Real yields pulling on cable

5 minute read

Key takeaways:

- The rise in sterling has been driven by the rise in UK real yields relative to those in the US, and greater clarity around Brexit, following the end of the extension period.

- The UK appears well placed to benefit from its earlier and faster roll out of vaccines relative to the US and Europe, where the virus remains a significant domestic problem.

- Bank of England comments suggesting negative interest rates are not imminent has helped to lift the real yields on UK gilts.

Sterling has breached US$1.40 for the first time since early 2018, as the pound continues to bounce from its March 2020 low of $1.15. The predominant driver has been the rise in UK real yields – the return investors receives after inflation is accounted for – relative to those in the US, along with the passing of the last Brexit deadline at the end of 2020. With the immediate trading relationship with the European Union (EU) now known, investors can get back to looking at fundamentals. Given the UK is among the leading countries for vaccine roll outs, it could recover faster than many currently predict. However, fundamentals and investor positioning have shifted to reflect this, leaving the outlook potentially more balanced.

Brexit was a dark cloud over UK assets and sterling for most of the period between the 2016 referendum and the end of 2020. The elimination of the repetitive deadlines with uncertain outcomes has changed the way investors view the UK currency. Investors, in aggregate, have moved to a small net long position in the pound and asset managers (in particular) are as long as they have been to the currency in a decade. With a new status quo set in the UK-EU relationship, investors can return to thinking about fundamentals first when it comes to sterling, with future new agreements between the EU and UK more likely to provide small incremental adjustments rather than dramatic shifts in the relationship.

Early vaccination lead bodes well for growth

And so, we return to the more standard analysis of economics and monetary policy. The UK appears well placed to benefit from its earlier and faster roll out of vaccines relative to most other nations, particularly the US and Europe where the virus remains a significant domestic problem. Compared to Europe, where restrictions remain fairly tight in an effort to mitigate the spread of the virus, the UK should be able to reopen its domestic economy faster. In relation to the US, a greater number of vaccinated people may lead to a faster return of spending once restrictions in the UK are eased. With the UK having seen some of the worst downgrades to growth expectations into the end of 2020, it could be in line for some forecast upgrades in 2021, particularly if it turns out that the UK government has been sandbagging (lowering economic growth expectations to make results look good) when it comes to the speed of the vaccine roll out.

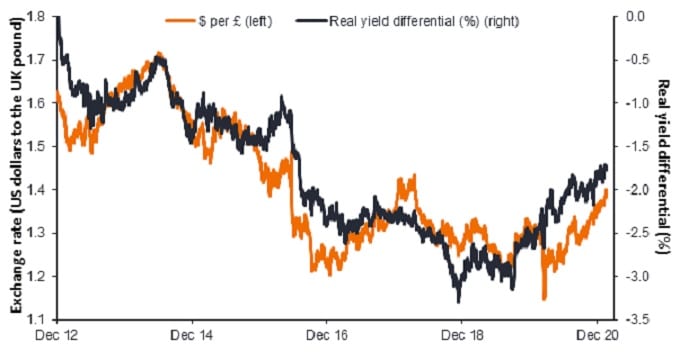

Another factor when it comes to cable (the exchange rate between the US dollar and sterling) has been the relative movements in monetary policy positions. Investors have continued to speculate that the Bank of England (BoE) may move into negative interest rates to support the economy, but this has become less likely as the path to economic recovery has become clearer. Recent BoE comments on negative interest rates not being imminent have reinforced this view and helped lift the real yields on UK gilts. In contrast, the US Federal Reserve (Fed) has generally been clear in its desire to keep easy monetary policy in place for longer than they might have in the last cycle. Fed Chair Powell has repeated this stance again in recent weeks and it is clearly weighing on real US Treasury yields, even as inflation expectations drag nominal yields higher. The relative move higher in UK real yields has been a clear factor in support of stronger sterling against the US dollar (Exhibit 1).

Source: Janus Henderson Investors, Bloomberg, as at 19 February 2021.

Notes: Real yield differential = UK 10-year gilt real yield minus US 10-year Treasury real yield.

Sterling outlook more balanced from here

However, UK real yields have now gained considerably versus other regions, pricing in a better economic path. At some point, forecasts will start to reflect the fact that European countries should be able to accelerate their vaccine programmes and that the US government is looking to add significant further stimulus to boost growth. Despite this, US and German real yields remain very low and we could see some catch up to the UK, which likely only has a vaccine advantage measured in months. In addition, much more bullish positioning in sterling may become a headwind to further significant appreciation. Therefore, the outlook for sterling is probably more balanced from here as the post-Brexit spark fades, relative fundamental support may shift, and positioning has moved to a more bullish stance.

Stronger sterling as a result of a better outlook for the UK economy first seems like a good thing for UK assets. In actual fact it tends to be a drag on the performance of UK equities relative to other regions. In this environment, firms more focused on the domestic UK narrative may represent a more interesting proposition than larger companies whose global revenues must be adjusted lower as sterling rises. A stronger UK economy is also not helpful for UK gilts where rising yields have led to sharp losses already this year. Investors need to think carefully about what this means for portfolio allocations, although those outside the UK may view a stronger currency as a tailwind to any UK investments they make.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.