Can multisector make sense for a core bond allocation?

Portfolio Managers John Lloyd and John Kerschner discuss whether it might make sense for investors to consider a multisector approach for a core bond allocation.

4 minute read

Key takeaways:

- As investors consider how to diversify their core bond allocation, we believe a multisector approach may result in better risk-adjusted returns over the long term.

- An active approach that incorporates multiple sectors may provide better exposure to the broad fixed income universe than a passive index.

- Multisector strategies may also allow investors to better manage and balance key risk factors relative to a benchmark index.

The investable fixed income universe in the U.S. – the largest in the world – is both broad and deep in its scope. When one considers the sheer scale of the market, and the multitude of sectors and industries represented, it can feel daunting to construct a portfolio that appropriately capitalizes on the full opportunity set.

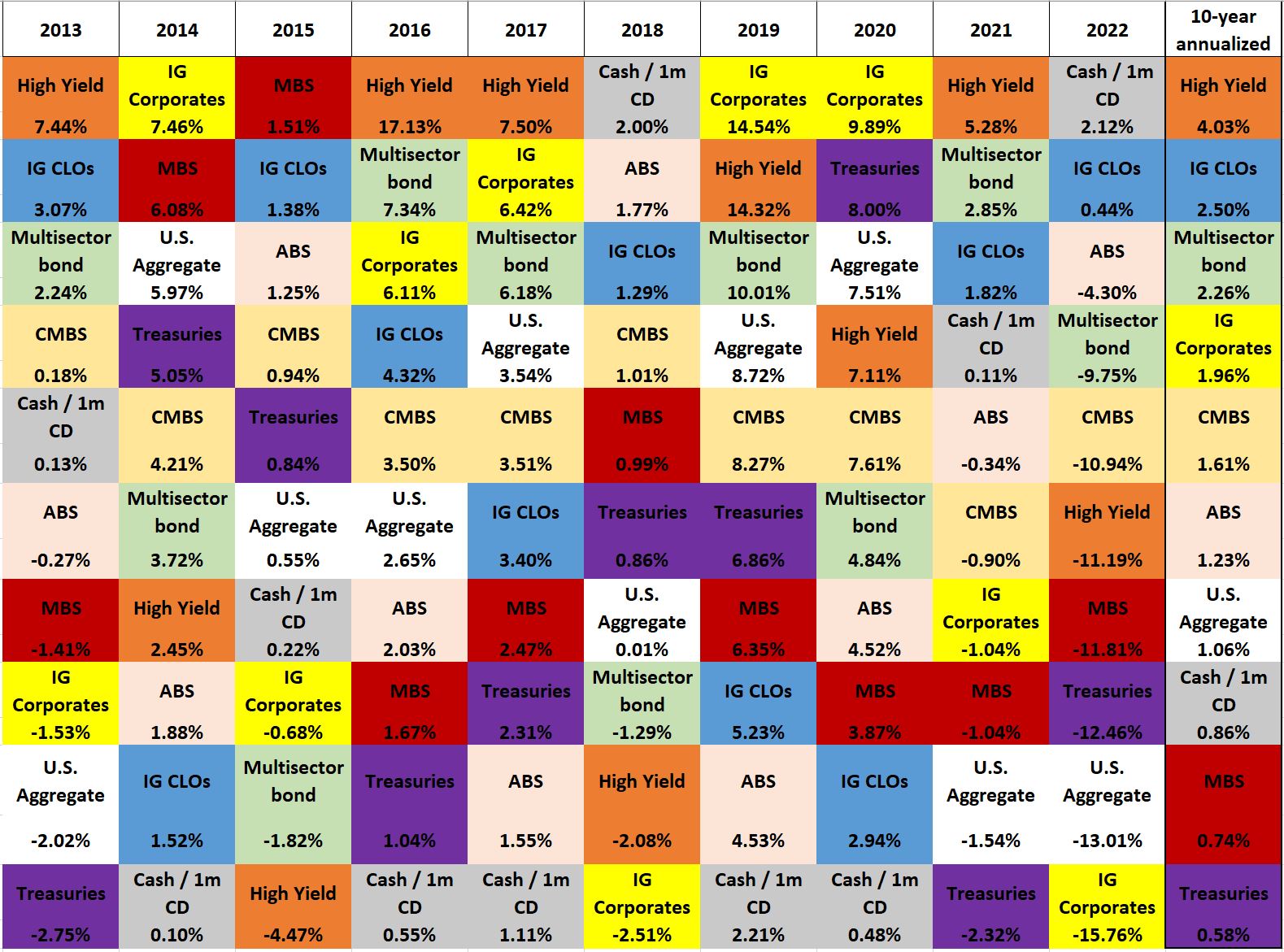

Market leadership among various sectors is also constantly changing, as shown in Exhibit 1. As such, it is difficult to accurately predict which sectors will do better than others from one year to the next.

Exhibit 1: Fixed income returns quilt (2013 – 2022)

Source: Bloomberg, J.P. Morgan, Janus Henderson Investors, as of 31 December 2022. Sub-asset class returns as per corresponding Bloomberg, J.P. Morgan, and Morningstar indices. Past performance is no guarantee of future returns.

Source: Bloomberg, J.P. Morgan, Janus Henderson Investors, as of 31 December 2022. Sub-asset class returns as per corresponding Bloomberg, J.P. Morgan, and Morningstar indices. Past performance is no guarantee of future returns.

How then should investors think about their bond allocations to maximize risk-adjusted returns?

In our view, an active, multisector approach may help to achieve better outcomes over the long term. As investors think about constructing a diversified bond portfolio, we suggest focusing on two key objectives.

1. Ensure appropriate access to the entire universe

While it isn’t critical to always be fully invested across all sectors, we do think that bond investors should have access to all sectors – or, alternatively, employ managers with a mandate that allows them to invest across the broad universe.

While it certainly has its merits, the Bloomberg U.S. Aggregate Bond Index (U.S. Agg), which has served as a proxy benchmark for a diversified bond allocation, does not accurately represent the fixed income universe, for three reasons.

First, certain significant sectors are excluded from the benchmark index, such as the floating-rate collateralized loan obligation (CLO) sector, which was the best-performing investment-grade sector in the U.S. on an annualized basis for the 10-year period ended 31 December 2022.1

Second, the U.S. Agg is limited in that it does not offer exposure to non-investment grade debt, such as high-yield corporates. And third, a sector’s weight in the U.S. Agg may not be representative of its weight in the investable universe. For example, non-agency securitized assets make up over 8% of the investment-grade market but represent less than 3% of the U.S. Agg.

In our view, a flexible, multisector mandate that allows a manager to be unbound by these benchmark limitations may offer investors appropriate exposure across the market spectrum.

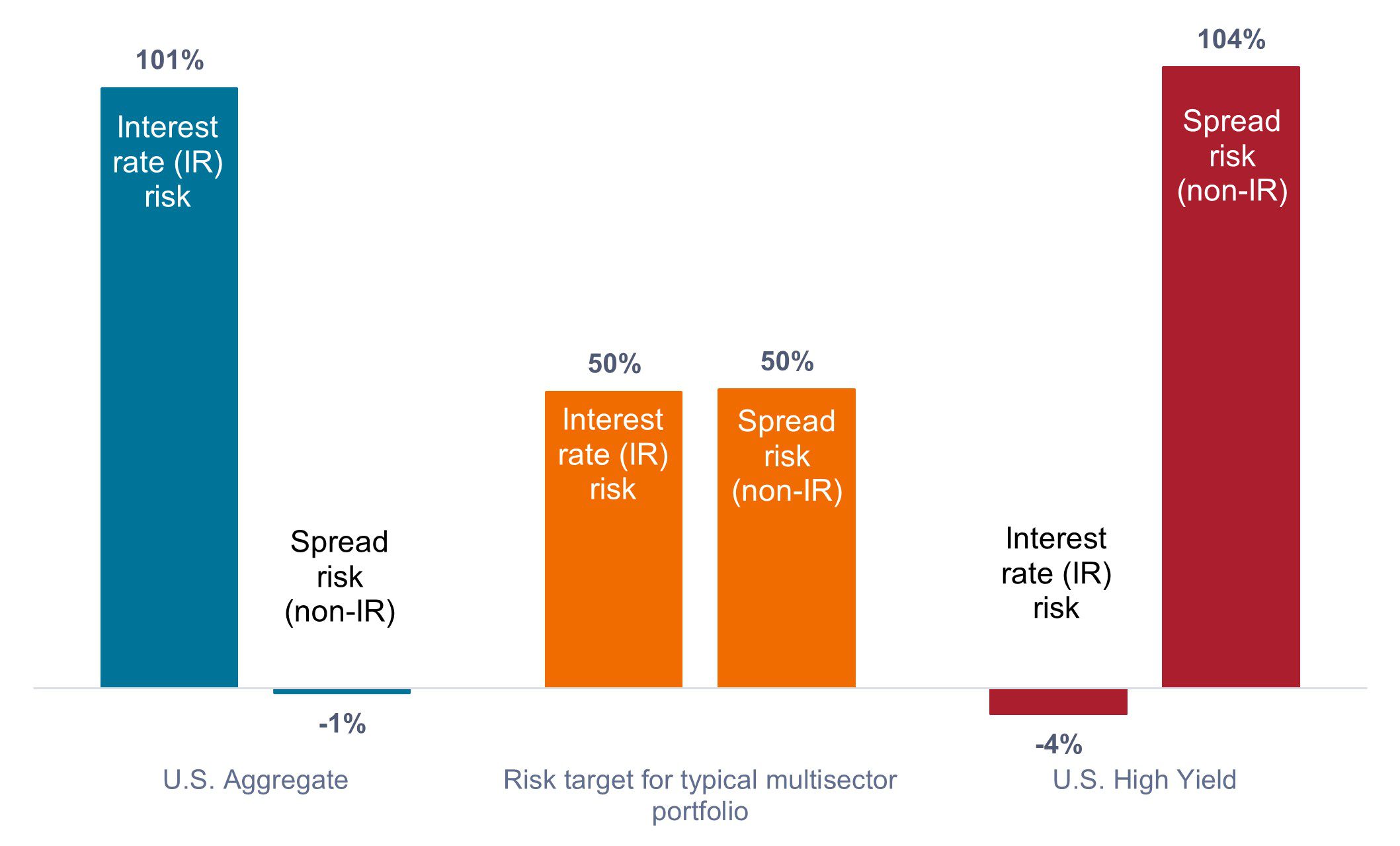

2. A balanced approach to risk

A multisector approach might differ from a traditional benchmark-focused approach in that a manager may be more selective regarding the source, and level, of risk within the portfolio. Essentially, a balance can be sought between the two main drivers of fixed income returns, namely interest rate risk and credit spread risk, as shown in Exhibit 2.

Exhibit 2: Percentage of total volatility by factor decomposition (April 2018 – March 2023 average)

Multisector portfolios may attempt to balance interest rate and credit spread risk

Source: Bloomberg, Janus Henderson Investors, as of March 31, 2023. Indices used to represent asset classes: U.S. Aggregate (Bloomberg U.S. Aggregate Bond Index), U.S. High Yield (Bloomberg U.S. Corporate High Yield Index). Past performance is no guarantee of future returns.

Source: Bloomberg, Janus Henderson Investors, as of March 31, 2023. Indices used to represent asset classes: U.S. Aggregate (Bloomberg U.S. Aggregate Bond Index), U.S. High Yield (Bloomberg U.S. Corporate High Yield Index). Past performance is no guarantee of future returns.

Recently, the multisector approach has provided better absolute returns (as shown in Exhibit 1 above): the Morningstar multisector bond category returned 2.26% annualized for the 10-year period ending December 2022 vs. the U.S. Agg’s return of 1.06%.

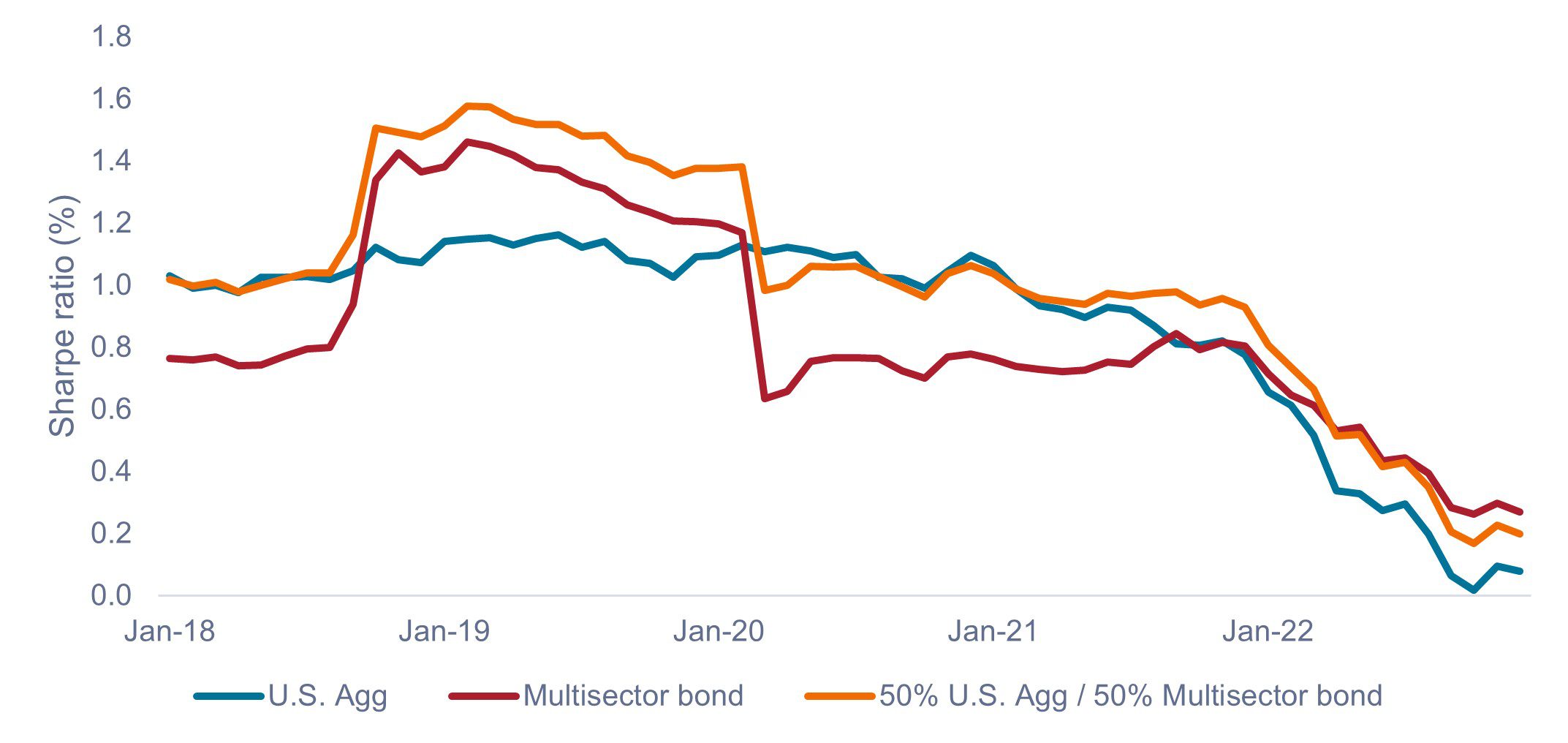

That said, the higher absolute return does come with somewhat higher volatility, so it’s important to also evaluate the U.S. Agg and multisector categories on a risk-adjusted basis, by way of their Sharpe ratios.

As shown in Figure 3, over the past five years, leadership in rolling 10-year annualized Sharpe ratios has oscillated between the U.S. Agg and the Morningstar multisector bond category. This is to be expected, for while a certain strategy might do better over time, it would not necessarily do better through all periods in the interim.

Many investors may be comfortable with higher volatility in exchange for potentially higher absolute returns. For others who might prefer their portfolios to look a little more like the benchmark index, we think it may make sense to split their core allocation between the U.S Agg and the multisector bond category. As a result of better diversification, during the five-year period ending December 2022, a 50/50 allocation generally resulted in improved risk-adjusted returns versus the U.S. Agg alone.

Exhibit 3: Rolling 10-year annualized Sharpe ratios (2018-2022)

Source: Morningstar, as of 31 December 2022. Multisector bond represents corresponding Morningstar category, U.S. Agg represents Bloomberg U.S. Aggregate Bond Index. Past performance is no guarantee of future returns.

Source: Morningstar, as of 31 December 2022. Multisector bond represents corresponding Morningstar category, U.S. Agg represents Bloomberg U.S. Aggregate Bond Index. Past performance is no guarantee of future returns.

Conclusion

As investors contemplate how they can gain exposure to the broad fixed income universe – while concurrently managing and balancing their exposure to key risk factors – we think a multisector approach may result in better absolute and risk-adjusted returns in the long run.

1 As shown in the final column of Exhibit 1.

Bloomberg U.S. Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market.

Bloomberg U.S. Corporate High Yield Bond Index measures the US dollar-denominated, high yield, fixed-rate corporate bond market.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Sharpe Ratio measures risk-adjusted performance using excess returns versus the “risk-free” rate and the volatility of those returns. A higher ratio means better return per unit of risk.

Active and passive investments may both lose value when valuations fall and market and economic conditions change.

Collateralized Loan Obligations (CLOs) are debt securities issued in different tranches, with varying degrees of risk, and backed by an underlying portfolio consisting primarily of below investment grade corporate loans. The return of principal is not guaranteed, and prices may decline if payments are not made timely or credit strength weakens. CLOs are subject to liquidity risk, interest rate risk, credit risk, call risk and the risk of default of the underlying assets.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Multisector bond portfolios seek income by diversifying their assets among several fixed-income sectors, usually U.S. government obligations, U.S. corporate bonds, foreign bonds, and high-yield U.S. debt securities. These portfolios typically hold 35% to 65% of bond assets in securities that are not rated or are rated by a major agency such as Standard & Poor’s or Moody’s at the level of BB (considered speculative for taxable bonds) and below.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.