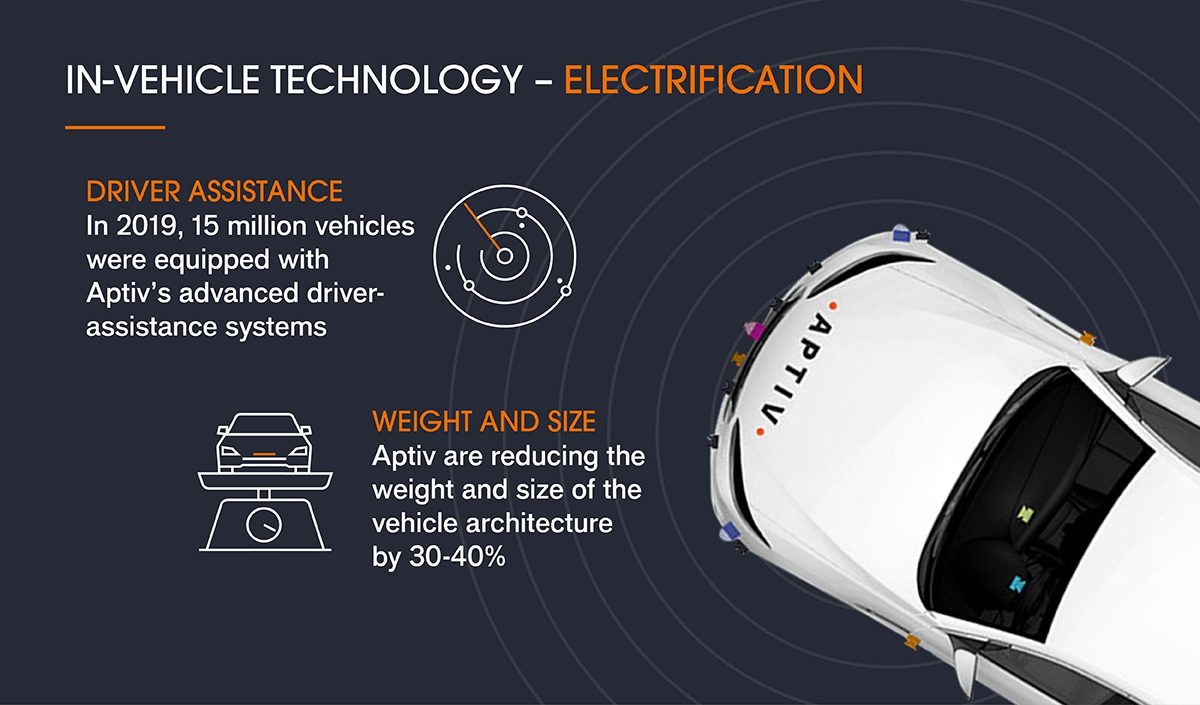

Aptiv is a global leader in the automotive technology industry, and believes that ‘active safety’ plays a crucial role in preventing road traffic accidents. From its headquarters in North America, Aptiv is delivering mobility technologies, such as radar sensors, driver assistance and automated driving options, that are designed to better connect drivers with their vehicles and surroundings, and to make roads safer for all users.

Cleaner transport

The European Environment Agency (EEA) has shown air pollution is a major cause of premature death and disease, and is now the single largest environmental health risk in Europe. In 2018, an estimated 379,000 premature deaths resulted from exposure to air pollution.2 Chronic exposure can affect every organ in the body, complicating and exacerbating existing health conditions, ranging from irritation of the eyes and nose to cardiovascular disease.

As a global technology leader working in close partnership with some of the world’s largest automobile manufacturers, Aptiv is responding to regulatory change by helping to make vehicles greener, as well as reducing their total lifecycle impact on the environment.

Reducing vehicle weight

The packaging of Aptiv’s high voltage electrification solutions (wiring harnesses, connectors, electrical centres and cable management) can help to reduce the weight and size of the vehicle architecture by 30-40%. This can save its original equipment manufacturer (OEM) customers to reduce the weight of their vehicles, make considerable savings on investment, while also boosting the environmental performance (and reducing the emissions) of their vehicles.

Recycling

Some of Aptiv’s manufacturing processes generate scrap plastic, so it is now reusing up to 20% of re-grinded material. Aptiv is also having discussions with some of its customers to increase its 20% recycled material threshold, but without compromising the integrity or safety of its products. Therefore, this improvement is likely to take time.

Electrification

Sustainability article

Aptiv’s strategy involves the design of products that enable the electrification of transport. By 2040, more than half of all passenger vehicles sold will be electric.5 With more than 20 years of expertise in automotive-grade high-voltage electric solutions, Aptiv is well positioned to serve the automobile industry with both vehicle architecture systems and electrical distribution systems for future generations of electrified vehicles.

Source: Aptiv 2020 Sustainability Report, published in November 2020

Source: Aptiv 2020 Sustainability Report, published in November 2020

1 World Health Organization, “Health topics – Air pollution”, [Accessed 19 July 2021].

2 European Environment Agency, “Air pollution: how it affects our health”, 14 December 2020 [Accessed 19 July 2021].

3 BBC News, “Air pollution: Coroner calls for law change after Ella Adoo-Kissi-Debrah’s death”, 21 April 2020 [Accessed 19 July 2021].

4 European Federation for Transport and Environment, “Weight-based standards make CO2 targets harder to reach,” European Federation for Transport and Environment, 2008.

5 CNN, “By 2040, more than half of new cars will be electric”, 6 September, 2019 [Accessed 19 July 2021].

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund follows a sustainable investment approach, which may cause it to be overweight and/or underweight in certain sectors and thus perform differently than funds that have a similar objective but which do not integrate sustainable investment criteria when selecting securities.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund follows a sustainable investment approach, which may cause it to be overweight and/or underweight in certain sectors and thus perform differently than funds that have a similar objective but which do not integrate sustainable investment criteria when selecting securities.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In respect of the equities portfolio within the Fund, this follows a value investment style that creates a bias towards certain types of companies. This may result in the Fund significantly underperforming or outperforming the wider market.