A study by the Global Technology Leaders Team explores the relationship between environmental, social and governance (ESG) factors and the valuations of technology companies. Portfolio Manager Alison Porter shares the key findings.

A multitude of studies have sought to prove that environmental, social and governance (ESG) factors have a significant impact upon stock price returns, but few have focused on valuation. Results have been particularly mixed for some of the strongest-performing regions, notably the US. Previous studies have shown less convincing correlations of stock returns with ESG considerations because of the lack of granularity in comparing similar companies. Given the strong outperformance of the technology (tech) sector versus the broader equity market in the last two decades1, the US market, which is more heavily weighted to tech, has often exhibited a weaker relationship between ESG factors and stock valuation.

The technology sector has been the largest source of economic value creation and disruption in stock markets over the last decade. An important question for us as technology investors, and for many of the clients we speak to, is ‘what is the relationship between ESG factors and valuation within the sector’? We therefore undertook a study to explore the extent to which technology companies with robust ESG ratings receive a valuation premium. It was important to isolate factors that affect stock price performance and valuation in order to remove the impact of technology disruption itself to examine the influence of ESG factors at a more granular level.

The technology sector has been the largest source of economic value creation and disruption in stock markets over the last decade. An important question for us as technology investors, and for many of the clients we speak to, is ‘what is the relationship between ESG factors and valuation within the sector’?”

Scope of the study

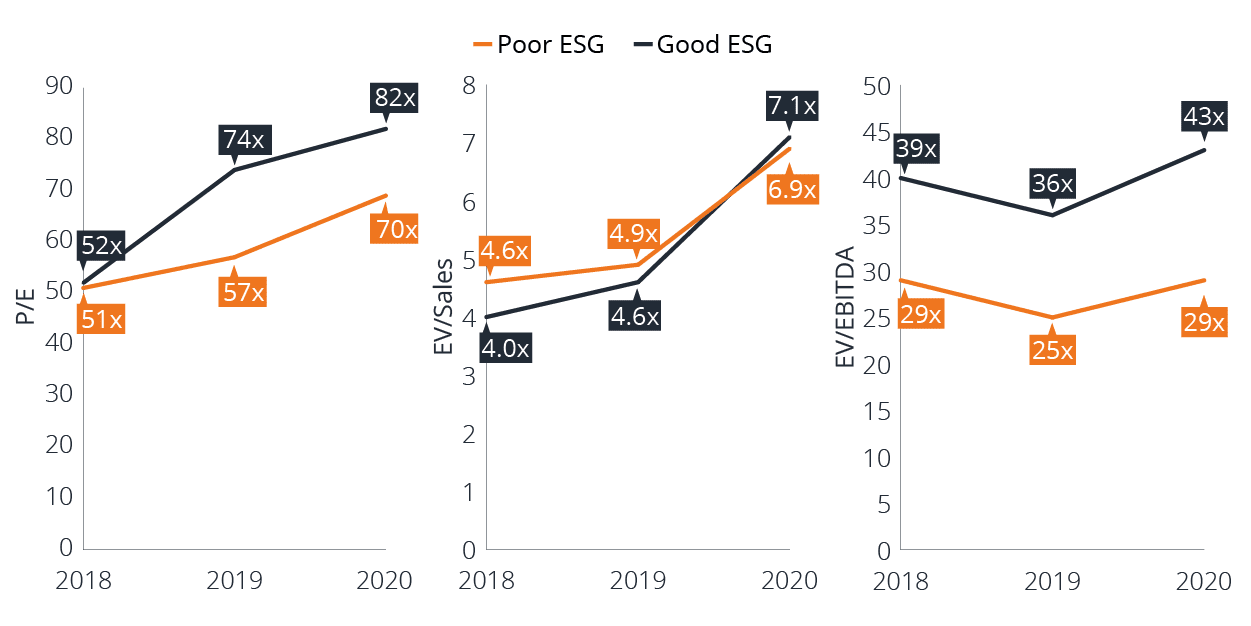

We used two approaches to answer the question, with data covering 2018 through 2020. The first approach was to rank the entire universe (MSCI ACWI Information Technology + Communication Services Index) of circa 700 tech stocks using our ESG scoring system2. We then divided the companies at the midpoint into “good” and “bad” ESG scorers and compared these against common valuation measures. Figure 1 shows the outcome with a clear relationship between good ESG scores and higher valuations.

Figure 1: Entire universe approach

Source: Bloomberg, Janus Henderson Investors, as at 31 December 2020. Entire/investable universe = MSCI ACWI Information Technology + Communication Services Index.

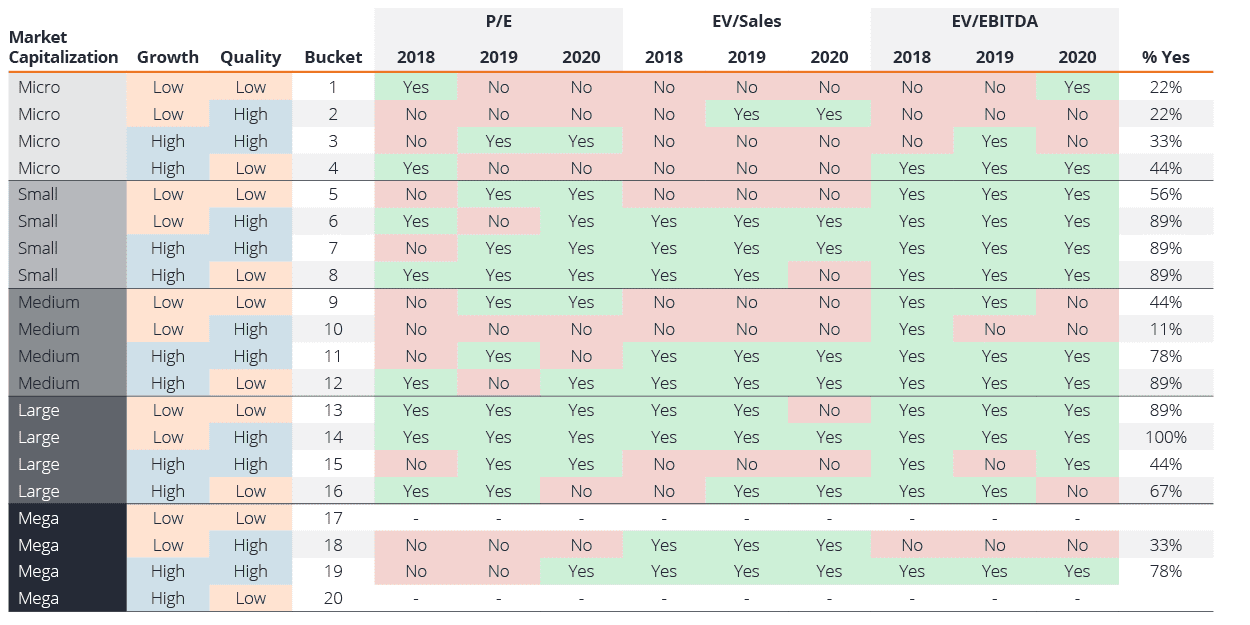

The second approach was designed to control for other valuation factors and to compare companies like-for-like. We therefore split the universe into 20 buckets based on company size, growth and quality. We then ranked each bucket using our proprietary ESG scoring system, and again the bucket was split in half and compared against valuations. This again showed a positive relationship in the majority of buckets (indicated in green in Figure 2) between ESG factors and valuation.

Figure 2: Bucketing approach

Source: Bloomberg, Janus Henderson Investors. Study period covers the years 2018-2020, data correct as at 31 December 2020. Market capitalisation classifications: Micro cap ($0-2.49bn); Small cap ($2.5-4.99bn); Medium cap ($5-24.9bn); Large cap ($25-249.9bn) and Mega cap ($250+bn). High/low growth and quality: each company was compared to the median value of the group. If this was higher than the median it was classified as ‘high’ and if not, it was classified as ‘low’. The same process was applied for growth and quality.

Key findings

There was of course significantly more detail behind the approach and findings, but to summarise the conclusions of the study, we found:

- Technology companies with strong ESG standards have their financial performance valued more highly by the market on average.

-

- 60% of multiples across companies with similar characteristics that were bucketed into showed a valuation premium given by the market for the higher-scoring ESG companies

- 54% of multiples showed a valuation premium when assessed against P/E ratios and enterprise value versus sales metrics

- 72% of multiples showed a valuation premium when assessed against enterprise value versus EBITDA

- ESG scores can be influenced by the level of corporate ESG data disclosure, which, in turn, can often be driven by companies’ market capitalisation.

- Technology companies with weak ESG standards can be value traps. Even companies with strong earnings growth are unlikely to receive full credit compared to peers who demonstrate positive regard to non-financial factors.

Regional perspective (and a surprise)

A clear trend is seen from 2018 to 2020 as premiums widened, and all continents saw a premium given in 2020. In Asia, in 2020 the higher-scoring ESG companies received on average a premium of +36% versus the lower-scoring companies.

Both Europe and North America, and indeed South America, saw sustained increases across the three years of data in the premiums given to higher-scoring ESG companies with respect to the P/E ratio.

The analysis also showed that the premium awarded for higher ESG ratings is not necessarily dependent on growth. A popular misconception is that for high-growth stocks on high multiples, ESG ratings would be less relevant. The study actually found that for high-growth companies, the relationship is even stronger.

A popular misconception is that for high growth stocks on high multiples, ESG ratings would be less relevant. The study actually found that for high growth companies, the relationship is even stronger."

Investment implications

The study shows empirically that companies that perform well on ESG metrics, and which can show significant improvement in these factors, have tended to be valued more highly by investors in the markets and, crucially, that ESG factors should be an integrated part of the investment process. In our view, effective active engagement to improve ESG aspects of performance can have a positive impact on capital returns. We believe that owning companies that are laggards on ESG metrics is appropriate only with a measured action plan for engagement.

It is of course important to remember that investors’ focus on ESG factors has only really intensified in the last ten years or so, and there should be an awareness of important nuances or gaps in the data. This is particularly the case when assessing the ESG credentials of smaller companies. But we believe the results of the study add to the body of literature supporting the integration of ESG considerations into investment thinking and could ensure capital is allocated more effectively for ESG-conscious investors.

Footnotes

1 Source: Refinitiv Datastream, MSCI AC World Information Technology Index vs MSCI World Index, 31 December 2001 to 31 December 2021. Past performance does not predict future returns.

2 The Global Technology Leaders Team’s proprietary ESG scoring system incorporates 25 raw data metrics considering E, S & G fairly and dynamically based on data quality and relevance. To avoid subjective interpretations, underlying raw data metrics were used where possible. A rating is applied and scaled based on data quality, data relevance to technology and finally ESG focus & relevance. Each company is thus assigned an individual ESG score.

For further information on this study please contact your local Janus Henderson representative.