Listed real estate at an inflection point?

Tim Gibson, Co-Head of Global Property Equities responds to key questions around the sector and explains why today’s pessimism could actually be an enticing opportunity for investors this year.

7 minute read

Key takeaways:

- A deep pricing disconnect currently exists between forward-looking listed REITs and backward-looking private real estate. Listed REITs suffered sharp falls in 2022 and failed to act as an inflation hedge in an environment of high and rising inflation.

- Public real estate currently trades at more than a 20% discount to NAV, which could be an opportune time to invest – historically it has outperformed private real estate at these valuations.

- A bottom-up, active approach to real estate investing enables the identification of high-quality companies that are capitalising on the tailwinds of secular growth themes.

In the wake of last year’s global market instability, bonds and equities experienced a rare year in which they both fell significantly. With market volatility persisting, the traditional resilience and stable income of listed real estate could attract investors back to the currently unloved asset class.

After a tough 2022, Real Estate Investment Trusts (REITs) are trading at historically-wide discounts, as investors grapple with a difficult cyclical economic backdrop as well as strong structural shifts within real estate markets. Hybrid working patterns are also having an unprecedented impact on office markets. In addition, office buildings are a prime target for global decarbonisation efforts.

Why did listed real estate perform poorly, while private property markets remained resilient amid the challenging investment environment in 2022?

The performance of listed REITs in 2022 was wildly at odds with that of non-listed real estate. US REITs were down more than 20%, whilst US private real estate was up 8%.1 Private real estate valuations are often reported on a quarterly basis, reflecting past performance. In contrast, forward-looking public market valuations are priced daily, reflecting current market conditions, which last year saw REITs reprice significantly having factored in rate rises and mounting recession fears.

What impact could moderating inflation have on REITs?

While listed real estate has proven it can act as an inflation hedge over the longer term, this was not the case in 2022. However, this did not come as a huge surprise to us given last year we had inflation that was high and rising. The good news however, is that data going back to the 1950s shows that US REITs historically outperformed other assets like broader equities, US 10-Year Treasuries and commodities in periods when inflation was high and falling.2

Whilst we are conscious of the challenges that exist in capital markets, given the magnitude of the interest rate hikes we have experienced over the last year, we believe there are grounds for optimism.

Indeed, with economic growth slowing and company earnings growth becoming more difficult to find, we expect the earnings resilience of listed real estate to come to the fore. According to Bloomberg market consensus estimates, US REIT earnings are forecast to grow by 5.1% in 2023, in comparison earnings for the broader S&P 500 Index are projected to fall by 6.4%.3 We believe this earnings resiliency is largely attributed to not only lease structures, which are often multi-year contracts providing good visibility of top line rental income, but also the strength of company balance sheets in the REITs space, which have improved dramatically since the Global Financial Crisis (GFC). US listed REIT leverage levels are at historical lows, while the average debt term-to-maturity is historically high at more than seven years, with the majority of debt financed at fixed rates.4

Lower leverage, a high proportion of fixed rate debt as well as longer debt duration continue to be crucial characteristics to look out for in listed property companies. Many private real estate companies used the recent era of cheap funding to increase borrowing in order to boost earnings and grow dividends. High levels of leverage and floating rate debt could prove extremely problematic in the period ahead.

Is now a good time to consider allocating to REITs?

It is important to take a step back and examine the performance of listed and private real estate markets over a longer time frame. While the uncertain environment in 2022 led to significant weakness for US REITs while private real estate still registered a positive return, the former delivered a 25-year positive annualised return of 8%, which turns out to be very similar to private markets, which returned 9% over the same period.1

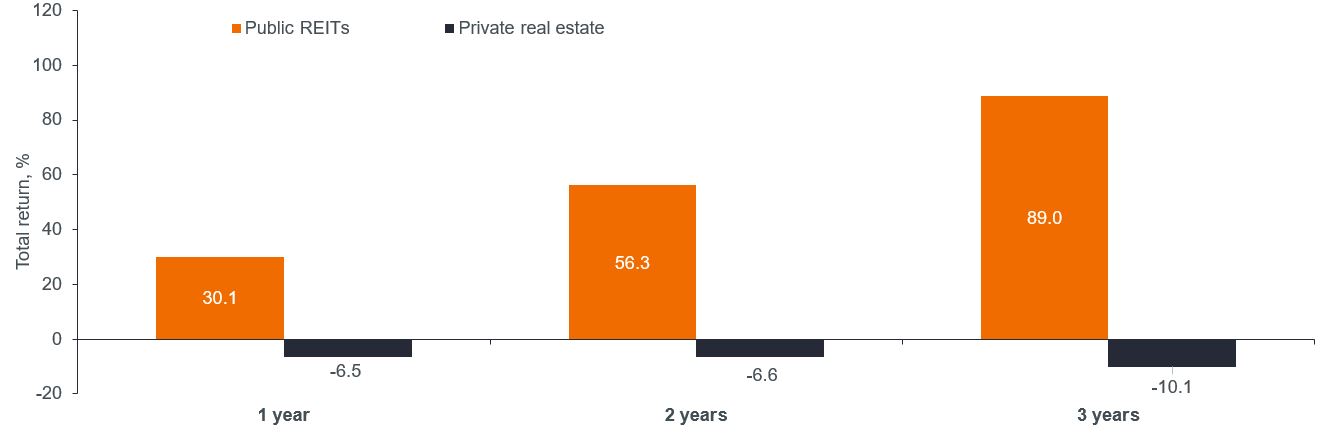

With public and private real estate markets delivering comparable returns over the long term, the chasm that has opened up in performance over the last year is significant and provides investors with a real opportunity. REITs are currently trading at a huge circa 25% discount to net asset value (NAV) – while private real estate trades at par to its NAV according to the most recent available data.5 And since 1990, public real estate has always outperformed private real estate over the subsequent three-year period when it has traded at a 20% or more discount to NAV.

Similar assets, different prices = the opportunity

Source: Morningstar Direct, Public REITs: FTSE Nareit All Equity REITs Total Return Index in USD, Private real estate: NCREIF Fund ODCE, 1 January 1990 – 30 September 2022, Discount to NAV data from Green Street Advisors. Past performance does not predict future returns.

Finally, a key benefit of listed property is liquidity. In contrast, some private real estate funds are now gated with investors faced with redemption concerns. This disconnect creates a clear window of opportunity for an allocation to listed real estate.

After the upheaval of retail property caused by the advent of e-commerce, offices are taking a hit from post-pandemic work patterns. Are offices the new retail?

Office REITs form a large part of the global property universe – about 14% of the FTSE EPRA Nareit Developed Index as at 28 February 2023.

In the US, as of Q4 2022, the overall office vacancy was 17.3%.6 The reasons for this high office vacancy are both cyclical and structural. Employees have been reluctant to return to the office with office occupancy remaining around 50% of pre-COVID levels.7 The shift towards hybrid working post COVID-19 has left the US disproportionately impacted due to a stronger preference for remote working. In addition, the US has suffered from turbulence in previously high-growth sectors, such as the slowdown in the dominant tech sector. Finally, upcoming supply will also act as a handbrake on the office market with 271.3 million square feet, or 4.2% of existing stock in the planning stage.8

Life science remains the only bright spot, with markets such as Boston, San Diego and the San Francisco Bay area continuing to experience strong demand.

The office predicament bears a striking resemblance to the situation faced by retail just a few years ago. While most areas within the retail sector have seemingly found its base and emerged out the other side, offices have yet to endure this painful multi-year process.

What is the best way to future-proof a property portfolio?

Real estate is an evolving asset class. Increasingly sophisticated technology, rapid urbanisation and shifts in demographics have fundamentally changed consumer behaviours and altered the needs and uses for real estate. Exposure to areas that tap into secular growth themes like changing demographics, e-commerce, and sustainability are more likely to be able to deliver attractive returns over the longer term compared to those that are in secular decline.

Reducing both the embedded and operational carbon of buildings as well as meeting changes in occupant health and wellbeing requirements will be of growing importance in the years ahead. As well as making environmental sense, it also makes financial sense. Buildings with green certifications can command a rent and sales premium over those that do not.9 We think a bottom-up, active approach to real estate investing, led by on-the-ground experts, will be crucial in identifying the highest-quality property companies that possess all the right elements to deliver consistent income and capital growth from a real estate portfolio.

1 Bloomberg, NCREIF, Green Street, Janus Henderson Investors analysis, as at 31 December 2022. Global REITS represented by FTSE EPRA Nareit Developed Index -24%; private real estate represented by OCDE Index -8%, returns in USD terms for calendar year 2022.

2 Refinitiv Datastream, Haver Analytics, Kenneth French, Goldman Sachs Global Investment Research. Data since 1950.

3 FTSE Russell, S&P Global Indices, Bloomberg, Janus Henderson Investors Analysis, as at 21 February 2023. There is no guarantee that past trends will continue, or forecasts will be realised.

4 NAREIT, S&P Financial, Citi Research, Janus Henderson Investors analysis, as at Q3 2022.

5 UBS, FTSE EPRA Nareit Developed Index as at 20 March 2023. OCDE Index as at 30 September 2022.

6 CBRE as at Q42022.

7 Kastle Back to Work Barometer as at 27 March 2023.

8 CommercialEdge, National Office Report March 2023.

9 JLL Global Research: How the ‘value of green’ conversation is growing up, January 2022.

Past performance does not predict future returns.

FTSE Nareit Equity REITs Index contains all equity REITs not designated as timber REITs or infrastructure REITs. The FTSE Nareit US Real Estate Index Series is designed to present investors with a comprehensive family of REIT performance indexes that spans the commercial real estate space across the US economy.

ODCE Index is a core capitalisation-weighted index that includes only unlisted (private) open-end diversified core strategy funds with at least 95% of their investments in US markets.

IMPORTANT INFORMATION

REITs or Real Estate Investment Trusts invest in real estate, through direct ownership of property assets, property shares or mortgages. As they are listed on a stock exchange, REITs are usually highly liquid and trade like shares.

Real estate securities, including Real Estate Investment Trusts (REITs) may be subject to additional risks, including interest rate, management, tax, economic, environmental and concentration risks.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.