Nintendo: gaming for social impact

Hamish Chamberlayne and Amarachi Seery, members of the Global Sustainable Equity Team, discuss how Nintendo is putting its stamp on the video gaming industry.

4 minute read

We explore two areas where Nintendo is demonstrating a focus on sustainability – doing it right in wellbeing and driving technological change for good – areas that contribute positively to society.

Doing right in wellbeing

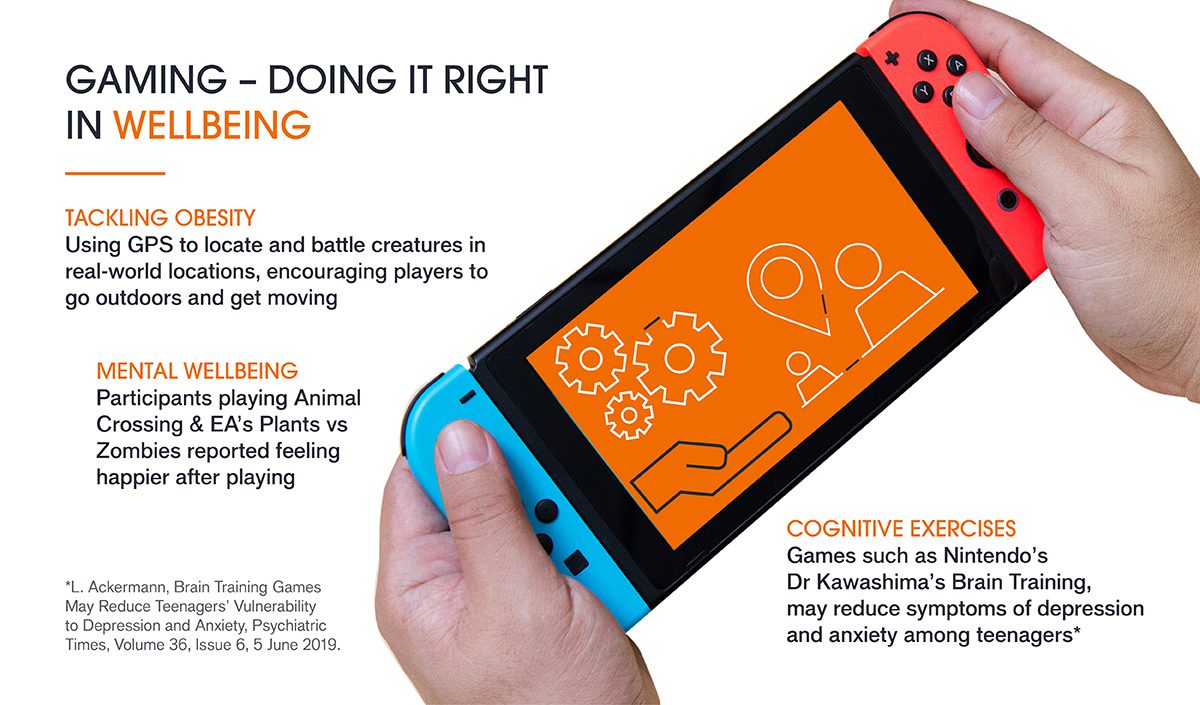

In recent years wellbeing and mental health awareness has increased dramatically. We consider it to be an integral part of overall health and wellbeing and were pleased to find that Nintendo’s games can contribute positively to overall wellbeing, which includes sub-themes such as mental health and managing obesity.

While video games can be a source of entertainment, they have often been met with contention. Numerous studies have been undertaken to assess the negative social implications associated with gaming. The impact of violence and depictions of gender and race stereotypes that appear in some video games are top of the list. Additionally, concerns have been raised about the amount of time spent playing video games, especially in children and young adults.

Next mission: mental health

Transparency is a core attribute of sustainable investing, both in terms of how sustainable development is incorporated and in the subsequent reporting of the results. In a breakthrough study with Oxford University, gaming firms Nintendo and EA allowed researchers to use real anonymised play-time data, rather than self-reported and estimated figures, to analyse the impact on participants mental health. The study found that participants playing Nintendo’s Animal Crossing: New Horizons and EA’s Plants vs Zombies: Battle for Neighborville reported feeling happier than those who had not played.3 This is contrary to other reports on gaming which have suggested that the more people play video games, the unhappier they feel. One possible reason for this discrepancy could be the social nature of the games in the study whereby players could interact with other users in order to build a positive environment around them. This is especially important in recent times where COVID-19 induced lockdown measures have led to reduced social interaction and loneliness.

Getting 1UP on obesity

The sedentary lifestyle associated with video games can be a health concern for children, who often opt for gaming and watching television instead of spending time outdoors and keeping active. With over 340 million children and teens classed as obese5, encouraging an active lifestyle from a young age is imperative. Nintendo was an early adopter of parental controls on its systems, allowing parents to set maximum playing times and enforcing breaks to prevent prolonged activity.

The company’s games are unique in design, focusing on movement and action as a core element of play. The Wii Fit uses motion sensing capabilities via the Wii remote to enable players to participate in virtual games of tennis, boxing, baseball, and more. The continued development and promotion of Nintendo’s active games such as Ring Fit Adventure and Pokémon GO also encourages users to get off the sofa and engage in new ways. Ring Fit is an exercising action role-playing game utilising a Pilates ring and leg strap. Pokémon GO is now one of the most successful mobile games of all times, becoming the most downloaded mobile game ever in its first month of release.6 The augmented reality game uses GPS to locate and battle virtual Pokémon creatures in real-world locations, encouraging players to go outdoors. As well as being loved by children, these games are enjoyed by adults too, meaning that all ages can reap the benefit of exercise.

Footnotes

1Statista, Video game market value worldwide from 2012 to 2020, 2021.

2Marketwatch.com, Videogames are a bigger industry than movies and North American sports combined, thanks to the pandemic, 2 January 2021.

3N. Johannes, M. Vuorre, A. Przybylski, Video game play is positively correlated with well-being, November 2020

4 L. Ackermann, Brain Training Games May Reduce Teenagers’ Vulnerability to Depression and Anxiety, Psychiatric Times, Volume 36, Issue 6, 5 June 2019.

5World Health Organisation, April 2020.

6Guiness World Records, News, August 2016.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund follows a sustainable investment approach, which may cause it to be overweight and/or underweight in certain sectors and thus perform differently than funds that have a similar objective but which do not integrate sustainable investment criteria when selecting securities.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund follows a sustainable investment approach, which may cause it to be overweight and/or underweight in certain sectors and thus perform differently than funds that have a similar objective but which do not integrate sustainable investment criteria when selecting securities.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In respect of the equities portfolio within the Fund, this follows a value investment style that creates a bias towards certain types of companies. This may result in the Fund significantly underperforming or outperforming the wider market.