Russia Ukraine market impact – a week on

A little over a week on from the beginning of the conflict, Ben Lofthouse, Head of Global Equity Income, explores how equity markets have reacted.

4 minute read

Key takeaways:

- The humanitarian impact of the crisis is saddening. Increased equity market volatility is likely to continue for some time as the ramifications become clearer.

- Increases in energy prices are likely to have a significant impact, both on global growth and certain sectors. They could also either be the cause of central banks pausing tightening or acting with increased urgency.

- Russia and Ukraine are key exporters of a number of other commodities, such as Palladium, Potash and wheat. It is important to keep a close eye on the shifting demand and supply dynamic.

The Russian Ukraine conflict is not a completely unexpected event given the build-up over the last three months. A period of increased equity market price volatility is now likely to continue for some time as the ramifications of the event become clearer. The limited number of listed companies in investors’ portfolios that are directly impacted by current events is, however, likely to be small.

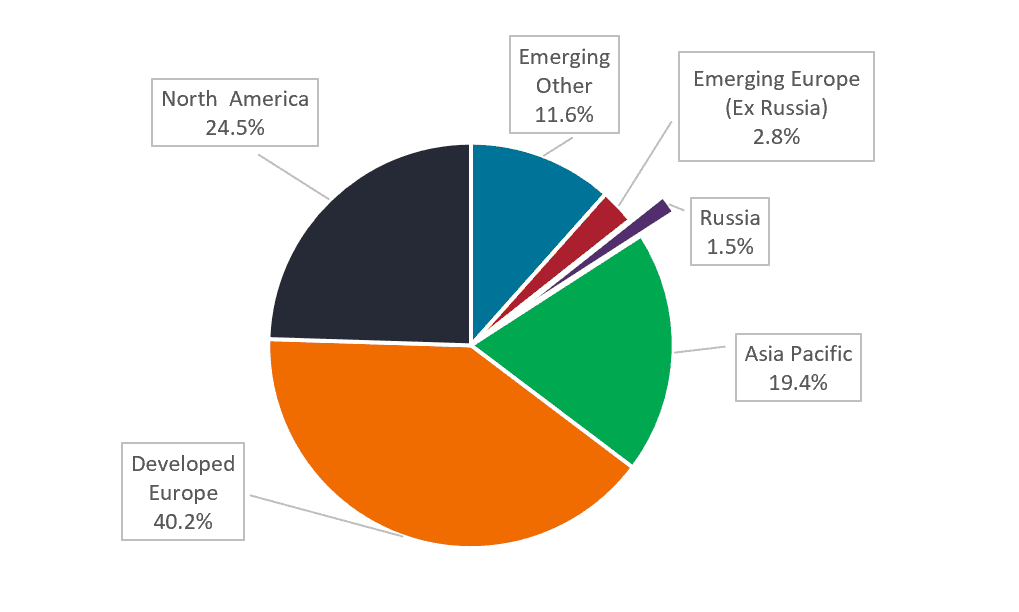

Why? Most mainstream equity investors have largely avoided direct investments in Russia since the initial incursion into Ukrainian territory in 2014, driven largely by uncertainty around sanctions imposed at the time (and that wariness has been reinforced subsequently after watching the increased use of prohibited investment lists by the US with regard to Chinese companies). Indeed, the chart below shows Russia accounts for just 1.5% of direct revenue exposure within the MSCI Europe Index.

Europe has minimal direct revenue exposure to Russia

Over the last week equity market falls have been felt most acutely in Europe with sectors such as autos, financials, and travel the most impacted. Other areas of the markets, that might benefit from higher prices, such as mining and energy, have fared better. Analysis of previous significant geopolitical events over the last few decades indicates that equity markets often recover relatively quickly, over a few weeks or months, but this obviously hides the fact that some sectors and companies will be more impacted and take longer. Avoiding those companies most impacted by sanctions will be important, as history shows sanctions can last for many years.

The economic impact of the conflict will therefore be the more important factor determining returns from here. This will depend on the duration of the conflict, and the sanctions and embargoes that might come as a result of it. At the time of writing, the sanctions announced so far are likely to have the most impact on companies with significant Russian or Ukrainian operations. However, we do know that even in Europe trade with Russia and the Ukraine is a relatively low figure, and accounts for around 1% of its GDP, so even if this halves, it would be manageable.

A potentially more significant impact will come from energy prices; some economists estimate that a $10 increase in oil has a 0.1% impact on global growth. Over the last week the oil price has risen more than 10%. Noticeably, there has been a price dislocation as western buyers seem to be trying to avoid Russian crude (see chart below), which has caused Brent North Sea crude to rise in price relative to the Russian Urals price. The higher oil price has benefitted energy producers while negatively impacting some utilities.

Similar price rises have been felt by buyers of natural gas, as shown in the chart below, particularly in Europe given the reliance of a number of European countries on Russian natural gas.

The interplay between higher energy prices, inflation, economic growth and central bank policy will be very closely watched in the coming months. Will higher energy prices due to this event cause central bankers to pause tightening, or add to the urgency? It is too soon to assess how central banks will react, but it could be that the cure for high prices is high prices, with demand impacted by higher costs or employment growth tempered, thus reducing the need for as many rate hikes as forecast. Russia and Ukraine are also key exporters of a number of other commodities, such as Palladium, Potash (for fertilising crops) and wheat. In terms of equity investments determining which companies might be impacted or benefit from changes in the demand and supply of these is something we will be analysing very closely in the coming months.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.