Got your back? Europe’s fragmentation problem

All eyes are on the European Central Bank (ECB) in its bid to tame inflation, but could tightening monetary policy at this point usher in different risks? Portfolio manager Bethany Payne considers the ECB's options.

11 minute read

Key takeaways:

- All eyes are on the European Central Bank (ECB) in its bid to tame inflation, but could tightening monetary policy at this point usher in different risks?

- Contrasting inflation and growth dynamics across the bloc pose a challenge for the ECB, shining a spotlight on fiscal sustainability.

- Much talk has centred around a backstop to contain peripheral countries’1 bond spreads, but what are the ECB’s options?

A peripheral problem?

The structural complexities of the eurozone have certainly resurfaced in recent weeks. Higher interest rate expectations have come hand in hand with wider spreads between German and peripheral government yields, triggering fears that the European Central Bank’s (ECB) narrow focus on tackling inflation risks the sustainability of peripheral debt.

The ECB called an emergency meeting on 15 June and announced accelerated efforts towards a tool to ensure that peripheral spreads remain contained, allowing the bank to raise interest rates as required. This has allayed some fears, but markets are suspicious of promises from a central bank that has regularly been stymied by the constraints of its mandate and underlying legal structure. The challenge of being focused solely on inflation while policy making for 19 divergent countries with different structural growth rates is not to be underestimated.

Contrasting dynamics, the same solution

Arguably, the ECB’s singular framework for price stability would demand higher bank rates regardless of employment levels – which would be inappropriate for some economies. This is a test of faith for the union and the ECB could quickly run into moral hazards. Unlike the Federal Reserve in the US, the ECB does not want to engineer a slowdown in demand to tackle inflation; its measured fiscal response to the pandemic also does not warrant it. Structural disinflationary forces, such as technological progress and labour underutilisation, still prevail and so therein lies a risk in going too far in policy action.

This is especially true considering the pandemic has increased the heterogeneity of the euro area. Inflation between countries is at its most varied since the 1990s, with energy the culprit (Figure 2). The ECB may have to hold its breath to lift the bank rate off the floor, knowing to fight off supply-driven inflation like this is akin pushing on string, while potentially weakening its own policy transmission across the bloc and increasing fragmentation risks, in other words divergence between weaker and stronger economies.

A spotlight on fiscal sustainability

European bonds are not in the same fragile condition as they were during the Sovereign Debt Crisis a decade ago, largely thanks to policies enacted at that time. European government debt has grown much more slowly than the US, reflecting treaties aimed at preserving the euro’s value. Nevertheless, indebtedness has risen since the crisis, mainly due to the unexpected burden of the pandemic.

Government deficits have increased during the COVID era and budget balances are at/below the negative 3% of GDP (Figure 3), but these are expected to improve as governments reduce pandemic-related spending. During a period of yield-suppressing quantitative easing (QE), worries of spiralling debt relative to the size of economies were not a concern. Without QE though, as the ECB tapers its asset purchases, government deficits are not so easy to ignore. With the interest burden increasing, higher inflation and stagnating growth, governments’ primary balances will be under pressure and a renewed focus will fall on fiscal sustainability.

Rising debt and interest burdens feel alarming at a time of weakening growth. The ECB revised down real gross domestic product (GDP) growth expectations by 0.9% for 2022 and by 0.7% for 2023, to 2.8% and 2.1% respectively2. However, the cost to European taxpayers is still very low; servicing their debt fell to just US$186 billion at the end of 2021, its lowest in at least 25 years,3 thanks to very low interest rates. Most major European nations have also become more resilient over the pandemic by extending the average maturity of debt and consequently reducing refinancing risks (Figure 4).

When looking at debt sustainability, it is Italy which really stands out to us. The country’s debt rose US$133bn or 4.6% in 2021, reaching a record high3. Not only is the debt pile significant and looks set to increase in 2022, but rate hikes would push the cost of Italy’s debt up significantly – and quicker than its peers.

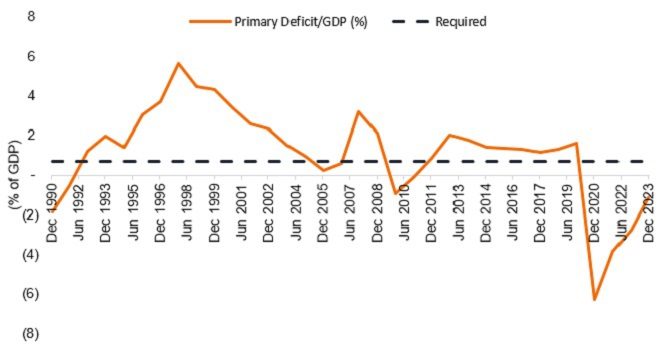

While most countries have increased the average maturity of debt on offer, half of Italy’s debt is still due in the next 5.5 years, compared to 7 years in 2010. Italy is also behind on its funding this year, only completing 52% of debt issuance by the end of June, compared with 68% at the same point last year4. While in our view a debt spiral is unlikely, 4% yields on Italy’s sovereign BTP (Buoni del Tesoro Poliennali) bonds demands strong budgetary discipline and positive primary balances. According to NatWest, Italy will need a 0.7% primary surplus if average funding costs are at 3.5% (Figure 5) to achieve debt stability.

Source: Bloomberg, 7 May 2022. The 0.7% level is what is required if the average interest rate is at 3.5%, NatWest 6 May 2022.

As a measure of debt costs, the effective cost on Italian debt is low at 1.5% due to QE and negative interest rates (compared to an average of 2.5%5). If the cost of servicing debt rises, and the economic environment deteriorates, then Italy could look fragile again. This would be worrying, especially into the election in 2023, given populism risks.

Got your back?

The emergency ECB meeting was called only a week after its scheduled one, where the bank decided only to guide on multiple rate hikes in future. The speed in rates increasing, spreads widening and perceived weakness in Italy probably pre-empted this decision, supporting our view that the ECB is likely to be proactive rather than reactive from here, and a new backstop is close to being announced.

ECB Governing Council member Schnabel suggested that the backstop will be used to prevent non-fundamental fragmentation risk (such as sentiment) rather than spread widening based on fundamental weakness. Debt sustainability (a fundamental) is thus still important as fundamental spread widening will be tolerated. Reports suggest ECB President Lagarde told Euro-area finance ministers that the ECB’s new backstop will be triggered if borrowing costs rise too far or too fast. Some widening will be tolerated then, but no precise interest rate or spread targets have been, or likely will be, disclosed. No one in the Governing Council will object to a commitment to safeguard the policy transmission mechanism – the process through which monetary policy decisions affect the economy in general and the price level in particular – and prevent fragmentation. However, when and how such a backstop should be activated could likely be very controversial, with serious legal and operational challenges to overcome. The hurdle to launching anything concrete might be high.

The last time fragmentation risks were acute was during the sovereign crisis, where ECB President Draghi’s “whatever it takes” speech was followed by an announcement of Outright Monetary Transactions (OMTs) – or unlimited asset purchases. The pledge itself was enough to contain peripheral spreads. While Lagarde has repeated many times that the ECB has the bloc’s back and is ready to do whatever is needed to avoid fragmentation, Lagarde is unlikely to get by so easily.

Unlike in 2010-2012 when the ECB stepped up, increasing its balance sheet by 67%6, as fragmentation risks increased, the paradox now is that QE is coming to an end and the net effect of its reversal works in the opposite direction. The backstop is therefore more crucial and needs to be credible, so that markets do not unduly test Lagarde’s resolve.

PEPP to the rescue?

To properly gauge the scale of the challenge, the ECB has bought more than EUR€4.9 trillion of bonds, equivalent to more than a third of the eurozone’s GDP, since launching QE. Over two years, it has bought more than all the extra bonds issued by the eurozone’s 19 governments7, giving it vast sway over borrowing costs in the region. The ECB has also been slower to slow/end its bond purchases than most western central banks.

Part of these purchases have been through the Pandemic Emergency Purchase Programme (PEPP) – a limited, but unconditional programme to buy bonds in response to pandemic-related stresses. Now ECB asset purchases are ceasing at the end of June, all that remains is the reinvestments of maturing bonds in the programmes, which for the PEPP continues until at least the end of 2024.

The ECB is making use of these reinvestments. At the June meeting, it announced further flexibility under PEPP to help with fragmentation risk. This could entail pulling forward future cash inflows from maturing bonds and investing these flows within the eurozone. It could be a form of ‘German bund quantitative tightening or QT’, transferring purchases from northern to southern European countries. This could be worth around EUR€200 billion8 a year of bond maturities brought forward.

For context, if the proportion of purchased bonds among eurozone countries were the same as seen before during this programme; a conservative estimate of PEPP would be equivalent to funding 11% of Italy’s new debt issuance this year. Given the flexibility of the programme, it is almost certain that PEPP reinvestments may account for more than this, but in comparison, PEPP bought nearly half of all Italian issuance in 20219.

While PEPP purchases have been more effective in times of stress and will be the first responder to help deal with peripheral spread crises, PEPP flexibility is only a partial solution to solvency and liquidity concerns. The advantage of using PEPP is the lack of conditions, helping to avoid fiscal restraint in response to what is, essentially, an external shock. The programme is however limited, and a backstop, to be credible, should arguably be unlimited. The bigger the bazooka, the less it is tested and therefore required.

The ECB’s options

For context, it is important to note that OMTs were unlimited and the programme still exists, but they impose conditionality upon nations, forcing a tightening of budgets. Similar conditionality is likely to be unappealing this time around, making it only effective when stresses have built almost to the point of no return. Clearly this is not what the ECB is seeking to achieve.

We believe the central bank will need to structure a backstop that will be considered effective, but which avoids contravening ECB legal rule around monetary financing, else it risks being challenged in the German constitutional court. This could be where the NextGenerationEU (NGEU) framework may be helpful.

NGEU is a cornerstone of Europe’s response to the pandemic, supporting the recovery by offering financial support to EU member states on the condition of specific investment and reform projects. This framework is a type of surveillance system, engendering growth and economic convergence across Europe. Marrying this framework with a new unlimited OMT, could enable the ECB to keep its balance sheet contained, while supporting the growth and integration of the eurozone. It could help spreads to converge and therefore help to limit downside risks.

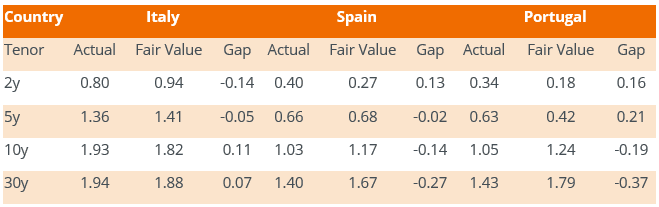

Source: Bloomberg, Janus Henderson Investors, 22 June 2022.

The tightening cycle begins

The extraordinary ECB meeting on 15 June suggests to us that the bank may be preparing to be more proactive than reactive in its efforts to tackle unwarranted market stress, paving the way for sustainable interest rate hikes from here. As we expect the ECB to raise interest rates by 0.25% in July and possibly again in September, we believe a generous backstop should be announced in July. If so, it will add pressure to German bund yields, but keep peripheral risk premiums suppressed.

However, the conflict in Ukraine is first and foremost on everyone’s minds and is affecting the fiscal outlook across governments. Germany, for example, has abruptly changed its policy on defence spending, committing to reach Nato’s target of 2% and continued to abandon its debt brake10. The question of energy security may also need to be answered with significant investment. Such fiscal pressures are likely to confront all western governments to varying degrees in the years ahead too. It is thus conceivable that another round of QE may even become necessary at some point.

Footnotes

1 Spain, Portugal, Italy and Greece are Europe’s peripheral countries.

2 Source: ECB, June 2022.

3 Source: Janus Henderson Investors, April 2022.

4 Source: Goldman Sachs, 27 May 2022.

5 Source: Bloomberg, 20 June 2022. Weighted average fixed coupon of Italian sovereign bond BTP.

6 Source: Bloomberg, 31 May 2022.

7 Source: Eurostat, ECB, as at 31 December 2021.

8 Source: ECB, Janus Henderson Investors, 31 May 2022. Realised redemptions may differ from forecasted redemptions due to early or late repayments. Forecasted estimate based on end of month data. Figures may be subject to revision.

9 Source: Goldman Sachs, ECB, 31 May 2022.

10 Designed to restrict structural budget deficits at the Federal level and limit the issuance of government debt.

Bank rate: the rate charged by the central bank for lending funds to commercial banks.

Disinflation: a fall in the rate of inflation.

A debt spiral: a situation where a country (or firm or individual) sees ever-increasing levels of debt.

Fiscal policy: Connected with government taxes, debts and spending. Government policy relating to setting tax rates and spending levels. It is separate from monetary policy, which is typically set by a central bank.

Spread/credit spread: the difference in the yield of a corporate bond over that of an equivalent government bond.

Real gross domestic product (GDP): the value of all finished goods and services produced by a country, within a specific time period (usually quarterly or annually), adjusted for inflation. It is usually expressed as a percentage comparison to a previous time period, and is a broad measure of a country’s overall economic activity.

Issuance: an issue is an offering of new securities to investors in an effort to raise capital.

Maturity: refers to the date on which an issuer or borrower of a loan or bond must repay the principal amount and interest to the holder or investor.

Monetary policy: central bank policies aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary stimulus refers to a central bank increasing the supply of money and lowering borrowing costs. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money (quantitative tightening).

Quantitative easing (QE): An unconventional monetary policy used by central banks to stimulate the economy by boosting the amount of overall money in the banking system. Opposite to quantitative tightening.

Primary surplus/ balance: The primary balance is the fiscal balance excluding net interest payments on public debt. That is, the primary balance is the difference between the amount of revenue a government collects and the amount it spends on providing public goods and services. A primary surplus means revenue outweighs spending.

Yields: The level of income on a security, typically expressed as a percentage rate. For a bond, this is calculated as the coupon payment divided by the current bond price.

Balance sheet: A financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time. Each segment gives investors an idea as to what the company owns and owes, as well as the amount invested by shareholders. It is called a balance sheet because of the accounting equation: assets = liabilities + shareholders’ equity.

Beta: Measure of a portfolio’s or security relationship with the overall market. The beta of a market is always 1. A portfolio with a beta of 1 means that if the market rises 10%, so should the portfolio. A portoflio with a beta more than 1 means it will likely move more than the market average. A beta less than 1 means that it is likely the portfolio and market move in the opposite directions.

Risk premium: The additional return over cash that an investor expects as compensation from holding an investment that is not risk free. The riskier an asset is deemed to be, the higher its risk premium.

Liquidity: The ability to buy or sell a particular security or asset in the market. Assets that can be easily traded in the market (without causing a major price move) are referred to as ‘liquid’.

Standard deviation: A statistic that measures the variation or dispersion of a set of values/data. A low standard deviation shows the values tend to be close to the mean while a high standard deviation indicates the values are more spread out. In terms of valuing investments, standard deviation can provide a gauge of the historical volatility of an investment.

Sovereign bonds: Bonds issued by governments and can be either local-currency-denominated or denominated in a foreign currency. Sovereign debt can also refer to the total of a country’s government debt.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.