Global Sustainable Equity: news and opportunities (April 2021)

Hamish Chamberlayne, Head of Global Sustainable Equities, reflects on 2021 so far and looks ahead to the opportunities in the world of sustainability.

6 minute read

Key takeaways:

- The most economically powerful nations are increasingly pushing sustainability-driven initiatives, with political and fiscal support addressing decarbonisation and electrification.

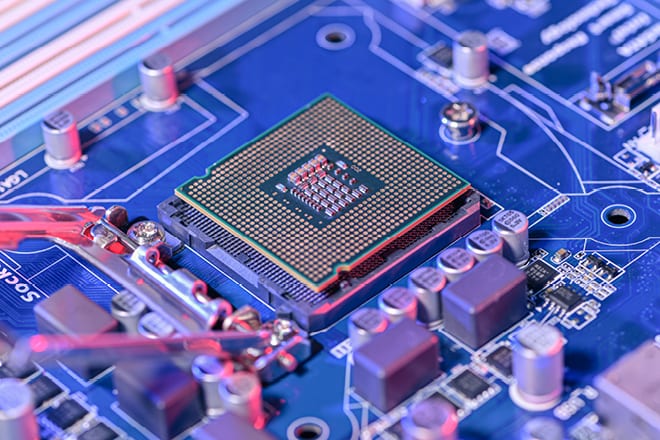

- Demand for semiconductors has heightened as continued digitalisation drives the need for data centre buildouts.

- In the near term we expect to see some normalisation and reversion to the mean. However, we believe the pandemic has accelerated and cemented some trends such that many of the societal and economic changes experienced will prove durable.

The near-year long rally in global equity markets continued into the first quarter of 2021, led by more economically sensitive and interest rate sensitive areas of the market. Now a year into the global pandemic, there has been significant progress in the rollout of COVID vaccination programmes albeit with progress varying from country to country. Despite some concern over the transmission of virus variants, it certainly appears that equity market participants have priced in the continued lifting of restrictions and a path towards the normalisation of economic activity.

US President Biden makes strides in sustainability

From a sustainability perspective we were pleased to see steps towards addressing climate change made by the new US administration. Cabinet appointments made by Biden clearly indicate that climate change will be a priority for the government. Renewable energy and sustainable investing experts, public health officials, environmental lawyers and proponents for carbon neutrality have all been given leading roles within government. The appointment of a National Climate Advisor – Gina McCarthy, the former head of the Environmental Protection Agency (EPA) under Obama – also signals clear intention to tackle climate concerns. Under McCarthy’s remit, she intends to make climate, equity and job creation considerations across the whole government.

Alongside these appointments, we have now seen the details of Biden’s US$2trillion-plus fiscal stimulus bill, the American Jobs Plan. The plan addresses many aspects of the US economy, but accelerating the migration to a greener, cleaner, healthier US economy and society is clearly at the heart of it. In the bill, there are material provisions to clean up the country’s drinking water supply, electrify a portion of the school bus fleet, retrofit buildings to higher environmental standards, further reduce the use of coal and gas generation within the energy mix, provide tax incentives for electric vehicles and, to generally invest in the country’s electric and renewable energy infrastructure.

Alongside these appointments, we have now seen the details of Biden’s US$2trillion-plus fiscal stimulus bill, the American Jobs Plan. The plan addresses many aspects of the US economy, but accelerating the migration to a greener, cleaner, healthier US economy and society is clearly at the heart of it. In the bill, there are material provisions to clean up the country’s drinking water supply, electrify a portion of the school bus fleet, retrofit buildings to higher environmental standards, further reduce the use of coal and gas generation within the energy mix, provide tax incentives for electric vehicles and, to generally invest in the country’s electric and renewable energy infrastructure.

A global push for decarbonisation

Alongside the US, there have been many other sustainability-driven initiatives across many of the most economically powerful nations. At the end of last year, China outlined a major decarbonisation plan, Germany further extended its electric vehicles subsidies and the UK set targets to run all UK homes with wind power by 2030. As sustainable equity investors these appointments and investment plans excite us. We spend our time looking for companies and business models that we believe are on the right side of sustainable trends and believe that increased policy and fiscal support for the climate agenda across the globe enriches our investable universe and potential investment returns.

Demand for semiconductors soar

One of the most notable global economic dynamics in the quarter has been the shortage in availability of semiconductors, curtailing production of autos, white goods, computers and smartphones. Thanks to the accelerated adoption of the digitalisation of the economy throughout the pandemic, there has been a massive increase in demand for semiconductors. Data centre buildouts, demand for mobile computing and gaming devices and rising digitisation of the auto vehicle fleet, have all contributed to higher demand.

Meanwhile production shortfalls have been caused by natural disasters impacting manufacturing plants in both Japan and Texas, further exacerbated by sanctions imposed against some Chinese manufacturers. This has led to several of the biggest semiconductor manufacturers stepping up capex plans along with policy support in the US for the build of more domestic production. As a result, stock prices of many semiconductor related companies have strengthened and our holdings in both Lam Research and ASML were clear beneficiaries.

Meanwhile production shortfalls have been caused by natural disasters impacting manufacturing plants in both Japan and Texas, further exacerbated by sanctions imposed against some Chinese manufacturers. This has led to several of the biggest semiconductor manufacturers stepping up capex plans along with policy support in the US for the build of more domestic production. As a result, stock prices of many semiconductor related companies have strengthened and our holdings in both Lam Research and ASML were clear beneficiaries.

Tesla’s share price continued to perform through the first half of the quarter, driven by its announcement of record production numbers in the previous quarter. However, disclosure that the company had invested a significant sum in bitcoin raised questions about its governance structures and its use of corporate cash to support CEO Musk’s pet projects. We have always taken a measured a risk-aware approach to our holding in Tesla, and we used the early year strength as an opportunity to take further profits and reduce our position size.

The digitalisation, electrification and decarbonisation nexus

Digitalisation, electrification and decarbonisation. If we had to characterise the investment themes we are most focused on it would be these three. We believe these are dynamics that are impacting every sector and every corner of the global economy. These well-established themes have been accelerated by the events of last year and we believe that they are powerful agents of positive change with regards to both societal and environmental sustainability goals. Digitalisation is playing a positive role in economic development and social empowerment, and we also see a close alignment between digitalisation and decarbonisation. It is important to recognise this trend is impacting all industries; it is blurring the lines between sector classifications. Many people call this the Fourth Industrial Revolution.

Looking ahead

So, what do we see as we look to the future? We believe it is instructive to distinguish between the near term and long term when it comes to thinking about the outlook for markets and identifying investment opportunities. In the near term we are conscious that valuations are high in some parts of the market. With extremely accommodative monetary policy and central banks committed to supporting higher growth, the conditions do exist for further equity market upside. However, we are becoming more sensitive to near‑term valuations. We are therefore focused on maintaining discipline in our portfolio construction.

As we look to the next several years we are optimistic. We see some very persistent and bankable investment trends that are closely aligned with sustainability. With a pro-climate US President, the European Union (EU) putting climate related investment at the heart of its economic recovery plan, and China recently reaffirming its commitment to green investment and decarbonisation, the stars are aligning for a globally synchronised clean energy and technology investment boom. We do expect to see some normalisation and reversion to the mean as the vaccines are rolled out, but we believe this pandemic has accelerated and cemented some trends such that many of the societal and economic changes we have experienced will prove durable.

Fiscal policy is Government policy relating to setting tax rates and spending levels. Fiscal stimulus refers to an increase in government spending and/or a reduction in taxes.

Monetary policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary stimulus refers to a central bank increasing the supply of money and lowering borrowing costs.

Sustainability article

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund follows a sustainable investment approach, which may cause it to be overweight and/or underweight in certain sectors and thus perform differently than funds that have a similar objective but which do not integrate sustainable investment criteria when selecting securities.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In respect of the equities portfolio within the Fund, this follows a value investment style that creates a bias towards certain types of companies. This may result in the Fund significantly underperforming or outperforming the wider market.