The impact of war on European energy policy

Richard Brown, a member of the European Equities Team led by John Bennett, discusses how the Russia/Ukraine conflict is driving European energy policy and the potential opportunities for investors.

9 minute read

Key takeaways:

- The Russia/Ukraine conflict has acted as a catalyst for the already prominent renewable energy ambitions of the EU, home to many of the largest renewable energy companies globally.

- We believe that increased demand for a steady of flow energy will ease some of the fears around competition between developers for contracts and will be supportive to sales growth for the utility sector and its supply chain.

- Deep fundamental research is essential to determine which companies are best placed to succeed against this backdrop.

The Russian invasion of Ukraine has dominated markets since the beginning of the year. First of all, we hope for an immediate end to the violence and casualties. To the extent that those hopes are answered, we struggle to see how NATO-allied nations could justify lifting economic sanctions in the near to medium term with material consequences for societies, investors and the assessment of environmental, social and governance (ESG) criteria.

We believe the invasion marks a paradigm shift, or at least an acceleration of emergent trends, towards greater localisation of supply chains and tangible investment into energy, infrastructure and defence. It also challenges the arbitrary, and at times counterproductive, moral score-carding approach adopted by many in the asset management industry towards companies that are economically, and therefore socially, critical. If these expectations prove to be correct, the market implications would be significant. Investors will once more be required to ‘care’ about company valuations – the price paid for a stream of cash flows – in a manner that has been somewhat elusive over the last decade.

In this article, we have chosen to focus on European energy policy, which is being totally redrawn with implications and opportunities for investors in the European equities market.

Achieving energy independence from Russia

In 2020, around 40% of the European Union’s (EU’s) gas was imported from Russia, with Germany and Italy particularly reliant on those supplies having imported 65% and 43% respectively – a damning reflection of energy policy of the past two decades.1 While less newsworthy than actions taken in defence policy, the response by European politicians has been extraordinary. Policy setters, via the European Commission’s REPowerEU initiative and 2022 Clean Energy Summit, have announced large scale, far-reaching and immediate action to reduce imports in 2022 and gain independence from Russian gas by the end of the decade.2

To achieve this goal in the near term policymakers have focused greater attention on alternative gas supplies through the liquefied natural gas (LNG) market, which involves the rapid purchase of government-funded LNG cargoes and mandating underground gas storage capacity to be topped up to at least 90% before each winter (this is typically around 30%).3 In doing so, LNG has been positioned as a vital transition fuel in the journey to net zero (with lower carbon emissions than coal or oil), largely changing investors’ perception of the fuel and highlighting its role in keeping the lights on and factories running in the EU’s largest economy Germany next winter.

We consider this to be a significant shift given that many LNG-related companies were often marked down for their environmental impact in the non-renewable, albeit lower carbon-emitting, fuel space in prior years. The policy also aims to speed up elements of the green transition by reducing the dependence on higher carbon emitting fossil fuels in homes, industry and power generation, a move that is set to benefit companies involved in energy grid infrastructure and building efficiencies.

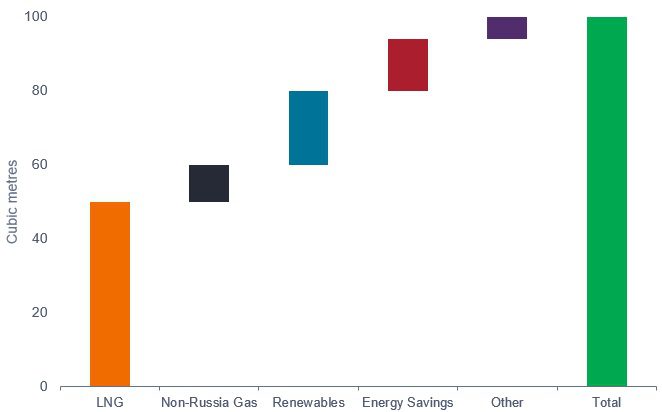

Figure 1: Areas forecast to replace energy shortfall in 2022

Source: ING Research, Janus Henderson Investors Analysis, EU Commission as at 15 March 2022. Note: REPowerEU proposes to reduce Russian gas imports by 100 billion cubic metres in 2022.

A renewed focus on renewables

We consider the most notable change in energy policy to be the revised renewable energy targets, with the EU aiming to approximately double the renewable incremental capacity to 900 gigawatts (GW) – according to our estimates – by 2030 and increase the deployment of renewables by 20%.4,5 The scale of this effort is put into perspective in figure 2, which shows the installed base of the largest European and US providers.

Given the ongoing news flow on ‘weaponisation’ of Russian gas supply and self-sanctioning on Russian hydrocarbons in general, we think the EU, individual member states and the UK are making huge efforts (most details remain behind the scenes) to prepare for a further significant acceleration in the renewable energy transition. For Europe’s nations, energy affordability and energy security have become prerequisites for survival.

| Company | Domicile | Installed Capacity (GW) |

| Iberdrola | Europe | 22 |

| NextEra | US | 17 |

| Enel | Europe | 16 |

| Berkshire Hathaway Energy | US | 12 |

| EDP | Europe | 12 |

| EDF | Europe | 11 |

| Orsted | Europe | 9 |

| RWE | Europe | 9 |

| Acciona Energia | Europe | 8 |

| Engie | Europe | 7 |

Critically, governments have identified the main bottle necks to achieving these targets – the speed of permitting renewable developments. Current regulations and red tape create a protracted and costly environment for wind and solar developers. Germany is now exploring options to expediate this process by reducing space reserved for military exercises at sea, cutting the minimum distance to residential area requirements on land and shortening maximum planning timelines by introducing time limits above which it will automatically count as approved. Every option appears to be on the table.

Elsewhere, Spain’s Ministry for the Ecological Transition (Miteco) has recently passed a law allowing solar projects smaller than 150 megawatts (MW) and wind farms under 75 MW to bypass the country’s lengthy Environmental Impact Assessment procedure, provided that projects are in low or moderate environmentally sensitive areas, and that their aerial grid connection lines do not exceed 15 kilometres and 220 kilovolts. Given that around half of Spain’s surface area has a low-to-moderate environmental sensitivity rating for the purpose of building solar and 36% for wind, the impact will be significant. Following in Spain’s footsteps, Portugal will stop requiring environmental impact studies for new solar projects up to 50 MW, according to João Galamba, the country’s Secretary of State for energy.6 It is clear that when offered the choice, European governments are prioritising energy independence and de-funding the Russian military by changing current planning regulations, a view we suspect the electorate would share.

Furthermore, it is reported that Italy has also recently followed suit by introducing a new ‘Energy Decree’ where core measures include a new simplification package that aims to speed up authorisation procedures for wind and solar plants.

To summarise, we believe that the Russia/Ukraine conflict has acted as a catalyst for the already prominent renewable energy ambitions of the EU. Naturally as investors this leads us to look more closely at the renewable developers and operators – predominantly European utility companies which are positioned to benefit from a step change in growth.

How could utility companies benefit from today’s energy policy?

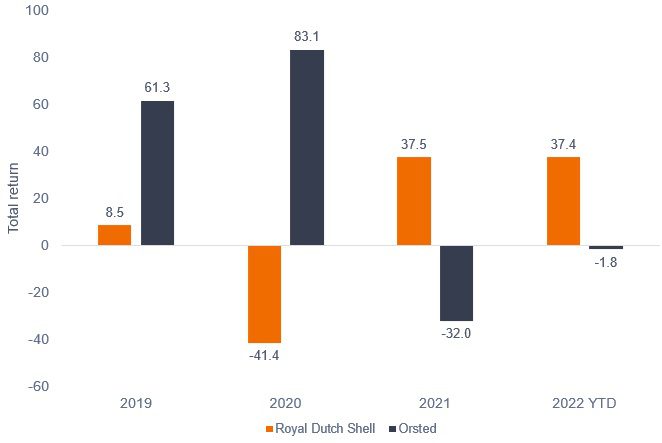

First, it is useful to see how share prices have behaved in recent years, as after all, the push toward renewable energy growth has been in place for some time. In this case, it is useful to compare the performance of Orsted, a Danish pure play renewables company, and Royal Dutch Shell, the largest energy stock in Europe. Orsted was one of the first operators to divest from its oil and gas activities and has subsequently morphed into one of the largest developer, owner and operator of offshore wind parks. Shell, albeit looking to address its environmental footprint, remains a more traditional energy producer.

Figure 3: Renewable energy versus traditional energy stock performance

Orsted performed phenomenally well in 2019 and 2020 but has since suffered much weaker performance along with other renewable energy ‘darlings’ (figure 3). This is due to rising input costs having materially lowered profit margins and increased competition from other oil majors, such as Shell, which are also looking to move their product mix away from fossil fuels. The concern has been that these oil producers would have less of a focus on the economic returns of the renewables project, with their primary aim instead focused on increasing their capacity as quickly as possible. In addition, Orsted’s share price reached a lofty valuation at the beginning of 2021 (figure 4). This serves as a useful reminder of the importance of industry analysis and valuation, even when considering an industry seeing a step change in its underlying growth profile, especially in an environment where interest rates are trending higher and increasing the cost of capital for companies.

Figure 4: Renewable energy company Orsted’s valuation peak

It is also crucial to consider energy affordability when analysing renewable developers given the implications for profitability. Household energy bills are estimated to increase by 65% this year compared to 2020, 7 with spot prices suggesting further dramatic increases. Regulators and governments will endeavour to protect consumers from massive increases in household bills (just look at how the cost of living dominated the recent French election debate), but in the end someone will have to pay. So far, government intervention has been widespread but fairly benign for the sector, focusing only on the most vulnerable customers. This has had a negligible impact on utilities’ profitability but remains a notable risk for the sector.

Looking further down the renewables supply chain

Outside of the developers, there are a number of small- and mid-sized companies in the renewables supply chain which have traditionally benefitted from increased wind and solar demand. These areas include suppliers of polysilicon (a material used for solar panels), wind turbine and photovoltaic equipment manufacturers, hydrogen production plants and makers of electrolysers, essential to energy production. In many instances, investor sentiment is very bearish in these areas as it focuses on short-term profit margin pressures from high raw material costs as well as a perception of order intakes remaining slow, which in our view is biased by the last year or two of price pressures.

Increased demand brings opportunity

Ultimately, the increased demand brought about by new EU policy will ease some of the fears around developer competition for contracts, in our view, and will be supportive to top line growth for the utility sector and its supply chain. The low volatility/defensive characteristics offered by the utilities may also be beneficial in what is an increasingly unpredictable economic backdrop. However, and as we have mentioned in other discussions around the energy transition, deep fundamental research is required to determine which companies are best placed to succeed.

1 Eurostat, DUKES, Jefferies Estimates, as at 2020.

2 European Commission, REPowerEU initiative, 8 March 2022.

3 European Commission, Questions and Answers on the new EU rules on gas storage, 23 March 2022. Member States must ensure that the underground gas storage infrastructures in its territory are filled up to at least 80% of their capacity at Member State level by 1 November 2022, rising to 90% for the following years.

4 European Commission, REPowerEU initiative, Janus Henderson Investors, 8 March 2022.

5 European Union Climate targets, October 2021.

6 Bloomberg New Energy Finance (BNEF) data, April 2022.

7 Jefferies research, as at 31 March 2022.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.