Deconstructing sustainable design

In the first of a series on sustainable design, Ama Seery, Sustainability Analyst on the Global Sustainable Equity Team, breaks down sustainable design and explains how the team incorporate it into their investment approach.

4 minute read

Key takeaways:

- Design is a multi-faceted term that shapes the world we live in. Sustainable design addresses environmental and social issues and contributes to sustainable development.

- The Global Sustainable Equity Strategy is founded on the belief that continuous design and development is key to the evolution of a sustainable economy.

- Companies will have to adapt and transform their business models to address the rising demand in sustainable products.

What is design? This is a hard question to answer because it is so complex. The term encompasses more than just aesthetics. It is applied when describing objects, systems and processes. It is used to shape the way we communicate and how we live. It is linked to the identities of individuals, organisations and nations. This topic is too big to address in one article. This is the first in a series we will be writing, addressing the topic in all of its different faculties.

He was right. The clothes you wear, the chair you sit in, the dwelling you live in and the manmade items that you can see were all designed. Even the font you are reading right now was designed! As humans we use design to serve our needs, and we believe that should also extend to sustainability.

The Janus Henderson Global Sustainable Equity Strategy

The Janus Henderson Global Sustainable Equity Strategy was created in 1991, informed by the Brundtland Commissions’ definition for sustainable development.

Sustainable development is development that meets the needs of the present without compromising the ability of future generations to meet their own needs”2

The strategy places great importance on the triple bottom line3, that is, to invest for profit, people and the planet in equal measure – see exhibit one.

Exhibit one: the triple bottom line

When talking about sustainable design in the context of the strategy, we are referring to design that addresses today’s problems and contributes to sustainable development. This is different from environmentally sustainable design or eco-design, which have a strong focus on environmental considerations. Importantly, sustainable design is not constrained by certification schemes, such as BREEAM4, LEED5 or the Life-cycle Assessment (LCA), that are often required in the built environment, as these tools can inform sustainable design.

Sustainable design in our investment process

The Global Sustainable Equity Strategy’s investment process, in itself, is an example of sustainable design. It is designed to take into account environmental and social considerations while at the same time aiming to provide clients with a persistent alpha source, compound growth and capital preservation.

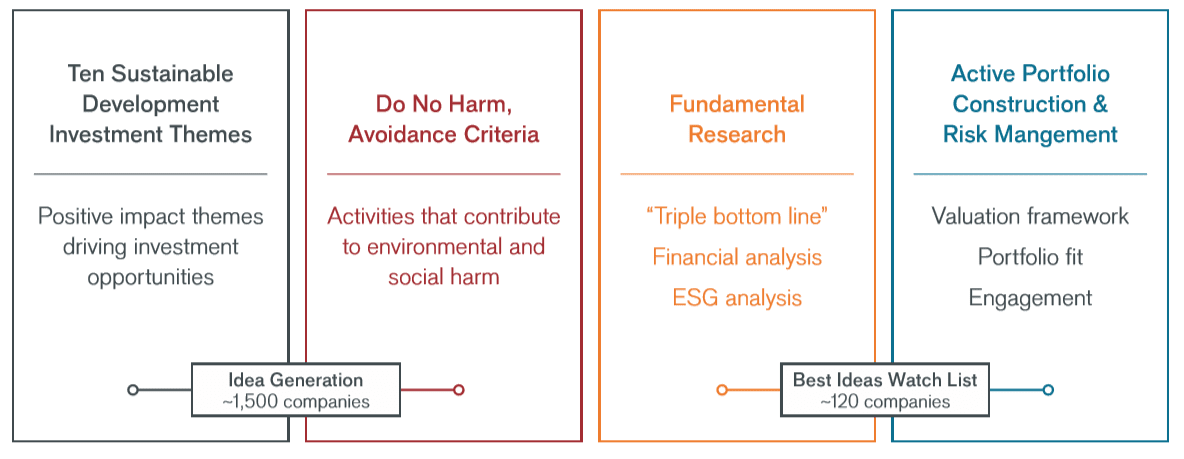

We consider four key elements to an investment approach (exhibit two) based on sustainability.

Exhibit two: the four pillars of sustainable investing

A positive and negative (avoidance) investment criteria is built into our investment process; we consider both the products and operations of a business, to invest in the companies that have a positive impact on the environment and society, which helps us to stay on the right side of disruption.

Company engagement and active portfolio management are also critical to our sustainable investment strategy as it allows us to partner with the companies we invest in. We discuss a wide range of environmental and social topics, including transitioning to a low-carbon model and supply chain management. We take an active approach to communicating our views to companies and seeking improvements, including appropriate standards of corporate responsibility.

When analysing a company, we look for evidence of sustainable design in its products/services and in its operations to give us an indication that the company is intentionally addressing environmental and social issues. It is this intentionality that is used as part of the evidence of positive impact. We continue to monitor this intentionality as part of our ongoing analysis of a business, even after it has become part of our portfolio. This falls under our Active Portfolio Construction and Risk Management pillar. We look to find evidence that environmental and social issues are a key factor in a company’s research and development process and believe that continuous improvement is an indicator for long-term, sustainable growth. This is embedded into our engagement with companies, where we discuss sustainable design with management.

We have noticed a distinct rise in demand for more sustainable products and transparency in the supply chain of these products from consumers. As individuals become more aware of the environmental and social impact of the services and products that they consume, companies in many different sectors have had to adapt and transform their business models to cater to this demand. We look to invest in companies that are acutely aware of the environmental and social impact of their products or services and actively work to design and develop positive impact products in a sustainable way.

Footnotes

1 Heskett, John. Design: A Very Short Introduction (Very Short Introductions) (p. 5). OUP Oxford.

2 Our Common Future: Report of the World Commission on Environment & Development

3 Coined by John Elkington, the triple bottom line refers to sustainable development having environmental, social and economic considerations.

4 BREEAM – Building Research Establishment’s Environmental Assessment Method

5 LEED – Leadership in energy and environmental design

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund follows a sustainable investment approach, which may cause it to be overweight and/or underweight in certain sectors and thus perform differently than funds that have a similar objective but which do not integrate sustainable investment criteria when selecting securities.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In respect of the equities portfolio within the Fund, this follows a value investment style that creates a bias towards certain types of companies. This may result in the Fund significantly underperforming or outperforming the wider market.