Sustainable investing – why a low-carbon approach matters

3 minute read

Climate change is the greatest environmental and social challenge that the world has ever faced.

There is an urgent need to transition to a low-carbon economic model in order to reverse the manmade damages made to the environment. Not doing so would risk health, livelihoods, food security, water supply, human security and economic growth. The most recent installment of the Intergovernmental Panel on Climate Change (IPCC) report, published on 9 August 2021, clearly outlines the state of the climate emergency and calls for an immediate and concerted effort to drastically reduce greenhouse gases and mitigate climate change.

Since the launch of the Global Sustainable Equity Strategy in 1991, we have had clearly defined principles concerning the types of businesses we allocate capital to. A distinguishing feature of the strategy is its low carbon approach. Not only do we believe that this the right thing to do for the environment, but we believe it makes good investment sense to avoid companies that are heavily exposed to climate-related risk and to invest in climate-related opportunities.

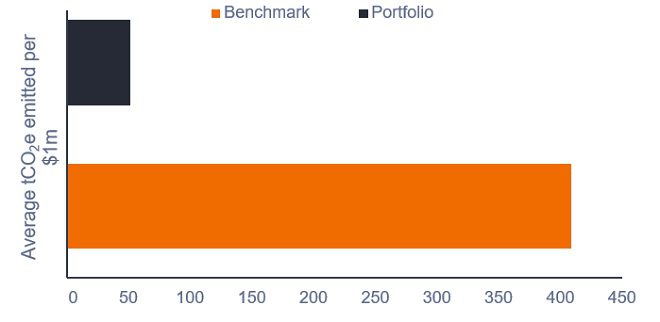

The Global Sustainable Equity Strategy has a carbon footprint that is significantly lower than the benchmark index

To address the climate issues that are emphasised in the IPCC report, we believe that the private sector will need to be instrumental in developing strategies which contribute to achieving net-carbon goals in order to support a carbon neutral economy. Investors will play an important role in this transition.

How can investors drive change?

The Global Sustainable Equity Team are co-founders of the Net Zero Carbon 101 (NZC10) commitment, alongside other asset management firms and the University of Oxford. The initiative sets ambitious yet achievable targets for reducing carbon emissions in the corporate sector. To do this effectively, NZC10 equips fund managers with a systematic framework to align their investment policies to the requirements for carbon neutrality, rather than just emissions reduction.

The Global Sustainable Equity Team’s low carbon approach to investing, which is woven into our investment process, means that the strategy has supported the impact of:

- 33 million metric tonnes of CO2e (carbon dioxide equivalent) emissions avoided – the equivalent to saving emissions from eight coal-fired power plants or annual energy of 4m homes or 7m cars off the road.

- 213 GWh of renewable energy generated – which could provide annual electricity for 20,000 homes in the US.2

We believe that only an active management solution can deliver a truly low carbon portfolio and, at the same time, specifically invest in companies playing a positive role in the transition to a low carbon economy.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.