Global money trends still cooling amid US data confusion

Global money trends continue to suggest a near-term economic slowdown, with the caveat that interpretation of US monetary statistics is complicated by recent regulatory changes.

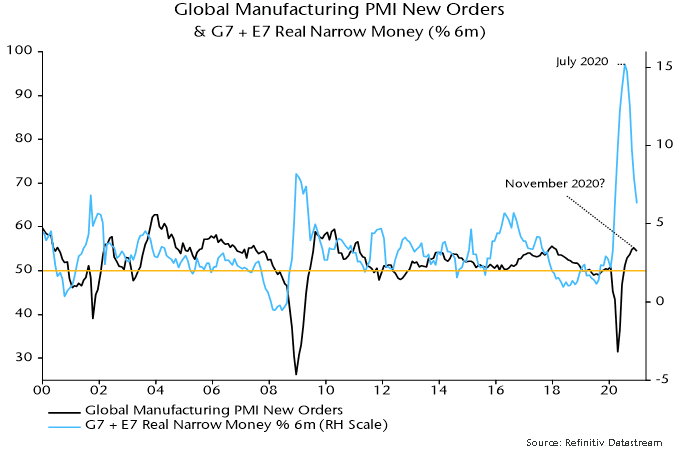

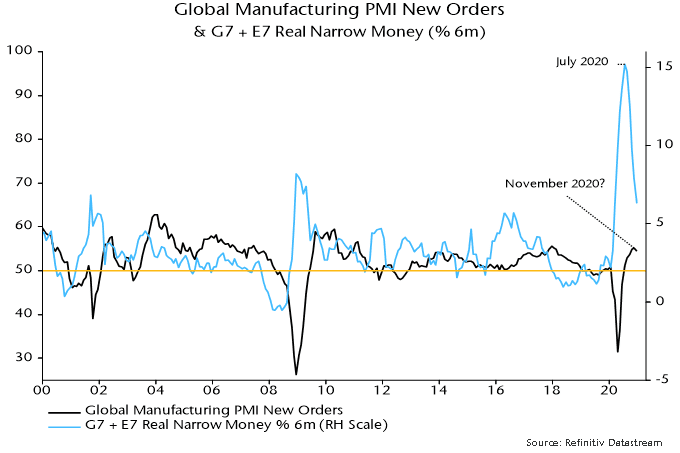

The key global monetary indicator followed here – six-month growth of real narrow money in the G7 economies and seven large emerging economies – is estimated to have fallen further in December, based on monetary data covering 70% of the aggregate. Real money growth has led the global manufacturing PMI new orders index by 6-7 months on average historically, so the continued decline from a July 2020 peak suggests that this PMI measure will move lower into Q2 – see chart 1.

Chart 1

An important qualification is that the G7 plus E7 money numbers for November / December incorporate an adjustment to US data to correct for an apparent upward distortion due to some banks reclassifying savings deposits (excluded from M1 and related measures) as demand deposits (included).

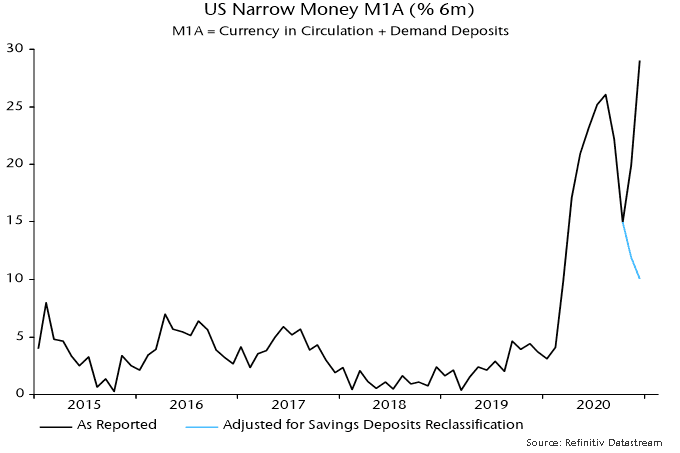

Excluding this adjustment, six-month growth of US narrow money rose to a new high at year-end – see chart 2. Some monetary observers ignore or are unaware of the reclassification distortion, arguing that the narrow money surge presages a super-strong economy and sharply higher inflation.

Chart 2

Fed statisticians haven’t responded to a request for confirmation of a reclassification effect on the data. The view that the strong November / December numbers are explained by such an effect – rather than a genuine flow of money out of “inert” savings deposits into “high velocity” demand deposits – rests on three considerations.

First, the Fed indicated that deposit reclassifications would occur following its decisions to cut reserve requirements on transactions deposits to zero and remove restrictions on withdrawals from savings deposits last spring.

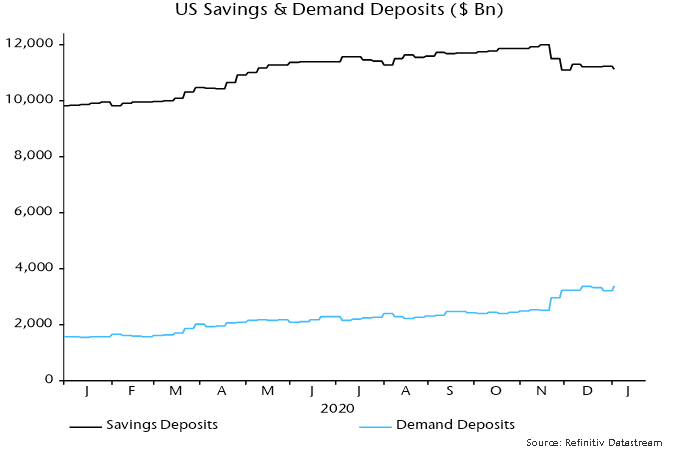

Secondly, the big fall in savings deposits and corresponding rise in demand deposits occurred between the weeks ending 16 November and 30 November – see chart 3. Movements outside this two-week window were “normal”. The weekly numbers are averages of daily data, so the reclassification is likely to have occurred during the week ending 23 November, with the effect carrying over into the following week. (The alternative view is that US election results triggered a big movement of money.)

Chart 3

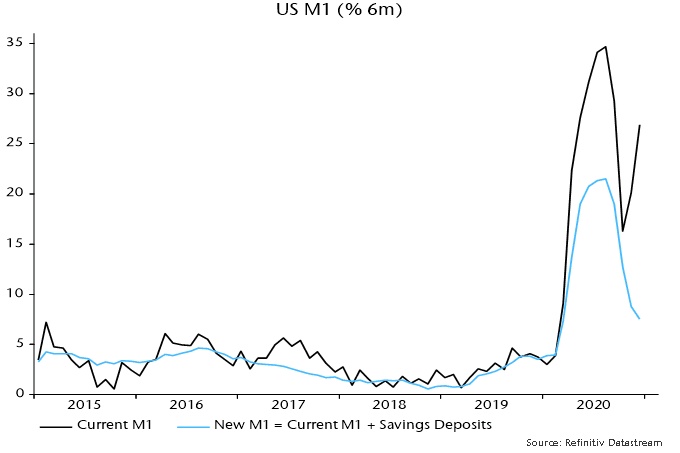

Thirdly, the Fed implicitly acknowledged that the M1 data have become distorted in its decision to redefine the aggregate to include savings deposits from next month. Six-month growth of the new M1 measure continued to slide in November / December – see chart 4.

Chart 4

The suggestion that US monetary conditions have become less expansionary is supported by broad money trends, while bank lending continued to contract into year-end (with weakness not due to PPP loan forgiveness, which has yet to kick in) – see chart 5.

Chart 5

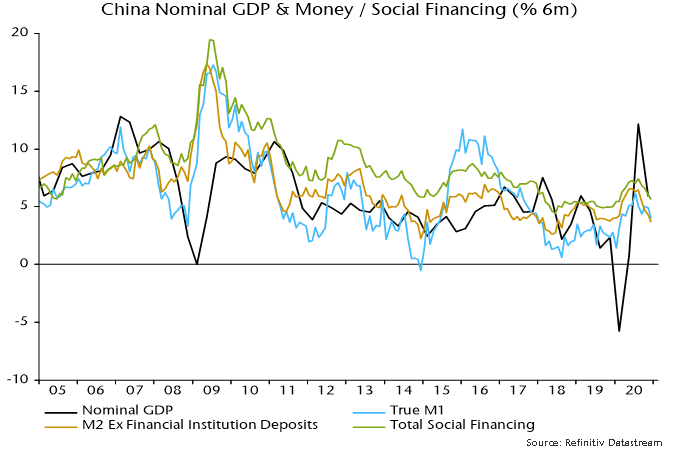

The fall in global six-month real narrow money growth in December also reflected declines in China, Japan and Brazil. The further slowdown in China – extending to broad money and credit, as shown in chart 6 – is consistent with the view here that PBoC policy is too tight and Chinese economic news is likely to disappoint in early 2021. A dovish PBoC policy shift may be needed to trigger the next leg of the global reflation trade but isn’t expected by the consensus and could be conditional on a prior market setback.

Chart 6

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.