Shining a light on possible unintended risks when allocating sustainably

The Portfolio Construction and Strategy (PCS) Team share practical insights from recent consultations with global investors on sustainable investing, specifically whether unintended risks are introduced into sustainable model portfolios and why it is important to follow an active, forward-looking approach when using environmental, social and governance (ESG) factors as criteria.

6 minute read

Key takeaways:

- The inconsistency of risk profiles between traditional (non-sustainable) and sustainable model portfolios is arguably because the asset management industry’s product offering is still catching up to investor demand on sustainable investment solutions.

- Differences between traditional and sustainable strategies are not just attributed to regions but can also be influenced by a style and sector tilt, all of which can have an impact on returns, often introducing unexpected risks.

- These are important considerations for investors in maintaining asset allocation risk consistency across model portfolios and finding a sustainable method to accomplish sustainable investing goals in the long term.

The war in the Ukraine and the subsequent pressure on oil and gas supplies, particularly in Europe, we believe has and will lead to a greater focus on sustainable investing in the future – particularly around localised renewable energy production.

In the case of sustainable investing, an ESG criteria is often considered in the portfolio construction processes. But what if many of these new sustainable portfolios are actually unrecognisable to their traditional portfolios when it comes to regional biases, style drifts, and sector concentrations? Are there unintended risks introduced by a shift to ‘sustainable’ investing?

The scarcity of sustainability

The inconsistency of risk profiles between traditional and sustainable portfolios is a result of the asset management industry’s product offering still catching up to investor demand for suitable sustainable investment solutions.

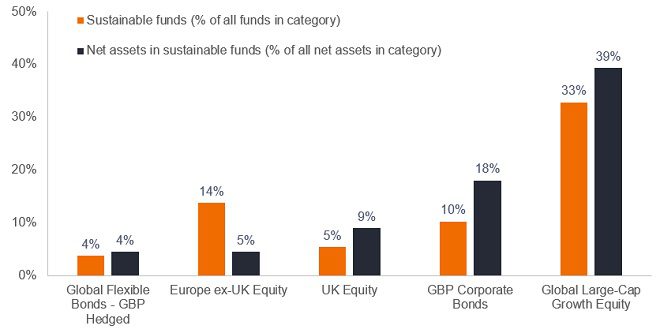

For example, an investor in traditional Europe ex-UK Equity or UK Equity has a plethora of strategies available. That same investor looking to mirror this selection in their sustainable portfolio is limited to a much smaller selection, as only 14% of European funds in that Morningstar Category explicitly indicate any kind of ESG impact in their strategy and only 5% of UK equity managers. There is a similar discrepancy within fixed income – where investors severely struggle to find sustainable options for their global flexible managers and tend to invest in traditional corporate bond managers.

Figure 1: The share of sustainable funds and total net assets in the respective Morningstar fund category

Source: Portfolio Construction and Strategy, Morningstar. Number of funds in the respective Morningstar category (Europe OE & MM market, ex funds of funds and feeder funds, excluding obsolete funds) and percentage of total net assets that explicitly indicate any kind of sustainability, impact or ESG strategy in their prospectus or offering documents, as at February 2022.

Granular or global?

The result of this availability challenge for investors is that many sustainable portfolios look and feel different to traditional portfolios and therefore are exposed to a different set of risks.

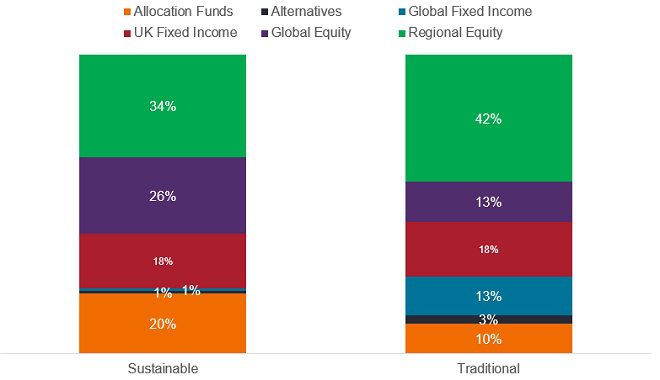

For example, this is demonstrated in Figure 2 below by taking an average of the moderate portfolio allocations of UK investors based on PCS team consultations. Within equities, the traditional model portfolio includes mainly regional equity allocations, such as UK equities or US equities, while the sustainable model portfolio has a higher allocation to global equity. Within fixed income, the phenomenon is the opposite with the traditional model portfolio fixed income allocation split between UK and global fixed income, while the sustainable model has almost all its fixed income allocated to the UK. We believe these asset allocation shifts – and therefore risk shifts – are attributable to the relative paucity of sustainable strategies in certain categories.

Figure 2: Portfolio holdings – significant differences

Source: Portfolio Construction and Strategy, as at February 2022. The allocations are shown for illustrative purposes to represent a model and are based on sample allocations from our database.

Different risks mean different returns

The scarcity of suitable regional sustainable equity strategies is one of the many reasons for the sustainable model being underweight regional equities and overweight global equities. This introduces meaningful return differentials.

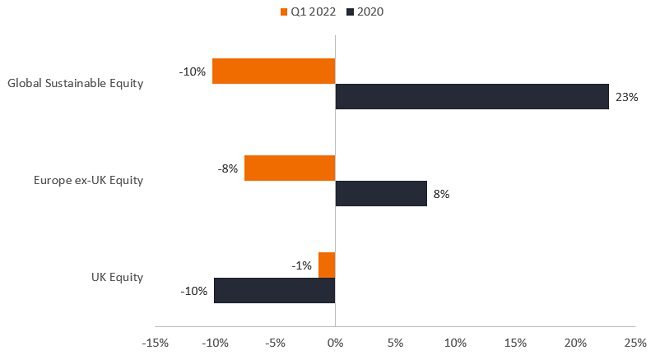

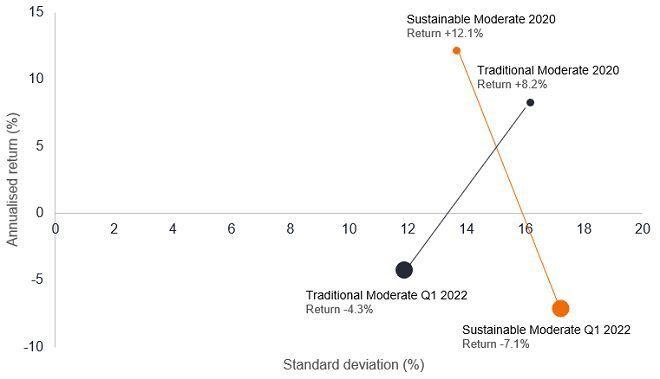

Global sustainable strategies experienced a strong surge in performance post-pandemic, however that has been fading year to date as concerns increase about inflation as well as the impact of the war in Ukraine, including rising oil and gas prices which many sustainable strategies will typically not be exposed to. Thus, many sustainable portfolios containing a global equities overweight have been impacted negatively year to date as shown in figures 3 and 4.

Figure 3: Regional vs global sustainable equity Morningstar Category – 2020 and Q1 2022 average returns

Source: Portfolio Construction and Strategy, Morningstar. Average 2020 calendar year and Q1 2022 returns of global sustainable equity, Europe ex-UK and UK equity Morningstar categories, in local currency, net of fees, as at 31 March 2022. Returns assume reinvestment of dividends and capital gains. Past performance does not predict future returns.

Figure 4: Traditional vs Sustainable Sample Moderate Portfolio – 2020 and Q1 2022 risk and returns

Source: Portfolio Construction and Strategy, Morningstar. Cumulative 2020 calendar year and Q1 2022 returns in local currency, net of fees, as at 31 March 2022. Returns assume reinvestment of dividends and capital gains. The allocations are shown for illustrative purposes to represent a model portfolio and are based on sample allocations from our database. Past performance does not predict future returns.

Style and sector considerations

The differences between traditional and sustainable solutions are not just attributed to regions. When we look at a sustainable equity portfolio versus traditional, there is a significant difference in the exposure to the growth factor as well as sector allocations.

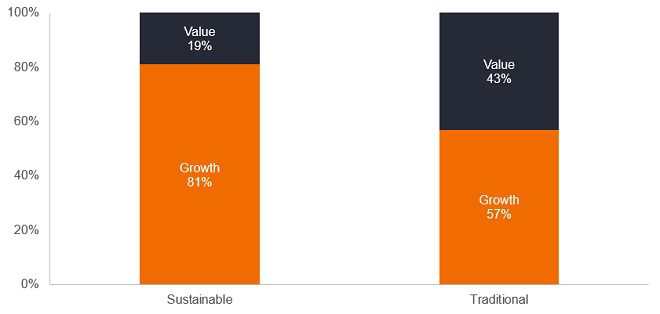

Figure 5: Growth vs. Value Equity Style Bias

Source: Portfolio Construction and Strategy, Morningstar. Average UK advisor allocation based on data shared with the PCS Team by UK financial advisory clients, as at March 2022.

This large exposure to growth has obvious consequences, especially during periods of market volatility. That is not to say investors should avoid sustainable investments, rather that investors should carefully consider the implications for portfolio construction and make necessary adjustments to balance some of these skews.

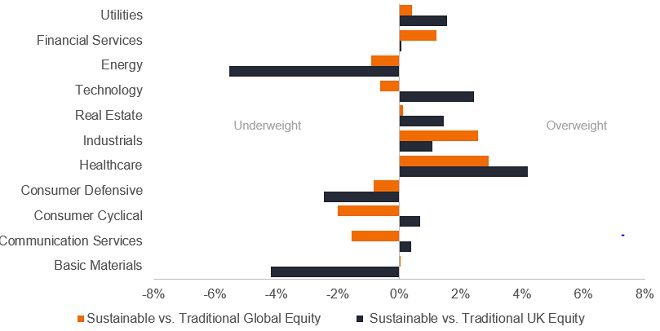

In the case example of UK investors, it is important to be aware of sector tilts that can be introduced by an overweight in traditional or sustainable funds.

Comparing the sector exposures of global and UK funds versus their sustainable counterparts, we see global sustainable equity funds tend to have a stronger bias towards the industrials and healthcare sectors (see Figure 6). These sectors generally outperformed in recent years, especially in 2020 as ‘beneficiaries’ of the COVID-19 crisis. Our analysis shows that managers of sustainable funds have typically been less exposed to cyclical sectors, such as energy, relative to broader equity funds.

Figure 6: Sustainable sector exposures compared with Traditional

Source: Portfolio Construction and Strategy, Morningstar as at March 2022. Sector exposures of funds’ holdings in the Morningstar categories, comparing global equity vs global ESG equity and UK equity vs. UK ESG Equity. ESG defined by Morningstar, as prospectus with a clear sustainability objective.

Looking forward

The key point to understand here is that moving between traditional and sustainable portfolios introduces different risks, which in turn may have implications for returns. Sustainable model portfolios come with their own unintended risks due to a limited number of fund choices at the moment, which may prevent effective diversification given the biases and concentrations in the portfolio.

We believe that sustainability should be an implementation decision, i.e. your overall asset allocation should be diversified in terms of regions, styles etc and then you choose your implementation/managers that fit your asset allocation.

There is no one-size-fits-all solution to sustainable investing. Our Portfolio Construction and Strategy Team partners with global investors to build sustainable portfolios by utilising the whole spectrum of ESG tools and resources at Janus Henderson. We would be delighted to contribute to your conversations on the issue.

——-

About the Portfolio Construction and Strategy Team

The PCS Team performs customised analyses on investment portfolios, providing differentiated, data-driven diagnostics. From a diverse universe of thousands of models emerge trends, themes and potential opportunities in portfolio construction that the team believes will be interesting and beneficial to any investor.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.