High yield in a rising rate environment

Brent Olson and Tom Ross, corporate credit portfolio managers on our Global High Yield platform, explore how factors affecting credit risk in high yield bonds might help balance upward pressure on interest rate risk.

8 minute read

Key takeaways:

- Rises in interest rates denote not just inflation concerns but a recognition by central banks that the economy is healing.

- Credit fundamentals among high yield bonds have improved, offering the potential for credit spreads to tighten and absorb some of the upward pressure on yields.

- High yield typically has a low duration (sensitivity to interest rates) and while the past is not always a guide, it has typically outperformed other fixed income asset classes in inflationary and rising rate periods.

A popular image when conveying risk in bonds is the see-saw – the pivoting plank found in children’s playgrounds whereby as one side goes down, the other side goes up. A few decades ago, these were often situated above concrete – children were made of sterner stuff back then, although memories of bruised knees and elbows might attest otherwise. Today, civic planners are kinder and soft sand or rubber normally breaks any fall.

Absorbing the impact

Typically, the see-saw is framed in the discussion of bond prices – as bond yields rise, prices fall and vice versa. But for high yield corporate bonds it is also a useful image for two of the key risks that face bonds – interest rate risk and credit risk. At a time when central bankers are turning more hawkish and are raising, or considering raising, rates (rising interest rate risk), can improving corporate conditions (declining credit risk) cushion the impact of rising rates?

First, it is important to establish that high yield bonds are typically less sensitive to interest rate changes than investment grade corporate bond and sovereign bond markets. Partly, this is structural; investors have traditionally been less willing to lend to riskier borrowers for longer periods so high yield bonds typically have shorter maturities – after all, why invite additional maturity risk (the wait to be repaid par value at maturity) when an investor is already taking greater risk at the credit level? Partly, it reflects the higher yields on high yield bonds, which essentially quickens the pace at which an investor is repaid their investment, particularly as the real value of coupon payments will decline over time in an inflationary environment. Taken together, shorter maturities and higher yields leads to lower average duration (interest rate sensitivity) on high yield bonds (see Figure 1).

| Index | Effective Duration (years) |

|---|---|

| European high yield | 3.5 |

| US high yield | 4.2 |

| European investment grade | 5.2 |

| US government | 7.2 |

| US investment grade | 8.0 |

| European government | 8.5 |

Source: Bloomberg, at 27 January 2021, Indices used, in descending order: ICE BofA Euro High Yield, ICE BofA US High Yield, ICE BofA Euro Corporate, ICE BofA US Treasury, ICE BofA US Corporate, ICE BofA European Union Government.

As a refresher, an effective duration of 3.5 years means that if there were to be a change in yield of 100 basis points, or 1%, then the bond’s price would be expected to change by 3.5%. Remember, when bond yields rise, bond prices fall and vice versa, so in a rising rate environment, a lower duration can be advantageous.

High inflation is clearly a concern for central banks and is driving their decisions to raise interest rates but allied to this is evidence of recovering economies that no longer need emergency support. Labour markets are buoyant, earnings are growing, and supply chains are beginning to repair. Asset markets have a tendency to predict the future and high yield bond markets have been registering this improvement for some time. Credit spreads (the additional yield over government bonds of similar maturity) have tightened considerably since their wides at the height of fears around the COVID pandemic but still offer room for further tightening (see Figure 2).

| Index | Current (January 2022) | Low in last 5 years | Low in last 20 years |

|---|---|---|---|

| Europe BB | 278 | 184 | 116 |

| Europe B | 479 | 291 | 200 |

| Europe CCC | 714 | 563 | 322 |

| US BB | 252 | 186 | 165 |

| US B | 380 | 323 | 236 |

| US CCC | 712 | 576 | 414 |

Source: Refinitiv Datastream, ICE BofA Euro High Yield, ICE BofA US High Yield, constituent rating indices. Govt OAS = option adjusted spread over government. Current at 27 January 2022. Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%, 27 January 2002 to 27 January 2022.

Of course, we are mindful that the high yield market is at the mercy of events. For now, heightened risk aversion due to geopolitics and central bank policy mean spread tightening faces a headwind. Central banks have been caught on the hop by inflation proving more elevated and persistent than they previously expected. Having been potentially slow to act, they may now feel pressured to be seen to be doing something. For the US Federal Reserve, in particular, having pivoted so sharply in the fourth quarter of 2021 it is unlikely they will soften their new hawkish tone in the next few months unless there are clear signs of inflation or economic data rolling over. This could make for a rocky few months in markets, although this is not necessarily a bad thing for an active investor as it can create opportunities.

Strong fundamentals

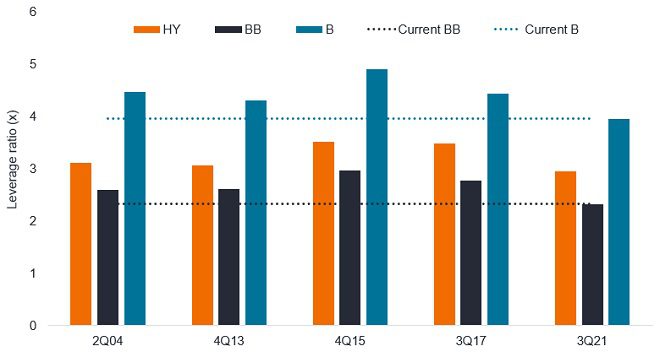

The pandemic was a shock that forced many issuers to tap capital markets for financing but underlying credit fundamentals among high yield borrowers have improved dramatically since. The leverage ratio, which is total debt divided by earnings before interest, tax, depreciation and amortisation (EBITDA), initially soared as borrowings rose and earnings fell. That dynamic has now reversed as companies pay down debt and earnings rise. Net leverage (where total debt is reduced by cash and cash equivalents on the balance sheet) has also shrunk as emergency cash originally earmarked to cover costs from revenue shortfalls has turned into cautionary cash. Such has been the improvement that Morgan Stanley noted that high yield leverage in the US has never been lower entering a monetary tightening cycle in the last two decades (see Figure 3)

Figure 3: US high yield net leverage never been lower entering a recent tightening cycle

Source: Morgan Stanley Research, Bloomberg, S&P Capital IQ, 2004 = rate rise, 4Q13 = taper, 4Q15 = rate rise, 3Q17 = quantitative tightening, 21 January 2022.

The improved earnings and low financing costs means that the interest coverage ratio (EBITDA/total interest expense) remains near highs, so we anticipate most companies being in a strong position to service their debts, even as interest rates rise. On average across US high yield, interest coverage is at 4.9x (up 0.8x on a year earlier).2 Furthermore, many high yield borrowers have been refinancing their debt to lock in low rates. While new debt supply is expected to remain high this year, we anticipate it being down on last year at a time when income yield will likely remain in demand, so the technical outlook appears favourable.

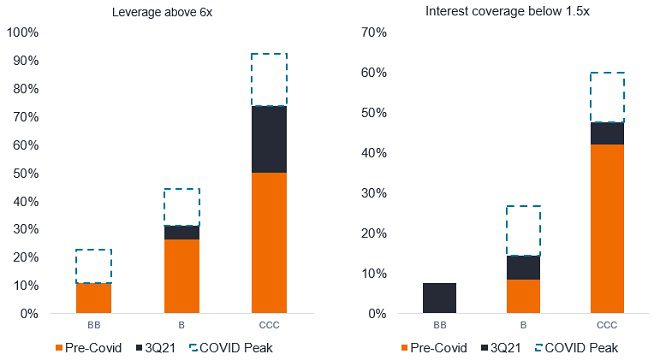

Not everywhere is rosy. Index averages can disguise underlying issues, which is why assessing credit fundamentals remains paramount. Stress remains concentrated in lower quality credits (see figure 4). Leverage levels across much of the market beyond CCC have returned to pre-COVID levels, but interest coverage levels lag the improvement in leverage levels.

Figure 4: Stress remains concentrated in lower quality credits (US high yield)

Percentage of overall index exhibiting high leverage or low interest coverage:

Source: Morgan Stanley Research, Bloomberg, S&P Capital IQ as at Q3 2021, 21 January 2022.

This marries with our view that BB rated bonds may be the area of high yield that offers the best risk-adjusted returns, not just because of stronger credit fundamentals but because this rating cohort is likely to remain popular with investment grade investors looking for extra yield as well as being a source of rising stars – issuers that are upgraded to investment grade.

Is inflation all bad?

With their mandates for price stability, central banks are responding to inflation through tighter monetary policy but inflation need not be a negative for investors. The sources of inflation are important. High yield as a universe has historically had a high weighting to materials and energy issuers, so higher commodity prices may ultimately help the cash flow of these companies. Clearly, there will be sectors of the market for which higher input costs exceed their capacity to pass on those costs – so it is important to look for companies with pricing power.

Historically, among the major fixed income asset classes, high yield has generally proven to be a good place to be in an inflationary environment (see Figure 5). Each inflationary episode is likely to be different, however, so investors should not rely on past trends being repeated.

| Period of rising inflation from low to high point | Inflation low point % | inflation high point % | High yield return % | Investment grade return % |

US Treasuries reurn % |

|---|---|---|---|---|---|

| 31/05/1994 – 31/12/1996 | 2.29 | 3.32 | 37.1 | 26.9 | 22.2 |

| 31/03/1998 – 30/06/2000 | 1.38 | 3.73 | 1.5 | 7.3 | 11.4 |

| 30/06/2002 – 31/03/2003 | 1.07 | 3.02 | 11.1 | 10.8 | 8.8 |

| 28/02/2004 – 30/06/2006 | 1.69 | 4.32 | 15.7 | 3.6 | 3.0 |

| 31/08/2007 – 31/08/2008 | 1.97 | 5.37 | -1.4 | 1.5 | 8.6 |

| 31/10/2009 – 30/09/2011 | -0.18 | 3.87 | 18.0 | 16.1 | 13.7 |

| 30/09/2015 – 31/07/2018 | -0.04 | 2.95 | 25.0 | 9.5 | 1.0 |

| 31/05/2020 – 31/12/2021 | 0.12 | 7.04 | 18.6 | 5.8 | -3.0 |

Source: Refinitiv Datastream, Janus Henderson Investors, 31 December 1993 to 31 December 2021, US All Urban Consumer Price Index annual inflation rate, total return in US dollars of ICE BofA US High Yield Index, ICE BofA US Corporate Index, ICE BofA US Treasury Index. Green shading signifies best performers.

A cautionary tale

Ultimately, there is no textbook answer to how economies will respond to emerging from a pandemic nor whether central banks are correctly assessing the current inflationary outlook. A potential risk is that if monetary policy is tightened too aggressively it could precipitate a recession. What is clear is that there is a shift in sentiment among central bankers as the emergency support that has characterised the past two years draws to a close.

Returning to our opening metaphor, the withdrawal of liquidity does not mean central bankers are about to replace the rubber matting beneath the see-saw with concrete, but investors will need to be more careful. Falls could be more painful as shown by the volatility in markets in January 2022, both in equities and bonds. For high yield, we take some comfort from the fact that rate rises also indicate growing confidence in the economy’s capacity to stand on its own two feet. Declining credit risk among selected high yield bond issuers we believe could help to offset some of the pressure from rising government bond yields.

1Source: S&P Global Ratings, Global Credit Outlook 2022, December 2021. Forecasts are estimates and are not guaranteed.

2Source: Morgan Stanley, US high yield interest coverage ratio at Q3 2021, 21 January 2021.

Credit risk: The risk that a borrower will default on its contractual obligations to investors, by failing to make the required debt payments. Anything that improves conditions for a company can help to lower credit risk.

Corporate bonds: A debt security issued by a company. Bonds offer a return to investors in the form of periodic payments and the eventual return of the original money invested at issue.

Credit spread: The additional yield (typically expressed in basis points) of a corporate bond (or index of bonds) over an equivalent government bond.

Default: The failure of a debtor (such as a bond issuer) to pay interest or to return an original amount loaned when due. The default rate is a measure of defaults over a set period as a proportion of debt originally issued.

Hawkish: describes policymakers when favouring tighter monetary policy (such as higher interest rates) to keep inflation in check.

High yield: A bond that has a lower credit rating than an investment grade bond. Sometimes known as a sub-investment grade bond. These bonds carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher coupon to compensate for the additional risk.

Inflation: The annual rate of change in prices, typically expressed as a percentage rate.

Interest rate risk: the risk that can arise for fixed income investors from fluctuating interest rates. As interest rates rise, the existing yields on fixed rate bonds become relatively less attractive so bond prices fall.

Investment grade: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings.

Leverage: The level of debt at a company.

Monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Ratings/credit ratings: A score assigned to a borrower, based on their creditworthiness. It may apply to a government or company, or to one of their individual debts or financial obligations. An entity issuing investment grade bonds would typically have a higher credit rating than one issuing high yield bonds. The rating is usually given by credit rating agencies, such as S&P Global Ratings; within high yield bonds, for example, a bond rated BB is deemed higher quality than a bond rated B, which is deemed higher quality than a bond rated CCC or below.

Taper: A central bank’s slowing down of the rate of its bond buying programme (quantitative easing). Quantitative tightening is where the central bank actively reduces the size of its bond holdings.

Volatility: the rate and extent at which the price of a portfolio, security or index, moves up and down.

Yield: The level of income on a security, typically expressed as a percentage rate. For a bond this is calculated as the annual coupon payment divided by the current bond price.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.

Specific risks

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- CoCos can fall sharply in value if the financial strength of an issuer weakens and a predetermined trigger event causes the bonds to be converted into shares/units of the issuer or to be partly or wholly written off.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall. High yielding (non-investment grade) bonds are more speculative and more sensitive to adverse changes in market conditions.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- Emerging markets expose the Fund to higher volatility and greater risk of loss than developed markets; they are susceptible to adverse political and economic events, and may be less well regulated with less robust custody and settlement procedures.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- CoCos can fall sharply in value if the financial strength of an issuer weakens and a predetermined trigger event causes the bonds to be converted into shares/units of the issuer or to be partly or wholly written off.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.