Will China spoil the global reflation party?

Chinese money trends have been signalling an economic slowdown in H1 2020. This appears to be playing out but the PBoC has kept policy tight and narrow money growth has fallen further in early 2020. A Chinese slowdown could derail current global reflation optimism.

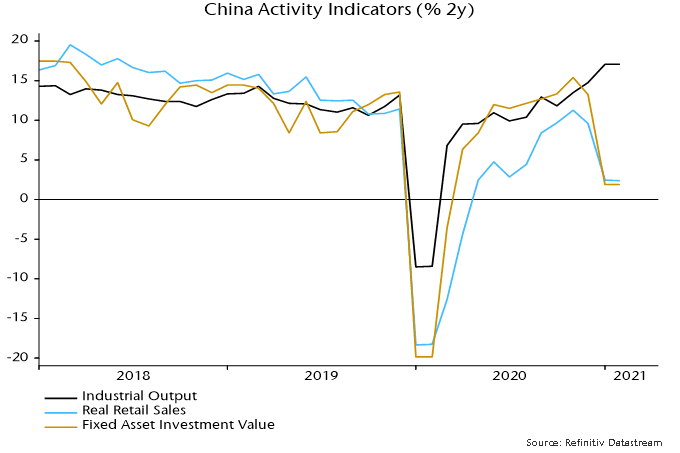

Covid base effects are distorting year-on-year growth rates of coincident economic indicators so a two-year comparison is more informative. Retail sales and fixed asset investment slowed sharply in January / February but industrial output gained further momentum – see chart 1.

Chart 1

Output strength is probably explained by additional working days due to covid travel restrictions that shortened workers’ holidays and reduced factory idling – this suggests payback in March / April. The NBS PMI manufacturing new orders index peaked in November and fell to its lowest since June last month.

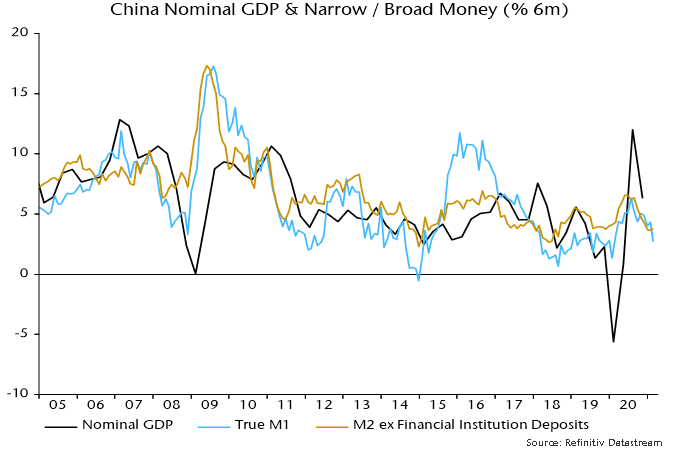

An economic slowdown had been signalled by money trends: six-month growth rates of narrow and broad money peaked over May-July 2020 at modest historical levels, moving lower during H2 – chart 2.

Chart 2

Six-month broad money growth stabilised in early 2021 but is below the post-GFC average, while narrow money growth has fallen further. Sectoral detail shows weaker expansion of both household and enterprise narrow money holdings, consistent with the joint slowdown in retail sales and private investment.

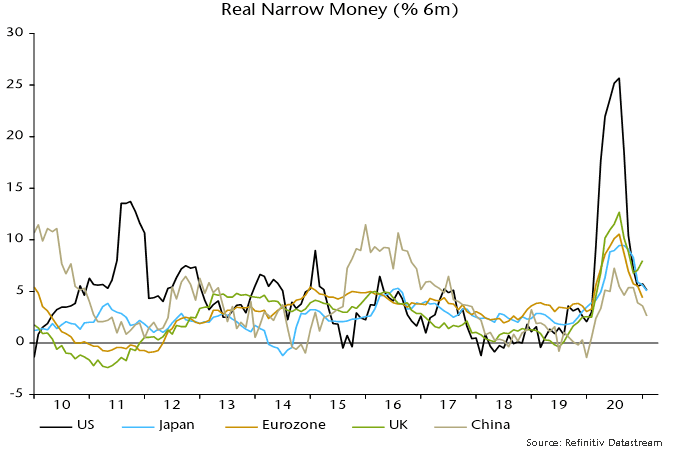

China has retained its bottom place in a ranking of six-month real narrow money growth across major economies despite falls elsewhere – chart 3.

Chart 3

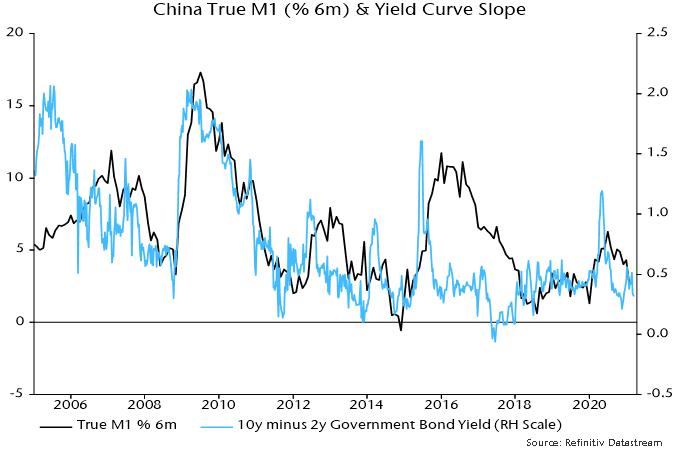

The expectation here had been that the PBoC would respond to early economic slowdown signs by partially reversing its H2 2020 policy tightening. Instead, it withdrew liquidity before the holiday to protest an easing of money market rates in December / January. Three-month SHIBOR has backed up to 2.7%, almost double its low in April / May 2020.

The suggestion that monetary policy is restrictive is supported by a flat yield curve – chart 4 – and weak core inflation: consumer prices ex. food and energy were unchanged in February from a year before.

Chart 4

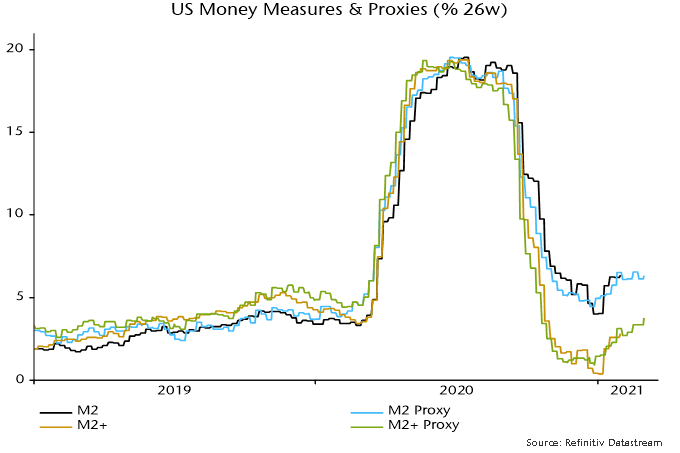

China led last year’s economic recovery and the expectation here has been that a Chinese slowdown would presage a loss of global industrial momentum into Q3 2020. Assuming that this scenario plays out, a key question is whether new US fiscal stimulus will drive a growth rebound during H2. This will hinge on the extent to which another deficit blowout in Q2 / Q3 is reflected in US money trends. Growth of the weekly broad money series calculated here has firmed slightly – chart 5 – and a significant pick-up is likely in late March / April as households receive stimulus payments.

Chart 5

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.