Maximum pain from the UK’s mini-budget

Global Bonds Portfolio Manager Bethany Payne reflects on the market’s sharply negative reaction to the UK government's tax-cutting mini-budget and its potential consequences.

6 minute read

Key takeaways:

- Market loses confidence in UK government’s approach as it announces as yet un-costed tax cuts and additional borrowing in a ‘dash for growth’.

- Sterling weakens and gilt yields rise sharply but ongoing risks mean overseas investors may be less willing to fund higher gilt issuance.

- Further questions arise around the impact on Bank of England (BoE) rate policy and how this may crystallise losses on its gilt holdings – potentially requiring payments from the UK Treasury.

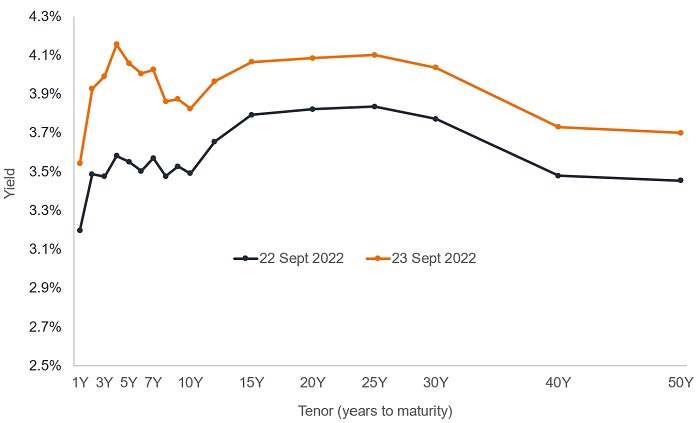

In its mini-budget announcement, the UK government was seeking to manufacture impressive growth levels, funded by heavy borrowing and tax cuts. Yet for the UK chancellor Kwasi Kwarteng, Friday 23 September may be a day he prefers to forget. It is doubtful it was the chancellor’s intention to add 50 basis points (bp) to the yield on UK 5-year government bonds, but such was the market’s fears about the scale of new gilt issuance that this was the result within an hour of him finishing delivering the mini-budget in parliament.1

Figure 1: Dramatic one day rise in UK gilt yield curve

Source: Bloomberg, GBP UK sovereign yield curve, 23 September 2022.

Wherever you looked across UK gilt markets, the story was the same. Yields rose across the board: the short end of the yield curve took the most pain but even yields on longer dated bonds rose sharply. Sterling came under similar stress, dropping from US$1.13 to US$1.09 against the US dollar, some distance from the US$1.35 it began 2022.2

While the UK government did not allow the Office for Budget Responsibility (OBR) initially to cost the fiscal event (although the OBR has been commissioned to report on 23 November 2022), the market did send their reaction loud and clear: investors have little faith in the government’s approach.

Gilts already feeling the heat

Already, over the first eight months of this year, local currency (sterling) gilt returns were bad (-19.5%), but in US dollar terms, gilts (-30.9%) have been the worst performing asset of all the major asset classes.3 With the sharp rise in gilt yields in September and a further fall in sterling the figures are likely to be worse still by the end of September.

There is a lot of funding through gilt issuance to do in the coming months and next year. This begs the question about who will sponsor gilts going forward. Relying on the kindness of strangers may only stretch so far because according to BoE data, overseas buyers deserted the UK in July, effectively reporting the largest ever monthly net sales (-£16.6 billion) by this sector, matched only by a one-off event in 2018.4

Concern around UK government borrowing was heightened earlier by its energy price cap proposals. The government expects the energy price cap to cost around £60bn for six months, but there is a catch: it involves a potentially very expensive bet on energy prices. The UK government has effectively entered into a short position in gas and electricity wholesale markets without a hedge – that is a naked short. This ties UK gilt yields to energy markets.

Contradictory policy

Moreover, the fiscal loosening within the budget runs counter to the BoE’s monetary tightening and its attempts to slow inflation.

The BoE sought to reassure markets that it preferred to assess the impact of the chancellor’s new strategy rather than engage in an emergency rate rise. It is not inconceivable, however, that we could see an inter-meeting hike from the BoE if sterling continues to depreciate, given that the next scheduled meeting for a rate hike decision is not until November. We had three dissenters wanting a 75bp hike at the September meeting the day before the mini-budget. If they had had the budget announcements to hand, it is likely, in our opinion, that they would have hiked more aggressively. We have raised our forecast for the next meeting to a 75bp hike*, with a risk to more if we see sterling continue to depreciate.

*Forecasts are estimates, may vary over time and are not guaranteed.

Banking a loss?

Added to that is growing speculation about what will happen with the BoE holdings of gilts, bought as part of its Asset Purchase Facility (APF) interventions. Rising bond yields mean that these have also lost a significant amount of value, with the loss on the long basket of gilts (those dated 15 years or more) reaching 42%.

Figure 2: APF holdings and unrealised losses

| Maturity of APF holdings | Loss |

|---|---|

| 0-3 years | -11% |

| 3-7 years | -17% |

| 7-15 years | -24% |

| 15+ years | -42% |

| Total % | -23% |

| Total £ | -220 billion |

Source: Janus Henderson calculations, Bank of England, Bloomberg, 26 September 2022. These calculations are estimates, may vary over time with market movements and are not guaranteed.

These severe losses raise concerns for us – is there a threshold at which the BoE becomes mindful of crystallising these losses at a cost to the taxpayer?

APF losses are indemnified by the UK Treasury, i.e. any financial losses are borne by the Treasury but any gains are owed to the Treasury. Around £120bn has been transferred to the Treasury from the APF as the coupon on gilts held is higher than the Bank Rate.5

But as Bank Rate is now higher than the coupon on gilts and the bank moves to crystallise losses across their portfolio due to quantitative tightening (QT), whereby the Bank actively sells gilts from the APF, transfers will have to be made in the opposite direction – from the Treasury to the BoE. This is going to be politically unpalatable and may even trigger a need for further gilt issuance.

Could we therefore be talking about tapering (reducing) quantitative tightening (QT) relatively soon or even cancelling QT before it has properly started?

The policies announced in the mini-budget inject major discretionary fiscal stimulus into possibly the tightest UK labour market on record, with unemployment at a near fifty year low and the job vacancy rate at a record high.6 We see debt-to-gross domestic product on a rising trajectory in the medium-term. In our view, the mini-budget package represents a material increase in risks: to inflation; to Bank Rate; and to the currency.

1Source: Bloomberg, intraday figures, yield on 5-year UK government bond, 23 September 2022

2Source: Bloomberg, GBPUSD currency exchange rate, 23 September 2022.

3Source: Deutsche Bank, August Performance Report, iBoxx £ Gilts Index, total returns between 31 December 2021 and 31 August 2022, 1 September 2022.

4Source: Bank of England, Bloomberg, foreign net gilt buying, 31 August 2022

5Source: Bank of England, ‘QE at the Bank of England: a perspective on its functioning and effectiveness’, 18 May 2022.

6Source: Refinitiv Datastream, UK labour force survey, unemployment rate; UK vacancy ratio, 31 July 1971 to 31 July 2022.

Bank Rate: the main policy interest rate set by the Bank of England

Basis point: Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Coupon: A regular interest payment that is paid on a bond. It is described as a percentage of the face value of an investment. For example, if a bond has a face value of £100 and a 5% annual coupon, the bond will pay £5 a year in interest.

Credit risk: The risk that a borrower will default on its contractual obligations to investors, by failing to make the required debt payments. Anything that improves conditions for a company can help to lower credit risk.

Fiscal policy: Government policy related to setting expenditure and tax levels. Fiscal loosening relates to tax cuts and greater expenditure in an attempt to stimulate economic growth; fiscal tightening is when the government raises taxes or spends less.

Gilt: A bond issued by the UK government to finance government expenditure. They take their name from the gilt-edging that used to exist on old bond certificates.

Gross domestic product: The value of all finished goods and services produced by a country, within a specific time period (usually quarterly or annually). It is a measure of the size of the economy.

Inflation: The annual rate of change in prices, typically expressed as a percentage rate.

Monetary policy: The policies of a central bank, such as the Bank of England, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary stimulus refers to a central bank increasing the supply of money and lowering borrowing costs. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Quantitative Tightening: The act of reducing the money supply to raise the cost of financing, typically to help slow the economy and temper inflation. Through quantitative tightening bonds held by the central bank are actively sold, which withdraws cash from the system. The opposite of quantitative easing, in which money is created by the central bank to buy bonds and increase the money supply.

Yield: The level of income on a security, typically expressed as a percentage rate. At its most simple, for a bond this is calculated as the annual coupon payment divided by the current bond price. When the yield on a bond rises, the bond price falls and vice versa.

Yield curve: A graph that plots the yields of similar quality bonds against their maturities. In a normal/upward sloping yield curve, longer maturity bond yields are higher than short-term bond yields. A yield curve can signal market expectations about a country’s economic direction.

GC 0922-120635 03-31-24 TL

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.