Alternatives: Are convertible bonds back on the menu?

Alternatives Portfolio Manager Natasha Sibley considers the impact of renewed activity in the primary market for convertible bonds, looking at how investors can put this to their advantage.

7 minute read

Key takeaways:

- After a lacklustre year for convertible bonds in 2022, global market stabilisation in 2023 has led to a pick-up in interest from both companies and investors, with issuance passing US$19bn for the first quarter.

- This recovery has helped to boost the delta profile of the convertible bond universe. The market now offers more of the desired convexity, a far cry from the lows of 2022, when many convertible bonds were trading close to their bond floors.

- Convertibles now look much better placed to play a diversifying role for investors’ portfolios, offering some potential downside support, with potential returns from equity options, and more attractive coupons – while still offering a source of reasonably priced funding for companies affected by rising costs.

Back in September 2022, we gave our thoughts on the market for convertibles in Opportunities in the aftermath. The primary market for convertible bonds dried up in the first half of 2022, a consequence of falling equity prices, rising rates, and widening credit spreads. It was one of the worst starts to a calendar year on record, with only US$11bn in convertibles issued globally in the first half of the year. The existing universe of convertibles also performed poorly, with smaller coupons relative to the rising rate environment and the embedded call options moving further out of the money (OTM). With equity markets selling off, these bonds offered little appeal for investors seeking to offset inflation.

At that point, we saw two potential directions for the market, both of which we thought were directionally positive. The first – a rise in new issuance – saw the prospect of companies returning to the market to refinance, as existing convertibles reached maturity, meeting demand for new paper from convertible investors.

The second was the risk of significant outflows from funds in this space, leading to a period similar to that which followed the 2008 global financial crisis, where we saw some convertible bonds trading at yields close to or just below their straight peers. That would have been a huge opportunity for investors with sufficient cash to purchase options for pennies (potentially even for free).

Are good times back for convertible bonds?

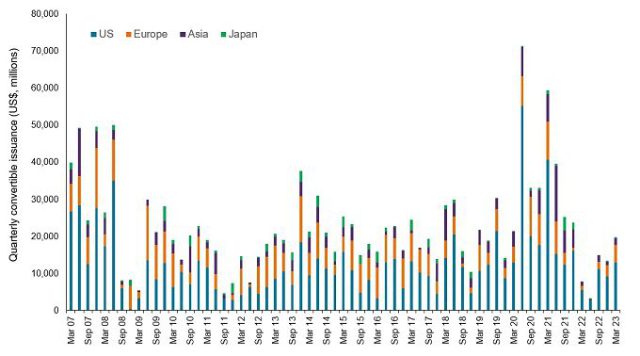

With 2022 marked by such low levels of activity, it has been encouraging to see global market stabilisation feed through to a pick-up in convertible bond issuance, which reached over US$19bn in notes for the first quarter of 2023 (Exhibit 1). This was almost half the total issuance seen across the whole of 2022 (US$39.5bn), with some interesting names taking advantage of the convertible market’s thirst for new paper.

Exhibit 1: Primary markets are once again open for business

Source: Bank of America, 31 March 2007 to 30 April 2023.

We saw cruise operator Carnival[i] bringing another US$1bn deal to the market in November, to cover principal payments on debt due to mature in 2024. Korean semiconductor manufacturer SK hynix[ii], a leading supplier of memory chips, raised a massive US$1.7bn in April 2023, securing cash for operations in response to sluggish chip demand.

Elsewhere, German food delivery service Delivery Hero[iii], no stranger to the convertibles market, launched a €1bn issue of senior, unsecured debt in February 2023 (maturing in 2030), alongside a buy-back of some of its OTM, shorter-dated bonds, extending its maturity profile. The convertibles were issued with an annual interest rate north of 3.0%; that higher coupon (unsurprising, given the path of interest rates) and a reasonable conversion premium helped to fuel strong demand.

Higher issuance was also used to fund some merger and acquisition activity, with German defence industry supplier Rheinmetall[iv] raising €1bn via two convertible notes in January 2023, primarily to help fund the acquisition of Expal Systems.

Some markets have been slow to wake

While we have seen a rise in issuance in Europe, Japan has been notably absent from the party, with just US$0.3bn of new paper thus far in 2023. The region has yet to buck 2022’s trend of closed primary markets – a far cry from the huge convertible bond issuances we saw from Mitsubishi Chemical and Kyushu Electric Power back in 2017[v]. Given the low level of Japanese convertibles that have redeemed so far this year, there has been a lesser need for refinancing.

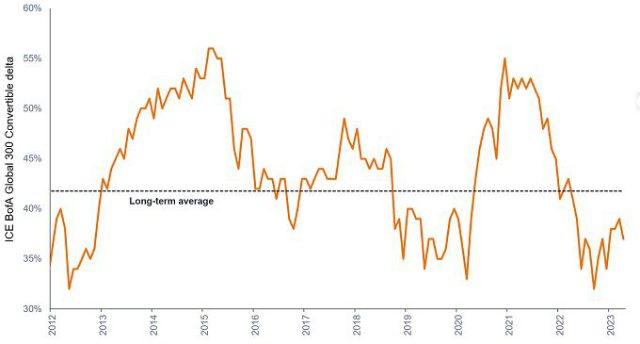

Outside Japan, the broader recovery in global convertible issuance and bounce back of equity markets has helped the delta profile (which indicates how sensitive a convertible bond is to a price change in the underlying share) of the convertible bond universe. Average deltas have moved from recent lows slightly above 30% – the level where convertibles become ‘busted’ and start to behave more like straight bonds. We are now closer to 40%, where we would expect to see a more balanced profile, and where the market has at least a little bit more of the desired convexity (Exhibit 2).

Exhibit 2: Convertibles no longer look ‘busted’

Source: Bank of America, 31 March 2012 to 30 April 2023. Shows the average delta for convertible bonds in the ICE BofA 300 Convertible Index. The long-term average here covers the period between 31 January 2000 and 30 April 2023. Past performance does not predict future returns.

Renewed demand for assets that combine equity and debt

Looking ahead, one potential boost to convertible issuance could stem from the current environment of higher interest rates. While higher coupons are undeniably attractive to investors, companies worried about the cost of debt can find convertibles and their comparatively lower coupons a more appealing alternative when considering financing options. This has not been particularly relevant for much of the post-financial crisis era, given the persistency of ‘ultra-low’ interest rates.

The value of a convertible bond comes partly from the cash flows and partly from the optionality of the bond to convert to common stock. The appeal of the embedded call option means that issuers can offer lower coupons than they would need to if issuing straight debt. In the case of South African energy company Sasol[vi], for example, which launched an offering of US$750 million in November 2022, the convertible bond offered an attractive coupon of 4.0%–4.5% per annum (paid semi-annually), with an initial conversion price offering a premium of 30%-35%.

On these terms, given where interest rates now stand, convertible bonds currently seem to offer a source of reasonably priced funding for companies affected by rising costs, as well as those looking for cash to fuel growth. For investors, adding an allocation to these hybrid securities can provide some downside support should market volatility pick up, with potential return coming through the convertible’s equity option. And given the higher yields on offer, investors are getting well rewarded to wait.

Delta – A measure of how sensitive a financial instrument is to a price change in the underlying share.

Convexity – This is a measure of the curvature in the relationship between convertible bond prices and interest rates, reflecting the rate at which the duration of a bond changes in response to interest rate movements. The right level of convexity gives convertible bonds an asymmetrical risk-reward profile, meaning they should share a portion of any increase in the underlying share price and provide a degree of downside support if the underlying equity falls in value.

—–

Important information:

Past performance does not predict future performance. The value of your investment may go down as well as up and you may not get back the amount originally invested. Examples used here are purely for illustrative purposes and should not be considered as a recommendation to buy or sell any security.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments, or its credit strength weakens.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers and narrowing indicate improving.

[v] Mitsubishi Chemical and Kyushu Electric Power issuance.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall. High yielding (non-investment grade) bonds are more speculative and more sensitive to adverse changes in market conditions.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund involves a high level of buying and selling activity and as such will incur a higher level of transaction costs than a fund that trades less frequently. These transaction costs are in addition to the Fund's ongoing charges.

- CoCos can fall sharply in value if the financial strength of an issuer weakens and a predetermined trigger event causes the bonds to be converted into shares/units of the issuer or to be partly or wholly written off.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- SPACs are shell companies set up to acquire businesses. They are complex and often lack the transparency of established companies, and therefore present greater risks to investors.